India Coffee Retail Chains Market Trends

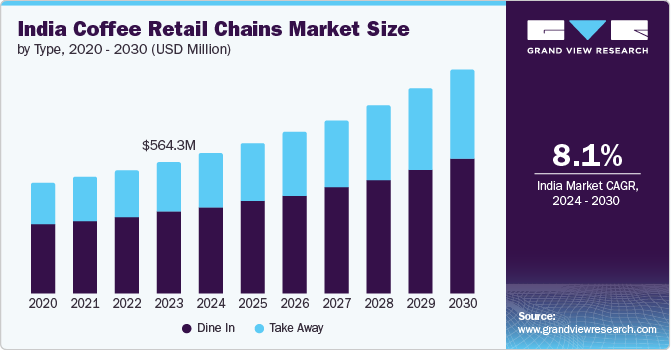

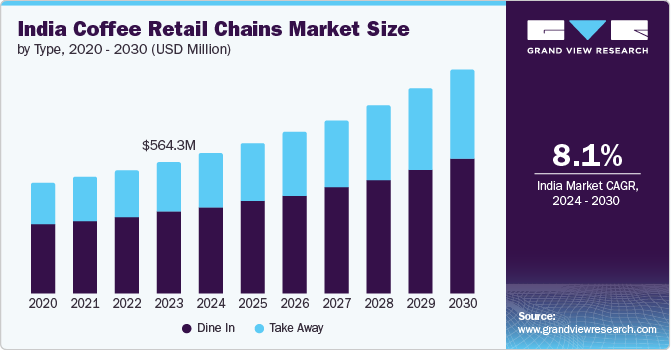

The India coffee retail chains market size was valued at USD 564.3 million in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030. This growth can be attributed to the growing coffee culture and changing lifestyle. The rising urbanization and increasing per capita income, demand for quality and premium coffee has surged, driving the coffee retails chains market growth.

Consumers are increasingly looking for places to socialize, relax and have a quality cup of coffee. In addition, there are promising opportunities among coffee retail chains with an increased emphasis on health and wellness to offer health-conscious coffee to consumers. Moreover, the preference of coffee among young population especially millennial and Gen-Z populations, who prioritize convenience and quality, is further fueling the demand for coffee retail chains in India.

Type Insights

The dine in segment dominated the market and accounted for a share of 62.4% in 2023. This dominance can be attributed to rising disposable income and emergence of social shops. The café culture has created demand for places that offer more than just coffee. The rapid urbanization and busier lifestyles are driving the need for convenient and comfortable spaces to take breaks and spend some quality time. This shift has offered opportunity to coffee chains to cater the needs by offering not just beverages but also food options along with good ambience, comfortable seating and interiors, for which consumer is ready to pay a premium price.

Take away is anticipated to witness the fastest CAGR during the forecast period, owing to hectic lifestyles and shift of more people to urban areas. The hectic lifestyle is creating demand for quick and convenient coffee options. The rising food delivery services have made it easier for consumers to order coffee for take away. Moreover, the rising health concerns and growing technologies have made consumers more comfortable for takeaway options, and coffee chains are enhancing the services by providing innovative packaging solution to cater this demand.

Region Insights

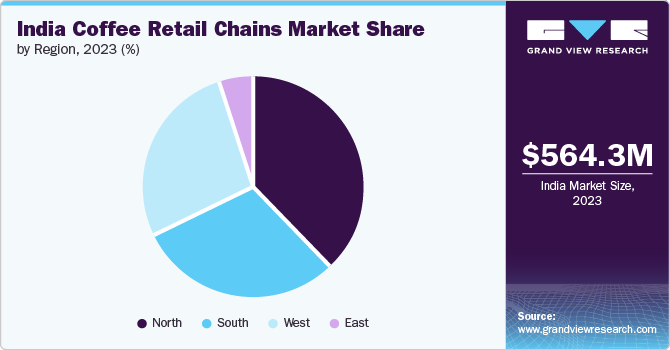

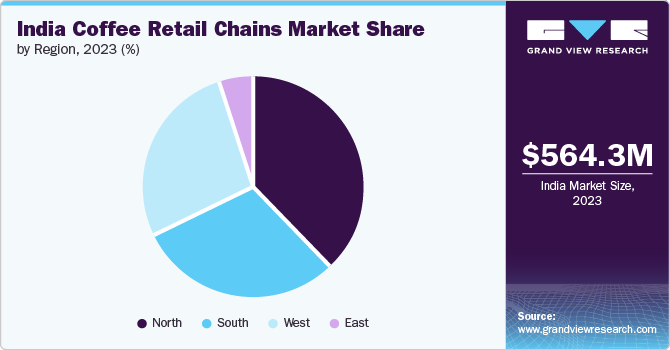

The North region dominated the market in 2023 and is expected to grow at a CAGR of 6.7% over the forecast period. This is owing to the presence of educational institutions and employment opportunities in Delhi, Gurgaon and Noida.

The South region is expected to grow rapidly in the coming years. Karnataka is largest producer of coffee in India accounting for approximately 70% of country’s total coffee production. Karnataka, especially Bangalore, known as Silicon Valley of India, is the most urbanized stated in India which attracts students, young professionals, entrepreneurs, thus creating a substantial market for coffee products. Moreover, Karnataka is a popular tourist destination known for its rich cultural heritage, historical sites and natural beauty. The growth in tourism is likely to boost the demand for coffee retail chains in the state.

India Coffee Retail Chains Company Insights

Some of the key companies in the India coffee retail chain market include Starbucks Coffee Company, Café Coffee Day, baristacoffee, Various organizations in the market are focusing on development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Starbucks offers coffee beverages, baked goods, sandwiches and other food & beverages items. Starbucks is known for its focus on customization, which allows customers to personalize their drinks according to their preferences.

-

Café Coffee Day (CCD) offers a wide range of coffee beverages, including cappuccinos, lattes, cold coffee and other coffee and food items.

Key India Coffee Retail Chains Companies:

- baristacoffee.

- Starbucks Coffee Company

- Café Coffee Day

- Third Wave Coffee

- Costa Coffee

- Tim Hortons USA Inc.

- BLUE TOKAI COFFEE ROASTERS

- Theobroma

- Nescafe Coffee House

- Indian Coffee House

Recent Developments

-

In July 2024, Nothing Before Coffee (NBC) announced the launch of coffee chain’s 64th outlet in Pune. The store offers organic coffee, mocktails, shakes, shrappe, hot chocolate, and a wide variety of snacks, noodles, cookies and sandwiches.

-

In July 2024, Blue Tokai, an Indian coffee roaster and café chain opened its first international outlet in Japan. It opened its first cafe in Hiroo, Tokyo, where consumers can enjoy authentic Indian coffee. In March 2024, Blue Tokai opened its 100th store with an outlet Kolkata and is aiming at reaching 200 venues in the coming 12-18 months.

-

In April 2024, Union Artisan Coffee, Malaysian coffee chain inaugurated its first café in India at Worldmark, Aerocity (New Delhi).

-

In January 2024, Tata Starbucks announced that by 2028 it was planning to introduce 1,000 stores in India. To reach this target, the JV is expected to increase its staff to approx. 8,600 partners, expand airport cafes, drive-thrus, 24-hour stores network and entering in Tier 2 & 3 cities.

-

In October 2023, Tim Hortons, Canadian coffee chain, launched its first outlet in Pune (Maharashtra). Tim Hortons first entered the Indian market in August 2022 by launching 2 outlets in National Capital Region.

-

In April 2023, Pret A Manger, UK sandwich & coffee chain, was launched in India at Maker Maxity in Mumbai (Bandra) under the partnership with Reliance Brands.

India Coffee Retail Chains Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 601.5 million

|

|

Revenue forecast in 2030

|

USD 961.5 million

|

|

Growth Rate

|

CAGR of 8.1% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD Million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, Region

|

|

Regional scope

|

India

|

|

State scope

|

Maharashtra, Karnataka, Delhi, Uttar Pradesh, Haryana, Telangana, Punjab, Tamil Nadu, Gujrat, Rajasthan.

|

|

Key companies profiled

|

baristacoffee., Starbucks Coffee Company, Café Coffee Day, Third Wave Coffee, Costa Coffee, Tim Hortons USA Inc., BLUE TOKAI COFFEE ROASTERS, Theobroma, Nescafe Coffee House, Indian Coffee House

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

India Coffee Retail Chains Market Report Segmentation

This report forecasts revenue growth at country and state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India coffee retail chains market report based on type and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)