India Care Services Market Size, Share & Trends Analysis Report By Type (Skilled Nursing Facility, Assisted Living Facility, Hospice & Palliative Care, Home Healthcare, Home Pathology/Clinical Testing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-945-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

India Care Services Market Size & Trends

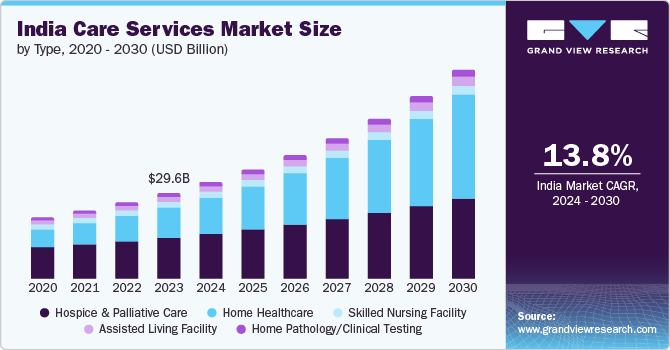

The India care services market size was estimated at USD 29.62 billion in 2023 and is expected to grow at a CAGR of 13.76% from 2024 to 2030. The increasing demand for higher quality care, the growing elderly population, the shift from communicable to chronic diseases, rapid technological advancements, rising disposable income, and the need for cost-effective care services are expected to drive the market in the coming years. The rise in the elderly population has led to increased demand for hospice care, skilled nursing facilities, assisted living facilities, and other services.

Increasing awareness and growing disposable income have enabled geriatric individuals to purchase homes in senior living societies with various types of care services. The government of India is also playing a major role in promoting care services in India. The Senior Care Reforms in India - Reimagining the Senior Care Paradigm, published by the NITI Aayog Government of India in February 2024, includes various schemes, initiatives, and programs for senior citizens. Some of these schemes by the Ministry of Social Justice and Empowerment includes Atal Vayo Abhyudaya Yojana (AVYAY), Scheme of Integrated Program for Senior Citizens (IPSrC), State Action Plan for Senior Citizens (SAPSrC), Seniorcare Ageing Growth Engine (SAGE) -Promoting Silver Economy, Rashtriya Vayoshri Yojana (RVY), Scheme for Awareness Generation and Capacity Building for the Welfare of Senior Citizens, and others.

Such initiatives are expected to provide considerable opportunities for care services in India. In September 2021, the Government of India launched the Ayushman Bharat Digital Mission (ABDM) (earlier known as the National Digital Health Mission) to promote the use of electronic medical records in home healthcare, hospice, and nursing home settings, among other uses.

The integration of remote patient monitoring technologies-including home infusion pumps, heart rate monitors, home oxygen systems, and glucose monitoring devices-is significantly increasing the value of home healthcare. The Guardian Connect System, by Medtronic, is the first smart glucose monitoring system in India. Furthermore, the use of artificial intelligence in healthcare is increasing in India, leading to improved service quality in homes, hospices, nursing homes, and other care settings.

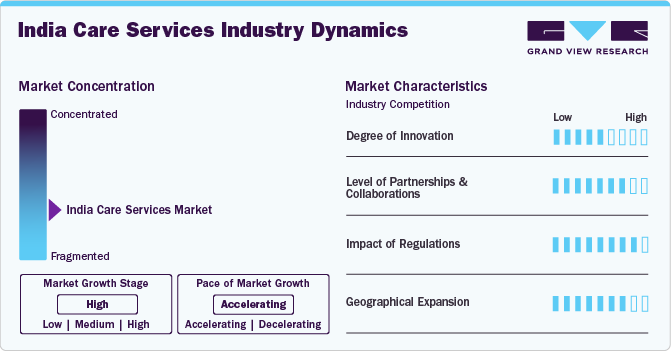

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and geographic expansion. The market is fragmented, with the presence of several emerging service providers holding the market share. The degree of innovation is moderate, and the level of partnerships & collaboration activities is high. The impact of regulations on the industry is high, and the geographic expansion of the industry is high.

The industry is experiencing a moderate level of innovation due to limited funding, regulatory challenges, and slow adoption of new technologies. For instance, in September 2023, Merago Inc. partnered with Portea Medical to integrate home healthcare services into its Merago Digital Healthcare Network platform. This is expected to cater to the needs of out-of-hospital patients.

The level of partnerships and collaboration in the market is high due to the demand for integrated healthcare solutions, the increasing complexity of patient care, and the drive to improve service delivery through shared resources and expertise. For instance, in March 2024, Antara Assisted Care Services Limited partnered with the Indian Institute of Technology Delhi (IIT Delhi) with a focus on developing offerings tailored specifically for the senior demographic.

Complex regulatory frameworks governing the care sector create barriers to entry for providers and investors. Licensing requirements, zoning regulations, and building codes vary across regions, adding bureaucracy & compliance costs. Navigating these regulations is time-consuming and expensive, particularly for smaller providers or new entrants.

The level of geographical expansion in the market is high due to the increasing demand for healthcare services in underserved and rural areas, the rising disposable incomes and health awareness among the population, and government initiatives to improve healthcare infrastructure across the country. For instance, in March 2024, Epoch Elder Care, a provider of dementia and assisted living care services, launched Epoch Picasso House, its second assisted living home in Pune. The facility offers person-centered and holistic care to elders.

Type Insights

Based on type, the hospice & palliative care segment dominated the market with a revenue share of over 48% in 2023. The growth of this segment is due to the increasing prevalence of chronic and terminal illnesses and a growing awareness of the benefits of palliative care. This has led to a rising demand for specialized end-of-life care that focuses on pain management and improving the quality of life for patients and their families. This trend is expected to be driven by the rising number of severe injuries and car accidents, the growing need for home healthcare services, and increasing disposable income.

The home healthcare segment is expected to experience the fastest CAGR during the forecast period due to the increased incidence of lifestyle diseases and the growing demand for high-quality, low-cost care. In addition, the rising prevalence of lifestyle diseases in India has boosted the demand for continuous and coordinated care for home-bound patients recovering from an acute injury or illness. Moreover, the Indian government has recently launched new initiatives to promote home healthcare in India. For instance, in January 2022, the Healthcare Federation of India released Home Healthcare 2.0, which included perspectives from industry stakeholders as well as government recommendations to create significant growth opportunities for home healthcare services in India.

Regional Insights

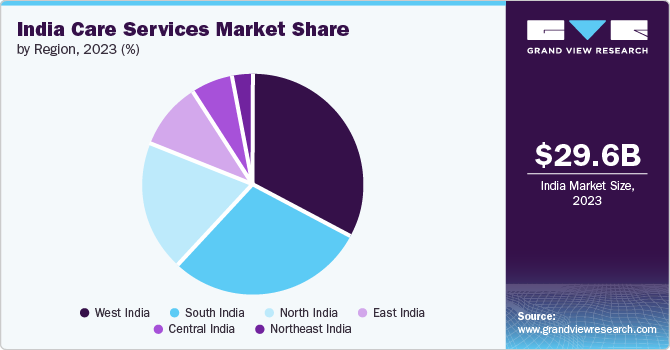

West India Care Services Market Trends

The West India care services market held the largest share of over 33% in 2023. The western region of India includes the states and union territories of Maharashtra, Diu & Daman, Goa, Gujarat, and Dadra & Nagar Haveli. The growth in this area is attributed to the presence of multiple service providers, increasing urbanization, and the rising number of nuclear families.

North India Care Services Market Trends

The North India care services market is anticipated to witness the fastest CAGR during the forecast period owing to the availability of retirement-friendly destinations suitable for assisted living services in the North. Major cities such as Amritsar, Jaipur, Lucknow, Dehradun, Chandigarh, and NCR are emerging as popular retirement destinations in Northern India. In addition, improved insurance coverage in the top cities of the northern region is contributing to the growth of the market.

South India Care Services Market Trends

The South India care services market includes the states of Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, and Telangana along with UTs Andaman & Nicobar, Lakshadweep, and Puducherry. The region has the presence of major established players such as Portea Medical (Bengaluru) and Nightingales Home Health Services (Hyderabad) providing diverse and established home healthcare services for patients in the region.

Key India Care Services Company Insights

The competitive rivalry in the market is moderate with the presence of several small & big players operating in nursing care, home healthcare, assisted living facilities, and others at a regional level. Providers are investing in technology for transforming services in India. The market is witnessing competition between the local & foreign players for a higher market share. The majority of the foreign players are looking forward to expanding their services in India by acquiring local players.

Key India Care Services Companies:

- Apollo Homecare

- Portea Medical

- HCAH Nightingales Home Health Services

- India Home Healthcare

- Grand World Elder Care

- Health Care at Home Private Limited

- Bharath Home Medicare

- Care24 Pvt Ltd.

- Ezee Medfind LLP

- Swarg Community Care

Recent Developments

-

In July 2024, Star Health and Allied Insurance Co. Ltd. launched Home Health Care services in 50 cities. This launch of the centers was in partnership with Care24 Pvt. Ltd., Athulya Home Healthcare, Portea Medical, Argala Health Services Private Limited, and CallHealth Services Pvt. Ltd. to offer in-home medical care across India.

-

In May 2024, Apollo Homecare launched the 'Home Discharge Program' to offer post-discharge care for cardiac surgery patients. This initiative represents a significant advancement in improving recovery and ensures the long-term well-being of patients undergoing cardiac procedures.

-

In March 2024, Kites Senior Care, a provider of geriatric care services, secured USD 5.37 million (Rs 45 Crore) in Series A funding. This funding to help the company expand its presence in cities such as Hyderabad, Bengaluru, and Chennai and support its expansion into three additional cities in Southern India.

-

In December 2023, Health Care at Home Private Limited, an out-of-hospital care provider, inaugurated its seventh Transition Care Centre (TCC) in Navi Mumbai, Maharashtra. This center offers a wide range of rehabilitation and senior services nationwide, focusing on affordable, personalized healthcare solutions. Over the next five years, the company aims to increase the number of transition beds to 2,500 and enhance its services through further technological integration.

-

In April 2023, Health Care at Home Private Limited acquired Bengaluru-based Nightingales Home Health Services. This acquisition is anticipated to bolster HCAH’s expansion plans and significantly boost the Indian home healthcare industry.

India Care Services Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 72.31 billion |

|

Growth rate |

CAGR of 13.76% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, region |

|

Country scope |

India |

|

Key companies profiled |

Apollo Homecare, Portea Medical, HCAH Nightingales Home Health Services, India Home Healthcare, Grand World Elder Care, Health Care at Home Private Limited, Bharath Home Medicare, Care24 Pvt Ltd., Ezee Medfind LLP, Swarg Community Care |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

India Care Services Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India care services market report based on type, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospice & Palliative Care

-

Home Healthcare

-

Skilled Home Healthcare

-

Unskilled Home Healthcare

-

-

Skilled Nursing Facility

-

Assisted Living Facility

-

Home Pathology/Clinical Testing

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Central India

-

North India

-

West India

-

East India

-

Northeast India

-

South India

-

Frequently Asked Questions About This Report

b. The India care services market size was estimated at USD 29.62 billion in 2023 and is expected to reach USD 33.37 billion in 2024.

b. The India care services market is expected to grow at a compound annual growth rate of 13.76% from 2024 to 2030 to reach USD 72.31 billion by 2030.

b. The West India segment held the maximum market share of over 33% in 2023. This attributable to the presence of multiple service providers, rising urbanization, and the growing rate of nuclear families in the west zone.

b. Some key players operating in the India care services market include Care 24, Apollo Homecare, Healthcare atHOME, Medifind, Portea Medical, Nightingales Home Health Services, India Home Health Care (IHHC), Grand World Elder Care, Healthcare atHome, Bharath Home Medicare, and Swarg Community Care.

b. Key factors driving the India care services market growth include the rising need for the better quality of care, increasing geriatric population, shift in trend from communicable to chronic diseases, rapid technological advancements, growing disposable income, and demand for cost-effective care services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."