India Car And Bike Care Products Market Size, Share & Trends Analysis Report By Car Care Products, By Bike Cleaning Products, By Packaging Volume, By End Use, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-346-7

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

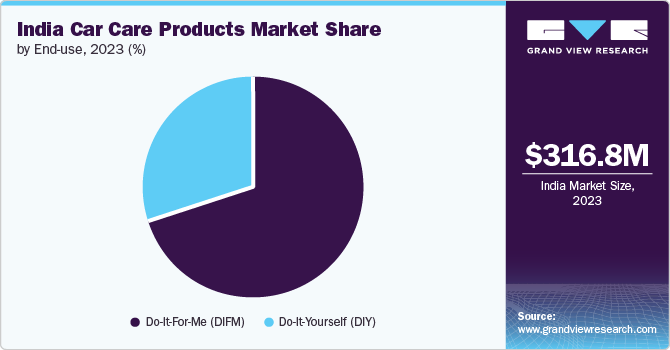

The India car and bike care products market size was valued at USD 316.8 million in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The use of bike & car care products for the maintenance and repair of vehicles is gaining popularity on account of growing awareness regarding their advantages among end users. With increasing disposable income and spending power, several younger population groups are inclined to buy cars & bikes to maintain their lifestyle and status. This is expected to positively impact the demand for premium car care products over the forecast period.

On account of the continuous growth of the automotive industry, the need for the repair and maintenance of vehicles is expected to rise. This, in turn, is expected to propel the demand for car & bike cleaning products over the forecast period. Recent years have seen an increase in interest and importance of aesthetics in automobiles, especially private vehicles. Moreover, the COVID-19 pandemic gave a boost to this interest as users stayed at home and had time and resources to make their vehicles aesthetically pleasing. The change in consumer behavior during the pandemic has led to an increased demand for DIY products and the usage of e-commerce for purchasing products.

Moreover, in 2020, the Government of India launched The National Electric Mobility Mission Plan (NEMMP) 2020, a comprehensive initiative focused on accelerating the adoption and production of electric vehicles in the country. After this, several players from the Indian automotive market, including Maruti Suzuki, Hyundai, Mahindra & Mahindra, and Tata Motors, are set to launch new hybrid and electric vehicles in the market. This is expected to drive the growth of the automotive industry in India, further propelling the demand for car & bike care products over the forecast period.

The automotive industry in India is rapidly growing on account of high economic growth, rising disposable income, urbanization, and infrastructure development. As per the data published by Invest India, the automobile industry produced a total of 28.43 million vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, from April 2023 to March 2024. The government of India is further taking steps to increase the output of the automotive industry. For instance, the Production Linked Incentive (PLI) Scheme for Automobile and Auto components was approved by the union cabinet in September 2021. The PLI-AUTO Scheme aimed at boosting the manufacturing of Advanced Automotive Technology (AAT) products, facilitating and promoting deep localization for AAT products, and enabling the creation of domestic and global supply chains. This is expected to promote the growth of the automotive industry in India, further driving the demand for car & bike care products in the country.

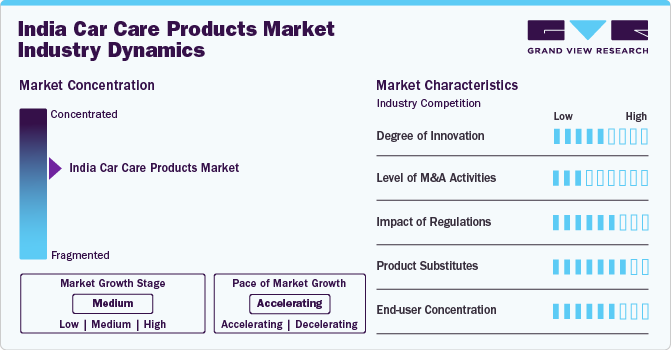

Market Concentration & Characteristics

The India car & bike care products industry is characterized as moderately competitive owing to the presence of both regional and multinational players. Car & bike care products require a variety of raw materials, proper infrastructure, and huge capital investment. This limits the entry of new players in the market. Major players have been in the market for many years, which gives them a cost advantage owing to their size, scale of operations, output, and cost of production. The new entrants have yet to establish themselves in terms of infrastructure and capital, which takes a significant amount of time to match up to the level of other major players.

The market is fragmented, with key players such as 3M, Motul, Formula 1 Wax, Sonax, and Turtle Wax Inc. These players face intense competition from regional players with strong distribution networks and know-how about suppliers, regulations, and each other. The manufacturers of car care products also provide products to garages and workshops, which further intensifies the competition.

The COVID-19 pandemic outbreak brought a halt to the automotive sector in India. According to data published by the Society of Indian Automotive Manufacturers, automotive domestic sales reduced from 21.5 million in 2019 to 18.6 million in 2020. This negatively impacted all the related and dependent markets, thus disrupting the demand for car and bike care products. However, the pandemic resulted in a change in consumer preferences.

The closing down of wholesale and retail shops turned users to online platforms, which offered wider products. In India, this trend was significantly accelerated by the pandemic, as users stayed at home and had time and resources to invest in car & bike care. The change in consumer behavior during the pandemic has led to an increased demand for DIY products and the usage of e-commerce to purchase these products. For personal users focusing on DIY, e-commerce platforms became an easier alternative to understand the alternatives and make informed purchases depending upon their needs.

During the pandemic, the focus on the personal hygiene of users increased considerably. This was also reflected in the upkeep of private vehicles. Regulations regarding cleaning procedures, such as sanitization at regular intervals and the use of interior cleaning products for personal vehicles, were major factors driving the market growth. Pandemic regulations also resulted in a decrease in detailing and personalization activities as such shops were not allowed to function in the beginning. However, as the lockdown progressed, the demand for services like detailing centers increased on account of the increasing interest of users in car aesthetics. The lockdown affected services such as cleaning and washing centers as they were forced to shut down due to regulations. This had a major effect on the demand for car care products by professional users.

However, with time at hand, personal vehicle users started maintaining their vehicles on their own with the help of DIY products. The restriction to access retail shops gave a boost to e-commerce sales of car care products as that helped the newer, first-time DIY customers to make informed selections. The Do-It-Yourself (DIY) trend for maintenance was popular during the pandemic, however, the trend of Do-It-For-Me (DIFM) is now taking over. The DIFM market is rapidly growing as several individuals opt for professional services for vehicle maintenance.

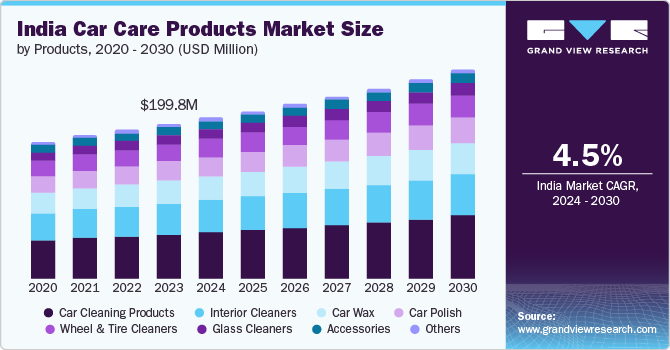

India Car Care Products Market Product Insights

Based on products, the car cleaning products segment dominated the market in 2023, accounting for a revenue share of 28.4%. This segment is expected to grow at the fastest CAGR of 5.2% from 2024 to 2030. Car cleaning products include a variety of products used to maintain the exterior appearance of a vehicle. Shampoo and detergent are frequently used to clean the metal surface of the cars. These products safely remove dirt, grease, oil stains, and other contaminants from the vehicle body. In addition, special insect removers are used to remove the insect residues from the bumper and hood of the car. These bug removers are applied to penetrate and loosen the insect residues while minimizing the mess.

India Car Care Products Market Packaging Volume Insights

Based on packaging volume, the 501 - 999 ml packaging volume segment contributed the largest market share in terms of revenue, accounting for 39.2% of the market in 2023, owing to its suitability for individuals as well as commercial use. This packaging volume is used for packaging moderate quantities of car care products and is usually a preferred option among independent repair shops, small workshops as well as individuals. An increasing number of people opting for maintenance and repair services, including car wash and detailing, is anticipated to have a positive impact on the segment growth over the coming years.

The 251 - 500 ml volume segment is forecasted to grow at the fastest CAGR of 5.2% from 2024 to 2030. This packaging volume is also generally meant for individual use or small garages. Improvement in consumer disposable income is expected to drive new car sales, which, in turn, is anticipated to drive the demand for car care products, thereby having a positive impact on the packaging volume segment growth. In addition, the do-it-yourself car maintenance and repair trend is further expected to fuel the segment's growth.

India Car Care Products Market End-use Insights

Based on end use, do-it-for-me (DIFM) dominated the market in 2023, accounting for a revenue share of 69.7%. DIFM end use for car care products includes its application from equipped services stations, maintenance yards, and car cleaning service providers. This segment is anticipated to ascend at a slower pace owing to high service costs and limited availability of products at professional service stores.

The do-it-yourself (DIY) is expected to grow at the fastest CAGR of 4.7% from 2024 to 2030. Growing demand for products from individual vehicle owners coupled with the wide availability of car care products in commercial markets are likely to support this segment growth in projected time. Growing trends for Do-It-Yourself (DIY) applications for car maintenance by individual owners are expected to further support products’ sale for DIY applications.

India Car Care Products Market Distribution Channel Insights

Based on distribution channel, retail chains accounted for the largest revenue share of 32.0% in 2023 and are anticipated to ascend at a significant CAGR over coming years. Growing penetration of retail stores in niche markets through third-party agreements and the establishment of local service shops are expected to support the retail distribution channels.

The E-commerce distribution channel is expected to witness a fastest growth rate of 4.8% from 2024 to 2030. Growing trends for online shopping owing to the wide availability of car care products from several manufacturers are expected to further increase the popularity of the e-commerce segment. Online portals allow users to select from a wide variety of car care products according to their car surface needs. Moreover, pictorial representation and existing consumer reviews present on the portal help users to make an easy choice for car care products. Convenient product delivery at the doorstep, along with comparatively lower costs, are other factors for the growing penetration of e-commerce distribution for car care products.

India Bike Care Products Market Product Insights

Based on product type, bike cleaning products accounted for the largest revenue share of 61.1% in 2023 and are expected to grow at the fastest CAGR over the coming years. This is owing to increasing demand for two-wheelers in the country, rising awareness regarding bike maintenance, and rising disposable incomes of the masses. According to the Society of Indian Automobile Manufacturers (SIAM), two-wheeler sales in India increased by 9.12% compared to the previous year to reach a total of 17.075 million units in 2023. This yearly increase in bike sales is expected to boost the demand for bike care products in the country.

India Bike Care Products Market End Use Insights

In 2023, Do-it-for-me (DIFM) end use segment dominated the market and accounted for the largest revenue share, owing to the presence of many bike care professional service centers set up by product manufacturers. These centers make it easy for bike owners to obtain professional services at their convenience. Furthermore, with increasing enthusiasm among people for purchasing super and adventure touring bikes, customers are bound to visit professional service centers due to a lack of experience in the maintenance of such bikes.

Key India Car And Bike Care Products Company Insights

Some of the key players operating in this market include 3M, Motul, and Pidilite Industries, Inc.

-

3M offers its products to a wide range of end-use companies, including cleaning & protecting, personal healthcare, home care, decoration, school supplies, office supplies, and sports & recreation. This company operates its business through five segments: industrial, safety and graphics, healthcare, electronics and energy, and consumer.

-

Motul S.A. is involved in the production of engine lubricants, transmission fluids, brake fluids, coolants & antifreeze, maintenance & care, and additives. This company also caters to powersport applications such as street bikes, scooters, off-roads, watersports, snowmobiles, karts & RC, marine, gardening, and bikes.

-

Pidilite Industries Inc., caters to several industries including textile and paper chemicals, industrial resins, organic pigments & preparations, leather chemicals, industrial adhesives, footwear adhesives, industrial bonding solutions, maintenance, repair, and overhaul solutions, and paper chemicals. Some of the major brands created by the company are Fevicol, Fevicol MR, Dr. Fixit, Fevikwik, M-Seal, Fevistik, Fevicryl, Hobby Ideas, and Motomax. Motomax brand includes products for exterior finish and protection for cars and bikes.

Vista Auto Care and Abro are some of the emerging market participants in this market.

-

Vista Auto Care is engaged in the production of cleaning, maintenance, and surface protection solutions for car and bike care industries.

-

Abro produces and distributes automotive, hardware, and consumer products in over 185 countries and territories worldwide.

Key India car And bike care products Companies:

- 3M

- Motul

- Pidilite Industries Ltd.

- Formula 1 Wax (West Drive)

- Turtle Wax, Inc.

- Vista Auto Care (Resil Chemicals)

- Würth India

- The Waxpol Industries Limited

- Shell Plc

- Miracle

- Auto Bros

- SONAX Gmbh

- Chemical Guys

- Sheeba India Pvt. Ltd.

- PROKLEAR

- GreenZ Car Care

- Niks

- Abro

- WaveX (Jangra Chemicals Private Limited)

Recent Developments

-

In January 2021, Motul expanded its automotive product portfolio by introducing a new car care product range, which includes 11 car cleaning products and six accessories. The products included in the range are glass cleaner, scratch remover, leather cleaner, rim brush, rim cleaner, and tire puncture spray, among others.

-

Turtle Wax Inc. entered the Indian market with its complete range of appearance products for four-wheelers and two-wheelers. The products will be made available in around 23 cities in India at accessory outlets, lubricant outlets, workshops, auto finish centers, and car spas.

India Car And Bike Care Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 330.2 million |

|

Revenue forecast in 2030 |

USD 435.9 million |

|

Growth rate |

CAGR of 4.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, end use, packaging volume |

|

Key companies profiled |

3M, Motul, Pidilite Industries Ltd., Formula 1 Wax (West Drive), Turtle Wax, Inc., Vista Auto Care (Resil Chemicals), Würth India, The Waxpol Industries Limited, Shell Plc, Miracle, Auto Bros, SONAX Gmbh, Chemical Guys, Sheeba India Pvt. Ltd., PROKLEAR, GreenZ Car Care, Niks, Abro, WaveX (Jangra Chemicals Private Limited) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

India Car And Bike Care Products Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India car and bike care products market report based on product, distribution channel, end use, and packaging volume.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Car Care Products

-

Car Cleaning Products

-

Car Polish

-

Car Wax

-

Wheel & tire Cleaners

-

Glass Cleaners

-

Interior Cleaners

-

Accessories

-

Others

-

-

Bike Care Products

-

Bike Cleaning Products

-

Bike Polish

-

Bike Chain Cleaners & Lubricants

-

-

-

Packaging Volume Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 250 ml

-

251 - 500 ml

-

501 - 999 ml

-

1 L - 5 L

-

Above 5 L

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Car Care Products

-

Do-It-Yourself (DIY)

-

Do-It-For-Me (DIFM)

-

-

Bike Care Products

-

Do-It-Yourself (DIY)

-

Do-It-For-Me (DIFM)

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Retail Chains

-

Car Detailing Stores

-

Frequently Asked Questions About This Report

b. The India car and bike care products market size was estimated at USD 316.8 million in 2023 and is expected to reach USD 330.2 million in 2024.

b. The India car and bike care products market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 435.9 million by 2030.

b. Bike cleaning products accounted for the largest revenue share of 61.1% in 2023 and is expected to dominate the market over the forecast period, owing to the increasing intrest in bike care & cleaning activities among young population groups

b. The key players operating in the India car & bike care market include 3M, Motul, Pidilite Industries Ltd., Formula 1 Wax (West Drive), Turtle Wax, Inc., Vista Auto Care (Resil Chemicals), Würth India, The Waxpol Industries Limited ,. Shell Plc, Miracle, Auto Bros, SONAX Gmbh, Chemical Guys, Sheeba India Pvt. Ltd., PROKLEAR, GreenZ Car Care, Niks, Abro, and WaveX (Jangra Chemicals Private Limited)

b. The India car & bike care is anticipated to be driven with increasing disposable income and spending power, several younger population groups are inclined to buy cars & bikes to maintain their lifestyle and status. This is expected to positively impact the demand for premium car care products over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."