- Home

- »

- Animal Health

- »

-

India Bovine Artificial Insemination Market Size, Report 2030GVR Report cover

![India Bovine Artificial Insemination Market Size, Share & Trends Report]()

India Bovine Artificial Insemination Market Size, Share & Trends Analysis Report By Solutions (Semen, Services), By Animal (Cow, Buffalo), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-468-9

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

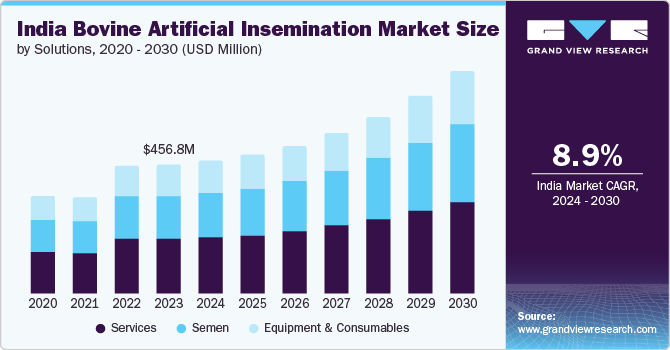

The India bovine artificial insemination market size is estimated to be USD 456.79 million in 2023 and is projected to grow at a CAGR of 8.94% from 2024 to 2030. Key factors expected to drive the market include ongoing government initiatives to increase artificial insemination practices in the country, rising government focus on boosting milk production in the country, emerging efforts from the authorities to structure the dairy sector, and increasing technological advancements.

India has a large population of livestock, which plays a vital role in contributing to the country's overall GDP. According to the Department of Animal Husbandry and Dairying (DAHD), India manufactured around 230.58 million tonnes (MT) of milk in the year 2023, which is around 25% of the global milk produced. As per the Livestock Census conducted in the country, there are around 303.76 million bovines, 74.3 million sheep, 148.9 million goats, 9.1 million pigs, and 851.8 million poultry.

The government has undertaken many initiatives, such as the Rashtriya Gokul Mission and the National Artificial Insemination Programme (NAIP), to develop and preserve indigenous bovine breeds. In its current phase, under NAIP, artificial insemination services are delivered free of cost to farmers at their doorsteps in over 605 districts across the country. In 2023-2024, according to DAHD, over 10 million doses of sex-sorted semen were produced in the country.

It is estimated that in 2023-2024, the government semen stations have produced over 4.95 million semen doses, and other channels like dairy cooperatives, NGOs, and private semen stations have produced over 4.97 million semen doses. Now, apart from production, to ensure that these semen doses are effectively employed in AI, the government provides a subsidy of INR 750 (USD 8.9) or 50% of the cost of sorted semen to the farmer when pregnancy is confirmed. Such activities are acting as catalysts to increase the penetration of AI among dairy farmers in the country.

Across the country, the government and private sector together have employed Multipurpose AI Technicians in Rural India (MAITRIs) to ensure that artificial insemination (AI) reaches the remotest parts of the country. In 2023-2024, a total of about 27,000 MAITRIs have been trained and deployed across India. Due to these activities, the country experienced a huge boost in the total number of artificial insemination procedures performed in the country. For example, according to data from DAHD, total AI procedures performed on the bovine population increased over 25% from 78.5 million in 2021 to 98.06 million in 2022. The adoption of artificial insemination also reached maximum of 100% in some states like Kerala.

Another crucial driving factor for the market is the launch of innovative technologies to aid the livestock sector in the country. For example, in March 2024 Press Information Bureau of India (PIB), the Indian government launched Bharat Pashudhan Livestock Data Stack, a digital database for real-time tracking monitoring of livestock animals in the country using a unique ID number. Through this system, farmers will be able to access as well as upload veterinary information related to artificial inseminations, vaccinations, new animal registration, ownership change, animal diseases diagnostic as well as treatment data, milk output recording, etc. The PIB further said that as of March 2024, 1.6 million entries per day are being added to this data stack.

Furthermore, in April 2023, students from IIT Delhi launched an online platform of livestock and livestock products called as Animall. Through this platform, individuals can buy/sell livestock as well as artificial insemination products like semen, gun, sheath, etc. In a funding round, the company raised over USD 14 million and was valued at approximately USD 75 million. Such market activities are driving the market by increasing efficiency, transparency, and accessibility. Digital platforms and data stacks contribute towards enabling farmers to make informed decisions, track animal health, and optimize breeding processes. This, in turn, will contribute to improving cattle productivity and enhance overall livestock management, resulting in rising demand for artificial insemination services and driving market growth.

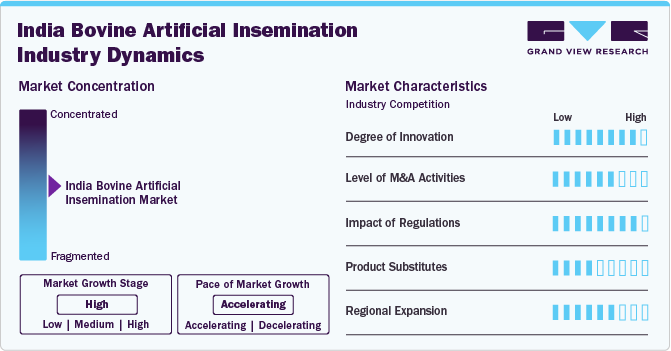

Market Concentration & Characteristics

The degree of innovation in this market is estimated to be high. This can be attributed to the fact that the private and government players in the country are focusing on developing innovative technologies to become self-reliant in the production of sex-sorted semen. The NDDB, a subsidiary of DAHD, 2022 developed an Indigenous sex-sorting semen technology to decrease reliance on the import of sex-sorted semen. This step will also help boost the proliferation of female calves through artificial insemination and ultimately increase milk output across the country.

The moderate to high impact of merger and acquisition activities on the market can be seen due to the increasing dominance of central government entities through the acquisition of dairy cooperatives and other agencies across different states in the country. For example, in March 2024, NDDB completed the acquisition of Mahanand Dairy, a venture of Maharashtra State Cooperative Milk Federation Ltd.

The impact of regulations is estimated to be very high in this market. In India, various government schemes like the Rashtriya Gokul Mission and NAIP contribute to the higher penetration of artificial insemination (AI) by providing structured regulatory guidelines and processes to ensure it.

The impact of product substitutes is estimated to be low to moderate. This is due to the fact that the government largely dominates and controls the country’s artificial insemination market. With comprehensive infrastructure, including semen stations across the country, regulations and guidelines, government subsidies, trained personnel like MAITRIs, and booming partnerships between the government and private sector, the impact of product substitutes is somewhat limited as the farmers are opting to utilize the government benefits.

Market players in this industry are fragmented across different states, with each state having its dominant dairy cooperatives and other agencies. However, in recent years, these leading players are expanding their business across the country. For example, in July 2023, Amul Dairy expanded into Andhra Pradesh by acquiring Chittoor Dairy by signing a MoU with the Andhra Pradesh Government,

Solution Insights

The services segment accounted for the largest revenue share of 42.85% in 2023. This dominance can be attributed to farmers' growing awareness of the benefits of artificial insemination and the widespread adoption of AI services as a result of government initiatives. This allows farmers to breed multiple cows from the semen of a single bull, thereby minimizing the need to maintain a large number of bulls on the farm. This saves time and resources while increasing breeding efficiency. Furthermore, artificial insemination allows farmers to keep accurate records of the genetic composition and performance of their herds. The productivity of the herd can eventually be increased by using this information to inform breeding decisions. Moreover, reducing the need for large herds and boosting the effectiveness of breeding programs can help lessen the negative environmental effects of the bovine industry.

The semen segment is anticipated to grow at the fastest CAGR of 9.59% over the forecast period due to several factors. This segment consists of normal & sexed semen. The main driving factor for this segment is the rising use of sex-sorted semen in the country. The adoption of sex-sorted semen in the country was largely dependent on its import from other countries like Brazil. However, in recent years, the government, as well as private players, have taken the initiative to produce sex-sorted semen indigenously, with records from DAHD putting the total production by the government as well as private players in 2023-2024 at more than 8 million doses.

Animal Insights

The cow segment dominated the market with a revenue share of 59.19% in 2023 and a CAGR of over 9% over the forecast period. This dominance can be mainly attributed to two factors: the population and the contribution to milk production. According to multiple annual reports published by the DAHD, cows have consistently dominated milk production in the country, with a share of more than 65%. This contribution points towards higher consumption of cow milk and hence increased profitability of using artificial insemination (AI) in cows in comparison to buffaloes.

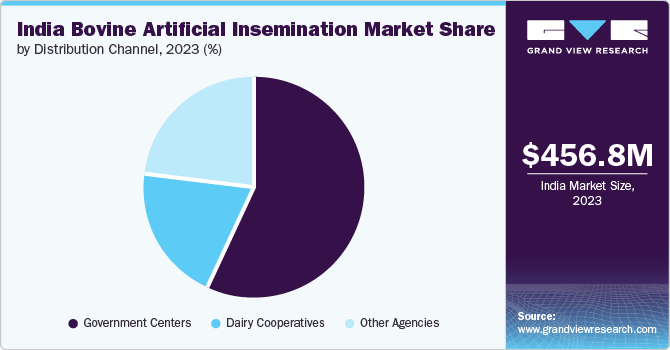

Distribution Channel

The government centers segment dominated the Indian market with a market share of 56.81% in 2023 and a CAGR of over 9.5% over the forecast period. This dominance can be attributed to the widespread penetration of government artificial insemination (AI) services across the country due to benefits like subsidies and free-of-cost AI services, government semen production stations, and partnerships with the private sector to enhance the penetration of bovine artificial insemination in the country.

Key India Bovine Artificial Insemination Company Insights

Considering the country's market competition, the industry is largely dominated by government entities like semen stations, dairy cooperatives, and government AI centers. This dominance is expected to continue in the future due to the benefits offered by them. When it comes to private players, these players are expanding in the country’s market by gaining distributors for their products and partnering with government entities.

Key India bovine Artificial Insemination Companies:

- National Dairy Development Board (NDDB)

- Genus plc

- Alta Genetics Inc.

- Xcell Breeding & Livestock Services Pvt Ltd

- Accuvance India

- Inguran Sorting Technologies LLP (Stgenetics)

- VikingGenetics

- Verka (MilkFed)

- IMV Technologies

- MINITÜB GMBH

- Paayas Milk Producer Company Ltd.

- Amul Dairy

- Maahi Milk Producer Company Ltd.

Recent Developments

-

In June 2024, according to a publication by Indian Express, Amul and Verka, leading milk brands from Gujarat & Punjab, respectively, are actively investing in expanding into newer states to spread their business dominance.

-

In June 2024, the authorities from Puducherry announced plans to launch IVF technology to boost milk production.

-

In May 2024, NDDB announced that novel and indigenous sex-sorting technology will be available throughout the country in the near future.

-

In January 2024, the NDDB signed an MoU with Odisha government for construction of a new GMP facility to boost production of different veterinary products like medicines and vaccines.

-

In February 2024, AltaGenetics exported over 40,000 semen doses of Gir to India to boost production of milk in the country.

-

In April 2023, VikingGenetics entered into the Indian market by signing Bulls-n-more as a distributor.

India Bovine Artificial Insemination Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 469.73 million

Revenue forecast in 2030

USD 785.03 million

Growth Rate

CAGR of 8.94% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, animal, distribution channel, region

Regional scope

Eastern Region; Southern Region; Western Region; Northern Region

Key companies profiled

National Dairy Development Board (NDDB), Genus plc, Alta Genetics Inc., Xcell Breeding & Livestock Services Pvt Ltd, Accuvance India, Inguran Sorting Technologies LLP (Stgenetics), VikingGenetics, Verka (MilkFed), IMV Technologies, MINITÜB GMBH, Paayas Milk Producer Company Ltd., Amul Dairy, & Maahi Milk Producer Company Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Bovine Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India bovine artificial insemination market report based on solutions, animal, distribution channel, & region:

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Consumables

-

Semen

-

Normal (Conventional) Semen

-

Sexed Semen

-

Services

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Cow

-

Buffalo

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Government Centers

-

Dairy Cooperatives

-

Other Agencies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Eastern Region

-

West Bengal

-

Bihar

-

Jharkhand

-

Odisha

-

Other States

-

-

Southern Region

-

Tamil Nadu

-

Kerala

-

Telangana

-

Andhra Pradesh

-

Karnataka

-

-

Western Region

-

Maharashtra

-

Gujarat

-

Other States

-

-

Northern Region

-

Haryana

-

Rajasthan

-

Punjab

-

Himachal Pradesh

-

Uttar Pradesh

-

Uttarakhand

-

Madhya Pradesh

-

Chhattisgarh

-

Other States

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the India bovine artificial insemination market include National Dairy Development Board (NDDB), Genus plc, Alta Genetics Inc., Xcell Breeding & Livestock Services Pvt Ltd, Accuvance India, Inguran Sorting Technologies LLP (Stgenetics), VikingGenetics, Verka (MilkFed), IMV Technologies, MINITÜB GMBH, Paayas Milk Producer Company Ltd., Amul Dairy, & Maahi Milk Producer Company Ltd.

b. Key factors expected to drive the market include ongoing government initiatives for increasing artificial insemination practices in the country, rising government focus on boosting milk production of the country, emerging efforts from the authorities to structurize the dairy sector, increasing technological advancements.

b. The India bovine AI market size was estimated at USD 456.79 million in 2023 and is expected to reach USD 469.73 million in 2024.

b. The India bovine artificial insemination arket is expected to grow at a compound annual growth rate of 8.94% from 2024 to 2030 to reach USD 785.03 million by 2030.

b. By solutions, the services segment accounted for the largest revenue share of 42.85% in 2023. This dominance can be attributed to farmers' growing awareness of the benefits of artificial insemination and the widespread adoption of AI services as a result of government initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."