- Home

- »

- Medical Devices

- »

-

India Biocompatible Dental Materials Market, Report 2030GVR Report cover

![India Biocompatible Dental Materials Market Size, Share & Trends Report]()

India Biocompatible Dental Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Metallic), By Application (Orthodontics), By End-use (Dental Hospitals And Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-312-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

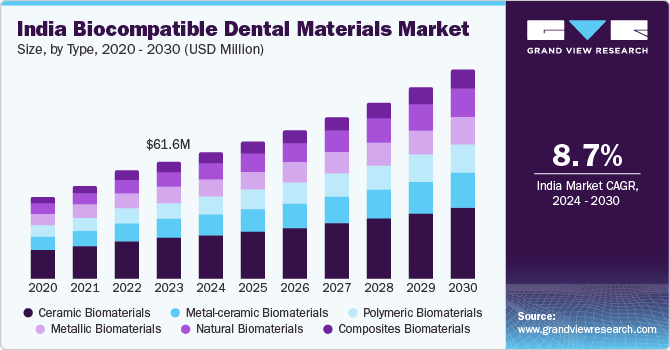

The India biocompatible dental materials market size was estimated at USD 61.6 million in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030. This growth is attributable to the increasing prevalence of dental caries, growing awareness regarding oral health, and the advancement and introduction of new biomaterials.

Dental caries, often known as tooth decay, periodontal disease, and oral cancer, are common dental health issues in India. According to the Borgen Project’s October 2020 blog on Issues of Dental Health in India, oral health issues are critical, with the highest oral cancer prevalence in the world. Poor oral hygiene, cigarette smoking, and a high-sugar diet contribute to multiple dental conditions in India. According to the Ministry of Health and Family Welfare, dental caries afflict over 60% of the Indian population, whereas periodontal disease affects approximately 85%.

In addition, tooth decay is widespread among youngsters because of poor oral hygiene as they consume many sugary foods and beverages and are more likely to develop dental caries, therefore, the frequency of dental caries in the young population is very high. The need for biocompatible dental materials is rising with increasing incidences of dental caries and associated procedures. Over the previous few decades, many dental restorative materials have augmented the market growth. In India, the trend shows an increase in oral health disorders, which have been steadily increasing in both prevalence and severity.

The Indian Dental Association (IDA) addressed significant gaps in oral health and well-being, as highlighted by the National Oral Health Survey, particularly affecting rural areas. Rural India faces a disproportionately low dentist population ratio, with less than 2% of dentists available to serve 72% of the rural population. Moreover, the prevalence of gum disease affects 95% of the population, only half of whom utilize a toothbrush. Merely 4.5% of the population seek dental care, underscoring the urgent need for enhanced oral health awareness, access to dental services, and preventive measures to address the grim reality of oral health disparities in India.

Decades of research have resulted in the creation of new materials, equipment, and technologies aimed at surgical treatment, expanding the understanding of the disease’s biology and effectively preventing or managing it. Many researchers have worked tirelessly to develop effective biocompatible dental materials to prevent and treat dental caries, focusing on inhibiting cariogenic plaque production while retaining beneficial bacteria, guiding and promoting dental hard tissue reconstruction, and delaying the progression of existing cavities. Technological advancements such as synthetic biomaterials have propelled the biocompatible dental materials market growth.

In September 2022, TeethFast secured seed funding totaling USD 0.65 million from high-net-worth individuals both domestically in India and internationally. TeethFast, an indigenous startup, specializes in offering manufacturing assistance for dental crowns, aligners, and metal frames to dental laboratories in the country and overseas. This investment underscores investors' growing interest and confidence in TeethFast's innovative approach to supporting dental laboratories with their manufacturing needs.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Rising technological developments in the field of biocompatible dental materials are anticipated to boost market growth. The novel product launches by key players are expected to further boost the market during the forecast period. For instance, in November 2023, Dentalkart, India’s prominent dental products and services provider, announced strategic alliance with Germany’s Baldus Sedation Systems. It marks a significant advancement in the Indian dental sector by introducing cutting-edge sedation solutions for dental practitioners. In addition, Dentalkart celebrates a notable achievement, surpassing a turnover of USD 12.06 million (INR 100 crores), demonstrating its dedication to transforming dental healthcare in India and its ambitious nationwide expansion strategy.

Several key players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. For instance, in August 2023, Rejové Aligners, a prominent player in the clear dental aligners market headquartered in Delhi, disclosed the acquisition of a predominant ownership interest in 32 WATTS, an esteemed brand specializing in clear aligners.

Compliance with international quality standards and regulatory requirements is crucial for dental product manufacturers to ensure the safety & efficacy of their products. Regulatory approval for dental biomaterials, including ceramic dental biomaterials, plays a crucial role in driving the biocompatible dental materials market.

Type Insights

The ceramic biomaterials segment dominated the market, with a share of 34.7% in 2023. Most medical device companies are focusing on developing advanced technologies due to the high prevalence of dental disease, which is likely to boost market growth. Ceramics are the most broadly used biomaterials in dental restoration, especially as dental inlays, bridges, or crowns. Various types of glass-ceramics and sintered ceramics are available nowadays to fulfil patient’s, dentists, and dental technicians’ needs regarding the processing of the products and properties of the biomaterials.

The natural biomaterials segment is expected to grow at the fastest CAGR over the forecast period. Natural biomaterials used in the field of dentistry are hydroxyapatite, collagen, chitosan, and assorted plant extracts. The selection of these materials depends on their capacity to emulate the inherent composition of the human body, facilitating enhanced assimilation and receptivity by the patient's tissues. The rising recognition of the environmental consequences associated with synthetic materials has increased focus on natural biomaterials. This heightened awareness is influencing patient preferences in dental treatments, prompting a surge in demand for materials that are both environmentally friendly and compatible with the human body.

In August 2022, Frimline introduced India's inaugural Toothpaste and Mouthwash, specifically designed to safeguard and enhance the oral health of expectant mothers. Dente91 Mom Toothpaste, enriched with Lactoferrin and Nano Hydroxyapatite, aids in reducing sensitivity, combating plaque, and repairing cavities. Formulated with essential vitamins such as Vitamin B6, Folic acid, Vitamin E, and Vitamin D3, it helps women's oral health during pregnancy. Furthermore, the toothpaste is free from Fluoride, SLS, Gluten, Paraben, Peroxide, and Triclosan, ensuring safety for pregnant women and their unborn babies.

Application Insights

The orthodontics segment held the largest market share in 2023. The orthodontic treatment is used to create healthy, straight teeth that properly meet opposite teeth in the opposite jaw. The orthodontics market is estimated to grow extensively in the near future due to different factors such as the increasing prevalence of dental diseases, an increasing geriatric population who are prone to tooth loss, and the rise in dental tourism.

One notable application of biomaterials in orthodontics is in the fabrication of orthodontic appliances, such as braces and aligners. Traditional braces, which consist of brackets, wires, and bands, have seen improvements in terms of the used biomaterials, leading to more efficient and comfortable treatment options. Biomaterials with superior strength and flexibility are chosen to withstand the forces applied during orthodontic adjustments. For instance, in September 2021, Rejové Clinique and Research Center, a renowned healthcare provider specializing in Dental, Skin, and Hair Treatments, announced 'Rejove Aligners,' advanced clear aligners tailored to address diverse oral health concerns, catering to individuals of all ages, with treatment overseen by experienced orthodontists in a unique doctor-owned and managed setup.

The implantology segment is expected to witness significant CAGR during the forecast period. The expansion of implantology in India can be attributed to an increased level of awareness regarding oral health and the advantages associated with dental implants. This heightened awareness has resulted in a shift among patients toward seeking enduring solutions for tooth replacement.

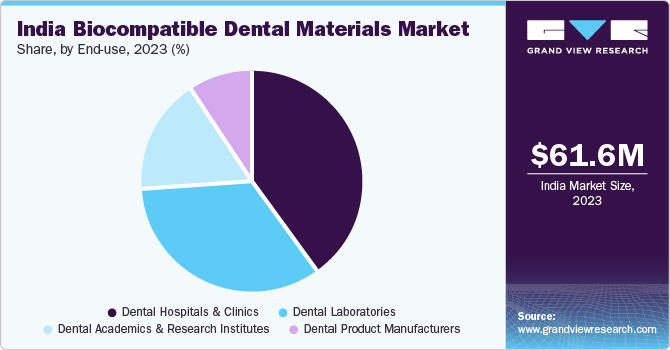

End-use Insights

The dental labs segment accounted for the largest market share in 2023 and is anticipated to have lucrative growth during forecast period. Dental laboratories utilize biocompatible dental materials for crafting personalized dental prosthetics like crowns, bridges, and dentures. These prosthetics are then inserted into patients' mouths by dentists. The purpose of using these biocompatible materials is to produce precise and durable dental prosthetics that closely resemble the natural teeth of the patient in terms of shape, size, and color.

The dental hospitals and clinics segment is likely to grow at the significant CAGR over the forecast period. Dental healthcare facilities, including hospitals and clinics, provide a diverse range of dental treatments administered by proficient personnel & certified professionals, thereby mitigating the likelihood of complications. It is evident that there exists a notable predisposition among individuals to prioritize dental hospitals and clinics as their primary choice for receiving comprehensive dental care services.

Key India Biocompatible Dental Materials Company Insights

Some of the key players operating in the India biocompatible dental materials market include Institut Straumann AG, Geistlich Pharma AG, Zimmer Biomet, Envista, Dentsply Sirona, 3M, and DSM.

-

Institut Straumann AG, a prominent entity in implant dentistry products, conducts its business operations through three distinct segments: replacement, digital, and regenerative solutions. The company actively engages in collaborative initiatives with esteemed dental clinics, research institutes, and universities to spearhead the development and manufacture of prosthetics & dental implants crucial for effective tooth replacement.

-

Dentsply Sirona manufactures and markets a diverse range of products and consumables in dental procedures. The company focuses on preventive and restorative medicine, orthodontics, prosthetics, endodontics, implants, healthcare imaging instruments, and CAD/CAM technologies.

KURARAY CO., LTD., Medtronic, Henry Schein, Inc., Mitsui Chemicals, Inc., Victrex plc, Ivoclar Vivadent AG, and GC Corporation are some of the other market participants in the India biocompatible dental materials market.

Key India Biocompatible Dental Materials Companies:

- Institut Straumann AG

- Geistlich Pharma AG

- Zimmer Biomet

- Envista

- Dentsply Sirona

- 3M

- DSM

- KURARAY CO., LTD.

- Medtronic

- Henry Schein, Inc.

- Mitsui Chemicals, Inc.

- Victrex plc

- Ivoclar Vivadent

- GC Corporation

Recent Developments

-

In June 2023, Evonik showcased a cutting-edge technological innovation used for dental prosthetics, using VESTAKEEP PEEK, a high-performance polymeric biomaterial acclaimed for its superior properties in diverse dental applications.

-

In May 2023, SprintRay Inc. received FDA 510(k) clearance for its innovative high-impact denture base resin.

India Biocompatible Dental Materials Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 110.0 million

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use

Country scope

India

Key companies profiled

Institut Straumann AG; Geistlich Pharma AG; Zimmer Biomet; Envista; Dentsply Sirona; 3M; DSM; KURARAY CO., LTD.; Medtronic; Henry Schein, Inc.; Mitsui Chemicals, Inc.; Victrex plc; Ivoclar Vivadent; GC Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Biocompatible Dental Materials Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India biocompatible dental materials market report based on product, application, and end-use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Metallic Biomaterials

-

Ceramic Biomaterials

-

Polymeric Biomaterials

-

Metal-ceramic Biomaterials

-

Natural Biomaterials

-

Composites Biomaterials

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthodontics

-

Implantology

-

Prosthodontics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Hospitals and Clinics

-

Dental Laboratories

-

Dental Academics and Research Institutes

-

Dental Product Manufacturers

-

Frequently Asked Questions About This Report

b. The India biocompatible dental materials market size was estimated at USD 61.6 million in 2023 and is expected to reach USD 66.6 million in 2024.

b. The India biocompatible dental materials market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 110.0 million by 2030.

b. Ceramic biomaterials dominated the India biocompatible dental materials market with a share of 34.7% in 2023. This is attributable to the most medical device companies are focusing on developing advanced technologies due to high prevalence of dental disease.

b. Some of the players operating in this market are Institut Straumann AG; Geistlich Pharma AG; Zimmer Biomet; Envista; Dentsply Sirona; 3M; DSM; KURARAY CO., LTD.; Medtronic; Henry Schein, Inc.; Mitsui Chemicals, Inc.; Victrex plc; Ivoclar Vivadent; and GC Corporation

b. Key factors that are driving the India biocompatible dental materials market growth include the increasing prevalence of dental caries, growing awareness regarding oral health, and advancement and introduction of new biocompatible dental materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.