India Animal Health Market Size, Share & Trends Analysis Report By Product, By Animal (Production Animal, Companion Animal), By Distribution Channel (Retail, E-Commerce, Hospital/ Clinic Pharmacy), By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-478-4

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

India Animal Health Market Size & Trends

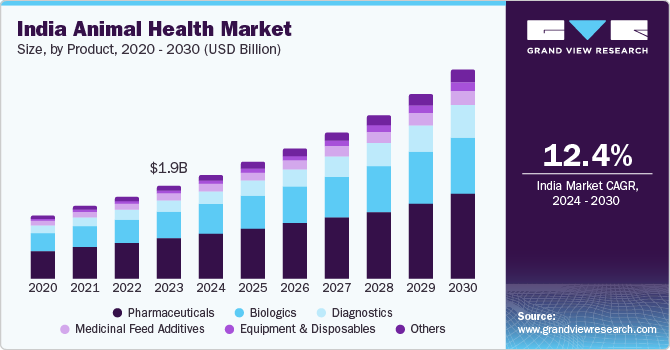

The India animal health market size was estimated to be USD 1.9 billion in 2023 and is anticipated to grow at a CAGR of 12.4% from 2024 to 2030. Key factors expected to drive the market include growing government participation, rising product/ service launches, evolving regulatory scenario, emergence of startup culture, increasing R&D investments and technological advancements.

The primary market driver is the increasing government support as well as participation in boosting the animal health sectors in India. This participation ranges from regulatory changes to the veterinary practices and testing of veterinary drugs; to initiatives to ensure high penetration of veterinary products and services to the remotest parts of the country. For example, in August 2023, the Government of India’s (GOI) Department of Animal Husbandry and Dairying (DAHD) finalized Standard Veterinary Treatment Guidelines (SVTGs) with an aim to standardized veterinary practices across the nation. The SVTGs coverage spans across 274 animal diseases across multiple animal species. The main purpose of these guidelines is to create standard treatment protocols, attempt to reduce prescription variability among veterinary practices, and ensure that veterinarians across the country comply to these guidelines. Furthermore, the main focus of these guidelines is to promote stewardship of veterinary drugs to inhibit irrational veterinary treatment practices and hence lessen the rising risk of antimicrobial resistance among animals.

In addition, according July 2024 article by The Hindu, with an aim to maintain a healthy animal, the Indian Pharmacopoeia Commission (IPC), waived off an obsolete veterinary vaccines safety test known as Target Animal Batch Safety Test (TABST) to inhibit the number of animal subjected. This decision has been made due to its lack of specificity and tendency to produce false results and hence potentially prove to be fata for the animal test subject. Such regulatory decision trudge India closer to aligning with international veterinary vaccine testing as well as veterinary treatment standards.

Furthermore, states across the country in collaboration with the DAHD, are taking strides in ensuring penetration of animal health into remotest sections of the country. For example, in February 2024, the Kerala Veterinary Council, with an aim to increase adoption of veterinary healthcare, launched a training program known as “A-Help”. Under this program more than 300 women have been trained as “Pashu Sakhis” and deployed in remote areas of the state.

Moreover, in order to boost management of animal health in India, the DAHD and United Nations Development Programme (UNDP) signed a MoU in May 2024. Under this partnership, a digital system to track vaccine stocks, flow, and storage temperatures by employing artificial intelligence (AI) will be implemented by DAHD. The former will also be able to utilize UNDP's Animal Vaccine Intelligence Network (AVIN). This will enhance skills and knowledge of stakeholders in animal husbandry, support livestock insurance, and ensure proper immunization coverage for livestock. The initiative addresses challenges in India's complex cold chain infrastructure and human resource limitations.

The Indian market for animal health will be driven by the government's recent measures, which include standardizing veterinary practices, eliminating outdated safety tests, and putting in place digital systems for vaccine management. These initiatives will result in better animal health outcomes, a rise in the use of veterinary care, and an improvement in stakeholders' abilities and knowledge. Consequently, it is anticipated that the market will grow due to an increase in demand for animal health services and products. Furthermore, an emphasis on lowering antimicrobial resistance and encouraging veterinary medication stewardship will result in transitioning to more sustainable and accountable animal health practices.

Another crucial driving factor for the market is the rising number of market players. The abundant growth of opportunities in the Indian animal health has, in the recent years attracted many new entrants into the market. For instance, in January 2024, ENTOD Pharmaceuticals, one of the leading announced entry into veterinary sector by launch of “Fur”, a range of veterinary ophthalmic medicines ranging from lubricating eye drops, anti-allergic drugs, antibiotics, as well as anti-glaucoma medications. Furthermore, in August 2024, Godrej Consumer products announced an investment of over INR 500 crore (USD 60 million) over the next five years into a new pet care business in India.

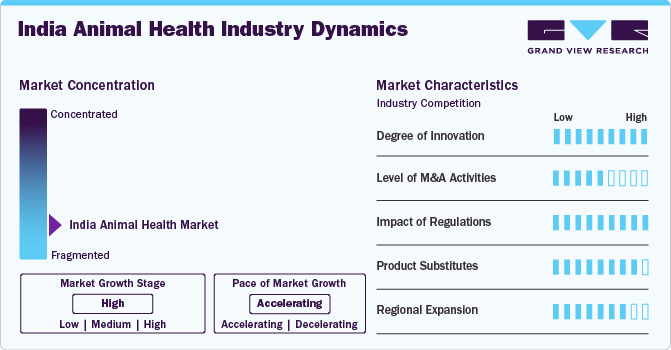

Market Concentration & Characteristics

The degree of innovation in the country’s market can be characterized for bringing in high impact. This can be attributed to the growing startups in the animal health industry of the country complemented by the increasing government support for such companies. For example, in June 2024, scientists from IIT Madras incubated startup, Vetinstant Healthcare launched their first product for monitoring of oxygen and heart rate in dogs.

Low to moderate impact of merger & activities on the market can be seen owing to animal health companies in the country venturing into diversifying their product portfolio by acquiring niche animal health products manufacturers. For instance, in February 2024, Zenex Animal Health acquired a Ayurvet, company that manufactures and supplies ayurvedic and herbal medicines for companion animals such as dogs and cats.

Due to the fact that the GoI is actively playing multiple roles in the country’s animal healthcare; from formulating regulatory standards for treatment and veterinary drug testing to manufacturing veterinary products such as medicines, biologics, and medicinal feed additives through their company India Immunologicals Ltd (established by NDDB). Furthermore, in order to achieve uniform animal care standards, the regulatory body in the country is updating its existing regulations to conform with international standard as well as forging international partnerships with leading organizations such as FAO, and UN.

The impact of product substitutes is estimated to be high. This is due to the fact that despite the commanding presence of globally leading companies such as Zoetis, Boehringer Ingelheim, Merck, and Virbac; large number of domestic players exists in the country. According to 2022 reports from Pashudhan Praharee, a GoI magazine dedicated towards publishing data on the country’s livestock industry, apart from the leading 10 companies, more than 50 domestic players currently operate in the Indian animal health industry.

The industry is subject to moderate-high impact of regional expansion activities by market players. Wherein, international animal health industry leaders, recognizing the expansion opportunities in India, are expanding their business in the country and on the other hand, domestic companies are expanding their horizons beyond the country’s boundaries. For instance, in September 2024, Zoetis announced expansion of its existing Global Capability Center in Hyderabad, India in an effort to strengthen its presence in the country.

Product Insights

The pharmaceuticals segment accounted for the largest revenue share of 42.96% in 2023. The pharmaceuticals segment is further classified into parasiticide, anti-infective, anti-inflammatory, analgesics, and others. The segment’s dominance which can be attributed to increasing prevalence of food-borne diseases, brucellosis, and zoonotic diseases that are potentially hazardous to animals, thus, leading to clinical urgency for use of potent pharmaceuticals and targeted medicines. Analgesics segment under the pharmaceuticals segment is estimated to grow at the highest rate due to increasing pre-operative as well as post-operative applications of these products in veterinary healthcare.The other segment containing segments such as veterinary telehealth, veterinary software and livestock monitoring is anticipated to grow at the fastest CAGR of 17.76% over the forecast period due to several factors. The growing adoption of these systems and growing awareness about the benefits of use of software solutions can be attributed to its growth. Furthermore, the prevalence of zoonotic and chronic diseases in animals and the rising adoption of IoT and AI by animal owners are some of the major drivers for the segment growth. The segment growth is also attributed to the rising usage among veterinarians to seek consultation from the veterinary specialist via telehealth tools to gain advice and insights regarding the care of the animal.

Animal Insights

The production animal segment dominated the India animal health market with a revenue share of 83.04% in 2023. The significant market share represented by the segment may be attributed to a global increase in government’s attention on increasing production of animal-derived products, food safety and sustainability. Total food security is a goal pursued by policymakers, such as NITI Aayog, in the country, which promotes large-scale food production and increases the breeding of producing animals. The policies are focused on long-term sustainability, which can be achieved by improving the productivity and giving more attention to production animal healthcare.

The companion animal segment is anticipated to growth at the highest growth rate over the forecast period owing to increase in companion animal ownership, awareness, and demand for efficient animal care. Increase in companion animal ownership is due to the associated health benefits. Consequently, animal-assisted therapy is increasingly preferred as an adjuvant in a number of areas of animal healthcare. In order to maintain the well-being of companion animals, adoption of pharmaceuticals and vaccines is increasing, thereby, serving as a driver for the segment. In addition, a significant rise in companion animal ownerships in the developed and developing regions can also be attributed to an increasing urbanization and growing disposable income.

Distribution Channel

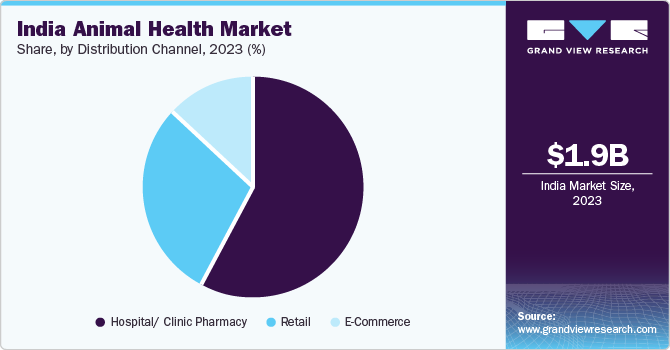

The hospital/clinic pharmacy segment dominated the market with a revenue share of 57.46% in 2023. The substantial share can be attributed to high accessibility and affordability. The Hospital/Clinic Pharmacy segment is expected to grow at a constant rate owing to the increasing prevalence of chronic diseases. Furthermore, hospitals provide advanced treatment products, which is expected to contribute to the overall growth of the hospital segment. The rise in the adoption of companion pets worldwide is driving the segment growth. Besides, high procedural volume as a consequence of frequent readmission of pets for treatment is one of the factors responsible for growth.

The e-commerce segment is anticipated to growth at the highest growth rate over the forecast period. This can be attributed to various advantages such as increased convenience for patients not willing to purchase medicines from retail or hospital pharmacies. Moreover, these also facilitate a consistent supply of drugs, as medications can be preordered. Benefits such as these are anticipated to accentuate the demand for e-commerce throughout the forecast period. Technological advancements along with increasing pet adoption are the main growth drivers. Increasing internet penetration is strengthening the smartphone using population across the globe as it allows better customer experience.

End Use Insights

The veterinary hospitals & clinics segment dominated the market with a revenue share of 72.12% in 2023. Presence of in-house laboratories in the veterinary hospitals and clinics is enabling faster diagnosis, helping patients avail treatment at the earliest. In addition, results of the clinical tests are easily available, which reduces the delay. Furthermore, the number of visits and time consumed in taking pet patients from one place to another is also saved. Thus, this segment is anticipated to exhibit considerable growth over the forecast period. Availability of a wide range of treatments as well as diagnostic options in veterinary hospitals & clinics is a high-impact rendering driver for this segment.

The point-of-care testing/in-house testing segment is anticipated to growth at the highest growth rate over the forecast period owing to increase in the number of initiatives undertaken for animal healthcare and availability of cost-efficient measures for disease diagnosis & monitoring. cCRP, fructosamine, phenobarbital, lactate, hemoglobin, fibrinogen, pancreatic lipase, NH3, serum amyloid A (SAA), and T4 tests are some examples of common veterinary point-of-care tests. These factors are anticipated to boost segment growth, as POC testing can help pet parents identify their pets’ health issues earlier before it becomes serious or life-threatening.

Key India Animal Health Company Insights

The market in India is quite competitive due to presence of many domestic companies alongside presence of a significant number of major manufacturers, such as Zoetis, Merck, Virbac, Boehringer, Elanco, and Ceva, and also dynamic involvement of government entities in manufacturing veterinary healthcare products apart from their regulatory role in the market. To increase their market presence & share, these players are implementing several strategic initiatives such as new product launches, regional expansions, R&D investments, partnerships with animal healthcare organizations, and free vaccination or zoonotic diagnostic campaigns.

Key India Animal Health Companies:

- Merck & Co., Inc.

- Ceva

- Vetoquinol S.A.

- Zoetis

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Incorporated

- IDEXX Laboratories, Inc.

- Neogen Corporation

- Virbac

- B. Braun Vet Care

- Covetrus, Inc.

- Avante Animal Health

- TeleVet

- Practo

- Mars Inc.

- Phibro Animal Health Corporation

- Dechra Pharmaceuticals Plc

- Bimeda Inc.

- Midmark Corporation

- Thermo Fisher Scientific

- IDVet

- Hester Biosciences Ltd

- India Immunologicals ltd.

Recent Developments

-

In August 2024, Boehringer Ingelheim (BI) India and Vvaan Lifesciences Private Ltd announced partnership for distribution rights of the former’s pet parasiticide product portfolio. This agreement was signed under BI’s initiative, India Animal Health Accelerated Growth Plan (AGP), to increase their influence in this Indian market.

-

In June 2024, Max PetZ hospital in Delhi performed the nation’s first non-invasive heart surgery on a dog using Transcatheter Edge-to-Edge Repair (TEER) technique.

-

In March 2024, scientists from IIT Guwahati completed the technology transfer of their innovative reverse genetic platform to develop a vaccines for swine fever vaccine that employs to BioMed Pvt Ltd for commercialization. This technology has marked launch of India’s first indigenously developed recombinant virus-based for classical swine fever.

-

In February 2024, New Delhi Municipal Council (NDMC), announced launch of new 200 multispecialty hospitals for animals in New Delhi. The authority further unveiled its plans to open an animal birth control office in the city.

-

In February 2024, Tata Group announced the launch of Tata Trusts Small Animal Hospital in Mumbai. This will one of the first tertiary care hospitals in the country that will operate 24/7 and provide services to small animals such as dogs, cats, rabbits, and others. The group has invested about INR 165 crore (USD 20 million) in this project.

-

In October 2023, the World Organization for Animal Health (WOAH) approved India’s self-declaration of bird-flu freedom in specific states such as Maharashtra, Tamil Nadu, Uttar Pradesh, and Chhattisgarh.

India Animal Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.1 billion |

|

Revenue forecast in 2030 |

USD 4.3 billion |

|

Growth Rate |

CAGR of 12.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, animal, distribution channel, end-use |

|

Country scope |

India |

|

Key companies profiled |

Merck & Co., Inc.; Ceva; Vetoquinol S.A.; Zoetis; Boehringer Ingelheim International GmbH; Elanco Animal Health Incorporated; IDEXX Laboratories, Inc.; Neogen Corporation; Virbac; B. Braun Vet Care; Covetrus, Inc.; Avante Animal Health; TeleVet; Practo; Mars Inc.; Phibro Animal Health Corporation; Dechra Pharmaceuticals Plc; Bimeda Inc.; Midmark Corporation; Thermo Fisher; Scientific; IDVet; Hester Biosciences Ltd; India Immunologicals ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

India Animal Health Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India animal health market report based on product, animal, distribution channel & end-use.

-

By Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Other Pharmaceuticals

-

-

Diagnostics

-

Consumables, reagents and kits

-

Instruments and devices

-

-

Equipment & Disposables

-

Critical Care Consumables

-

Anesthesia Equipment

-

Fluid Management Equipment

-

Temperature Management Equipment

-

Rescue & Resuscitation Equipment

-

Research Equipment

-

Patient Monitoring Equipment

-

-

Medicinal Feed Additives

-

Other Products

-

Veterinary Telehealth

-

Veterinary Software

-

Livestock Monitoring

-

-

-

By Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals

-

-

-

By Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

-

By End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Reference Laboratories

-

Point-of-care Testing/In-house Testing

-

Veterinary Hospitals & Clinics

-

Others end use

-

Frequently Asked Questions About This Report

b. The India animal health market size was estimated at USD 1.9 billion in 2023 and is expected to reach USD 2.1 billion in 2024.

b. The India animal health market is expected to grow at a compound annual growth rate of 12.4% from 2024 to 2030 to reach USD 4.3 billion by 2030.

b. By product, the pharmaceuticals segment accounted for the largest revenue share of 42.96% in 2023. The pharmaceuticals segment is further classified into parasiticide, anti-infective, anti-inflammatory, analgesics, and others. The segment’s dominance which can be attributed to increasing prevalence of food-borne diseases, brucellosis, and zoonotic diseases that are potentially hazardous to animals, thus, leading to clinical urgency for use of potent pharmaceuticals and targeted medicines.

b. Some key players operating in the India animal health market include Merck & Co., Inc., Ceva, Vetoquinol S.A., Zoetis, Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, IDEXX Laboratories, Inc., Neogen Corporation, Virbac, B. Braun Vet Care, Covetrus, Inc., Avante Animal Health, TeleVet, Practo, Mars Inc., Phibro Animal Health Corporation, Dechra Pharmaceuticals Plc, Bimeda Inc., Midmark Corporation, Thermo Fisher, Scientific, IDVet, Hester Biosciences Ltd, and India Immunologicals ltd.

b. Key factors that are driving the market growth include growing government participation, rising product/ service launches, evolving regulatory scenario, emergence of startup culture, increasing R&D investments and technological advancements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."