- Home

- »

- Food Safety & Processing

- »

-

India Aluminum Beverage Can Market, Industry Report, 2030GVR Report cover

![India Aluminum Beverage Can Market Size, Share & Trends Report]()

India Aluminum Beverage Can Market Size, Share & Trends Analysis Report By Application (Carbonated Soft Drinks, Alcoholic Beverages), By Region (North & Central, South, West, East), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-732-2

- Number of Report Pages: 50

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

India Aluminum Beverage Can Market Trends

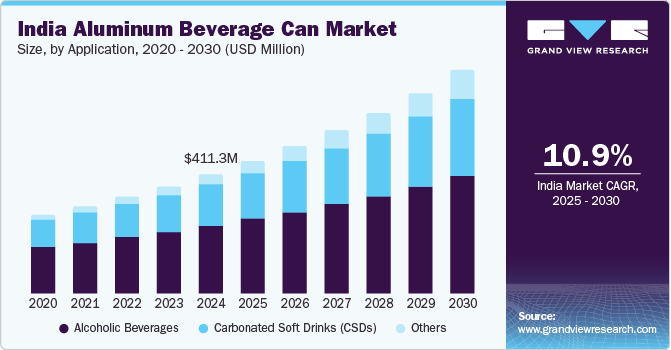

The India aluminum beverage can marketsize was estimated at USD 411.3 million in 2024 and is expected to grow at a CAGR of 10.9% from 2024 to 2030. The market growth is attributed to the increasing energy consumption and sports drinks and a rise in beverage companies' design innovation and marketing efforts. In addition, the convenience and portability of aluminum cans appeal to younger consumers, while sustainability concerns enhance their attractiveness due to recyclability. Furthermore, the expansion of the craft beer segment and the popularity of on-the-go beverages further support market growth, positioning aluminum cans as a preferred packaging choice.

Beverage cans are increasingly favored for convenience and portability, appealing to consumers with busy lifestyles who prioritize easy-to-carry packaging. Their lightweight and resalable features make them ideal for on-the-go consumption, especially among urban populations. Energy drink brands have capitalized on this trend, targeting active individuals seeking quick access to beverages during workouts or outdoor activities. Moreover, aluminum cans' recyclability is crucial to their market growth, driven by rising environmental awareness among consumers and companies. Aluminum cans can be recycled indefinitely without quality degradation, making them a sustainable choice. Many beverage companies highlight their commitment to sustainability by promoting recyclable cans, attracting eco-conscious consumers.

Furthermore, beverage cans provide an excellent platform for creative branding and eye-catching designs. The 360-degree printable surface allows brands to create distinctive packaging that stands out on retail shelves, particularly vital in the craft beer and flavored alcoholic beverage sectors, where unique designs serve as key differentiators. Overall, the combination of convenience, sustainability, and branding opportunities positions aluminum beverage cans as a preferred packaging solution in the market, driving their continued growth in India.

Application Insights

Alcoholic beverages dominated the market, accounting for the largest revenue share of 56.9% in 2024. This growth is attributed to the increasing disposable income among consumers has led to a rising demand for premium and craft alcoholic drinks, particularly among younger demographics who view alcohol consumption as part of socializing. In addition, changing social norms and a growing acceptance of diverse drinking habits further fuel this trend. Furthermore, the proliferation of microbreweries and craft beer brands caters to this evolving consumer preference. At the same time, innovative marketing strategies enhance product visibility and appeal in urban centers, solidifying the market's expansion.

Carbonated soft drinks are expected to grow at a CAGR of 10.8% over the forecast period, owing to the rising health consciousness among consumers, prompting a shift towards low-calorie and healthier beverage options, driving demand for soft drinks packaged in aluminum cans. In addition, the convenience of portable packaging aligns with the fast-paced lifestyles of urban populations, making these cans an attractive choice. Furthermore, aggressive marketing campaigns by beverage companies and the introduction of innovative flavors help capture consumer interest. Moreover, expanding retail channels, including supermarkets and convenience stores, facilitates greater accessibility to carbonated soft drinks in aluminum cans, further propelling market growth.

Regional Insights

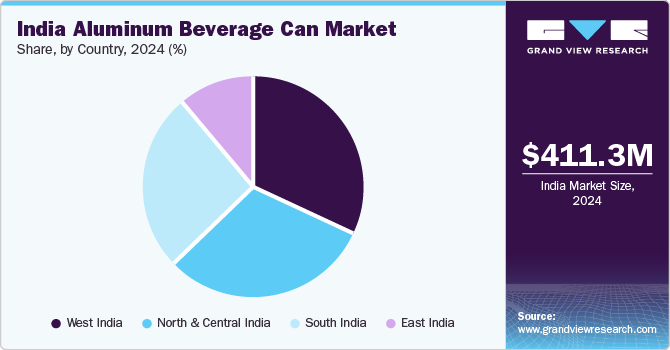

The aluminum beverage can market in West India dominated the Indian market and accounted for the largest revenue share of 32.3% in 2024, attributed to the region’s strong presence of key beverage companies, such as United Breweries and Carlsberg, which have established filling facilities in Maharashtra, particularly in Aurangabad. This concentration of production capabilities enhances the availability of aluminum cans. In addition, the thriving tourism industry in states such as Goa and Maharashtra has increased consumption of energy drinks and craft beers, further driving demand for convenient packaging solutions. Furthermore, the emphasis on innovative designs and sustainable practices also contributes to the market's expansion in West India.

North and Central India aluminum beverage can market is expected to grow at a CAGR of 11.0% over the forecast period, owing to health consciousness and changing consumer behaviors. There is a growing preference for non-sugary beverages, including energy drinks and healthier alternatives, which aligns with the increasing awareness of wellness among consumers. In addition, irregular working hours and social gatherings have heightened the demand for on-the-go beverages, making aluminum cans an appealing choice. Furthermore, expanding organized retail channels facilitates greater accessibility to these products, further supporting market growth in this region. The combination of health trends and convenience continues to shape consumer preferences, driving the aluminum beverage can market forward.

The aluminum beverage market in South India is expected to grow significantly over the forecast period, driven by a robust manufacturing sector, particularly in cities such as Bengaluru and Chennai, which enhances demand for aluminum cans. In addition, the increasing popularity of energy drinks and craft beers aligns with consumer preferences for convenient and portable packaging. Furthermore, rising health consciousness encourages the consumption of low-calorie beverages. The expansion of organized retail channels improves accessibility, while a focus on sustainability prompts beverage companies to adopt aluminum cans, further propelling market growth.

Key India Aluminum Beverage Can Company Insights

Some of the key companies in the market include Akshar Products, Hindustan Tin Works Ltd (HTW), Can Pack India Private Limited, and others. These companies are employing various strategies to enhance their market presence. This includes new product launches and strategic partnerships. Furthermore, companies are also pursuing mergers and acquisitions to expand their capabilities and market reach while investing in sustainability initiatives to align with consumer preferences for eco-friendly packaging solutions.

-

Can-Pack India Pvt. Ltd produces high-quality aluminum cans for various segments, including carbonated soft drinks, energy drinks, and alcoholic beverages. Can-Pack India aims to promote the use of aluminum packaging through initiatives such as the Aluminum Beverages Can Association of India, collaborating with industry leaders to enhance awareness of aluminum cans' environmental and economic benefits.

-

Hindustan Tin Works Ltd (HTW) produces a wide range of products, including two-piece aluminum cans for soft drinks, beer, and other beverages. The company is known for its innovative packaging solutions that cater to the evolving demands of the beverage sector. HTW's focus on quality and sustainability has solidified its reputation as a reliable supplier in the Indian aluminum beverage can market, serving domestic and international clients.

Key India Aluminum Beverage Can Companies:

- Akshar Products

- Hindustan Tin Works Ltd (HTW)

- Can Pack India Private Limited

- Rexam HTW Beverage Can (India) Ltd

- Metcan Packs Ltd

- Bikaner Polymers Pvt Ltd

- Aniruddha Pack World

- Casablanca Industries Pvt Ltd

- Shiba Containers Pvt Ltd

- Suparna Exports Pvt Ltd

India Aluminum Beverage Can Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 457.4 million

Revenue forecast in 2030

USD 767.1 million

Growth Rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Million cans, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Country scope

India

Key companies profiled

Akshar Products; Hindustan Tin Works Ltd (HTW); Can Pack India Private Limited; Rexam HTW Beverage Can (India) Ltd; Metcan Packs Ltd; Bikaner Polymers Pvt Ltd; Aniruddha Pack World; Casablanca Industries Pvt Ltd; Shiba Containers Pvt Ltd; Suparna Exports Pvt Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Aluminum Beverage Can Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the India aluminum beverage can market report based on application, and region.

-

Application Outlook (Volume, Million Cans, Revenue, USD Million, 2018 - 2030)

-

Carbonated Soft Drinks (CSDs)

-

Alcoholic Beverages

-

Others

-

-

Regional Outlook (Volume, Million Cans, Revenue, USD Million, 2018 - 2030)

-

West India

-

North and Central India

-

South India

-

East India

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."