- Home

- »

- Agrochemicals & Fertilizers

- »

-

India Agrochemicals Market Size, Industry Report, 2030GVR Report cover

![India Agrochemicals Market Size, Share & Trends Report]()

India Agrochemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Fertilizers, By Crop Protection Chemicals, By Application, And Country Forecasts

- Report ID: GVR-4-68040-318-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Agrochemicals Market Size & Trends

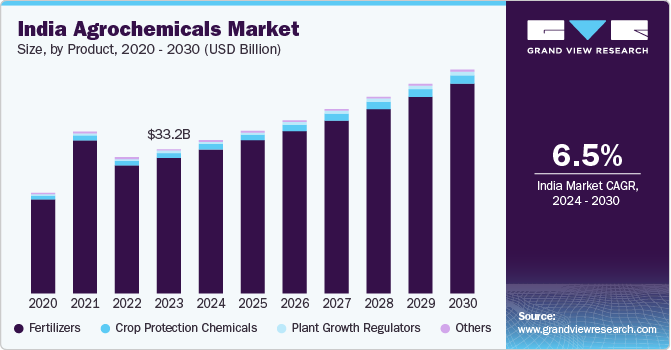

The India agrochemicals market size was estimated at USD 33.16 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. Advancements in agricultural technology have upgraded modern farming practices, leading to the widespread adoption of agrochemicals for efficient and sustainable crop management. Development of hybrid seeds, which combine desirable traits from different plant varieties to enhance yields, improve resistance to pests and diseases, and optimize resource utilization. Precision farming techniques, such as satellite imagery, drones, GPS-guided equipment, and soil sensors, enable farmers to precisely apply agrochemicals, fertilizers, and water as per the specific crop needs, reducing waste and environmental impact.

Government policies, subsidies, and initiatives aimed at promoting agriculture and enhancing farmers' income drive the adoption of agrochemicals. Schemes such as soil health cards, crop insurance, and fertilizer subsidies influencing farmers' choices regarding agrochemical usage.

Awareness programs, training initiatives, and farmer education campaigns play a crucial roles in promoting the responsible and sustainable use of agrochemicals, and encouraging the adoption of Integrated Pest Management (IPM) strategies within the agricultural sector. These programs aim to educate farmers about the potential risks associated with indiscriminate agrochemical use and highlight the importance of using them judiciously to minimize adverse environmental impacts.

In August 2022, FMC India initiated a collaborative campaign with the Agriculture Department of Maharashtra State to promote crop protection stewardship. This marks a significant effort to raise awareness and encourage responsible agricultural practices among farmers. This joint campaign aimed to educate farmers about the importance of using crop protection products judiciously, adhering to recommended dosages and application techniques, and implementing integrated pest management strategies.

Intense competition among agrochemical companies, encompassing both domestic companies such as UPL, Deccan Fine Chemicals, and others similar international companies, including Bayer Crop Science Ltd., Rallis India Ltd., and others, drive innovation, robust product development, and enhanced affordability of agrochemicals in the Indian market. This competitive landscape compels companies to constantly strive for technological advancements, research breakthroughs, and the introduction of novel formulations that offer improved efficacy, environmental sustainability, and cost-effectiveness.

In August 2023, Bayer CropScience Limited, GenZero, and Shell collaborated on an initiative to reduce methane emissions in rice cultivation. Leveraging their respective expertise in agriculture, technology, and energy, the collaboration is focused on developing sustainable solutions to mitigate the environmental impact of rice farming. Bayer contributed its knowledge in crop protection and agronomic practices to optimize rice production while minimizing greenhouse gas emissions. GenZero, known for advancements in agricultural technology and data analytics, provided insights, and tools to enhance farming practices and resource efficiency.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the growth is accelerating. The Indian agrochemicals market has witnessed a significant degree of innovation. Companies are focusing on developing new formulations, bio-based alternatives, and precision agriculture technologies to improve efficacy, reduce environmental impact, and address regulatory concerns. Innovations in the development of crop protection products with enhanced pest resistance, improved nutrient delivery systems, and eco-friendly formulations comply with evolving regulatory standards.

In November 2023, Insecticides (India), launched four new products: "Cropguard," "Weedshield," "Fungimix," and "BioBoost". These new products are expected to offer effective solutions for pest management, weed control, fungal diseases, and enhancing agricultural productivity. By introducing a diverse range of products, Insecticides (India) aims to cater to a broader spectrum of crops and farming practices, thereby expanding its market reach and strengthening its position in the agrochemical sector. This launch reflects the company's continuous efforts towards research and development, sustainable agriculture practices, and supporting farmers with high-quality solutions to address crop challenges and improve yields.

Regulatory factors play a significant role in shaping the Indian agrochemicals market. Government regulations and policies regarding product registration, import/export controls, pesticide residues, and environmental protection have a direct impact on market dynamics.Stringent regulatory requirements can pose challenges for market entry and product approval, leading companies to invest in research and development to comply with regulatory standards and ensure market access.

In India, there is a growing trend towards IPM practices and organic farming methods as substitutes or complementary approaches to conventional agrochemical usage.Biopesticides, organic fertilizers, and bio stimulants are gaining traction as alternatives to synthetic agrochemicals, driven by consumer preferences for sustainable and environmentally friendly agricultural practices.

The Indian agrochemicals market has a diverse customer base, including large-scale commercial farms, smallholder farmers, agribusinesses, and government agencies. End-user concentration varies across different segments and regions, with a significant portion of the market catering to small and marginal farmers who rely on affordable crop protection solutions and agronomic support services.

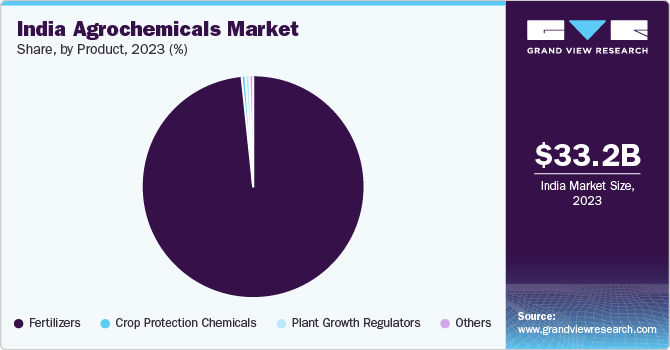

Product Insights

Based on product, fertilizers held the largest market share of 68% in 2023. Fertilizers play a crucial role in enhancing soil fertility and providing essential nutrients to crops. With the growing demand for food due to population growth, farmers rely on fertilizers to improve yields and meet market demands. The Indian government provides subsidies and support schemes for fertilizers to promote agricultural productivity and ensure affordability for farmers. These subsidies make fertilizers more accessible and incentivize their use among farmers.

Crop protection chemicals are expected to grow at the fastest CAGR over the forecast period. Increasing pest and disease pressures due to climate change, globalization, and changing agricultural practices drive the demand for crop protection chemicals. Farmers rely on these chemicals to prevent yield losses and maintain crop health.

Fertilizers Insights

Based on fertilizers, the nitrogenous segment held the largest market share in 2023 as nitrogen is essential for plant growth and is a critical component of amino acids, proteins, and chlorophyll. Farmers use nitrogenous fertilizers to enhance crop productivity, increase yields, and improve overall plant health. With the world's population steadily increasing, there is a growing demand for food production. Nitrogenous fertilizers help meet this demand by supporting the cultivation of high-yielding crop varieties and intensifying agricultural production.

Secondary fertilizers (calcium, magnesium, and sulfur fertilizers) is expected to grow at fastest CAGR during the forecast period. Secondary fertilizers contribute essential secondary nutrients that are critical for plant growth and development. These fertilizers are commonly used to adjust soil pH levels. Acidic soils require lime (calcium carbonate) to neutralize acidity, improve nutrient availability, and promote healthy root development. Magnesium-containing fertilizers also help maintain optimal pH levels and prevent nutrient imbalances hence driving the growth of the segment.

Crop Protection Chemicals Insights

Based on crop protection chemicals, insecticides held the largest market share in 2023 and is expected to grow at fastest CAGR during forecast period. Insects pose significant threats to crops by causing damage through feeding, transmission of diseases, and reducing overall plant health. Insecticides are essential for controlling pest populations and minimizing crop losses. The emergence of new pest species, invasive pests, and pest resistance to existing control methods increases the demand for innovative insecticides. Continuous research and development address evolving pest challenges and support sustainable pest management practices.

Application Insights

Based on application, cereal & grains held the largest market share in 2023. Cereal crops and grains, including wheat, rice, maize, barley, and oats, are staple foods consumed worldwide. The high demand for these crops to meet global food needs drives significant investment in crop protection chemicals to ensure optimal yields and quality. Cereal crops are cultivated extensively across diverse agro-climatic regions due to their adaptability and suitability for large-scale farming. The expansion of cereal cultivation areas increases the demand for crop protection chemicals to manage pests, diseases, and weeds effectively.

Fruits & vegetables are expected to grow at the fastest CAGR during the forecast period. These crops encompass a wide range of crops with unique pests, disease, and weed management requirements. The need for specialized crop protection chemicals tailored to specific crops and pest profiles fuels segment growth.

Key India Agrochemicals Company Insights

Some of the key companies operating in the India agrochemicals market are UPL, Bayer CropScience Limited

-

UPL Limited offers a diverse range of crop protection solutions tailored to address farmers' evolving needs. Its product lineup consists of herbicides, insecticides, fungicides, and specialty chemicals aimed at improving crop productivity, safeguarding against pests and diseases, and enhancing agricultural practices. UPL's innovative formulations, such as microencapsulated pesticides, biopesticides, and IPM solutions, promote sustainable agriculture and environmental stewardship.

-

Bayer CropScience Limited offers a diverse range of innovative products to support sustainable agriculture. Its product portfolio includes crop protection solutions such as insecticides, herbicides, and fungicides designed to effectively manage pests, weeds, and diseases in various crops. Bayer CropScience also provides seed treatments, plant growth regulators, and biologics to enhance crop yields, quality, and resilience.

Key India Agrochemicals Companies:

The following are the leading companies in the India Agrochemicals Market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer CropScience Limited

- Syngenta India Private Limited

- UPL

- BASF SE

- ADAMA

- Dhanuka Agritech Ltd.

- Sumitomo Chemical India ltd.

- Indofil Industries Limited.

- Nufarm

- Crystal Crop Protection Ltd.

Recent Developments

-

In March 2023, Bayer CropScience Limited and Superplum formed a strategic partnership focusing on sustainable crop protection. Bayer's expertise in crop science and innovative technologies combined with Superplum's digital farming platforms aimed to optimize pest management and reduce chemical usage. The collaboration leveraged data analytics and AI-driven insights to enhance crop health, productivity, and environmental sustainability. The partnership emphasized farmer education and the adoption of integrated pest management practices for long-term resilience in agriculture. Overall, the alliance aimed to create a holistic approach to crop protection, promoting environmentally friendly and efficient farming practices.

-

In January 2021, UPL partnered with TeleSense, a provider of IoT-based grain monitoring solutions, to address post-harvest challenges in the agricultural supply chain. The collaboration aimed to leverage TeleSense's advanced sensors, data analytics, and AI-powered predictive insights to monitor grain quality, storage conditions, and pest infestations in real-time. By integrating TeleSense's technology with UPL's expertise in crop protection and post-harvest management, the partnership sought to optimize storage practices, reduce spoilage, and improve grain quality throughout the storage and transportation phases.

-

In April 2024, ADAMA introduced Forapro, a cereal fungicide for revolutionizing disease control and crop yields. Forapro offers robust protection against a broad range of fungal diseases that commonly affect cereals like wheat, barley, and oats. Its innovative formula incorporates multiple modes of action, ensuring unparalleled effectiveness in combating evolving pathogens. Additionally, Forapro is designed to enhance plant health and resilience, ultimately resulting in increased yields and superior crop quality. This launch signifies a significant leap forward in sustainable agriculture, equipping farmers with a potent solution to safeguard their investments and bolster global food security.

-

In December 2023, Sumitomo Chemical, announced plans to establish a new agrochemical plant in India, marking a significant investment in the country's agricultural sector. This strategic move by Sumitomo Chemical underscores its commitment to serving the growing demand for agricultural solutions in India and the broader Asia-Pacific region. The new plant is expected to leverage advanced technologies and sustainable practices to manufacture a wide range of agrochemical products aimed at enhancing crop productivity, quality, and sustainability. By setting up a local manufacturing facility, Sumitomo Chemical aims to strengthen its market presence, improve supply chain efficiency, and cater to the specific needs of Indian farmers while contributing to the country's agricultural growth and food security initiatives. This investment also reflects confidence in India's favorable business environment, skilled workforce, and potential for long-term growth in the agrochemical sector.

-

In November 2023, India Pesticides Limited (IIL) expanded its product portfolio by launching four new crop protection solutions: "GreenGuard Pro" for effective pest control, "BioShield Max" for disease management, "YieldBoost Pro" for enhancing crop yields, and "QualityGuard Plus" for improving crop quality. This launch marked the company's growth trajectory and commitment to agricultural innovation. These new solutions are designed to address key challenges faced by farmers, ranging from pest and disease management to enhancing crop yields and quality.IIL's strategic focus on research and development has enabled the development of cutting-edge formulations and technologies, ensuring that the new crop protection solutions are effective, sustainable, and environmentally friendly.

-

In April 2021, Azelis India expanded their business by acquiring Spectrum Chemicals and Nortons Exim, increasing their presence in the agrochemicals, home care, and specialty chemicals segments for industrial applications. This strategic acquisition not only expanded Azelis India's product portfolio but also strengthened their market position, allowing the company to offer a wider range of innovative solutions to its customers in India and beyond. With Spectrum Chemicals' expertise in agrochemicals and Nortons Exim's specialization in specialty chemicals for industrial applications, Azelis India gained access to new technologies, capabilities, and customer networks, enabling it to deliver enhanced value and customized solutions across various sectors.

India Agrochemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 33.16 billion

Revenue forecast in 2030

USD 51.29 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, fertilizers, crop protection chemicals, application

Country scope

India

Key companies profiled

Bayer CropScience Limited; Syngenta India Private Limited; UPL; BASF SE; ADAMA; Dhanuka Agritech Ltd.; Sumitomo Chemical India ltd.; Indofil Industries Limited.; Nufarm; Crystal Crop Protection Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Agrochemicals Market Report Segmentation

This report forecasts revenue and volume growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India agrochemicals market report based on product, fertilizer, crop protection chemicals, and application.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Fertilizers

-

Crop Protection Chemicals

-

Plant Growth Regulators

-

Others

-

-

Fertilizer Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Nitrogenous

-

Phosphatic

-

Potassic

-

Secondary Fertilizers (Calcium, Magnesium, and Sulfur Fertilizers)

-

Others

-

-

Crop Protection Chemicals Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Herbicides

-

Insecticides

-

Fungicides

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Cereal & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

Frequently Asked Questions About This Report

b. The global India agrochemicalsmarket size was estimated at USD 33.16 billion in 2023 and is expected to reach USD 35,208.7 million in 2024

b. The global India agrochemicals market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 51.29 billion by 2030

b. Based on product, fertilizers held the largest market share of 68% in 2023. Fertilizers play a crucial role in enhancing soil fertility and providing essential nutrients to crops.

b. Some key players operating in the India agrochemicals market include Bayer CropScience Limited, Syngenta India Private Limited, UPL, BASF SE, ADAMA, DHANUKA AGRITECH LTD., Sumitomo Chemical India ltd., Indofil Industries Limited.., Nufarm, Crystal Crop Protection Ltd.

b. Advancements in agricultural technology have upgraded modern farming practices, leading to the widespread adoption of agrochemicals for efficient and sustainable crop management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.