India Aerospace Parts Manufacturing Market Size, Share & Trends Analysis Report By Product (Engine, Aircrafts Manufacturing), By Aircraft (Commercial, Business), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-293-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

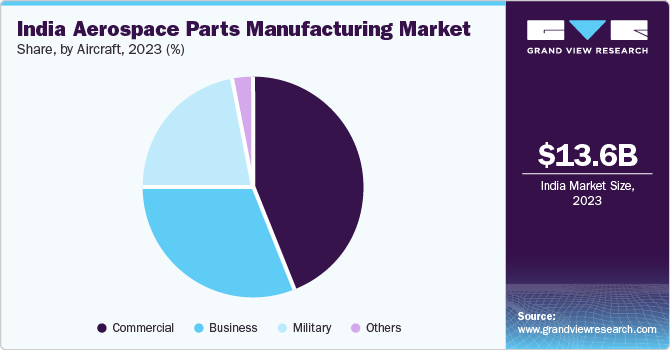

The India aerospace parts manufacturing market size was estimated at USD 13.6 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The market is driven by the increasing demand for air travel, both domestic and international. As airlines expand their fleets and modernize their aircraft, the demand for high-quality aerospace components is expected to surge.

Advancements in technology such as additive manufacturing (3D printing), have revolutionized the aerospace parts manufacturing sector in India. 3D printing allows for rapid prototyping and production of complex aerospace components with reduced lead times, enabling companies to respond according to market demands. The ability to customize parts according to specific design requirements enhances overall efficiency and performance in aerospace applications. This technology contributes to cost-effectiveness by minimizing material wastage and streamlining production processes therefore 3D printing has become a key driver of market growth in India's aerospace parts manufacturing industry, fostering innovation and competitiveness.

The growth of Maintenance, Repair, and Overhaul (MRO) services in India has significantly boosted demand for aerospace parts and components within the country. With an increasing number of aircraft being serviced and maintained domestically, there is a corresponding rise in the requirement for locally manufactured parts to support these operations. This demand is driven by factors such as the need for quick turnaround times in MRO activities, compliance with stringent aviation regulations, and the preference for cost-effective solutions.

The Indian government's proactive promotion of the aerospace and defense sectors through initiatives, including Make in India has been instrumental in stimulating domestic manufacturing activities. By emphasizing self-reliance and local production, these policies aim to reduce dependency on imports and boost the growth of indigenous industries. Easing Foreign Direct Investment (FDI) norms specifically in the aerospace sector has attracted significant investments from both domestic and international players, leading to the establishment of new manufacturing facilities, technology transfers, and the development of specialized capabilities.

Strategic partnerships are a driving force behind the India aerospace parts manufacturing market growth, primarily due to the access they provide to advanced technologies, international standards, and market expansion opportunities. These collaborations empower Indian manufacturers to produce high-quality aerospace components while also facilitating skill development through knowledge transfer initiatives. In November 2022, Bharat Electronics Limited (BEL) entered a Landmark Transfer of Technology (LAToT) agreement with India's premier defense research organizations, the Defense Research and Development Laboratory (DRDL) and the Instruments Research and Development Establishment (IRDE). This LAToT agreement focuses on the manufacture of Laser Based End Game Fuse, a critical component used in precision-guided munitions and smart weapon systems. The collaboration between BEL, DRDL, and IRDE signifies a significant step towards indigenous production and technological self-reliance in defense manufacturing.

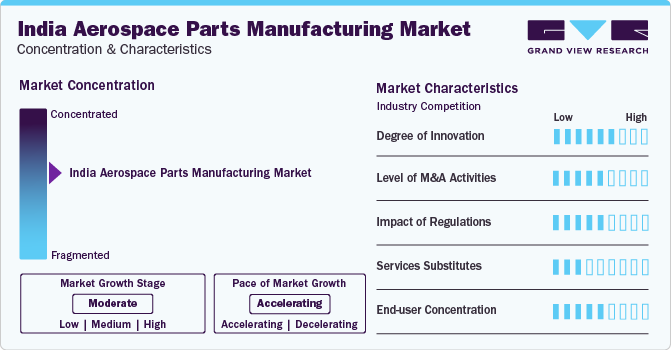

Market Concentration & Characteristics

The industry growth stage is moderate and the pace of the market growth is accelerating. Innovation plays a crucial role in the aerospace parts manufacturing sector. The integration of Internet of Things (IoT) sensors and connectivity features into aerospace components is enhancing their functionality and performance. Smart components can provide real-time data on factors such as temperature, pressure, and structural integrity, enabling proactive maintenance and performance optimization. The development of lightweight and high-strength composite materials, such as Carbon Fiber Reinforced Polymers (CFRP), is revolutionizing aircraft design and manufacturing. These materials offer significant weight savings, fuel efficiency improvements, and durability compared to traditional metallic structures.

In India, the Directorate General of Civil Aviation (DGCA) plays an important role alongside other regulatory bodies in enforcing stringent guidelines specifically tailored for aerospace parts manufacturing. These regulations encompass a wide range of aspects, including materials standards, manufacturing processes, design certifications, and testing protocols. By adhering to these stringent regulations, aerospace companies in India ensure the reliability and performance of their products and bolster their global competitiveness by meeting the stringent quality and safety requirements of the international aerospace market.

Aerospace parts manufacturing services have no direct substitutes. However, the evolution of technology and materials can significantly impact the demand for specific components or services within the industry. The increasing adoption of composite materials offers advantages such as lightweight construction, improved fuel efficiency, and enhanced durability compared to traditional metallic parts.

The market serves a diverse range of end users, including commercial airlines, defense organizations, and space agencies. The concentration of end users varies across different aerospace industry segments, with defense and space sectors often having a higher concentration of government or large institutional customers.

Product Insights

Based on product, aircraft held the largest market share of 51.2% in 2023. Research and Development (R&D) investments have led to technological advancements in aircraft manufacturing processes. It includes adopting advanced materials, automation, digitalization, and Industry 4.0 technologies, enhancing efficiency, quality, and competitiveness in the aircraft segment. India's rapidly growing aviation sector, fueled by increasing passenger traffic and demand for air travel, has led to a surge in orders for commercial aircraft. This demand drives the need for aircraft manufacturing and related components.

Avionics segment is expected to grow at the fastest CAGR over the forecast period. The Indian government's initiatives, such as "Make in India" and policies promoting indigenous manufacturing in aerospace and defense, are creating a conducive environment for investments and technology transfer in avionics manufacturing.

Aircraft Insights

Based on aircraft, the commercial segment held the largest market share in 2023. India has witnessed a significant increase in domestic and international air travel, driven by factors such as rising disposable incomes, a growing middle class population, and increased connectivity between tier-2 and tier-3 cities. This increase in air travel has led to a higher demand for commercial aircraft, including narrow-body and regional jets manufactured in India by companies like Dynamitic Technologies and Tata Advanced Systems, in partnership with global aerospace giants.

The business segment is expected to grow at the fastest CAGR over the forecast period. The increasing demand for commercial and defense aircraft and the rising trend of outsourcing aerospace components production to India due to its cost-effectiveness and skilled workforce are driving the growth of the business segment in India's aerospace manufacturing sector. Collaborations and partnerships between Indian aerospace firms and global industry leaders are driving innovation, knowledge transfer, and the adoption of best practices, contributing to the rapid growth of the business segment.

Key India Aerospace Parts Manufacturing Company Insights

Some of the key companies operating in the market are Bharat Electronics Limited (BEL) and Hindustan Aeronautics Limited (HAL)

-

Bharat Electronics Limited (BEL), an aerospace and defense electronics company in India, is renowned for its diverse range of high-tech products. BEL offers a comprehensive portfolio of electronic systems and components tailored for aviation, space, and defense applications in the market. These products include radar systems for surveillance and tracking, avionics for aircraft communication and navigation, electronic warfare systems for threat detection and countermeasures, missile guidance systems, satellite communication equipment, and airborne electronics for various platforms.

-

Hindustan Aeronautics Limited (HAL) offers a comprehensive range of products and services across various aerospace industry segments. HAL manufactures a diverse portfolio of aerospace products, including fighters, trainers, helicopters, and transport aircraft. The company is known for iconic platforms such as the HAL Tejas, India's indigenous light combat aircraft, and the Dhruv Advanced Light Helicopter

Key India Aerospace Parts Manufacturing Companies:

- Aequs Private Limited

- Aeron Systems Private Limited

- ALPHA DESIGN TECHNOLOGIES PVT LTD

- avantel limited

- Bharat Electronics Limited (BEL)

- Dynamatic Technologies Limited

- Godrej.com

- Hindustan Aeronautics Limited (HAL)

- L&T Technology Services Limited

- Tata Advanced Systems Limited

Recent Development

-

In November 2022, Bharat Electronics Limited (BEL) made a significant collaboration by signing a Landmark Transfer of Technology (LATOT) agreement with China Aerospace Science and Industry Corporation (CASDIC) and India's Defense Research and Development Organization (DRDO). This LATOT agreement focuses on the transfer and localization of advanced aerospace and defense technologies, aiming to enhance India's indigenous capabilities in critical areas such as missile systems, avionics, and electronic warfare.

-

In April 2024, General Electric (GE) invested $30 million in a new manufacturing facility in Pune. The facility is set to focus on aerospace parts manufacturing, leveraging advanced technologies and a skilled workforce to produce high-quality components for aerospace parts manufacturing. This investment strengthens GE's presence in India and contributes to the country's aerospace sector growth, fostering innovation, job creation, and technological advancements in the industry.

-

In November 2023, Dynamatic Technologies delivered the first A220 Escape Hatch Door to Airbus Atlantic, contributing to the advancement of aerospace manufacturing. This delivery showcases Dynamatic's commitment to precision engineering and high-quality manufacturing standards, meeting Airbus Atlantic's stringent requirements for safety and performance. The successful delivery of the A220 Escape Hatch Door strengthens Dynamatic's position as a reliable supplier in the aerospace industry. It demonstrates their capability to produce critical components for cutting-edge aircraft like the A220.

India Aerospace Parts Manufacturing Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 21.48 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, aircraft |

|

Key companies profiled |

Aequs Private Limited; Aeron Systems Private Limited; ALPHA DESIGN TECHNOLOGIES PVT LTD; avantel limited; Bharat Electronics Limited (BEL); Dynamatic Technologies Limited; Godrej.com; Hindustan Aeronautics Limited (HAL); L&T Technology Services Limited; Tata Advanced Systems Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

India Aerospace Parts Manufacturing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India aerospace parts manufacturing market report based on product, and aircraft:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Engine

-

Aircrafts Manufacturing

-

Cabin Interiors

-

Equipment, Safety & Support

-

Avionics

-

Insulation Components

-

-

Aircraft Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Business

-

Military

-

Others

-

Frequently Asked Questions About This Report

b. The India aerospace parts manufacturing market size was estimated at USD 13.6 billion in 2023 and is expected to reach USD 14.44 billion in 2024

b. The global India aerospace parts manufacturing market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 21.48 billion by 2030

b. Based on product, aircrafts manufacturing segment held the largest market share at 51.2% in 2023. Research and Development (R&D) investments have led to technological advancements in aircraft manufacturing processes.

b. Some key players operating in the India aerospace parts manufacturing market include Aequs Private Limited, Aeron Systems Private Limited, ALPHA DESIGN TECHNOLOGIES PVT LTD, avantel limited, Bharat Electronics Limited (BEL), Dynamatic Technologies Limited, Godrej.com, Hindustan Aeronautics Limited (HAL), L&T Technology Services Limited, Tata Advanced Systems Limited

b. Factors such as the increasing demand for air travel, both domestic and international, are fueling the market growth as airlines expand their fleets and modernize their aircraft, the demand for high-quality aerospace components grows

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."