Incontinence Pads Market Size, Share & Trends Analysis Report By Product Type, By Patient, By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-097-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global incontinence pads market size was estimated at USD 6.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.73% from 2023 to 2030. The market growth is attributed to the rising prevalence of kidney disease and nephrological complications and the growing geriatric population suffering from urinary incontinence. Incontinence pads are increasingly in demand due to a growing incidence of urinary incontinence, especially in older people. Additionally, the rise in cases of mobility limitation brought on by several chronic conditions, including arthritis, brain stroke, paralysis, multiple sclerosis, etc., is fueling the market growth.

According to the WHO, by 2050, there will be 2 billion older people worldwide. Elder population is more likely to suffer from chronic diseases, which also cause urinary incontinence due to decreased immunity. Aging causes a loss in bladder capacity, control, and subsequently, a rise in urination frequency. This leads to incontinence issues. To control the urgency and frequency of urine incontinence among the aging population, incontinence pads are used more frequently. Thus, the rising geriatric population is expected to surge the demand for incontinence pads globally.

High incidences of urologic conditions such as urine retention, incontinence, cystitis, and kidney stones result in bladder dysfunction. Urinary incontinence or leakage are common bladder control problems that affect the majority of people. Numerous chronic diseases and ailments, including Parkinson's disease, prostate cancer, stroke, and diabetes mellitus, raise the risk of urine incontinence.

For instance, Phoenix Physical Therapy reports that urinary incontinence affects 200 million people globally. Women most frequently experience stress urine incontinence. As a result, it is expected that the rising number of patients with related illnesses will increase demand for incontinence pads, driving market growth throughout the forecast period.

Product Type Insights

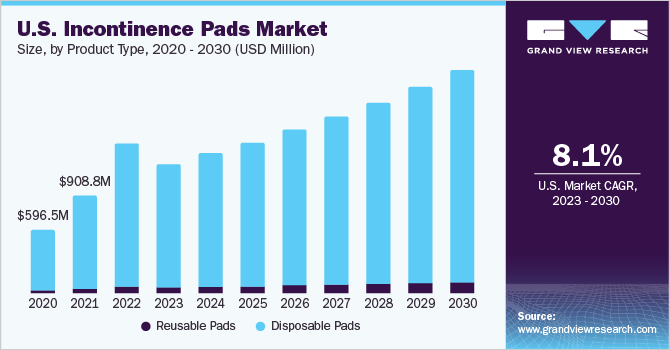

The disposable pads segment dominated the market with 93.3% of the revenue share in 2022. The segment's growth can be attributed to the several advantages disposable incontinence pads offer. These pads are increasingly gaining popularity as they are easy to dispose of and convenient to use, and besides aiding the patient, these products also aid healthcare staff by maintaining the cleanliness of the surroundings.

The increasing use of single-use incontinence pads and the growing preference for eco-friendly products are also expected to contribute to segment growth. Unlike reusable pads, which require proper cleaning and disinfection to prevent infection transmission, disposable pads offer a low risk of infection. The presence of numerous key players in the market offering disposable incontinence pads. Thus, the segment is expected to grow significantly at a CAGR during the forecast period due to such factors.

Patient Insights

The female incontinence pads segment dominated the market with a share of 64.6% in 2022. The segment growth is attributed to the growing incidences of urinary incontinence in women due to pregnancy, menopause, or other chronic diseases. According to a study by Female Pelvic Medicine & Reconstructive Surgery released in April 2022, 61.8% of women in the US experienced urine incontinence (UI), with 32.4% experiencing symptoms at least monthly in 2021. Among women with UI, 37.5% had stress incontinence, 22.0% had urgent incontinence, 31.3% suffered from multiple symptoms, and 9.2% had unidentified incontinence. Thus, it is expected that an increased prevalence of UI in women will result in increased demand for female incontinence pads.

The male incontinence pads segment is expected to grow at a significant CAGR during the forecast period due to raising awareness about urinary incontinence in males and increasing adoption of incontinence pads to improve quality of life. Furthermore, the prevalence of male UI is more in European countries. Thus, the adoption of male incontinence pads is expected to increase in Europe. In addition, the availability of products specifically geared towards men and increased male grooming has also contributed to segmental growth.

Distribution Channel Insights

The offline sales segment is further categorized into hospital pharmacies, retail pharmacies, hypermarkets, and supermarkets. The offline sales segment dominated the market for incontinence pads and accounted for a revenue share of 63.9% in 2022. Numerous consumers prefer shopping at offline distribution channels as it provides them with product verification, authenticity, and certainty. Moreover, offline stores offer convenience, customization options, and personalized assistance, which are expected to drive the growth of this segment.

The online sales segment is estimated to grow at a CAGR during the forecast period. This is primarily due to the significant rise in internet usage and many products on e-commerce websites. Social media lets consumers learn about the many incontinence pads sold. Due to this factor, many manufacturers have started to promote and market their products on social media and e-commerce websites to increase their product sales.

End-use Insights

The hospital segment held the largest market share of 32.7% in 2022. The growth is attributed to the growing adoption of incontinence pads after nephrology and urological surgical procedures. Incontinence pads are most often used for post-op care in hospitals to ensure the proper disposal of urine when patients have limited mobility. In addition, the unprecedented outbreak of COVID-19 increased hospital admissions, particularly among older patients. As older patients often require incontinence pads during hospital stays to minimize frequent movement, the hospital segment is expected to experience significant growth during the forecast period.

The homecare settings segment is anticipated to showcase the fastest CAGR from 2023 to 2030, owing to increasing in-home care services for the elder population as well as growing awareness about personal hygiene and cost-effective solutions for urinary incontinence, which is expected to fuel the segment growth over the forecast period. Moreover, comfort, convenience, personalized care, technological advancements, the increasing aging population, and patient preference are some of the primary factors propelling the demand for homecare solutions in managing incontinence effectively at home.

Regional Insights

Europe accounted for the largest market share of 43.5% in 2022. The factor contributing to the segment’s growth is the rising prevalence of urine incontinence, growing sedentary lifestyle adoption, and the development of technologically advanced goods for producing disposable incontinence pads. The rising prevalence of urinary incontinence in several European countries drives regional growth.

For instance, according to a study conducted in Sweden and reported in a SpringerLink article from March 2022, urinary incontinence, characterized as an issue of accidental urine loss, is thought to affect 25 to 45% of adult women. The high prevalence of urine incontinence in Europe is expected to boost the use of incontinence pads.

North America is expected to showcase the fastest CAGR over the forecast period owing to a growing elderly population and the increasing need for minimally invasive surgeries for kidney diseases. For instance, an updated NCBI article in August 2022 predicts that 13 million Americans suffer from urine incontinence every year and that the prevalence is 50% or more among nursing home patients. Furthermore, growing home care services for the elderly population are supplementing regional growth.

Key Companies & Market Share Insights

The market for incontinence pads is highly competitive. There are several local players and start-ups in the market which are providing various types of incontinence pads. Manufacturers actively develop incontinence pads with maximum absorbency to strengthen their product offerings. The key players are involved in strategic developments such as mergers and acquisitions, partnerships, and new product launches to improve their market positioning.

For instance, in April 2022, Kimberly-Clark launched Poise Ultra-Thin Pads with Wings to protect against bladder leaks in women. Similarly, the first quality enterprises launched MaxSorb+ Zone in April 2022; this high-quality bladder control pad provides faster absorption to help support skin health. Some prominent players in the global incontinence pads market include:

-

Cardinal Health Inc.

-

Kimberly Clark Corporation

-

Medline Industries, LP.

-

Procter & Gamble

-

ABENA A/S

-

PAUL HARTMANN AG

-

Essity Aktlebolag (publ)

-

Ontex BV

Incontinence Pads Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 7.20 billion |

|

Revenue forecast in 2030 |

USD 10.64 billion |

|

Growth rate |

CAGR of 5.73% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historic data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, trends |

|

Segments covered |

Product type, patient, end-use, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Global Incontinence Pads Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global incontinence pads market report based on product type, patient, end-use, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Reusable Pads

-

Disposable Pads

-

-

Patient Outlook (Revenue, USD Billion, 2018 - 2030)

-

Female Incontinence Pads

-

Male Incontinence Pads

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics

-

Long-term Care Facilities

-

Homecare Settings

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline Sales

-

Hospital Pharmacies

-

Retail Pharmacies

-

Hypermarkets and Supermarkets

-

-

Online Sales

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global incontinence pads market size was estimated at USD 6.8 billion in 2022 and is expected to reach USD 7.2 billion in 2023.

b. The global incontinence pads market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 10.64 billion by 2030.

b. Europe segment held the largest share in 2022 with a market share of 43.5% among the other product over the forecast period owing to its increasing use across the globe.

b. Some key players operating in the incontinence pads market include Cardinal Health Inc., Kimberly Clark Corporation, Medline Industries, LP., Procter & Gamble, ABENA A/S, PAUL HARTMANN AG, Essity Aktlebolag (publ), Ontex BV among others.

b. An increase in nephrological complications and kidney disorders, technological advancements in the material used for manufacturing disposable incontinence pads, and growing public awareness of personalized care and hygiene is the key factor responsible for the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."