Incident Response Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Vertical (BFSI, Government), By Service Type, By Security Type, By Deployment, By Organization Size, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-335-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Incident Response Market Size & Trends

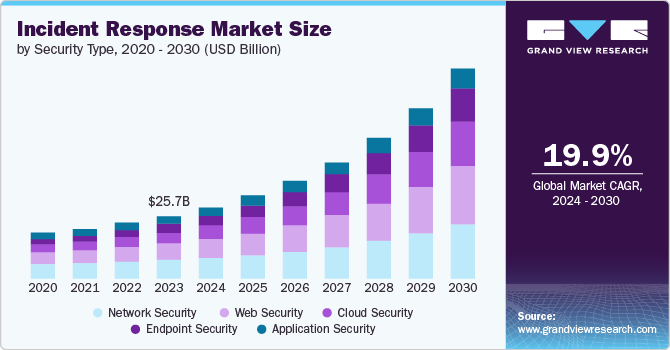

The global incident response market size was estimated at USD 25.67 billion in 2023 and is expected to grow at a CAGR of 19.9% from 2024 to 2030. Various factors, such as the increasing complexity of cyber-attacks, the need for organizations to comply with data privacy regulations, and the growing adoption of cloud computing and advanced technologies, are driving the market growth. Governments and their security entities, including regulatory agencies in different regions, are highly attentive to safeguarding their citizens' and organizations' confidential information against cyber threats. The dynamic nature of these threats has led to the establishment of numerous government regulations worldwide, which organizations must strictly comply with-failure to meet these essential security criteria subjects organizations to substantial fines from government and regulatory authorities.

The growing number of security breaches worldwide is anticipated to propel the market growth. IR plays a crucial role in identifying and managing cyber security threats, such as data breaches, as it aids in mitigating damages and curtailing the time and costs associated with recovery. Furthermore, with the support of an incident response team, organizations can devise strategic preventative measures for incident management and enhance their existing fault detection processes. Consequently, it has become imperative for every company to establish an incident response protocol to swiftly and effectively tackle various security incidents. The surge in the adoption of innovative and advanced technologies across different sectors is contributing to an increase in security breaches, thereby fueling market revenue growth.

A significant trend in the market is the integration of incident response strategies with SOAR (Security Orchestration, Automation, and Response) technologies. SOAR solutions enhance the incident response process by automating routine tasks, coordinating workflows, and combining diverse security tools and technologies in a unified dashboard. This synergy boosts the speed and precision of incident response efforts, facilitating quick identification, examination, and mitigation of security breaches throughout an organization's IT network. By adopting SOAR tools, security departments can decrease response durations, lower risk levels, and heighten the success rate of incident handling, thereby strengthening the overall defense framework of the organization. In addition, SOAR platforms support better teamwork and communication within incident response teams, promoting improved strategy and choices in the face of security challenges. As businesses work to stay abreast of the constantly evolving cyberthreat landscape and handle increasing security alerts, integrating incident response measures with SOAR capabilities is poised to maintain its momentum, spurring further growth and advancements in incident response technology.

Security Type Insights

The network security segment accounted for the largest market revenue share in 2023. Modern networks are complex, encompassing a mix of on-premises infrastructure, cloud environments, and mobile devices. This complexity creates new vulnerabilities that attackers can exploit. Moreover, cybercriminals are increasingly targeting network vulnerabilities to access systems and steal data. Network security advancements are crucial for detecting and preventing these attacks.Advanced network monitoring tools provide greater visibility into network traffic patterns and potential anomalies. This allows security teams to identify suspicious activity and respond to threats faster.

The endpoint security segment is expected to grow significantly during the forecast period. The growing number of devices such as laptops, desktops, tablets, and smartphones accessing corporate networks expands the attack surface for organizations. Endpoint security solutions are essential for safeguarding these devices. Moreover, the increasing adoption of the Internet of Things (IoT) devices in various industries introduces new security challenges. Endpoint security solutions can be extended to manage and protect these devices. Cybercriminals increasingly target endpoints with sophisticated malware, phishing attempts, and zero-day exploits. Thus, advanced endpoint security solutions are necessary to detect and prevent these threats.

Component Insights

The services segment led the market in 2023, accounting for a revenue share of 54.62% .Numerous organizations lack the in-house expertise to handle complex cyber incidents effectively. Managed incident response services provide access to skilled professionals who can guide the organization through the response process. Moreover, organizations increasingly recognize the high costs associated with data breaches, including financial losses, reputational damage, and legal repercussions. Investing in incident response services is a cost-effective way to prevent or minimize these costs.

The solution segment is predicted to foresee significant growth in the coming years. Incident response solutions automate tasks such as log analysis, threat detection, and incident investigation, enabling organizations to identify and respond to security incidents faster, minimizing damage. Automation frees security personnel to focus on more strategic tasks and complex investigations, improving overall efficiency. Moreover, incident response solutions provide a central platform for managing all aspects of an incident response process, from initial detection to containment, eradication, and recovery. This improves communication, coordination, and overall incident management.

Service Type Insights

The assessment and response segment accounted for the largest market revenue share in 2023. Organizations are increasingly focused on minimizing the damage caused by security incidents. Assessment and response services help them detect and contain threats quickly, preventing further compromise and data loss. Cyber attackers are constantly developing more advanced techniques to evade detection. Advanced assessment and response solutions with threat intelligence capabilities can help organizations identify and respond to these evolving threats more effectively.

Incident response planning and development is predicted to foresee significant growth in the coming years. Organizations are increasingly aware of the prevalence and potential consequences of cyberattacks. This awareness fuels the need for a well-defined plan to guide the response process and minimize damage. Moreover, data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) emphasize the importance of having a documented incident response plan. IR Planning & Development services ensure that organizations comply with these regulations and are prepared to handle data breaches effectively.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. Businesses increasingly migrate data, applications, and workloads to the cloud environment. This shift requires robust security solutions specifically designed for cloud security incidents.The rise of Software-as-a-Service (SaaS) and cloud-native applications expands the attack surface for organizations, necessitating cloud-based incident response solutions tailored to these environments.Cloud-based solutions facilitate collaboration between internal security teams and external incident response providers, streamlining communication and coordination during an incident.

The on-premises segment will exhibit a significant CAGR over the forecast period. Various organizations still rely heavily on on-premises data centers and applications. These require dedicated incident response solutions that integrate seamlessly with existing infrastructure. Moreover, organizations adopt a hybrid cloud approach, where some data and applications remain on-premises while others migrate to the cloud. On-premises incident response solutions cater to this hybrid environment, ensuring comprehensive security across both on-premises and cloud deployments.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023.Large enterprises have vast and complex IT infrastructures, encompassing on-premises data centers, cloud deployments, and a multitude of devices. This expansive attack surface makes them prime targets for cybercriminals.Cyber attackers are constantly developing more sophisticated techniques to bypass traditional security measures. Advanced incident response solutions with threat intelligence capabilities are crucial for large enterprises to detect and respond to these evolving threats effectively.

The SMEs segment is anticipated to exhibit a significant CAGR over the forecast period. While data breaches can devastate any organization, the financial impact on SMEs can be particularly severe. Even a minor breach can disrupt operations, damage reputation, and lead to significant financial losses.SMEs often rely on third-party vendors for various services. These vendors can introduce additional security risks. Incident response solutions can help SMEs assess vendor security posture and potentially mitigate these risks.

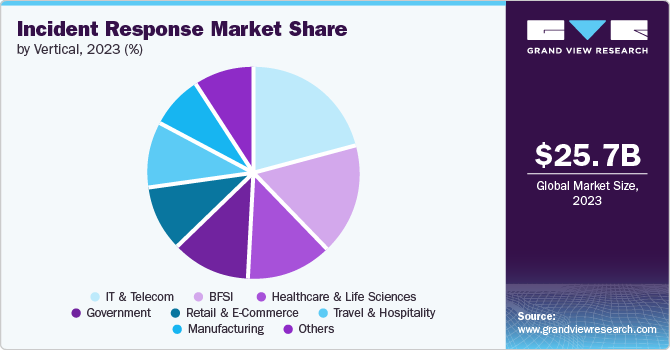

Vertical Insights

The IT & telecom segment accounted for the largest market revenue share in 2023. IT & Telecom companies store vast amounts of sensitive user data, making them prime targets for cybercriminals seeking financial information, intellectual property, or personal data for identity theft.Cybercriminals are increasingly targeting the IT & Telecom supply chain to gain access to a wider network of systems and users. Incident response solutions can help organizations identify and respond to these complex attacks effectively. The growing adoption of IoT devices in IT & Telecom networks introduces new security challenges. Incident response solutions can help monitor and secure these devices effectively.

The healthcare & life sciences segment is anticipated to exhibit the highest CAGR over the forecast period. Healthcare & life sciences organizations are increasingly reliant on electronic health records (EHRs), medical devices, and other connected technologies. This expanded attack surface creates new vulnerabilities for cybercriminals to exploit.The healthcare & life sciences industry faces emerging threats such as attacks on medical devices and manipulation of clinical trial data. Advanced incident response solutions with threat intelligence capabilities are crucial for detecting and mitigating these evolving threats.

Regional Insights

North America dominated the market with a revenue share of over 35.0% in 2023. Due to its high concentration of critical infrastructure, valuable data, and large corporations, North America is a prime target for cybercriminals. Organizations require advanced incident response solutions to detect and mitigate these sophisticated attacks. The increasing adoption of cloud computing necessitates cloud-based incident response solutions for comprehensive security across cloud environments. North America is a prominent region in cloud adoption, driving the market for these solutions.

U.S. Incident Response Market Trends

The incident response market in the U.S. is anticipated to exhibit a significant CAGR over the forecast period. Numerous U.S. states have enacted data privacy regulations, such as the California Consumer Privacy Act (CCPA) and the upcoming Virginia Consumer Data Protection Act (VCDPA). These regulations further emphasize the need for robust incident response capabilities. Moreover, U.S. organizations across various sectors, including critical infrastructure, finance, and healthcare, are prime targets for cybercriminals. Advanced incident response solutions are crucial for detecting and mitigating these targeted attacks.

Europe Incident Response Market Trends

The incident response market in Europe is expected to witness significant growth over the forecast period. The General Data Protection Regulation (GDPR) imposes strict data security and breach notification requirements on organizations processing the personal data of EU citizens. This regulation has significantly increased the demand for robust incident response solutions across Europe. Various European organizations are adopting a more proactive security approach, identifying and mitigating risks before they escalate into incidents. Incident response solutions with threat-hunting and vulnerability assessment capabilities support this proactive security posture.

Asia Pacific Incident Response Market Trends

The incident response market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. Cloud adoption is rising in APAC, necessitating cloud-based incident response solutions for comprehensive security across these environments. Moreover, the APAC region has more cybercriminal incidents due to rapid digitalization and potentially less mature cybersecurity practices compared to more established markets. Advanced incident response solutions are crucial for detecting and mitigating these evolving threats.

Key Incident Response Company Insights

Key incident response companies include BAE Systems, Check Point Software Technologies Ltd., and Cisco Systems, Inc. Companies active in the incident response market focus aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/technology development. For instance, in August 2023, Sophos Ltd., a cybersecurity services provider, launched Sophos Incident Response Retainer, which offers businesses rapid entry to Sophos' pioneering fixed-cost incident response service, featuring 45 days of 24*7 Managed Detection and Response (MDR). This retainer eliminates bureaucratic hurdles, enabling Sophos' incident responders to tackle active cyberattacks for investigation and remediation immediately. The package also encompasses external vulnerability scans and essential readiness advice, empowering businesses to proactively enhance their security defenses by identifying and addressing vulnerabilities, thereby minimizing the chances of a breach.

Key Incident Response Companies:

The following are the leading companies in the incident response market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Cylance Inc.

- Dell Inc.

- FireEye, Inc.

- International Business Machines Corporation

- Kaspersky Lab

- McAfee, LLC

- Palo Alto Networks, Inc.

Recent Developments

-

In June 2024, Cyera, a data security services provider, launched Cyera Incident Response Service. This service, offered on a retainer basis, is staffed by a highly skilled group of incident responders utilizing Cyera's data security system. This setup enables them to quickly and effectively address incidents by providing essential data insights and context, helping to identify the most critical data that needs attention.

-

In March 2024, International Business Machines Corporation, a cyber security solutions provider, announced the inauguration of the IBM X-Force Cyber Range in Washington, U.S., marking a significant step towards assisting federal agencies in fortifying their defenses against increasing cybersecurity threats. This advanced facility underscores International Business Machines Corporation's dedication to supporting the federal sector, safeguarding the nation's vital infrastructure, and catering to its corporate clients' needs.

-

In January 2024, Check Point Software Technologies Ltd., a cyber security platform provider, launched Infinity AI Copilot’s first generation. By combining the power of AI and cloud technologies, Infinity AI Copilot tackles the worldwide scarcity of cybersecurity experts, enhancing the productivity and efficacy of security teams. Key capabilities policies and AI Copilot include enhanced security administration, deployment and management security policies, and enhanced security mitigation and response.

Incident Response Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 29.46 billion |

|

Revenue forecast in 2030 |

USD 87.53 billion |

|

Growth rate |

CAGR of 19.9% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, service type, security type, deployment, organization size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

BAE Systems; Check Point Software Technologies Ltd.; Cisco Systems, Inc.; Cylance Inc.; Dell Inc.; FireEye, Inc.; International Business Machines Corporation; Kaspersky Lab; McAfee, LLC; and Palo Alto Networks, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Incident Response Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global incident response market report based on component, service type, security type, deployment, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retainer

-

Assessment and Response

-

Tabletop Exercises

-

Incident Response Planning and Development

-

Advanced Threat Hunting

-

Others

-

-

Security Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Web Security

-

Application Security

-

Endpoint Security

-

Network Security

-

Cloud Security

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Government

-

Healthcare & Life Sciences

-

Retail & E-Commerce

-

Travel & Hospitality

-

Manufacturing

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global incident response market size was estimated at USD 25.67 billion in 2023 and is expected to reach USD 29.46 billion in 2024.

b. The global incident response market is expected to grow at a compound annual growth rate of 19.9% from 2024 to 2030, reaching USD 87.53 billion by 2030.

b. North America dominated the incident response market with a share of 35.3% in 2023. North America is a prime target for cybercriminals due to its high concentration of critical infrastructure, valuable data, and large corporations. Organizations require advanced incident response solutions to detect and mitigate these sophisticated attacks. The increasing adoption of cloud computing necessitates cloud-based incident response solutions for comprehensive security across cloud environments.

b. Some key players in the incident response market include BAE Systems, Check Point Software Technologies Ltd., Cisco Systems, Inc., Cylance Inc., Dell Inc., FireEye, Inc., International Business Machines Corporation, Kaspersky Lab, McAfee, LLC, and Palo Alto Networks, Inc.

b. Key factors that are driving the incident response market growth include the increasing complexity of cyber-attacks, the need for organizations to comply with data privacy regulations, and the growing adoption of cloud computing and advanced technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."