In-vitro Toxicology Assays Market For Cannabis And Nicotine Testing Size, Share & Trends Analysis Report By Type (Cannabis Testing, Nicotine Testing) By Technology, By Application, By Method, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-551-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

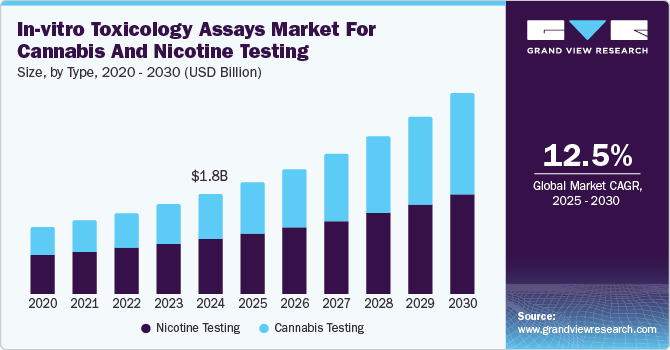

The global in-vitro toxicology assays market for cannabis and nicotine testing size was estimated at USD 1.85 billion in 2024 and is projected to grow at a CAGR of 12.5% from 2025 to 2030. The increasing regulations and compliance requirements enforced by governments are boosting the demand for in-vitro toxicology assays. In addition, growing cannabis legalization and rising public health concerns around nicotine and cannabis consumption further fuel the need for reliable testing methods. Moreover, the booming market for cannabis products, including edibles and vapes, necessitates extensive safety testing to meet these regulatory requirements. Therefore, a combination of factors such as growing regulations and public health concerns is driving the in-vitro toxicology assays market for cannabis and nicotine testing.

With the expanding legalization of cannabis for medical and recreational use, the demand for accurate testing to ensure product safety and quality is increasing. In addition, testing for potency, contaminants, and harmful substances is necessary to meet strict regulatory standards. Moreover, accurate testing helps mitigate health risks from unregulated or unsafe products. Therefore, it ensures that cannabis products remain consistent, safe, and reliable, garnering the trust of industry participants and the public.

Due to the rising incidence of diseases linked to nicotine consumption, global efforts have been launched to raise awareness and reduce health risks. In addition, governments and organizations, such as the CDC, are initiating programs to prevent tobacco-related conditions like COPD and heart disease. For instance, the CDC's projects, such as Healthy China 2030 and Action on Salt China, in China specifically target reducing tobacco use and sodium intake to address these health challenges. Such initiatives aim to create awareness among the public about the dangers of nicotine and promote healthier lifestyles.

Type Insights

The nicotine testing segment dominated the market with a revenue share of 55.3% in 2024, driven by increasing public awareness of the health risks associated with nicotine, such as addiction and respiratory diseases. Hence, there is a growing demand for safer products. In addition, stricter regulatory requirements for nicotine-containing products, like e-cigarettes and smokeless tobacco, have created a need for accurate testing to ensure compliance with safety standards. Moreover, the rise of e-cigarette use and other nicotine products has led to a demand for rigorous testing to meet regulatory guidelines and ensure product safety. Therefore, antismoking campaigns and tobacco control programs emphasize the monitoring of nicotine levels in these products.

Cannabis testing is projected to witness the highest CAGR of 14.7% over the forecast period, which can be attributed to concerns over contaminants like pesticides, heavy metals, and mold in cannabis products. The demand for thorough testing has increased to ensure consumer safety. In addition, as cannabis products are consumed in various forms, such as edibles, concentrates, & CBD-infused goods, consistent and accurate testing has become more critical. Moreover, these products require testing for potency, purity, and the absence of harmful substances to meet safety standards.

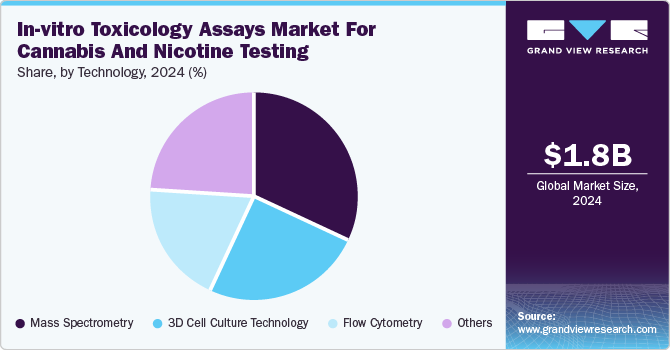

Technology Insights

The mass spectrometry segment dominated the market with the largest revenue share of 31.7% in 2024 due to its high sensitivity and accuracy in detecting trace contaminants and active compounds, which ensures product safety and regulatory compliance by providing comprehensive detection of cannabinoids, nicotine, and harmful substances. In addition, it allows both qualitative and quantitative analysis, ensuring proper dosing and consistency, especially in medical cannabis and nicotine products. Moreover, its ability to analyze complex samples, such as oils, edibles, and concentrates, adds to its versatility. Therefore, the speed and efficiency of modern mass spectrometry technologies make them essential for rapid testing in the expanding cannabis and nicotine markets.

The 3D cell culture technology segment is projected to grow at a 14.0% CAGR over the forecast period. Driven by its ability to mimic human tissues, 3D cell culture technology offers toxicity predictions, improving testing reliability. In addition, it enhances drug screening by providing a realistic model for testing the effects of cannabis and nicotine on human cells. Moreover, it helps identify potential toxic effects that may be missed in 2D cultures while reducing the reliance on animal testing. Therefore, 3D cultures can be customized for specific products, providing faster, more reliable results, which is crucial for the growing cannabis and nicotine industries.

Application Insights

The cytotoxicity testing segment dominated the market with the largest revenue share of 26.5% in 2024, which can be attributed to its ability to identify harmful effects on human cells. Cytotoxicity testing ensures product safety and regulatory compliance. In addition, it helps manufacturers detect toxic compounds in cannabis and nicotine products, addressing growing concerns over consumer health. Moreover, cytotoxicity testing is essential for screening products for potential cell damage and long-term risks. Therefore, it remains a crucial technology to ensure the safety of cannabis and nicotine products.

The genetic toxicity testing segment is projected to grow at a CAGR of 14.6% over the forecast period, which can be attributed to the growing need to identify mutagenic and carcinogenic risks. Genetic toxicity testing ensures cannabis and nicotine products do not cause genetic damage. In addition, regulatory agencies require this testing to ensure products meet safety and health standards. Moreover, with the growing concerns about long-term health risks, genetic toxicity testing is becoming even more critical to protect consumer health. Therefore, it plays a vital role in detecting harmful substances and ensuring that products are safe for use and are compliant with regulations.

Method Insights

The cellular assay segment dominated the market with the largest revenue share of 57.5% in 2024. Due to its high sensitivity, the cellular assay method detects subtle toxic effects at the cellular level, providing a detailed toxicity assessment. In addition, it evaluates a wide range of toxicity endpoints, including cytotoxicity, genotoxicity, and mutagenicity. These assays are more relevant to human health, offering better predictions of how cannabis and nicotine products may affect human cells. Furthermore, they are ethical, cost-effective, and faster than traditional animal testing, making them an ideal choice for the industry. Therefore, the versatility of cellular assays allows them to test a wide range of cannabis and nicotine products efficiently and accurately.

The others segment is projected to grow at a CAGR of 13.1% over the forecast period. The risk of microbial contamination has become a significant concern with the increasing number of cannabis- and nicotine-based products. In addition, microbiological testing methods, such as biochemical-based and molecular tests, are essential for detecting harmful microorganisms like bacteria, fungi, and mold. These contaminants can compromise product quality and pose health risks to consumers.

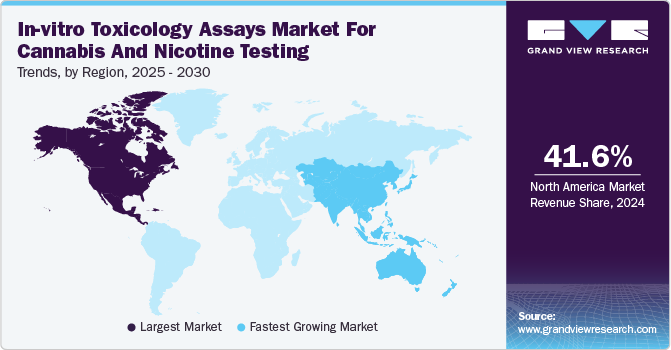

Regional Insights

North America in-vitro toxicology assays market for cannabis and nicotine testing dominated the global market with a revenue share of 41.6% in 2024. Fueled by the legalization of cannabis in North America, particularly in the U.S. and Canada, the cannabis industry has seen significant growth, leading to a wider variety of products such as flowers, edibles, vape pens, oils, and concentrates. In addition, as the market for these products expands, there is a growing need for comprehensive safety testing to ensure consumer protection. Moreover, the increasing variety of cannabis products demands strict regulatory guidelines to ensure product safety. Therefore, the demand for safety testing and in-vitro toxicology assays continues to rise with the growing market.

U.S. In-vitro Toxicology Assays Market For Cannabis And Nicotine Testing Trends

The U.S. in-vitro toxicology assays market for cannabis and nicotine testing dominated North America, driven by the establishment of a comprehensive regulatory framework governing the testing of cannabis and nicotine products. Agencies such as the Food and Drug Administration (FDA) and the Drug Enforcement Administration (DEA) impose strict testing requirements to ensure product safety and efficacy. For instance, the FDA's guidelines on cannabis-derived products mandate testing for contaminants, which drives the demand for in-vitro toxicology assays to meet these standards.

Europe In-vitro Toxicology Assays Market For Cannabis And Nicotine Testing Trends

The Europe in-vitro toxicology assays market for cannabis and nicotine testing held a substantial market share in 2024, which can be attributed to the growing interest in medicinal cannabis across Europe, particularly in countries like Germany, driven by the discovery of the endocannabinoid system and its potential therapeutic benefits. In addition, as more European countries legalize cannabis for medical use, the demand for reliable and accurate testing methods is expected to increase. These testing methods are essential to ensure the safety, potency, and efficacy of cannabis-derived products. Therefore, the need for robust toxicology assays continues to grow, supporting the market's expansion.

The in-vitro toxicology assays market for cannabis and nicotine testing in Germany is expected to grow over the forecast period, driven by the establishment of a strong regulatory framework for cannabis, including the Cannabis Act (CanG), which came into effect on April 1, 2024, allowing for the legal consumption, possession, and cultivation of cannabis. In addition, the law maintains strict control over medicinal cannabis through the Medicinal Cannabis Act (MedCanG), which is overseen by the German Federal Institute for Drugs and Medical Devices (BfArM). Moreover, BfArM ensures compliance with pharmaceutical quality standards, requiring all medical cannabis products to be tested according to the German Pharmacopoeia (DAB). This regulatory structure drives demand for reliable in-vitro toxicology assays to guarantee product safety and efficacy before consumption.

Asia Pacific In-vitro Toxicology Assays Market For Cannabis And Nicotine Testing Trends

The Asia Pacific in-vitro toxicology assays market for cannabis and nicotine testing is anticipated to register the fastest CAGR of 14.2% over the forecast period, which can be attributed to the rapidly evolving regulatory landscape in the region. In addition, several countries are implementing frameworks to govern the use of cannabis and nicotine products. For instance, Australia has established a strong regulatory system through the Mass Spectrometry Goods Administration (TGA), which oversees the approval and monitoring of medicinal cannabis products. Therefore, the TGA's strict compliance priorities for testing safety and efficacy drive demand for in-vitro toxicology assays to ensure products meet these high standards.

China has been actively developing its regulatory framework for nicotine products, particularly e-cigarettes, with the State Tobacco Monopoly Administration (STMA) implementing strict regulations. In addition, the GB Standard on E-Cigarettes, which came into effect in October 2022, mandates comprehensive safety assessments and toxicological testing of e-liquids. Moreover, the standard imposes limits on nicotine concentrations and has mandated labeling, including the requirement for nicotine extracted from tobacco with a purity of at least 99%. Therefore, these stringent regulations drive demand for reliable in-vitro toxicology assays to ensure compliance and product safety.

Key In-vitro Toxicology Assays Market For Cannabis And Nicotine Testing Company Insights

Some key companies operating in the market include Stemina Biomarker Discovery, Inc.; Broughton; LifeNet Health LifeSciences; Labstat International, Inc.; and TOXIKON. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands through medical device validation and verification.

-

Stemina Biomarker Discovery, Inc. offers assays for evaluating the toxicity of various substances, including cannabis and nicotine products, using human cell-based models. The company provides services that help assess the safety and efficacy of these products in compliance with regulatory standards. Stemina’s services support the in-vitro toxicology assays market by enabling accurate, reliable testing for product safety in the cannabis and nicotine sectors.

-

Broughton offers comprehensive testing and regulatory compliance services for nicotine and tobacco products, including e-cigarettes and related devices. The company's services include in-vitro toxicology assays to assess the safety and efficacy of nicotine-containing products, which are focused on toxicological testing, product formulation, and safety assessment.

Key In-vitro Toxicology Assays Market For Cannabis And Nicotine Testing Companies:

The following are the leading companies in the in-vitro toxicology assays market for cannabis and nicotine testing market. These companies collectively hold the largest market share and dictate industry trends.

- Stemina Biomarker Discovery, Inc.

- Broughton

- Labstat International, Inc.

- LifeNet Health LifeSciences

- TOXIKON

- Integrated Lab Solutions GmbH

- Enthalpy Analytical

- PBR Laboratories, Inc.

Recent Developments

-

In October 2023, Labstat International, Inc. announced its expansion into Europe by establishing a new laboratory in Utrecht, the Netherlands. This strategic move enhanced Labstat's analytical testing capabilities for tobacco and nicotine products, allowing it to serve clients better in the European market.

-

In February 2021, Stemina Biomarker Discovery, Inc. announced the launch of its innovative human cell-based DevTox QuickPredict assay designed to predict the developmental toxicity potential of nicotine-containing products. This assay utilizes advanced human cellular models to provide more accurate assessments of how these substances may affect fetal development, addressing a critical gap in current toxicity testing methods.

In-vitro Toxicology Assays Market For Cannabis And Nicotine Testing Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.06 billion |

|

Revenue forecast in 2030 |

USD 3.70 billion |

|

Growth rate |

CAGR of 12.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type,technology, application, method, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Stemina Biomarker Discovery, Inc.; Broughton; Labstat International, Inc.; LifeNet Health LifeSciences; TOXIKON; Integrated Lab Solutions GmbH; Enthalpy Analytical; PBR Laboratories, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global In-vitro Toxicology Assays Market For Cannabis And Nicotine Testing Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global in-vitro toxicology assays market for cannabis and nicotine testing report based on type, technology, application, method, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cannabis Testing

-

Nicotine Testing

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

3D Cell Culture Technology

-

Mass Spectrometry

-

Flow Cytometry

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Genetic Toxicity Testing

-

Carcinogenicity Testing

-

Cytotoxicity Testing

-

Mutagenicity Testing

-

Others

-

-

Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cellular Assay

-

Live Cells

-

High Throughput / High Content Screening

-

Molecular Imaging

-

Others

-

-

Fixed Cells

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."