In-store Analytics Market Size, Share & Trends Analysis Report By Solution Type (Shopper Traffic Analysis, Inventory Management), By Deployment (Cloud, On-premise), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-390-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

In-store Analytics Market Size & Trends

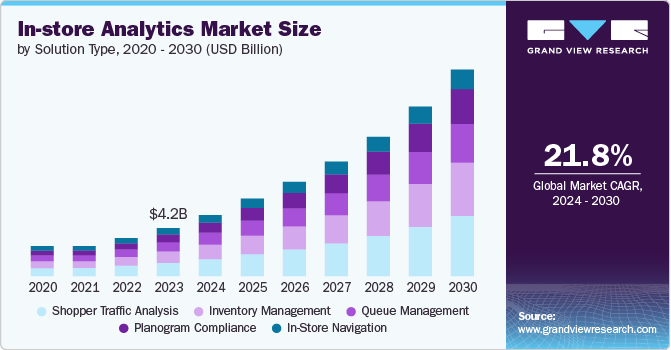

The global in-store analytics market size was estimated at USD 4.17 billion in 2023 and is projected to grow at a CAGR of 21.8% from 2024 to 2030. The market is experiencing robust growth driven by technological advancements and rising demand for data-driven solutions that can enhance retail operations. Retailers are increasingly adopting in-store analytics to gain deeper insights into customer behavior, simplify operations, and improve the overall shopping experience. This involves the deployment of sensors, cameras, and IoT devices within stores to monitor and analyze various aspects, such as shopper movements and foot traffic patterns.

These technologies provide real-time data on how customers interact with products and navigate through the store. The gathered data is then processed and analyzed using advanced analytics platforms. These platforms utilize algorithms and machine learning to extract actionable insights from the data. For instance, retailers can optimize store layouts based on traffic flow analysis, enhance inventory management by predicting demand patterns, and implement targeted marketing strategies based on customer preferences and behaviors. This analytical approach helps in operational efficiency and also in creating personalized shopping experiences that can drive customer satisfaction and loyalty.

The market is experiencing notable expansion driven by the increasing focus on personalized customer experiences and seamless omnichannel integration. Retailers are embracing analytics solutions to customize promotions, recommendations, and services according to individual shopper preferences and behaviors. This customer-centric approach enhances satisfaction, boosts sales conversions, and cultivates customer loyalty. In-store analytics integrate insights from both online and offline retail channels, offering a unified perspective on customer journeys across various touchpoints. This holistic approach empowers retailers to provide cohesive experiences such as efficient click-and-collect services and personalized in-store interactions, effectively meeting the evolving demands of digitally connected consumers. As competition intensifies, the effective use of in-store analytics becomes increasingly crucial for retailers aiming to differentiate themselves and stay ahead in the competitive retail sector.

Integration with digital marketing strategies is crucial for in-store analytics because it enables retailers to deliver timely and relevant promotions tailored to customers' immediate needs and preferences. Utilizing real-time data from in-store analytics platforms, retailers gain insights into customer behavior and preferences while they shop. This data empowers retailers to create personalized marketing campaigns targeting customers based on their location within the store, past purchase history, and browsing patterns. Integrating in-store analytics with digital marketing strategies also facilitates omnichannel marketing efforts, allowing retailers to synchronize online and offline promotional activities for a seamless shopping experience. For instance, a customer browsing online might receive a personalized offer that they can redeem in-store, utilizing insights from previous interactions and current location data gathered through in-store analytics.

Solution Type Insights

The shopper traffic analysis segment led the market and accounted for 28.2% of the global revenue in 2023. This segment focuses on understanding and optimizing the flow of customers within retail environments. By utilizing sensors, cameras, and other technologies, retailers can track foot traffic patterns, measure dwell times, and analyze peak shopping hours. These insights help retailers make informed decisions about store layout, staffing levels, and promotional strategies to enhance the overall shopping experience and maximize operational efficiency. As competition intensifies in the retail sector, the ability to effectively analyze and utilize shopper traffic data has become increasingly critical for retailers aiming to meet evolving consumer expectations.

The inventory management segment is projected to grow significantly from 2024 to 2030. This segment focuses on optimizing stock levels, reducing waste, and ensuring that products are available when and where customers need them. Advanced analytics tools and real-time data tracking enable retailers to monitor inventory levels accurately, predict demand, and streamline replenishment processes. The adoption of these technologies helps prevent stockouts and overstock situations, leading to improved customer satisfaction and increased sales. As retailers prioritize efficiency and responsiveness in their supply chains, the importance of effective inventory management continues to rise. Consequently, the segment is expected to see substantial growth as retailers increasingly invest in advanced solutions to enhance their inventory control and operational performance.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2023. Cloud deployment dominates the market, offering significant advantages in terms of expandability, adaptability, and cost-efficiency. Retailers are increasingly opting for cloud-based solutions because they allow for easy integration with existing systems and provide real-time data access from any location. This deployment model supports rapid deployment and updates, ensuring that retailers can quickly adapt to changing market conditions and technological advancements. Moreover, cloud-based analytics solutions offer enhanced data security and compliance with regulatory standards, which are critical in handling sensitive customer information. The ability to scale resources up or down based on demand further drives the adoption of cloud deployment in the in-store analytics market.

The on -premises segment is projected to grow at significant CAGR from 2024 to 2030. This segment involves deploying analytics solutions directly within the retailer's own IT infrastructure, offering greater control over data security and system customization. Retailers opting for on-premises solutions can customize the analytics platforms to their specific needs and integrate them seamlessly with existing legacy systems. This approach is particularly appealing to businesses with stringent data privacy requirements or those operating in regions with strict regulatory environments. As a result, this segment is expected to see substantial growth, driven by the need for enhanced data control and compliance capabilities.

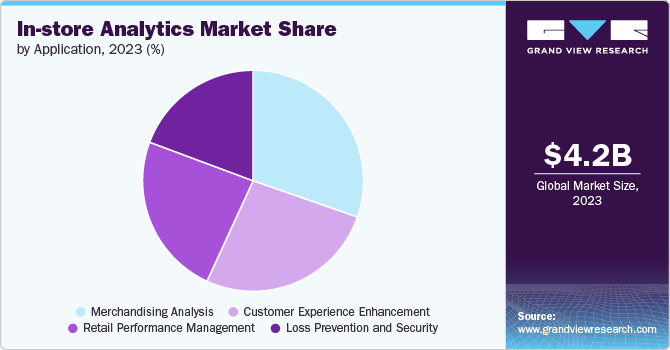

Application Insights

The merchandising analysis segment accounted for the largest revenue share in 2023. This segment optimizes product placement, assortment, and pricing strategies to maximize sales and profitability. By utilizing advanced analytics tools, retailers can gain insights into customer preferences, buying patterns, and product performance. These insights enable retailers to make data-driven decisions about inventory management, promotional activities, and store layouts. Merchandising Analysis helps retailers improve operational efficiency and enhance the shopping experience. As competition in the retail sector continues to intensify, the demand for effective merchandising analysis solutions is expected to remain strong, driving further growth in this segment.

The customer experience enhancement segment is projected to grow significantly from 2024 to 2030. This segment improves the overall shopping experience by utilizing data to understand and anticipate customer needs and preferences. Retailers are increasingly using analytics tools to personalize interactions, streamline customer journeys, and enhance service quality. By analyzing data on customer behavior, feedback, and engagement, retailers can tailor marketing efforts, optimize store layouts, and improve staff allocation to serve customers better. As consumers continue to demand more personalized and seamless shopping experiences, the adoption of customer experience enhancement solutions is expected to rise. Consequently, this segment is poised for substantial growth, driven by the need to meet evolving consumer expectations and promote long-term customer loyalty.

Regional Insights

North America in-store analytics market dominated and accounted for 37.6% share in 2023. North American market is driven by a high adoption rate of advanced technologies and a strong focus on enhancing customer experiences. Retailers in this region have been at the forefront of adopting innovative analytics solutions, recognizing the significant competitive advantages these technologies offer. The rapid implementation of advanced analytics tools has allowed North American retailers to gain deep insights into customer behavior, preferences, and shopping patterns. These insights enable retailers to make data-driven decisions that enhance various aspects of the shopping experience.

U.S. In-store Analytics Market Trends

The in-store analytics market in the U.S. is expected to grow significantly over the forecast period.The U.S. in-store analytics market is witnessing a surge in the adoption of AI and machine learning technologies to enhance real-time data processing and customer insights. Moreover, there is a growing trend towards integrating in-store analytics with omnichannel strategies, enabling seamless customer experiences across both physical and digital retail environments.

Europe In-store Analytics Market Trends

The Europe in-store analytics market is experiencing growth driven by stringent data protection regulations such as the General Data Protection Regulation (GDPR) which ensures robust data privacy and security measures. Moreover, there is an increasing emphasis on utilizing advanced analytics to improve customer engagement and operational efficiency, with many retailers adopting AI-powered solutions to personalize shopping experiences and optimize inventory management.

Asia Pacific In-store Analytics Trends

The in-store analytics market in the Asia Pacific is anticipated to register the fastest CAGR from 2024 to 2030. In the Asia Pacific region, the in-store analytics market is undergoing significant growth driven by the expanding retail sector across countries such as China, India, and Southeast Asian nations has created a ripe environment for adopting advanced technologies, including in-store analytics. As more brick-and-mortar stores and shopping centers emerge, there is a growing need to understand and optimize customer behavior to drive sales and enhance operational efficiency. The adoption of digital technologies such as IoT devices and sensors helps in capturing real-time data within physical retail environments.

Key In-store Analytics Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In January 2024, Myavana, a U.S.-based Beauty Technology Company, announced a retail partnership with Ulta Beauty, Inc. to support the company's hair care retail innovation within the beauty industry and expand its enterprise retail operations. Through this partnership, Ulta Beauty aims to integrate Myavana’s advanced HairAI hair analysis technology into its e-commerce try-on experiences to provide personalized product recommendations.

Key In-store Analytics Companies:

The following are the leading companies in the in-store analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Capillary Technologies India Limited

- Honeywell Intelligrated (Honeywell International Inc.)

- LTIMindtree Limited

- Microsoft

- Mood Media

- RETAILNEXT, INC.

- SAP SE

- Sensormatic Solutions (Johnson Controls)

- Trax Retail

- Zebra Technologies Corp.

Recent Developments

-

In June 2024, Honeywell announced an update to its Guided Work Solutions, incorporating AI and machine learning to enhance operational efficiency and shopper experiences for retailers by enabling in-store associates to perform tasks like order fulfillment and shelf restocking with improved speed and accuracy. This AI-driven solution supports Honeywell's focus on automation and helps retailers increase productivity.

-

In March 2024, Honeywell partnered with Berkshire Grey, a U.S.-based AI company, to integrate its Momentum Warehouse Execution Software (WES) and cybersecurity capabilities with Berkshire Grey's AI-enabled robotic sortation and picking systems. This collaboration enhances throughput, labor efficiency, and order accuracy for retail and fulfillment operations.

-

In March 2024, Honeywell and Tompkins Robotics, a U.S.-based provider of Autonomous Mobile Robot (AMR) automation for warehouses, partnered to enhance distribution and fulfillment operations with high-capacity, flexible automation. This collaboration combines Tompkins’ advanced AMRs with Honeywell’s software and integration expertise, offering businesses modular solutions that boost speed, efficiency, and scalability.

-

In January 2024, Microsoft introduced generative AI and data solutions for retailers, including retail data solutions in Microsoft Fabric, copilot templates on Azure OpenAI Service, and enhanced features in Microsoft Dynamics 365 Customer Insights to enable personalized shopping experiences and improve store operations. These innovations aim to help retailers address challenges such as high store associate turnover and shifting shopping habits.

In-store Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.06 billion |

|

Revenue forecast in 2030 |

USD 16.51 billion |

|

Growth rate |

CAGR of 21.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution type, deployment, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Capillary Technologies India Limited; Honeywell Intelligrated (Honeywell International Inc.); LTIMindtree Limited; Microsoft; Mood Media; RETAILNEXT, INC.; SAP SE; Sensormatic Solutions (Johnson Controls); Trax Retail; Zebra Technologies Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global In-store Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-store analytics market report based on solution type, deployment, application, and region:

-

Solution Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Shopper Traffic Analysis

-

Queue Management

-

Planogram Compliance

-

Inventory Management

-

In-Store Navigation

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Merchandising Analysis

-

Retail Performance Management

-

Customer Experience Enhancement

-

Loss Prevention and Security

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-store analytics market size was estimated at USD 4.17 billion in 2023 and is expected to reach USD 5.06 billion in 2024.

b. The global in-store analytics market is expected to grow at a compound annual growth rate of 21.8% from 2024 to 2030 to reach USD 16.51 billion by 2030.

b. North America dominated the in-store analytics market with a share of 37.6% in 2023. This is attributable to its advanced technological infrastructure, high levels of retail investment, early adoption of innovative solutions, and a strong focus on understanding consumer behavior.

b. Some key players operating in the in-store analytics market include Capillary Technologies India Limited, Honeywell Intelligrated (Honeywell International Inc.), LTIMindtree Limited, Microsoft, Mood Media, RETAILNEXT, INC., SAP SE, Sensormatic Solutions (Johnson Controls), Trax Retail, Zebra Technologies Corp.

b. Key factors driving market growth include the proliferation of big data and analytics tools, the rise of omnichannel retail strategies, increasing consumer expectations for personalized experiences, and the need for enhanced operational efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."