- Home

- »

- Automotive & Transportation

- »

-

In-plant Logistics Market Size, Share & Growth Report, 2030GVR Report cover

![In-plant Logistics Market Size, Share & Trends Report]()

In-plant Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Robots, ASRS, Conveyors & Sortation Systems, Cranes, AGVs, WMS, RTLS), By Location, By Industry Vertical (Automobiles, Food & Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-277-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In-plant Logistics Market Summary

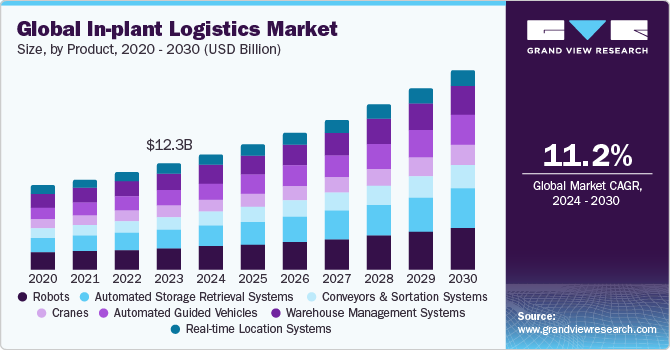

The global in-plant logistics market size was valued at USD 12.34 billion in 2023 and is projected to reach USD 23.28 billion by 2030, growing at a CAGR of 11.2% from 2024 to 2030. This surge is driven by the increasing adoption of automation technologies like robots, automated storage and retrieval systems (ASRS), and real-time tracking solutions.

Key Market Trends & Insights

- North America dominated the market in 2023, capturing the largest revenue share at 31.9%.

- The U.S. in-plant logistics market held the largest revenue share of 73.7% in 2023.

- By product, the robots segment dominated the target market and accounted for the largest revenue share of over 20.1% in 2023.

- By location, the storage facilities segment is expected to register the highest CAGR of 11.2% over the forecast period.

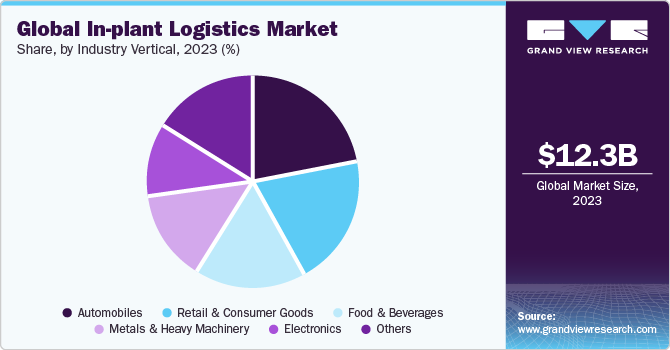

- By industry vertical, the automobiles segment dominated the target market, accounting for a revenue share of 22.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.34 Billion

- 2030 Projected Market Size: USD 23.28 Billion

- CAGR (2024-2030): 11.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Manufacturers are recognizing the efficiency gains offered by these technologies, which can optimize internal workflows, minimize errors, and boost overall productivity. This trend is expected to continue as Industry 4.0 principles and artificial intelligence become more integrated with in-plant supply chain systems.

The global in-plant logistics market is driven by numerous factors that shape its growth trajectory. Technological advancements play a pivotal role, with innovations like AI, automation, and the IoT revolutionizing industries and fostering demand for new products and services. Moreover, rising disposable income, particularly in developing economies, empowers consumers to spend more, driving market expansion. Globalization further amplifies the market dynamics by facilitating international trade, broadening market reach, and enabling companies to tap into diverse consumer bases.

Urbanization adds another dimension, concentrating demand in cities and fueling growth across sectors like retail and real estate. Additionally, the growing emphasis on environmental sustainability is reshaping consumer preferences, creating opportunities for eco-friendly products and services that cater to conscientious consumers. However, despite these driving forces, the global market faces constraints that impede its full potential. Geopolitical instability poses a significant risk, with political tensions and trade conflicts disrupting supply chains and eroding consumer confidence. Economic fluctuations, including downturns and currency volatility, can dampen consumer spending and investment, constraining market activity.

Moreover, resource scarcity, exacerbated by factors like climate change, threatens production capabilities and drives up costs across industries. Moreover, stringent regulations and trade barriers hinder market access and increase operational burdens for businesses, particularly those operating internationally. Additionally, cyber security threats loom large, with the proliferation of cyberattacks posing risks to business operations and consumer trust, especially in the digital realm. Addressing these challenges will be crucial for sustaining and fostering growth in the global market landscape.

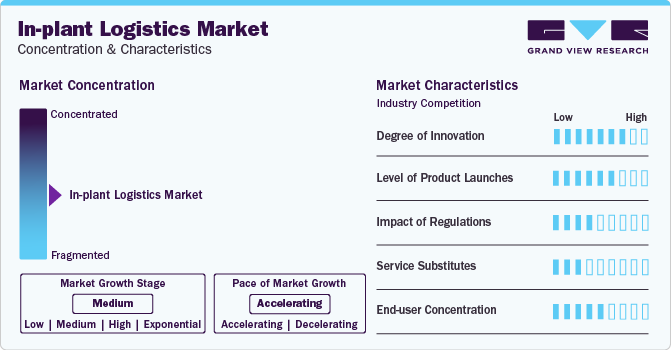

Market Concentration & Characteristics

The degree of innovation serves as a critical indicator of industry dynamism and competitiveness. This metric assesses the extent to which companies within the sector are embracing and implementing innovative technologies and methodologies to enhance operational efficiency and meet evolving customer demands. The market is poised for significant innovation driven by the widespread adoption of cutting-edge technologies. This includes advanced automation systems, robots, internet-of-things (IoT) devices, and predictive analytics. These solutions hold immense promise for optimizing critical processes like material handling, inventory management, and order fulfillment.

Moreover, innovative approaches to warehouse layout design, inventory tracking, and supply chain visibility contribute to improving overall productivity and responsiveness within manufacturing facilities. Monitoring the degree of innovation provides valuable insights for stakeholders, enabling them to identify emerging trends, anticipate competitive threats, and capitalize on growth opportunities in the rapidly evolving landscape of in-plant logistics.

The level of product launches within the market reflects the pace and diversity of new solutions and services being introduced to address the unique challenges faced by manufacturing facilities. Companies in this sector frequently launch innovative products ranging from automated guided vehicles (AGVs) and robotic arms to warehouse management software and real-time asset tracking systems. These product launches cater to a wide range of in-plant logistics needs, including material flow optimization, inventory control, and facility layout design.

Moreover, service offerings such as consulting, training, and maintenance support complement product launches, providing comprehensive solutions to enhance operational efficiency and agility in manufacturing environments. By tracking the level of product launches, stakeholders can stay informed about the latest advancements, assess market trends, and make informed decisions regarding investment, partnership, and product development strategies.

The impact of regulations on the market encompasses a range of factors, including safety standards, environmental regulations, labor laws, and trade policies. Regulatory compliance plays a significant role in shaping industry practices and operational requirements within manufacturing facilities. Stringent regulations related to workplace safety, hazardous material handling, and emissions control may necessitate investments in equipment upgrades, training programs, and compliance management systems.

Moreover, trade regulations and tariffs can influence sourcing decisions, supply chain strategies, and logistics costs for manufacturers operating in global markets. Regulatory changes and updates require constant monitoring and adaptation by industry participants to ensure compliance and mitigate operational risks. Additionally, regulatory initiatives promoting sustainability, energy efficiency, and ethical labor practices are increasingly influencing supply chain management practices and procurement decisions in the in-plant logistics sector.

In the in-plant logistics market, service substitutes refer to alternative solutions and approaches that fulfill similar functions or address comparable needs as traditional product offerings. Companies offering in-plant services may adopt a variety of service substitutes to enhance their value proposition, differentiate their offerings, and meet diverse customer requirements. For example, instead of purchasing and maintaining their own fleet of material handling equipment, manufacturers may opt for third-party logistics (3PL) services or equipment leasing arrangements to access the required resources on a flexible basis.

Similarly, companies may leverage managed services, such as warehouse outsourcing or inventory management solutions, to streamline operations and reduce overhead costs. Service substitutes can offer several advantages, including cost savings, scalability, and access to specialized expertise, making them an attractive option for manufacturers seeking to optimize their in-plant operations while focusing on their core competencies.

End-user concentration in the market refers to the distribution of demand among different customer segments or industries. A high level of end-user concentration indicates that a significant portion of market demand is driven by a relatively small number of large customers or industry sectors. Conversely, a low level of end-user concentration suggests a more diversified customer base with demand spread across multiple industries or geographic regions.

Understanding end-user concentration is essential for in-plant logistics providers to identify key customer segments, assess market opportunities, and tailor their offerings to meet specific industry needs. Moreover, high end-user concentration may pose risks related to customer dependency and revenue volatility, necessitating proactive customer relationship management and diversification strategies. By analyzing end-user concentration, stakeholders can gain insights into market dynamics, competitive positioning, and growth potential within the market.

Product Insights

The robots segment dominated the target market and accounted for the largest revenue share of over 20.1% in 2023. Robots have emerged as invaluable assets, particularly in tasks characterized by repetition and precision. Their adeptness at material handling, sorting, and order fulfillment significantly enhances operational efficiency while minimizing errors. The landscape of robotics has evolved significantly from its traditional role in heavy-lifting tasks. Recent advancements have transformed robots into highly adaptable and agile assets, seamlessly aligning with and enhancing existing workflows within businesses.

Despite the initial investment required, the long-term benefits of deploying robots in the facility are substantial, particularly in reducing labor costs, especially for tasks involving hazardous materials or physically taxing environments. Moreover, robots excel in assuming risky responsibilities, thus mitigating workplace accidents and injuries. Unlike human workers, robots operate tirelessly, ensuring uninterrupted operations and swifter turnaround times, thereby optimizing productivity in the in-plant logistics market.

The automated storage and retrieval systems (ASRS) segment is expected to register the highest CAGR of 11.3% over the forecast period. ASRS is rapidly transforming the market landscape by maximizing space utilization and streamlining inventory management. These intelligent systems leverage computer-controlled mechanisms to store and retrieve goods on demand, optimizing picking times and order fulfillment accuracy.

The growing demand for efficient warehousing and rising labor costs are driving the adoption of ASRS across industries. Furthermore, advancements in automation and integration with warehouse management systems (WMS) are creating a more dynamic storage environment, allowing businesses to adapt to fluctuating inventory levels and order fulfillment demands. As the market prioritizes efficiency and space optimization, ASRS is poised for continued growth and innovation.

Location Insights

The receiving & delivery docks segment asserted its dominance in the market, claiming the largest market share of 26.2% in 2023. Receiving and delivering docks play a crucial role in the efficiency of the market. They act as the critical entry and exit points for materials and finished goods. While traditional docks rely on manual processes, the market is witnessing a rise in automation solutions. This includes dock scheduling software, automated guided vehicles (AGVs), and automated loading and unloading systems.

These advancements streamline dock operations, reduce congestion, and expedite turnaround times for incoming and outgoing shipments. Furthermore, the integration of real-time tracking systems with receiving and delivery docks enhances visibility and control over the flow of goods, allowing for better inventory management and improved planning throughout the in-plant logistics chain. As the focus on speed and efficiency intensifies, receiving and delivery docks are poised to transform from passive zones to intelligent hubs within the ecosystem.

The storage facilities segment is expected to register the highest CAGR of 11.2% over the forecast period. Storage facilities are the backbone of the market, serving as the physical space for housing raw materials, work-in-progress inventory, and finished goods. However, the concept of a storage facility is evolving beyond just basic warehousing. Modern facilities are adopting smarter storage solutions to optimize space utilization and inventory management. This includes the use of vertical storage solutions like mezzanines and high-bay racking, which maximize vertical space and improve accessibility.

Additionally, the integration of warehouse management systems (WMS) with storage facilities allows for real-time inventory tracking, streamlining picking and replenishment processes. Furthermore, the growing trend of automation within storage facilities is leading to the implementation of automated storage and retrieval systems (ASRS) and automated guided vehicles (AGVs) for efficient movement and retrieval of goods. As the market strives for greater efficiency and cost optimization, storage facilities will continue to transform into intelligent hubs that leverage Location and automation to ensure seamless material flow within the manufacturing environment.

Industry Vertical Insights

The automobiles segment dominated the target market, accounting for a revenue share of 22.1% in 2023. Due to the complex and just-in-time nature of car manufacturing, efficient in-plant logistics are paramount. This translates into a high demand for advanced solutions like automated guided vehicles (AGVs) for transporting parts and materials throughout the assembly line. Additionally, the growing trend of electric vehicle (EV) production necessitates specialized in-plant logistics solutions for handling bulky batteries and other EV components.

Furthermore, the industry's focus on lean manufacturing principles necessitates real-time inventory tracking and optimized storage solutions to minimize waste and production delays. The ongoing advancements in automation and the shift towards alternative fuel vehicles within the automotive industry are creating a dynamic landscape for in-plant logistics. This presents a significant opportunity for the broader supply chains, as it fuels demand for innovative and adaptable solutions that can cater to the evolving needs of auto manufacturers.

The food and beverages segment is expected to grow at the fastest CAGR of 11.2% over the forecast period. Stringent food safety regulations and the perishable nature of many goods necessitate meticulous handling and temperature control throughout the production process. ASRS offers a solution by optimizing space utilization and ensuring proper cold chain management for temperature-sensitive items. Additionally, the integration of IoT sensors with equipment and packaging allows for real-time monitoring of product quality and expiration dates, minimizing waste and ensuring food safety.

Furthermore, the rise of e-commerce and on-demand delivery services necessitates efficient order fulfillment processes. In response, food and beverage companies are increasingly adopting automated picking and packing systems to expedite order fulfillment and maintain product freshness. As consumer demand for convenience and diverse food options continues to grow, the food and beverage industry's reliance on innovative in-plant logistics solutions will only increase.

Regional Insights

North America dominated the market in 2023, capturing the largest revenue share at 31.9%. This growth is underpinned by several key factors. The strong manufacturing sector in the U.S. and Canada, particularly in industries like automotive, drives the demand for efficient in-plant logistics solutions. Additionally, the adoption of automation technologies such as robots, AGVs, and ASRS is increasingly prevalent, leading to streamlined processes and heightened productivity.

Moreover, the emphasis on supply chain optimization and just-in-time manufacturing fuels the need for real-time inventory tracking and visibility solutions. However, the high initial costs of automation implementation and concerns regarding job displacement are some of the challenges faced by the facility operators. Nonetheless, with its established manufacturing base, technological advancements, and focus on operational efficiency, the North American market is poised for substantial growth.

U.S. In-plant Logistics Market Trends

The U.S. in-plant logistics market held the largest revenue share of 73.7% in 2023 and is experiencing substantial growth, propelled by propelled by a confluence of factors. The booming e-commerce sector and the growing trend of omnichannel fulfillment are driving the need for faster and more efficient order fulfillment within manufacturing plants. In-plant logistics solutions play a crucial role in meeting these demands. A robust manufacturing base, particularly in areas like automotive, aerospace, and pharmaceuticals, creates a strong demand for efficient in-plant logistics solutions.Recent disruptions in global supply chains have highlighted the importance of in-plant logistics optimization. Companies are investing in solutions that improve visibility, traceability, and control over their internal logistics operations, leading to greater supply chain resilience.

The in-plant logistics market in Canada is surging, fueled by a strong and diverse manufacturing base (automotive, aerospace, and food and beverages) demanding efficient solutions. Automation is key, with robots, AGVs, and ASRS streamlining material handling and cutting costs. Sustainability is also a growing concern, driving the adoption of eco-friendly practices. Digital integration with IoT sensors and real-time tracking provides greater control and visibility. As Canada's manufacturing landscape evolves, the market is poised for further growth, driven by innovation and a relentless pursuit of operational excellence.

Asia Pacific In-plant Logistics Market Trends

The Asia Pacific in-plant logistics market recorded the fastest CAGR of 12.5% over the forecast period from 2024 to 2030. The region's burgeoning manufacturing sector, particularly in China and India, creates a massive demand for efficient in-plant logistics solutions. Furthermore, the rising labor costs and a growing focus on automation are driving companies to embrace technologies like robots, AGVs, and ASRS. The rise in e-commerce and the adoption of omnichannel fulfillment strategies require manufacturing plants to enhance their order fulfillment processes for quicker and more precise results, thus spurring demand for innovative solutions.

Moreover, the expanding footprint of global brands with intricate supply chains presents an attractive prospect for in-plant logistics providers offering comprehensive, integrated solutions. With the Asia Pacific region maintaining its manufacturing leadership, the market is positioned for substantial growth, fueled by a combination of economic dynamics, technological progress, and a drive for operational excellence.

The in-plant logistics market in China is experiencing a staggering growth driven by several key factors. China's dominant position in global manufacturing creates a massive demand for efficient in-plant logistics solutions to manage vast production volumes.As labor costs increase, companies are turning to automation technologies like robots and automated guided vehicles (AGVs) to optimize processes and reduce reliance on manual labor.The surge in e-commerce necessitates faster and more accurate order fulfillment within manufacturing plants, driving demand for innovative in-plant logistics solutions. Moreover, government initiatives promoting Industry 4.0 principles, which emphasize automation and data-driven manufacturing, accelerate the adoption of advanced in-plant logistics solutions.

India in-plant logistics market in India is flourishing, fueled by a surge in manufacturing across diverse sectors like automotive, pharmaceuticals, and FMCG. To optimize material handling, inventory management, and fulfillment, companies are embracing automation. E-commerce and omnichannel retail demand faster fulfillment, leading to investments in automation and optimized warehouse layouts. Sustainability is a growing focus, with eco-friendly practices minimizing environmental impact. Overall, India's market thrives due to manufacturing expansion, automation adoption, e-commerce growth, and a focus on sustainability. By capitalizing on these trends, stakeholders can unlock new opportunities and achieve sustained growth in this dynamic landscape.

Key In-plant Logistics Company Insights

Some of the key companies operating in the market include Daifuku Co., Ltd., KUKA AG, and XPO Logistics, among others.

-

Established in 1937, Daifuku Co., Ltd. has been a leading force in in-plant logistics market. Specializing in material handling systems, ASRS, and factory automation, they cater to diverse industries like automotive, aerospace, and healthcare. Their comprehensive solutions include conveyors, AGVs, robotics, and warehouse management software. The company’s focus on R&D ensures cutting-edge solutions that optimize efficiency, productivity, and space utilization. This commitment to innovation positions them as a trusted partner for companies seeking to elevate their in-plant logistics operations worldwide.

-

KUKA AG is a leading provider of robotics and automation solutions, offering a comprehensive range of products and services for in-plant logistics applications. Founded in Germany in 1898, KUKA has a long-standing reputation for excellence in industrial robotics, with a strong presence in automotive manufacturing and other key industries worldwide. The company's portfolio includes industrial robots, collaborative robots (cobots), autonomous mobile robots (AMRs), and software solutions for flexible and efficient material handling, assembly, and logistics processes within manufacturing plants.

-

XPO Logistics is a provider of supply chain solutions, including in-plant logistics services tailored to the unique needs of manufacturing facilities. Headquartered in the U.S., the company operates across a vast network of warehouses, distribution centers, and transportation assets worldwide, serving a diverse customer base across various industry verticals. The company offers a wide range of in-plant logistics solutions, including warehousing, inventory management, kitting, sequencing, and line-side delivery services, designed to optimize efficiency and streamline operations within manufacturing plants. With a focus on Location-driven innovation and continuous improvement, XPO leverages advanced digital platforms, robotics, and automation technologies to deliver tailored solutions that meet the evolving demands of its customers in the in-plant logistics market.

BEUMER Group GmbH & Co. KG and Honeywell International Inc. are some of the emerging market companies in the target market.

-

BEUMER Group GmbH & Co. KG is increasingly focusing on automation solutions within the in-plant logistics space. Their offerings in areas like sorting systems, palletizers, and conveyor systems cater to the growing demand for efficient material handling within manufacturing facilities.

-

The Automation and Sensing Technologies division of Honeywell International Inc. offers a range of solutions relevant to in-plant logistics, including warehouse management systems, barcode scanners, and machine vision systems. These solutions contribute to improved inventory control, traceability, and overall efficiency within manufacturing plants.

Key In-plant Logistics Companies:

The following are the leading companies in the in-plant logistics market. These companies collectively hold the largest market share and dictate industry trends.

- BEUMER Group GmbH & Co. KG

- C.H. Robinson

- CEVA Logistics

- Dachser

- Daifuku Co., Ltd.

- Expeditors

- GXO Logistics

- Honeywell International Inc.

- JBT Corporation

- KUKA AG

- Nippon Yusen Kabushiki Kaisha (NYK Line) (Yusen Logistics)

- SSI Schaefer Group

- TGW Logistics Group

- Toyota Industries Corporation

- XPO Logistics

Recent Developments

-

In June 2023, BEUMER Group GmbH & Co. KG acquired The Hendrik Group Inc., to expand its portfolio in bulk material transport within manufacturing facilities. By integrating the company’s expertise in air-supported belt conveyors, BEUMER offer a wider solution range to manufacturers, catering to the growing demand for efficient and environmentally friendly bulk material transport within production facilities

-

In May 2023, SSI Schaefer partnered with Brands for Less to streamline operations through a state-of-the-art automated storage system. This innovative system leverages robotic shuttles and vertical lifts to efficiently deliver bins to designated pick-up zones. This collaboration was aimed to significantly improve storage and retrieval processes for Brands for Less, leading to increased efficiency, reduced costs, and supporting the company's future growth

-

In January 2023, KUKA AG upgraded its KMP 600-S diffDrive platform, a high-speed automated guided vehicle (AGV) solution, renowned for its durability. It is specifically engineered to withstand the rigorous demands of industrial production. With its IP 54 design, this AGV ensures reliable operation even in challenging conditions, including exposure to water spray and dust

In-plant Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.41 billion

Revenue forecast in 2030

USD 23.28 billion

Growth rate

CAGR of 11.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, location, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Mexico; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

BEUMER Group GmbH & Co. KG; C.H. Robinson; CEVA Logistics; Dachser; Daifuku Co., Ltd.; Expeditors; GXO Logistics; Honeywell International Inc.; JBT Corporation; KUKA AG; Nippon Yusen Kabushiki Kaisha (NYK Line) (Yusen Logistics); SSI Schaefer Group; TGW Logistics Group; Toyota Industries Corporation; XPO Logistics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-plant Logistics Market Report Segmentation

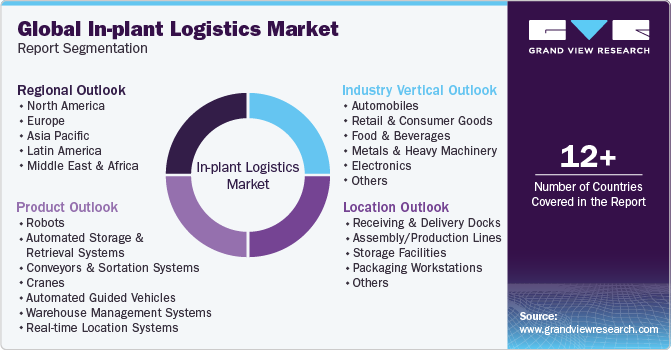

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global in-plant logistics market report based on product, location, industry vertical, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Robots

-

Automated Storage And Retrieval Systems (ASRS)

-

Conveyors & Sortation Systems

-

Cranes

-

Automated Guided Vehicles (AGVs)

-

Warehouse Management Systems (WMS)

-

Real-time Location Systems (RTLS)

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

Receiving & Delivery Docks

-

Assembly/Production Lines

-

Storage Facilities

-

Packaging Workstations

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Automobiles

-

Retail & Consumer Goods

-

Food & Beverages

-

Metals & Heavy Machinery

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-plant logistics market size was estimated at USD 12.34 billion in 2023 and is expected to reach USD 13.41 billion in 2024.

b. The global in-plant logistics market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 23.28 billion by 2030.

b. The robots segment accounted for the largest revenue share of 20.1% in 2023 and is expected to remain dominant over the forecast period in the market.

b. Some key players operating in the in-plant logistics market include BEUMER Group GmbH & Co. KG, C.H. Robinson, CEVA Logistics, Dachser, Daifuku Co., Ltd., Expeditors, GXO Logistics, Honeywell International Inc., JBT Corporation, KUKA AG, Nippon Yusen Kabushiki Kaisha (NYK Line) (Yusen Logistics), SSI Schaefer Group, TGW Logistics Group, Toyota Industries Corporation, and XPO Logistics, among others.

b. Key factors driving the in-plant logistics market's growth include the increasing adoption of automation technologies such as robots, automated storage and retrieval systems (ASRS), and real-time tracking solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.