In-line Process Viscometer Market Size, Share & Trends Analysis Report By Technology (Vibration, Torsional Oscillation, Acoustic Wave), By Industry (Petroleum, Chemicals, Pharmaceuticals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-234-1

- Number of Report Pages: 87

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

ILPV Market Size & Trends

The global in-line process viscometer market size was valued at USD 199.0 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. The rise in global energy demand has led to an increase in refining capacities which is eventually expected to drive the market for in-line process viscometers (ILPV). In-line process viscometers have several advantageous properties that help them to stabilize the refining process as well as to provide reliability and accuracy while operating. Moreover, the use of ILPV reduces the viscosity-related issues of identifying and resolving time, which helps to increase the process efficiency. These properties of ILPV are further expected to drive the market.

It has become essential for countries to take substantial steps to meet the increasing energy demand. Thus, global economies are focusing on increasing their refining capacities which is beneficial for the ILPV market growth. According to the International Energy Agency’s June 2022 report, the global oil demand was anticipated to reach 101.6 million (b/d) in 2023, which is higher than the pre-pandemic demand. Viscosity is a very crucial attribute that needs to be maintained in the refineries. Thus with the rise in consumption and demand of energy, viscometers become a very crucial component for refineries. Moreover, the regulatory norms set by regulatory bodies such as the American Society for Testing and Materials (ASTM) are forcing the producers to consider viscometers as a solution for quality control.

It takes approximately 4-12 hours to identify and rectify a problem arising due to the viscosity of a particular fuel. This can lead to damage costing around USD 1.5 million, which can be reduced or minimized using ILPV. Besides, the cost of setting up an in-line process viscometer is only one-fourth that of the cost incurred during breakdown maintenance. Accurate control of fuel viscosity is considered to be a crucial component in the automotive industry, and an in-line process viscometer controls fuel atomization, beneficial for efficient combustion, and hence is gaining acceptance in the automotive industry across the globe. It has real-time monitoring which helps the producers to keep a watch on product quality and meet the regulatory standards simultaneously.

Product innovations and technological up-gradation for various applications in refineries and other niche applications have helped to consistently improve the quality of production, profitability, and productivity. However, the lack of ability to measure multidirectional flow coupled with the repeated price wars is expected to remain key challenges for market participants. The growth of the global food & beverage industry coupled with increasing healthcare expenditure, particularly in emerging markets of Asia and Latin America is expected to fuel the demand for ILPV. The growing importance of considering parameters for controlling process and asphalt mixing is expected to provide novel opportunities to market participants.

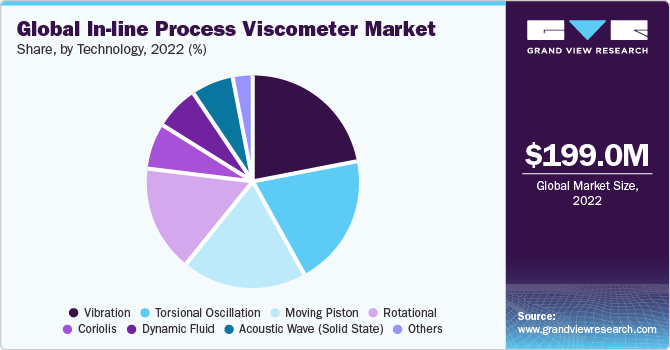

Technology Insights

Based on technology, the market is segmented into rotational, torsional oscillation, vibration, moving piston, coriolis, dynamic fluid pressure, acoustic wave and others. The vibration segment dominated the overall market and accounted for the largest revenue share of 22.22% in 2022. Vibration-based viscometers have had the highest demand due to their ease of incorporation into various industrial fluid processes. They provide real-time viscosity measurement without coming in direct contact with the fluid and interrupting the flow. This aids in ensuring the highest quality, accuracy, and reliability over larger periods.

The acoustic wave segment is expected to grow at the fastest CAGR of 7.2% from 2023 to 2030. This growth can be attributed to their ability to provide accurate measurements using waves. The increasing demand for high-precision wireless sensing devices that provide accuracy and reliability is driving segmental growth.

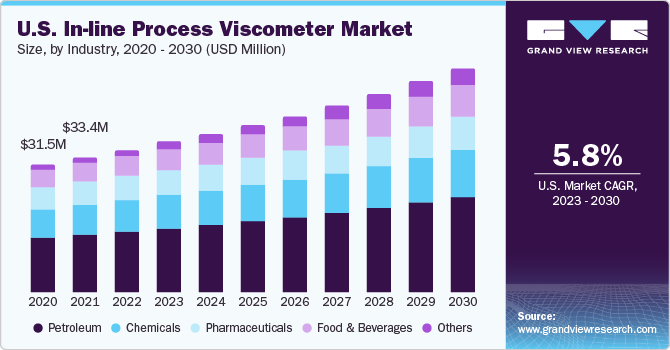

Industry Insights

The petroleum segment accounted for the largest revenue share of 38.70% in 2022 and it is expected to grow at the fastest CAGR of 7.1% over the forecast period. This can be attributed to the utilization of viscometers in the petroleum industry for applications such as crude oil production and refining process. Quality control is a key parameter in the petroleum industry that can be monitored using the in-line process viscometer.

The increase in demand and production of crude oil is further expected to drive the segment growth. According to the U.S. Energy Information Administration in January 2023, the country’s average crude oil production in 2022 was 11.9 million barrels per day (b/d), which is estimated to reach an average of 12.4 million (b/d) by 2023 and further 12.8 million (b/d) by 2024.

The chemical market is estimated to grow at a significant CAGR in the forecast period. High revenue chemical industries such as lubricants and oils, adhesives, paints and coatings, inks, etc. are striving for automation of their manufacturing processes. This will result in a growing demand for ILPV in the chemical segment.

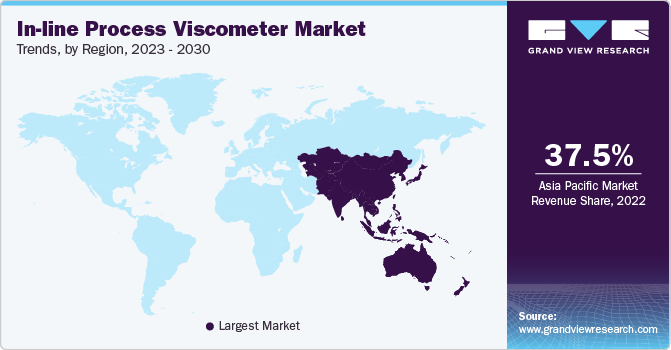

Regional Insights

Asia Pacific dominated the global in-line process viscometer market and accounted for the largest revenue share of 37.50% in 2022 and is expected to grow at the fastest CAGR of 7.1% during the forecast period. Growing energy demand coupled with the growth of the petroleum and chemical industry particularly in emerging markets of China and India is expected to fuel the demand for ILPV in this region. According to the Ministry of Petroleum and Natural Gas of the Government of India (GOI) in March 2023, in India there were a total number of 23 refineries with a refining capacity of 248.9 MMTPA, which is the fourth largest refining capacity in the world. Similarly, according to an article published by Reuters in February 2023, China was home to 32 refineries.

The growth of the chemical industry in these emerging economies of the region is also boosting the regional growth of the in-line process viscometer. According to the Department of Chemicals and Petrochemicals of the GOI, from 2014-15 to 2019-20, the share of Gross Value Added (GVA) of the chemical sector has grown with a CAGR of 12.57%.

In addition, the growth of the food and beverages industry and regulatory norms set by authorities such as the Food Safety and Standards Authority of India (FSSAI), China Food and Drug Administration (CFDA), Food Standards Australia New Zealand (FSANZ) is increasing demand of ILPV in the region.

The Middle East and Africa region is estimated to grow at a lucrative CAGR over the forecast period due to the presence of crude oil refineries which is the major driving force behind the growing demand for ILPV. Moreover, this region also accommodates the presence of huge chemical industries which would add up to the demand further in the future.

Key Companies & Market Share Insights

The market is competitive in nature and the players are undertaking various strategies to increase their market penetration. Vendors in the market are launching new and innovative products to cater to the demands of various end-user in the market.

Key In-line Process Viscometer Companies:

- Lamy Rheology

- Brabender Gmbh & Co. Kg

- Hydramotion Ltd.

- Werbeagentur Johnson

- VAF Instruments

- FUJI ULTRASONIC ENGINEERING Co., Ltd.

- Sofraser

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- BARTEC Top Holding GmbH

- Analytical Technology and Control Ltd (ATAC)

Recent Developments

-

In August 2021, Cambridge Viscosity, Inc. launched its new ViscoLab PVT+ viscometer for laboratory application. This viscometer is anticipated to perform in high-pressure as well as high-temperature situations.

-

In March 2021, Brabender GmbH & Co. KG announced the launch of its Convimeter II. This device can be used for measuring viscosity as well as for process control in production for developments of pastes and liquids. Moreover, it allows monitoring of viscosity continuously with the help of a history display.

In-line Process Viscometer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 210.2 million |

|

Revenue forecast in 2030 |

USD 327.2 million |

|

Growth rate |

CAGR of 6.4% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

October 2023 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, industry, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Russia; Spain; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Lamy Rheology; Brabender Gmbh & Co. Kg; Hydramotion Ltd.; Werbeagentur Johnson; VAF Instruments; FUJI ULTRASONIC ENGINEERING Co., Ltd.; Sofraser; Emerson Electric Co. Endress+Hauser Group Services AG; Lemis Baltic; BARTEC Top Holding GmbH; Analytical Technology and Control Ltd (ATAC) |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

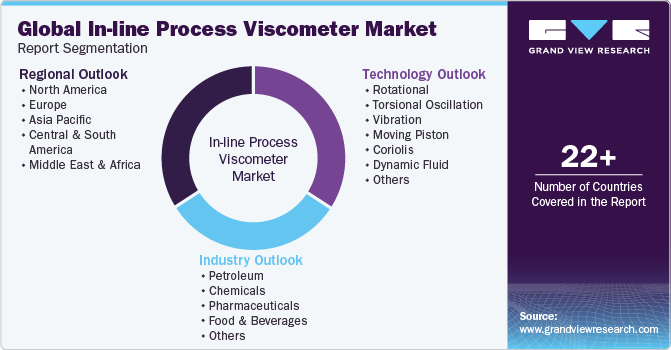

Global In-line Process Viscometer Market Report Segmentation

This report forecasts revenue and volume growth at global & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-line process viscometer market report based on technology, industry, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotational

-

Torsional Oscillation

-

Vibration

-

Moving Piston

-

Coriolis

-

Dynamic Fluid

-

Acoustic Wave (Solid State)

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Petroleum

-

Chemicals

-

Pharmaceuticals

-

Food and Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-line process viscometer market size was estimated at USD 199.0 million in 2022 and is expected to be USD 210.2 million in 2023.

b. The global in-line process viscometer market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 327.2 million by 2030.

b. Asia Pacific dominated the market in 2022 by accounting for a share of 37.5% of the market, owing to growing energy demand coupled with the growth of the chemical industry, particularly in emerging markets of China and India.

b. Some of the key players operating in the in-line process viscometer market include Lamy Rheology, Brabender Gmbh & Co. Kg, Hydromotion, Marimex America Llc., Nanometre (Galvanic Inc.), Vaf Instruments, Fuji Ultrasonic Engineering, Sofraser, Micro Motion (Emerson Process Management), Mat Mess- & Analysetechnik, Norcross, Endress+Hauser Consult AG, Lemis Baltic, Orb Instruments, Inc., Bartec, Atac, and Vectron International, Inc.

b. The rapid increase in refining capacities on account of growing energy needs is expected to drive the global demand for in-line process viscometers. The use of in-line process viscometers helps in stabilizing the refining process; it is reliable and accurate during its performance.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."