In-dash Navigation System Market Size, Share & Trends Analysis Report By Component, By Technology, By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-415-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

In-dash Navigation System Market Trends

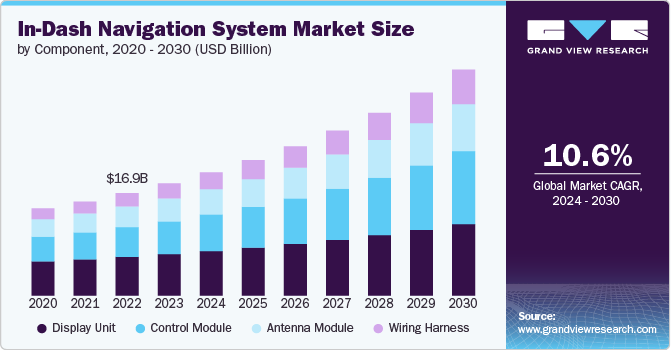

The global in-dash navigation system market size was estimated at USD 18.48 billion in 2023 and is expected to grow at a CAGR of 10.6% from 2024 to 2030. An in-dash navigation system is a built-in component of a vehicle’s dashboard that provides navigation and infotainment features. It typically combines GPS navigation with various multimedia functions, such as audio and video playback, connectivity options, and real-time information. Increasing demand for advanced safety and navigation features in vehicles, regulatory safety standards and the rise in demand for electric and autonomous vehicles are major driving factors behind the market growth.

In-dash navigation systems are increasingly being integrated with Advanced Driver Assistance Systems (ADAS), which enhance vehicle safety and driving convenience. This integration allows for real-time updates and more precise navigation guidance based on inputs from sensors and cameras around the vehicle. For example, navigation systems can now offer predictive routing by considering live traffic conditions, road hazards, and even the vehicle's current speed and lane position. This improves route accuracy and contributes to overall road safety by alerting drivers to potential issues and helping avoid accidents. Thus, the rising adoption of ADAS systems in vehicles is further driving the growth of the market.

Voice recognition technology has seen significant advancements, making it integral to modern in-dash navigation systems. Modern navigation units feature advanced voice recognition for route setting and system control, enabling drivers to keep their focus on the road. Additionally, these systems provide voice-guided turn-by-turn directions. Unlike older models that only verbalized the distance to the next turn, modern units now articulate street names and exit numbers, offering clearer and more detailed guidance. This trend increases convenience and enhances safety by minimizing distractions and allowing for a more hands-free driving experience, thereby improving the market’s growth.

The integration of in-dash navigation systems with smartphone ecosystems is becoming more prevalent, thereby driving the market’s growth. By connecting with platforms such as Apple CarPlay and Android Auto, navigation systems can leverage smartphone capabilities to offer a more seamless and personalized experience. This integration allows drivers to access apps, media, and communication tools directly through their in-dash system, creating a unified interface that simplifies interaction and enhances usability. It also ensures that drivers can use familiar smartphone apps for navigation, such as Google Maps or Waze, within their vehicle's interface, providing continuity and convenience.

Despite the advancements in the in-dash navigation system market, several factors restrain its growth. The high cost associated with integrating advanced technologies, such as sophisticated voice recognition, real-time traffic updates, and integration with other driver assistance systems, could hamper the growth of the market. Additionally, concerns about data privacy and security remain significant, as navigation systems often require access to personal data and real-time location information. Compatibility issues with various vehicle models and the rapid pace of technological change also pose challenges, potentially leading to obsolescence and necessitating frequent updates or replacements.

Component Insights

The display unit segment dominated the market in 2023 and accounted for a 36.85% share of global revenue. The display unit is a critical component of in-dash navigation systems, serving as the primary interface between the driver and the system. Modern display units are characterized by high-resolution touchscreens that offer clear, detailed visuals and intuitive controls. Increasing advances in display technology, such as OLED and LED screens, and demand for improved brightness, color accuracy, and visibility in various lighting conditions can be attributed to the segment growth. As vehicle manufacturers and consumers demand more advanced and visually appealing interfaces, the display unit segment is expected to witness continued innovation and growth from 2024 to 2030.

The wiring harness segment is projected to witness significant growth from 2024 to 2030. The wiring harness connects the display unit with other electronic components and systems within the vehicle. Modern harnesses are often made from high-quality, flexible materials that can withstand the rigors of automotive environments. Increasing advancements in wiring harness design to improve durability, reduce electromagnetic interference, and simplify installation are major factors behind the segment's growth.

Technology Insights

The 2D maps segment dominated the market in 2023. The segment's growth is driven by its simplicity, cost-effectiveness, and ease of integration. 2D maps offer a straightforward approach to navigation by clearly displaying streets, landmarks, and basic routes. This simplicity makes them user-friendly and reduces the computational power needed, allowing for faster and more reliable performance in entry-level systems, thereby boosting the segment’s growth.

The 3D maps segment is projected to witness significant growth from 2024 to 2030. 3D maps provide a more immersive and detailed view of geographical environments, offering features such as realistic terrain, building models, and dynamic perspective changes that improve situational awareness and user engagement. The growing demand for advanced navigation systems that enhance driving comfort and safety is driving the adoption of 3D mapping technology in in-dash navigation systems. Furthermore, as hardware and processing capabilities continue to advance, the integration of 3D maps is becoming more feasible and cost-effective for a broader range of vehicles.

Vehicle Type Insights

The passenger cars segment dominated the market in 2023. The segment's growth can be attributed to increasing consumer demand for advanced in-car technology and enhanced driving experiences. The rise in the adoption of SUVs, sedans, luxury cars, and other higher-end passenger vehicle models is further boosting the segment's growth. In addition, advancements in user interfaces and affordability are making these systems more accessible across various passenger car segments. This growing consumer preference for advanced navigation solutions is significantly boosting the market growth in this segment.

The commercial vehicles segment is projected to witness significant growth from 2024 to 2030. The need for efficiency, safety, and compliance in commercial fleet management can be attributed to the growth of the segment. Fleet operators are increasingly adopting advanced navigation systems to optimize routes, improve fuel efficiency, and ensure timely deliveries. Features such as real-time traffic data, vehicle tracking, and integration with logistics management systems are becoming essential for commercial operations, thereby driving demand for in-dash navigation systems in commercial vehicles.

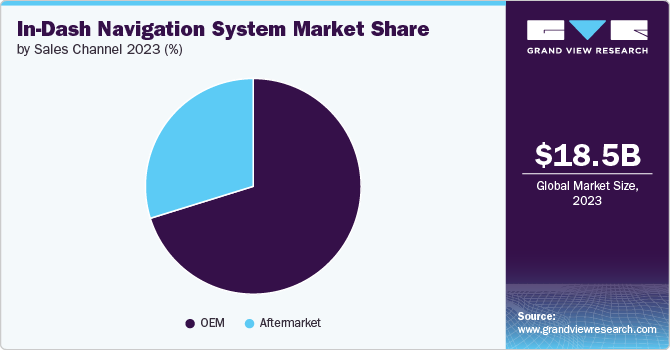

Sales Channel Insights

The Original Equipment Manufacturer (OEM) segment dominated the market in 2023. The increasing demand for advanced, integrated technology in modern vehicles can be attributed to the segment’s growth. As automakers strive to differentiate their models and enhance their appeal, they are incorporating cutting-edge navigation systems as standard or optional features in new vehicles. Furthermore, advancements in technology and the decreasing cost of integration are making it more feasible for OEMs to include sophisticated navigation systems. The collaboration between automakers and technology providers is also facilitating the development of advanced features that further drive the growth of the OEM segment.

The aftermarket segment is projected to witness significant growth from 2024 to 2030. The aftermarket segment is growing due to the increasing demand of vehicle owners to upgrade their existing vehicles with advanced features. Many consumers seek to enhance their driving experience with modern navigation capabilities without purchasing a new car. The availability of a wide range of aftermarket navigation systems, coupled with competitive pricing and the option for custom installations, is fueling this growth. For instance, Online Car Stereo, the U.S.-based car audio/stereo and accessories, provides aftermarket in-dash GPS navigators for vehicles from Pioneer Corporation, Alpine Electronics, Inc., and other brands.

Regional Insights

The in-dash navigation system market in North America is expected to witness notable growth from 2024 to 2030. The growing trend towards connected and autonomous vehicles is driving the demand for advanced in-dash navigation systems in the region. The presence of several automotive manufacturers and technology providers in the region further accelerates the development and adoption of these systems.

U.S. In-Dash Navigation System Market Trends

The in-dash navigation system market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.An increasing demand for enhanced driving experiences, including voice control, real-time traffic updates, and seamless smartphone integration, drives the adoption of advanced in-dash navigation systems in the region. Additionally, the competitive automotive market, with numerous manufacturers offering high-end and luxury vehicles, is further driving the demand for these systems, thereby driving the market’s growth.

Asia Pacific In-Dash Navigation System Market Trends

The Asia Pacific region dominated the in-dash navigation system market in 2023 and accounted for a 33.56% share of the global revenue. Rapid urbanization, increasing adoption of passenger cars, and rising consumer disposable incomes are major factors behind the growth of the market. In addition, the region's growing automotive industry and demand for autonomous and electric vehicles are also contributing to this growth.

Europe In-Dash Navigation System Market Trends

The in-dash navigation system market in Europe is expected to grow at the highest CAGR from 2024 to 2030.The presence of major automotive manufacturers and technology companies in Europe, combined with consumer preferences for premium and connected vehicle features, is contributing to the regional market growth.

Key In-dash Navigation System Company Insights

Key players operating in the in-dash navigation system market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

- In February 2023, India's prominent digital maps provider, MapmyIndia, introduced a range of Mappls Gadgets designed for cars and two-wheelers. This lineup includes advanced vehicle GPS trackers, dash cameras, in-dash navitainment systems, and smart helmet kits. The In-Dash Navitainment System is seamlessly integrated into the dashboard and includes features such as steering wheel controls, video output for displaying media from the head unit on rear seat monitors, and support for rear view AHD cameras, all contributing to a smooth driving experience.

Key In-dash Navigation System Companies:

The following are the leading companies in the in-dash navigation system market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Harman International

- Alpine Electronics, Inc.

- Pioneer Corporation

- Garmin Ltd.

- Tomtom NV

- Clarion Co. Ltd.

- JVCKENWOOD Corporation

In-Dash Navigation System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 20.31 billion |

|

Revenue forecast in 2030 |

USD 37.26 billion |

|

Growth rate |

CAGR of 10.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, vehicle type, sales channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Continental AG; Robert Bosch GmbH; Denso Corporation; Harman International; Alpine Electronics, Inc.; Pioneer Corporation; Garmin Ltd.; Tomtom NV; Clarion Co. Ltd.; JVCKENWOOD Corporation |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global In-Dash Navigation System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-dash navigation system market based on component, technology, vehicle type, sales channel, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Display Unit

-

Control Module

-

Antenna Module

-

Wiring Harness

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

2D Maps

-

3D Maps

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-dash navigation system market size was estimated at USD 18.48 billion in 2023 and is expected to reach USD 20.31 billion in 2024.

b. The global in-dash navigation system market is expected to grow at a compound annual growth rate of 10.6% from 2024 to 2030, reaching USD 37.26 billion by 2030.

b. The display unit segment dominated the market in 2023 and accounted for a 36.85% share of global revenue. The display unit is a critical component of in-dash navigation systems, serving as the primary interface between the driver and the system. Modern display units are characterized by high-resolution touchscreens that offer clear, detailed visuals and intuitive controls. Increasing advances in display technology, such as OLED and LED screens, and demand for improved brightness, color accuracy, and visibility in various lighting conditions can be attributed to the segment growth.

b. Some of the players operating in the in-dash navigation system market include Continental AG, Robert Bosch GmbH, Denso Corporation, Harman International, Alpine Electronics, Inc., Pioneer Corporation, Garmin Ltd., Tomtom NV, Clarion Co. Ltd., and JVCKENWOOD Corporation.

b. Increasing demand for advanced safety and navigation features in vehicles, regulatory safety standards and the rise in demand for electric and autonomous vehicles are major driving factors behind the growth of the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."