In-building Wireless Solutions Market Size, Share & Trends Analysis Report By Business Model (Service Providers, Enterprises, Neutral Host Operators), By Venue Size, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-343-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

In-building Wireless Solutions Market Trends

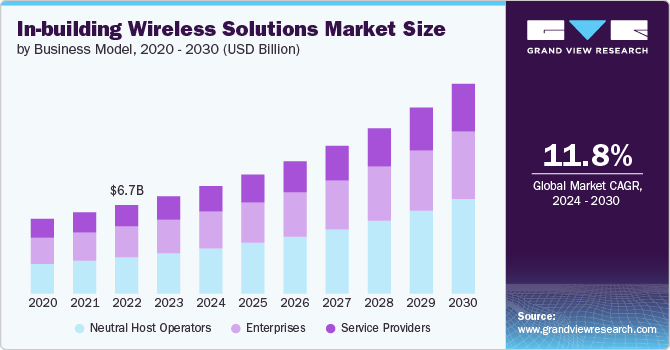

The global in-building wireless solutions market size was estimated at USD 7.38 billion in 2023 and is projected to grow at a CAGR of 11.8% from 2024 to 2030. The market growth is propelled by the escalating demand for seamless and high-speed connectivity within structures, driven by the pervasive use of smartphones, IoT devices, and the growing adoption of smart building technologies. The increasing reliance on data-intensive applications, such as video streaming and real-time communication, emphasizes the need for robust in-building wireless solutions. Moreover, the surge in remote working and the emergence of 5G technologies further fuel the demand for enhanced indoor coverage and capacity. Organizations are investing in Distributed Antenna Systems (DAS), small cells, and Wi-Fi networks to address connectivity challenges. At the same time, the ongoing digital transformation and smart city initiatives globally contribute to the market's expansion.

The transformation of work environments, marked by the rise of remote and flexible work arrangements, has intensified the need for robust in-building wireless solutions. With an increasing reliance on cloud-based applications and collaboration tools, businesses prioritize seamless connectivity to support productivity. The demand for consistent, high-speed internet within offices and commercial spaces has surged, prompting investments in advanced in-building wireless infrastructure. Furthermore, the proliferation of Internet of Things (IoT) devices in workplaces adds complexity to connectivity requirements, driving the adoption of sophisticated in-building wireless technologies to ensure reliable communication and data exchange.

The global deployment of 5G networks is a pivotal driver for the in-building wireless solutions market. As 5G promises significantly higher data speeds, lower latency, and increased device density, organizations are keen to ensure comprehensive indoor coverage to leverage these advanced capabilities. The millimeter-wave frequencies used in 5G pose challenges for indoor penetration, making in-building wireless solutions, such as small cells and DAS, crucial for delivering the promised 5G performance indoors. The anticipation of transformative applications, such as augmented reality (AR), virtual reality (VR), and smart building automation, further underscores the importance of robust in-building wireless infrastructure as an enabler of the next generation of connected technologies.

The importance of reliable in-building wireless communication for public safety and emergency response cannot be overstated. Regulations in many countries require that buildings, particularly large public venues and commercial structures, provide seamless communication channels for first responders. This demand has led to increased investments in in-building wireless solutions that ensure consistent, robust coverage for emergency services, such as police, fire, and medical personnel. Enhanced communication capabilities in critical situations help improve response times and coordination, ultimately saving lives and property. Consequently, building owners and managers are prioritizing the deployment of technologies such as DAS and repeaters to comply with safety regulations and provide reliable emergency communication networks.

Building owners and property managers are increasingly focusing on enhancing the user experience and tenant satisfaction by providing superior in-building wireless connectivity. In commercial real estate, reliable wireless coverage is becoming a key differentiator that can attract and retain tenants. High-quality wireless connectivity is essential for modern businesses that depend on seamless communication and access to cloud-based services. Additionally, residential buildings are seeing a growing demand for uninterrupted internet access to support smart home devices, entertainment, and remote work. By investing in advanced in-building wireless solutions, property managers can offer a competitive edge, enhance tenant satisfaction, and ultimately increase property value. This trend underscores the role of wireless connectivity as a critical amenity in the real estate market.

Business Model Insights

The neutral host operators segment dominated the market with a revenue share of 41.5% in 2023. The segment is rapidly gaining traction, driven by the growing need for cost-effective and scalable connectivity solutions. These operators provide shared infrastructure that can be utilized by multiple mobile network operators (MNOs), reducing the financial burden on individual carriers while ensuring comprehensive indoor coverage. The proliferation of 5G and the increasing complexity of wireless networks have further emphasized the value of neutral host models, enabling faster deployment and enhanced user experiences. Additionally, building owners and enterprises benefit from streamlined installation processes and reduced operational complexities associated with managing multiple networks. As a result, neutral host operators are becoming essential partners in delivering seamless, high-quality wireless connectivity in diverse indoor environments.

The enterprises segment is a significant driver in the in-building wireless solutions market, fueled by the rising demand for seamless and high-speed connectivity within corporate environments. As businesses increasingly rely on cloud-based applications, collaboration tools, and IoT devices, robust indoor wireless solutions have become essential to maintain productivity and operational efficiency. The shift towards hybrid and remote work models has further amplified the need for reliable in-building wireless infrastructure to support flexible work arrangements. Enterprises are investing in advanced technologies like DAS, small cells, and enhanced Wi-Fi networks to address connectivity challenges and ensure uninterrupted service. Additionally, the integration of smart building technologies and automation systems underscores the critical role of strong wireless networks in modern enterprise environments.

Venue Size Insights

The large venues segment dominated the market in 2023. Large venues, such as stadiums, airports, and convention centers, dominate the market due to their high demand for robust and extensive wireless connectivity. These venues require powerful and scalable solutions to handle the massive influx of users, especially during peak events. The proliferation of data-heavy applications, such as live streaming and real-time social media engagement, further drives the need for advanced in-building wireless infrastructure. Additionally, public safety requirements mandate reliable communication channels for emergency services, making investments in Distributed Antenna Systems (DAS) and small cells crucial. The integration of smart technologies to enhance the visitor experience and streamline operations also underscores the importance of strong and seamless wireless networks in large venues.

Medium venues, including office buildings, shopping malls, and hotels, are emerging as a significant segment in the in-building wireless solutions market. The growing reliance on mobile devices and cloud-based applications in these spaces drives the need for consistent and high-speed connectivity. The shift towards hybrid work environments and the increasing adoption of IoT devices add complexity to connectivity requirements, prompting investments in advanced wireless solutions. Medium venues are also prioritizing customer experience, utilizing enhanced wireless networks to support digital services and personalized experiences. As these venues seek to offer a competitive edge and meet rising expectations, the adoption of in-building wireless technologies continues to accelerate.

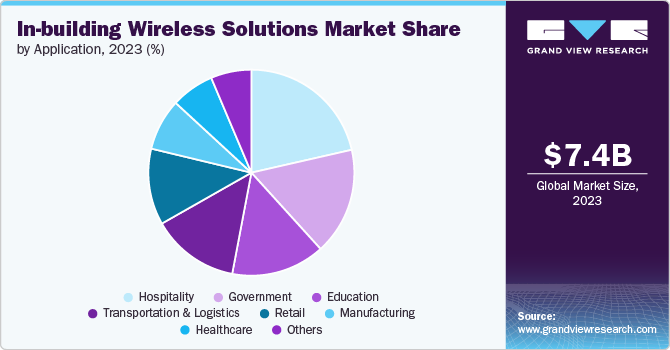

Application Insights

The hospitality segment dominated the market in 2023. There is a significant focus on enhancing guest experience through advanced wireless technologies. Hotels are adopting robust Wi-Fi infrastructures to provide seamless connectivity for guests and support personalized services via mobile apps and smart room controls. Operational efficiencies are also improving with wireless solutions facilitating automated check-ins, room service requests, and staff communication. Integration of IoT devices like smart thermostats and security systems further drives the demand for reliable wireless networks, ensuring a secure and compliant environment for guest data handling.

In the transportation and logistics segment, wireless technology plays a crucial role in digitizing supply chains and optimizing operations. Real-time tracking and monitoring of goods in transit are enabled through wireless networks, enhancing supply chain visibility and efficiency. Warehouse operations benefit from automation technologies supported by wireless connectivity, such as RFID tracking and autonomous robots, which streamline inventory management and reduce costs. Fleet management also sees improvements with wireless communication facilitating real-time data transmission for vehicle health monitoring, route optimization, and driver behavior analysis. Safety measures are bolstered through wireless-enabled surveillance, access control systems, and emergency communication, ensuring enhanced security and swift response times in transportation hubs and vehicles alike.

Regional Insights

The North American in-building wireless solutions market dominated the global market in 2023 and accounted for a 32.5% share. North America dominated the largest market share in 2023 owing to its robust technological infrastructure, including well-established telecommunications networks and advanced connectivity solutions. The high adoption rate of emerging technologies, coupled with a strong presence of major industry players, has significantly contributed to North America's market leadership. Additionally, the region's proactive approach to the deployment of 5G networks, coupled with a growing demand for seamless connectivity in diverse sectors such as commercial, residential, and industrial, has propelled the North American region.

U.S. In-building Wireless Solutions Market Trends

The U.S. in-building wireless solutions market is experiencing robust growth driven by increasing demand for seamless connectivity in sectors such as hospitality, healthcare, and commercial real estate. The adoption of 5G technology is accelerating, enhancing data speeds and capacity, thereby fueling the deployment of in-building wireless solutions to support IoT devices and smart building applications.

Asia Pacific In-building Wireless Solutions Market Trends

The in-building wireless solutions market in Asia Pacific is expanding rapidly due to urbanization, digital transformation initiatives, and increased smartphone usage. Countries such as China, Japan, and India are leading in 5G adoption, driving demand for robust in-building wireless solutions to support high-speed data connectivity and IoT applications. Smart city projects are accelerating the deployment of Distributed Antenna Systems (DAS) and small cells to improve indoor coverage in densely populated urban areas. Industries such as healthcare, education, and retail are also investing in wireless technologies to enhance operational efficiency and customer experiences.

Europe In-building Wireless Solutions Market Trends

The in-building wireless solutions market in Europe is advancing with a focus on connectivity enhancement and compliance with regulatory standards. The region is leading in 5G implementation, prompting investments in advanced wireless infrastructure to support smart buildings and IoT ecosystems. Countries such as Germany, the UK, and France are at the forefront of deploying in-building wireless solutions across sectors such as manufacturing, transportation, and hospitality. Regulatory frameworks, including GDPR, underscore the importance of secure and compliant wireless networks, driving investments in technologies that ensure data privacy and security. The demand for reliable indoor coverage and capacity is driving the deployment of DAS and small cells in commercial buildings, stadiums, and public venues across major European cities.

Key In-building Wireless Solutions Company Insights

Key players in the in-building wireless solutions market are actively driving innovation and playing a pivotal role in shaping the industry landscape. Leading companies such as CommScope Holding Company, Inc.; Corning Incorporated; Ericsson; Huawei Technologies Co., Ltd.; Cobham Limited; AT&T, Inc.; Verizon Communications, Inc.; TE Connectivity Ltd; Dali Wireless, Inc.; and Nokia Corporation are at the forefront of advancing in-building wireless technologies. These industry giants demonstrate a strong commitment to research and development, continually investing in solutions to address the growing demand for seamless indoor connectivity.

In October 2022, PROSE Technologies, a company specializing in wireless antenna solutions, transmission technologies, and coverage solutions, unveiled its latest product—a novel Active Distributed Antenna System (DAS) designed for the 5G network. The announcement emphasized PROSE Technologies' collaborative efforts with operators, aiding them in expanding their backhaul capabilities through the utilization of E-band microwave solutions, especially considering the substantial offload capacity of Radio Access Networks (RANs).

Key In-building Wireless Solutions Companies:

The following are the leading companies in the in-building wireless solutions market. These companies collectively hold the largest market share and dictate industry trends.

- CommScope Holding Company, Inc.

- Corning Incorporated

- Ericsson

- Huawei Technologies Co., Ltd.

- Cobham Limited

- AT&T, Inc.

- Verizon Communications, Inc.

- TE Connectivity Ltd

- Dali Wireless, Inc.

- Nokia Corporation

In-building Wireless Solutions Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.14 billion |

|

Revenue forecast in 2030 |

USD 15.85 billion |

|

Growth rate |

CAGR of 11.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Business model, venue size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

CommScope Holding Company, Inc.; Corning Incorporated; Ericsson; Huawei Technologies Co., Ltd.; Cobham Limited; AT&T, Inc.; Verizon Communications, Inc.; TE Connectivity Ltd; Dali Wireless, Inc.; Nokia Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global In-building Wireless Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-building wireless solutions market report based on business model, venue size, application, and region:

-

Business Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Service Providers

-

Enterprises

-

Neutral Host Operators

-

-

Venue Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Venues

-

Medium Venues

-

Small Venues

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Manufacturing

-

Transportation and Logistics

-

Education

-

Retail

-

Hospitality

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-building wireless solutions market size was estimated at USD 7.38 billion in 2023 and is expected to reach USD 8.14 billion in 2024.

b. The global in-building wireless solutions market is expected to grow at a compound annual growth rate of 11.8% from 2024 to 2030 to reach USD 15.85 billion by 2030.

b. North America dominated the in-building wireless solutions market with a share of 32.5% in 2023. North America dominated the market share in 2023 owing to its robust technological infrastructure, including well-established telecommunications networks and advanced connectivity solutions.

b. Some key players operating in the in-building wireless solutions market include CommScope Holding Company, Inc., Corning Incorporated, Ericsson, Huawei Technologies Co., Ltd., Cobham Limited, AT&T, Inc., Verizon Communications, Inc., TE Connectivity Ltd, Dali Wireless, Inc., and Nokia Corporation.

b. Key factors that are driving the market growth include increasing demand for network coverage and capacity and deployment of 5G networks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."