In-building Wireless Market Size, Share & Trends Analysis Report By Offering, By Business Model (DAS, Small Cells, Wi-Fi, Hybrid Systems, Cellular/3G/4G/5G), By Building Size, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-332-3

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

In-building Wireless Market Size & Trends

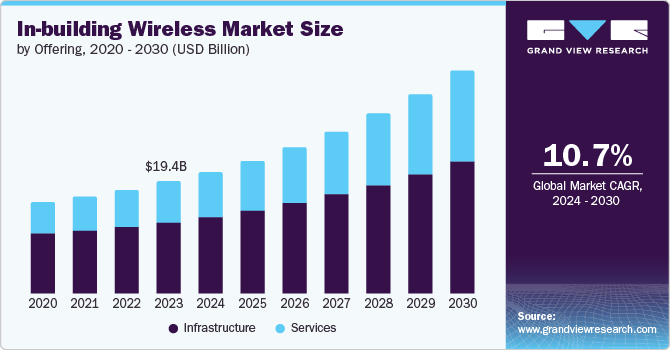

The global in-building wireless market size was estimated at USD 19.42 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030. The rise of smart devices, including wearables and IoT devices, is driving the growth of the in-building wireless market. With the increasing number of connected devices within establishments, a robust infrastructure is essential to support these devices and provide high-speed connectivity throughout the premises.

In-building wireless solutions offer the required infrastructure to handle the growing number of smart devices and provide seamless connectivity for users. With the advent of Industry 4.0, manufacturers aim to deploy in-building wireless solutions across various application areas, including Robotics, Intelligent Process Automation (IPA), Automatic Guided Vehicles (AGVs), Process Automation (RPA), remote site monitoring, autonomous vehicles, smart cities, and drone surveillance. These applications demand low latency, high bandwidth, and secure networks. In-building wireless solutions enable enterprises to independently operate scalable and reliable networks that support their current business use cases.

Most enterprises prioritize low latency costs, recognizing the essential role of in-building wireless solutions as the backbone of their infrastructure to support mission-critical applications. The growing number of IoT and Machine-to-Machine (M2M) devices, which leverage AI and ML to support mission-critical equipment across industries, has enhanced the reliability of indoor wireless coverage with high bandwidth, low latency, and high service deliverability. Enterprises with mission-critical applications are expected to increasingly rely on in-building wireless solutions for coverage rather than depending solely on carriers.

The deployment of 5G networks is transforming the in-building wireless market by driving the demand for improved indoor capacity and coverage. With 5G offering low latency and ultra-fast speeds, users expect seamless connectivity within buildings. This necessitates in-building wireless solutions such as Distributed Antenna Systems (DAS), small cells, and indoor repeaters to circulate 5G signals indoors effectively. In addition, the use of the mmWave spectrum in 5G requires creative methods to overcome propagation challenges, making in-building solutions vital for extending coverage.

Enterprises across various industries are set to leverage 5G-enabled applications to enhance customer experiences and productivity, thus increasing the demand for reliable indoor connectivity solutions. Furthermore, 5G provides prospects to improve emergency communications and public safety within buildings. The deployment of 5G networks is reshaping the in-building wireless landscape, with businesses presenting innovative and scalable solutions poised to succeed in this evolving market.

Offering Insights

The infrastructure segment led the market in 2023, accounting for over 62.0% share of the global revenue. In-building wireless infrastructure addresses the challenges posed by building materials like steel, concrete, and low-emissivity glass, which can block or weaken cellular signals. By deploying specialized equipment, this infrastructure enhances and distributes cellular signals, ensuring occupants maintain connectivity on their mobile devices regardless of their location within the building. Besides improving coverage, in-building wireless infrastructure supports various wireless communication technologies, including 4G LTE, 5G, Wi-Fi, and public safety communications.

The services segment is predicted to foresee significant growth in the coming years. The increasing complexity of modern in-building wireless systems has driven the demand for professional services, including design, installation, and ongoing maintenance, to ensure optimal performance. In addition, the rapid deployment of 5G networks and the integration of advanced technologies such as IoT and AI into these systems have heightened the need for specialized expertise and support. Moreover, enterprises are increasingly outsourcing their in-building wireless needs to service providers to benefit from their technical know-how and cost efficiencies.

Building Size Insights

The large buildings segment accounted for the largest market revenue share in 2023, owing to the significant demand for advanced wireless infrastructure in large buildings such as commercial complexes, shopping malls, and high-rise office buildings. These structures require robust and extensive in-building wireless systems to ensure comprehensive coverage and high-quality connectivity across multiple floors and areas. The complexity and scale of large buildings necessitate sophisticated solutions such as DAS and small cells to manage the high volume of users and data traffic effectively. In addition, the increasing need for seamless connectivity to support a wide range of applications, including IoT devices, smart building systems, and high-speed internet access, drives the substantial investment in wireless infrastructure for these large spaces.

The small & medium size buildings segment is anticipated to witness significant growth in the coming years. This high growth is driven by the increasing demand for efficient and cost-effective in-building wireless solutions that cater to a variety of commercial and residential spaces. As technology advances and the need for seamless connectivity becomes more pervasive, smaller buildings are investing in robust wireless infrastructure to support a growing number of smart devices, IoT applications, and high-speed internet requirements. The rise of remote work and the proliferation of connected technologies in everyday life further fuel this demand.

Application Insights

The commercial campuses segment accounted for the largest market revenue share in 2023, owing to the substantial demand for advanced wireless infrastructure within large commercial complexes, such as office parks, business centers, and industrial campuses. These establishments require extensive and reliable in-building wireless systems to support a high volume of users, multiple devices, and a wide array of applications. The need for seamless connectivity across expansive areas, along with the integration of smart building technologies and high-speed internet access, drives significant investment in solutions such as DAS and small cells.

The transportation & logistics segment is anticipated to exhibit the highest CAGR over the forecast period. This projected growth is driven by the increasing need for advanced in-building wireless solutions to support the evolving demands of the transportation and logistics sectors. As supply chains become more complex and digitalized, there is a growing need for reliable and high-speed connectivity within warehouses, distribution centers, and transportation hubs. In addition, the rise of smart transportation solutions, such as connected vehicles and automated facilities, further fuels the demand for robust and seamless wireless networks. As these sectors continue to innovate and expand, the need for sophisticated in-building wireless infrastructure is expected to drive substantial growth in this segment.

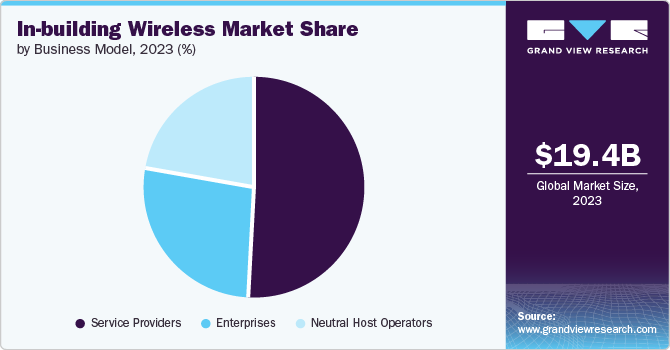

Business Model Insights

The service providers segment accounted for the largest market revenue share in 2023. The growing adoption of IoT and AI technologies in various industries fueled the need for reliable and seamless connectivity, which service providers are well-equipped to deliver. Enterprises prefer outsourcing these critical tasks to service providers to leverage their technical knowledge and cost-effective solutions. This reliance on service providers for efficient and effective in-building wireless solutions significantly contributed to their leading market position.

The neutral host operator segment is predicted to foresee significant growth in the coming years. Neutral host operators typically engage in long-term ownership contracts with venue owners or commercial facilities, allowing them to generate revenue over time. In this arrangement, post-installation services and the costs of ownership, such as carrier management and system upgrades, are handled by third-party operators. For end-users, neutral host operators provide small cell networks and DAS to service providers and enterprises. In addition, they can partner with telecom operators to provide in-building wireless connectivity solutions to end-users.

Regional Insights

North America dominated with a revenue share of over 35.0% in 2023. North America, including the U.S. and Canada, features well-established infrastructures that drive a high demand for in-building wireless solutions. The strong economies of these countries enable substantial investments in advanced technologies, reinforcing their market leadership. The growing need for seamless indoor connectivity is fueled by the rise in smart device usage and data-intensive applications, highlighting the importance of reliable indoor wireless coverage. Additionally, the rapid rollout of 5G networks has increased the need for more robust infrastructure to support the higher frequencies and data rates associated with 5G technology.

U.S. In-building Wireless Market Trends

The U.S. In-building wireless market is expected to grow at a CAGR of 8.6% from 2024 to 2030. This growth is driven by several key factors, including the country's advanced technological infrastructure and substantial investments in cutting-edge wireless solutions. The surge in smart device usage, data-intensive applications, and the rapid expansion of 5G networks is significantly boosting the demand for robust in-building wireless systems. The U.S. market is also benefiting from the increasing adoption of IoT applications across various industries, which require reliable and high-speed indoor connectivity.

Europe In-building Wireless Market Trends

The In-building Wireless market in the European region is expected to witness significant growth over the forecast period This growth is fueled by increasing investments in advanced in-building wireless technologies and the expansion of 5G networks across the region. The rising demand for seamless connectivity due to the proliferation of smart devices and IoT applications drives the need for robust indoor wireless solutions. In addition, the push towards digital transformation and remote work has further highlighted the importance of reliable in-building connectivity.

Asia Pacific In-building Wireless Market Trends

The In-building Wireless market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The Asia Pacific region is anticipated to exhibit the highest CAGR over the forecast period. This rapid growth is driven by accelerating urbanization, increasing infrastructure investments, and the expansion of 5G networks across the region. In addition, the region's burgeoning technology sector and significant strides in digital transformation contribute to the heightened need for seamless and reliable indoor connectivity. As economies in Asia Pacific continue to develop and modernize, the demand for advanced in-building wireless infrastructure is expected to surge significantly.

Key In-building Wireless Company Insights

Key In-building wireless companies include Corning Incorporated, Huawei Technologies Co., Ltd., JMA Wireless, Nokia, and Samsung Electronics Co., Ltd. Companies active in the in-building wireless market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in February 2024, Wipro Limited, a leading technology services and consulting firm, announced a collaborative private wireless solution with Nokia to support enterprises in scaling their digital transformation efforts. This joint solution will offer enterprises a secure 5G private wireless network integrated with their operational infrastructure. It promises enhanced mobility, reliability, connectivity speed, and real-time access to business insights, along with the capability to handle large data volumes with minimal latency.

Key In-building Wireless Companies:

The following are the leading companies in the in-building wireless market. These companies collectively hold the largest market share and dictate industry trends.

- Airspan Networks

- Cobham Limited

- CommScope, Inc.

- Corning Incorporated

- Huawei Technologies Co., Ltd.

- JMA Wireless

- Nokia

- Samsung Electronics Co., Ltd.

- TE Connectivity

- Telefonaktiebolaget LM Ericsson

Recent Developments

-

In June 2024, Hewlett Packard Enterprise Development LP unveiled the HPE Aruba Networking Enterprise Private 5G, designed to simplify and accelerate the management and deployment of private 5G networks. This solution delivers high levels of reliable wireless coverage across expansive campus and industrial settings, and it opens up new, previously unexplored use cases for private cellular networks.

-

In May 2024, ZTE Corporation, a global leader in information and communication technology solutions, announced a commercial deployment of its latest-generation wireless products in partnership with Thailand's top mobile operator, Advanced Info Service PLC. This deployment, which takes place at the A-Z Center, aims to leverage advanced technology to assist Advanced Info Service PLC in developing a green, ultra-simplified, and intelligent telecommunications network.

-

In May 2024, Boldyn Networks announced the acquisition of Apogee Telecom, Inc. This strategic acquisition enhances Boldyn Networks' connectivity offerings in the expanding education market by integrating Apogee Telecom, Inc.'s established reputation and expertise with Boldyn's global experience and comprehensive range of wireless and fiber solutions.

In-building Wireless Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 21.05 billion |

|

Revenue forecast in 2030 |

USD 38.66 billion |

|

Growth rate |

CAGR of 10.7% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, business model, building size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Airspan Networks; Cobham Limited; CommScope, Inc.; Corning Incorporated; Huawei Technologies Co., Ltd.; JMA Wireless; Nokia; Samsung Electronics Co., Ltd.; TE Connectivity; Telefonaktiebolaget LM Ericsson |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global In-building Wireless Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global in-building wireless market report based on offering, business model, building size, application, and region.

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Infrastructure

-

Distributed Antenna System (DAS)

-

Small Cells

-

Wi-Fi

-

Hybrid Systems

-

Cellular/3G/4G/5G

-

-

Services

-

-

Business Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Service Providers

-

Enterprises

-

Neutral Host Operators

-

-

Building Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Buildings

-

Small & Medium Size Buildings

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial Campuses

-

Government

-

Transportation & Logistics

-

Hospitality

-

Industrial & Manufacturing

-

Education

-

Healthcare

-

Entertainment & Sports Venues

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global in building wireless market size was estimated at USD 19.42 billion in 2023 and is expected to reach USD 21.05 billion in 2024.

b. The global in building wireless market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 38.66 billion by 2030.

b. North America dominated the in building wireless market with a share of 35.0% in 2023. North America, including the U.S. and Canada, features well-established infrastructures that drive a high demand for in-building wireless solutions. The strong economies of these countries enable substantial investments in advanced technologies, reinforcing their market leadership.

b. Some key players operating in the in building wireless market include Airspan Networks, Cobham Limited, CommScope, Inc., Corning Incorporated, Huawei Technologies Co., Ltd., JMA Wireless, Nokia, Samsung Electronics Co., Ltd., TE Connectivity, Telefonaktiebolaget LM Ericsson.

b. The rise of smart devices, including wearables and IoT devices, is driving the growth of the in-building wireless market. With the increasing number of connected devices within establishments, a robust infrastructure is essential to support these devices and provide high-speed connectivity throughout the premises.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."