Impact Investing Market Size, Share & Trends Analysis Report By Asset Class, By Offerings, By Investment Style, By Investor Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-098-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global impact investing market size was estimated at USD 66.75 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 18.8% from 2023 to 2030. The impact investing Asset Under Management (AUM) was valued at USD 3.3 trillion in 2022. The market growth is driven by numerous key factors shaping the landscape of sustainable and socially responsible investments. One of the main drivers is the increasing demand from investors to align their investments with their values and positively impact society and the environment. Investors are becoming more aware of our social and environmental challenges and are seeking investment opportunities that address these issues while generating financial returns.

Another driver for the growth of the impact investing market is the growing recognition of the potential for financial returns from investments that create positive social and environmental outcomes. Impact investments are no longer seen as a trade-off between financial returns and impact but rather as an opportunity to achieve both. More evidence emerges of successful impact investment strategies and the financial performance of impact funds. As a result, investors are becoming more confident in allocating their capital to these opportunities.

Regulatory changes and policy support are also driving the growth of the impact investing market. Governments around the world are implementing policies and regulations that encourage and support sustainable investments. This includes initiatives such as tax incentives, grants, and subsidies for impact investments, as well as the integration of Environmental, Social, and Governance (ESG) considerations into regulatory frameworks. These measures provide a favorable environment for impact investing to thrive and attract a broader range of investors.

The rise of impact measurement and reporting standards is also driving the impact investing industry’s growth. Investors are demanding greater transparency and accountability in measuring and reporting the social and environmental impact of their investments. Standardized frameworks, such as the Global Reporting Initiative (GRI) and the Impact Reporting and Investment Standards (IRIS+), guide for measuring and communicating impact. These standards not only enable investors to make informed decisions but also contribute to building credibility and trust in impact investing.

One major restraint for the impact investing industry’s growth is the lack of standardized metrics and measurement tools to assess the social and environmental impact of investments. Without universally accepted standards, it becomes challenging for investors to compare and evaluate different impact investment opportunities. To overcome this restraint, industry stakeholders can work towards developing and adopting standardized impact measurement frameworks, such as the Global Impact Investing Network's Impact Reporting and Investment Standards (IRIS), to ensure consistency and transparency in measuring and reporting impact. In addition, collaboration among investors, organizations, and regulators is crucial to establish clear guidelines and best practices, fostering greater confidence and trust in the impact investing industry.

COVID-19 Impact Analysis

The COVID-19 pandemic has highlighted the importance of impact investing. The global health crisis has exposed vulnerabilities in our societies and economies, reinforcing the need for investments that address social and environmental challenges. The pandemic has also demonstrated the resilience and performance of impact investments in times of crisis. Consequently, attracting more attention and interest from investors looking for sustainable and resilient investment opportunities.

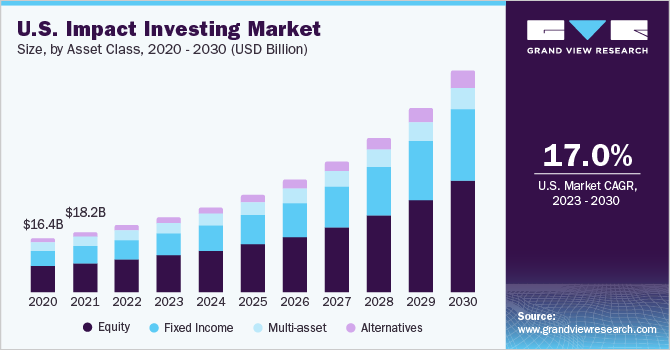

Asset Class Insights

The equity segment dominated the market in 2022 and accounted for a revenue share of more than 48.0%. Equity investments provide investors with an ownership stake in companies actively addressing social and environmental challenges. This allows investors to directly contribute to positive change by supporting businesses that align with their values and impact goals. Moreover, equity investments offer the potential for significant financial returns, which can be attractive to investors seeking both impact and financial gains.

The fixed income segment is anticipated to register significant growth over the forecast period. Fixed-income investments offer investors a stable and predictable income stream, making them an attractive option for risk-averse investors seeking both financial returns and impact. This aligns well with the goals of impact investing, which seeks to generate positive social and environmental outcomes alongside financial gains. Moreover, the growing demand for sustainable and socially responsible investment options has prompted the development of green and social bonds, specifically fund projects with positive environmental or social impacts.

Offerings Insights

The equity segment dominated the market in 2022 and accounted for a revenue share of more than 32.0%. The equity market provides many opportunities, from established impact-focused funds to early-stage venture capital investments in innovative and impactful startups. This diversity allows investors to align their capital with companies that closely align with their values and impact objectives. Moreover, the equity segment offers liquidity, allowing investors to buy and sell shares relatively easily, enhancing flexibility and portfolio management.

The bond funds segment is anticipated to register significant growth over the forecast period. Bond funds provide investors with a fixed income stream through interest payments, making them an attractive option for those seeking stable returns. This stability appeals to impact investors who prioritize both financial performance and social or environmental impact. In addition, the bond market offers a wide range of impact-focused fixed-income investment opportunities, including green bonds, social bonds, and sustainability bonds.

Investment Style Insights

The active segment dominated the market in 2022 and accounted for a revenue share of over 63.0%. Active investing allows impact investors to have direct engagement and influence on the companies or projects they support. This hands-on approach aligns with the goals of impact investors who seek to drive positive change and make a tangible impact on social and environmental issues. Active managers actively select investments based on specific impact criteria, conducted via due diligence, and actively monitor and engage with portfolio companies to ensure they uphold their impact objectives.

The passive segment is anticipated to register significant growth. Passive investing offers simplicity and cost-effectiveness for investors seeking exposure to a diversified portfolio of impact assets. Passive funds, such as Exchange-traded Funds (ETFs) and index funds, replicate a specific benchmark or index, providing broad market coverage. This approach appeals to investors who prioritize broad-based impact exposure without needing active management or the associated fees.

Investor Type Insights

The institutional investors segment dominated the market in 2022 and accounted for a global revenue share of over 65.0%. The segment has experienced significant growth due to the increasing interest from institutional investors, such as pension funds and endowments. These investors recognize the importance of incorporating social and environmental factors into their investment decisions. They view impact investments as an opportunity to generate both financial returns and positive societal and environmental outcomes. As a result, there has been a surge in allocations towards impact investments as institutional investors seek to contribute to sustainable development.

The retail segment is anticipated to register significant growth over the forecast period. Retail investors exhibit increased awareness and interest in investing and making an impact toward a sustainable future. In addition, traditional banks like ABN Amro and Aegon Asset Management, which now offer impact investment products to retail investors, such as the Global Impact Equity Fund. Furthermore, several retail investment apps have emerged as popular choices among young investors. Impact investing provides a platform for retail investors to make a positive impact while generating financial returns.

Regional Insights

North America dominated the impact investing market in 2022 and accounted for a revenue share of more than 35.0%. This is primarily due to the rising interest among investors in aligning their investments with social and environmental values. The region boasts a mature impact investing ecosystem characterized by a robust network of impact investors, intermediaries, and impact-driven enterprises. This ecosystem facilitates the flow of capital toward impactful projects and enterprises, driving the market's growth. In addition, North America's strong regulatory framework and supportive policies also create a favorable environment for impact investing activities.

The Asia Pacific regional market is anticipated to emerge as the fastest-growing market from 2023 to 2030. The region is home to a large and rapidly growing population, presenting significant social and environmental challenges that require innovative solutions. Impact investing provides a platform for addressing these challenges while generating sustainable financial returns. In addition, there is a growing awareness and interest in sustainable development and social entrepreneurship across the Asia Pacific region.

Key Companies & Market Share Insights

In the dynamic landscape of the impact investing industry, key companies actively pursue strategies such as mergers and acquisitions, strategic partnerships, and collaborations to bolster their market presence and enrich their offerings. With a steadfast commitment to driving positive social and environmental change, the industry leaders seek to carve out substantial market shares and position themselves as frontrunners in impact investing.

By strongly emphasizing sustainability and responsible investment practices, the companies aim to meet the growing demand for impactful investments and assume pivotal roles in shaping the future of global impact investing. With the continued expansion of the impact investing industry, the players are poised to contribute significantly to advancing social and environmental goals.

In May 2023, Lumen Advisers, an innovative investment advisory firm, formerly P3 Capital, entered into a licensing agreement with Sparo, a Microsoft for Startups company. This collaboration aims to introduce cutting-edge financial products centered around verifiable ESG investing on the Betterment platform. The platform's official launch is planned to align with the "ChangeNow" event, Microsoft's Entrepreneurship for Positive Impact, scheduled in Paris on May 25th. This strategic partnership between Lumen Advisers and Sparo underscores their commitment to driving positive change and promoting sustainable investing practices. Some prominent players in the global impact investing market include:

-

BlackRock, Inc.

-

Goldman Sachs

-

Bain Capital LP

-

Morgan Stanley

-

Vital Capital

-

Prudential Financial, Inc.

-

BlueOrchard Finance Ltd.

-

Manulife Investment Management Holdings (Canada) Inc.

-

Leapfrog Investments

-

Community Investment Management LLC

Impact Investing Industry Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 76.02 billion |

|

Revenue forecast in 2030 |

USD 253.95 billion |

|

Growth rate |

CAGR of 18.8% from 2023 to 2030 |

|

Base year of estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, trends |

|

Segments covered |

Asset class, offerings, investment style, investor type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

BlackRock, Inc.; Goldman Sachs; Bain Capital LP; Morgan Stanley; Vital Capital; Prudential Financial, Inc.; BlueOrchard Finance Ltd; Manulife Investment Management Holdings (Canda), Inc.; Leapfrog Investments; Community Investment Management LLC |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Impact Investing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the impact investing industry report based on asset class, offerings, investment style, investor type, and region:

-

Asset Class Outlook (Revenue, USD Billion, 2017 - 2030)

-

Equity

-

Fixed Income

-

Multi-asset

-

Alternatives

-

-

Offerings Outlook (Revenue, USD Billion, 2017 - 2030)

-

Equity

-

Bond Funds

-

ETFs/Index Funds

-

Alternatives/Hedge Funds

-

-

Investment Style Outlook (Revenue, USD Billion, 2017 - 2030)

-

Active

-

Passive

-

-

Investor Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Institutional Investors

-

Retail Investors

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global impact investing market size was estimated at USD 66.75 billion in 2022 and is expected to reach USD 76.02 billion in 2023.

b. The global impact investing market is expected to grow at a compound annual growth rate of 18.8% from 2023 to 2030 to reach USD 253.95 billion by 2030.

b. North America dominated the impact investing market with a share of 35.68% in 2022. This is primarily due to the rising interest among investors in aligning their investments with social and environmental values.

b. Some key players operating in the impact investing market include BlackRock, Inc.; Goldman Sachs; Bain Capital LP; Morgan Stanley; Vital Capital; Prudential Financial, Inc.; BlueOrchard Finance Ltd; Manulife Investment Management Holdings (Canda), Inc.; Leapfrog Investments; Community Investment Management LLC.

b. Key factors that are driving the market growth include the rise of impact measurement and reporting standards and governments around the world are implementing policies and regulations that encourage and support sustainable investments.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."