Immunotherapy Drugs Market Size, Share & Trends Analysis Report By Drug Type (Monoclonal Antibodies, Immunomodulators), By Indication (Infectious Diseases, Cancer), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-961-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Immunotherapy Drugs Market Size & Trends

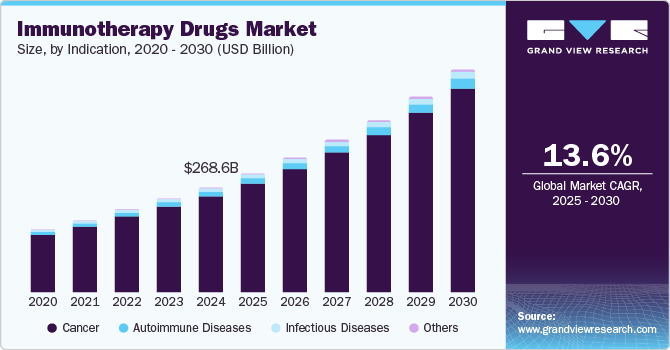

The global immunotherapy drugs market size was valued at USD 268.6 billion in 2024 and is expected to grow at a CAGR of 13.6% from 2025 to 2030. This market is primarily driven by the rising incidence of chronic diseases globally. According to the International Diabetes Federation (IDF), in 2021, approximately 537 million adults aged between 20 and 79 were living with diabetes, which is expected to rise to 783 million by 2045. Moreover, key industry players are focusing on new product developments and engaging in strategic collaborations to advance research in the immunotherapy drugs field.

Some key factors driving the market are the increasing number of chronic disease cases, especially cancer, and a growing preference for treatments that boost the immune system's ability to fight illnesses. Immunotherapy provides a promising alternative to traditional therapies by targeting specific cells, potentially causing fewer adverse effects. Major categories of immunotherapy drugs are monoclonal antibodies and immune checkpoint inhibitors, which have become widely accepted in clinical practice as effective treatment options for various conditions.

As the market evolves, ongoing research and development efforts are expected to lead to more innovative therapies, improving patient outcomes and expanding treatment options for those suffering from chronic diseases. This progress will likely enhance the overall effectiveness of immunotherapy and further solidify its role in modern medicine.

The immunotherapy drugs market has grown rapidly due to the increasing demand for advanced cancer treatments. Immunotherapy works by boosting or altering the body's immune system to fight diseases such as cancer more effectively. It has become a promising treatment option because it targets cancer cells, specifically reducing damage to healthy tissues compared to traditional treatments such as chemotherapy. Consequently, many patients turn to immunotherapy for better outcomes and fewer adverse effects.

Continuous research and development is another key driver of the immunotherapy drugs industry. Pharmaceutical companies are investing heavily in finding new immunotherapies to treat a wide range of cancers and other diseases, leading to the approval of various immune checkpoint inhibitors, monoclonal antibodies, and other therapies that have shown significant success. Hence, the growing number of clinical trials and FDA approvals is boosting market growth and expanding patient treatment options.

The market also benefits from increased awareness and access to immunotherapy treatments worldwide.With growing awareness of the benefits of immunotherapy among patients and the ongoing improvements in healthcare systems, the demand for these innovative drugs continues to rise. However, challenges such as high treatment costs and limited availability in certain regions may impact market growth. Despite these obstacles, the immunotherapy drugs market is expected to keep expanding, with more breakthroughs expected in the coming years.

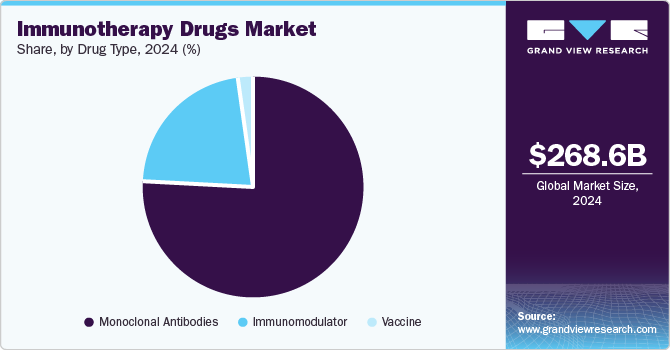

Drug Type Insights

The monoclonal antibodies segment accounted for the largest share of 76.2% in 2024. This growth is due to increased research and development in therapeutic monoclonal antibodies and supportive government initiatives. For example, in May 2022, the U.S. FDA accepted the supplemental Biologics License Application for priority review of Dupixent (dupilumab), used to treat prurigo nodularis.

The vaccines segment is expected to register the fastest CAGR during the forecast period. This growth can be attributed to the strategic partnerships between key industry players and increased clinical trials focused on vaccine development. For example, in January 2022, Pfizer Inc. and BioNTech SE formed a strategic collaboration to develop an mRNA-based vaccine to prevent shingles. This partnership combined BioNTech's mRNA technology with Pfizer's expertise in antigen development. In addition, in March 2022, the National Institutes of Health launched a Phase 1 trial for three investigational HIV vaccines based on mRNA technology.

Indication Insights

The cancer segment dominated the market, accounting for 91.4% of the revenue in 2024, driven by the rising prevalence of cancer and the growing launch of cancer immunotherapies. According to the GLOBOCAN 2020 report, breast cancer and lung cancer were the most diagnosed types of cancer worldwide, with prevalence rates of approximately 11.7% and 11.4%, respectively. This data highlights the significant impact of these cancers on global health, as breast cancer surpassed lung cancer as the leading diagnosis among women. In addition, in April 2021, the FDA approved Opdivo (nivolumab) in combination with chemotherapy for treating patients with gastric cancer.

On the other hand, the infectious diseases segment is anticipated to register the fastest CAGR during the forecast period. This growth can be attributed to the increasing awareness and demand for effective treatments and preventive measures. The rising incidence of influenza, dengue fever, and measles, particularly in Low- and Middle-Income Countries (LMICs), creates significant market opportunities for innovative solutions. For example, the surge in dengue cases in Brazil and the resurgence of measles in Europe highlight the need for enhanced vaccination efforts and new therapeutic options. These challenges present a unique opportunity for developing vaccines, treatments, and public health initiatives. The emergence of new pathogens, highlighted by the COVID-19 pandemic and previous outbreaks such as Ebola and Zika virus, further emphasizes the need for innovative approaches to combat these diseases effectively.

Regional Insights

The North America immunotherapy market dominated the global market, with a revenue share of 49.9% in 2024. This strong position is attributable to the high incidence of cancer and autoimmune diseases, which drives the need for effective treatments. The region benefits from advanced healthcare infrastructure and significant investments in research and development, leading to innovative therapies that enhance immune responses. In addition, favorable healthcare policies and increased spending on health services support the adoption of immunotherapy drugs. As a result, this market is expected to grow rapidly, reflecting the ongoing demand for safer and more effective cancer treatments.

U.S. Immunotherapy Drugs Market Trends

The U.S. immunotherapy drugs market is expected to witness a significant CAGR during the forecast period, driven by the growing demand for effective treatments for cancer and autoimmune diseases. This market benefits from strong investments in research and development, leading to innovative therapies that enhance the immune system's ability to fight these conditions. In addition, supportive government policies and a well-established healthcare infrastructure improve patient access to these advanced treatments. With growing awareness of immunotherapy options among healthcare providers and patients, the U.S. will likely maintain its leading position in this market, reflecting ongoing advancements in cancer care and improved patient outcomes.

Europe Immunotherapy Drugs Market Trends

Europe immunotherapy drugs market is expected to experience significant growth, driven by the increasing adoption of immunotherapy over conventional treatment methods. This shift is largely due to the effectiveness of immunotherapy in treating various cancers and autoimmune diseases, along with a growing demand for monoclonal biosimilars. The market benefits from expedited regulatory approvals, facilitating quicker access to new treatments. In addition, advancements in technology and research are enhancing the development of innovative therapies, while favorable reimbursement policies are improving patient access to these treatments. Despite challenges such as high treatment costs and competition in drug development, the market is set to maintain a steady growth trajectory in the coming years, reflecting a strong commitment to improving patient care and outcomes across the region.

Asia Pacific Immunotherapy Drugs Market Trends

Asia Pacific immunotherapy drugs market is projected to grow at a CAGR of 15.1% over the forecast period. This growth can be attributed to the increasing prevalence of cancer and autoimmune diseases, leading to a rising demand for effective treatment options. The region is witnessing significant investments in healthcare infrastructure, research, and development, resulting in innovative therapies that enhance immune responses. In addition, there is a growing focus on personalized medicine, which helps customize treatments to individual patient needs, further boosting market growth. As awareness of immunotherapy options increases among healthcare providers and patients, the Asia Pacific immunotherapy drugs industry is expected to play a crucial role in shaping the future of cancer treatment in the region. Factors such as rising healthcare expenditure and government support for research initiatives also contribute to this market's positive outlook.

China immunotherapy drugs market is expected to grow at the fastest rate due to rising demand for effective cancer treatments and advancements in healthcare infrastructure. The market is witnessing an increasing adoption of immunotherapy, particularly monoclonal antibodies, which accounted for a substantial market share in recent years. The approval of key immunotherapy drugs, such as Opdivo and Keytruda, has marked a turning point in the treatment landscape, providing new treatment options for various malignancies. In addition, the Chinese government's initiatives to enhance cancer care and promote biomedical research foster a supportive environment for the development of and accessibility to immunotherapy treatments. Despite challenges such as limited awareness among patients and healthcare providers, the overall outlook for the immunotherapy drugs industry in China remains positive, reflecting a commitment to improving cancer treatment and patient outcomes.

Key Immunotherapy Drugs Company Insights

The immunotherapy drugs market is undergoing significant transformation, driven by the increasing prevalence of cancer and autoimmune diseases and advancements in research and development. Some key players in this dynamic market are Amgen Inc., Novartis AG, AbbVie, and Johnson & Johnson Services, Inc. Amgen is recognized for its innovative therapies in oncology; Novartis focuses on targeted treatments; AbbVie specializes in immunology, and Johnson & Johnson offers a range of immunotherapy options across various therapeutic areas. These companies are adopting different growth strategies, including mergers and acquisitions, expansion of product portfolios, and increased investment in R&D to develop new therapies that enhance immune responses. With the growing demand for effective cancer treatments, the immunotherapy drugs industry is expected to experience substantial growth in the coming years.

-

Amgen Inc. is a key player in the immunotherapy drugs market, focusing on innovative treatments for cancer and autoimmune diseases. The company is known for its products, such as BLINCYTO, which helps treat certain types of leukemia, and KYPROLIS, which is used for multiple myeloma. Amgen is committed to improving cancer care and has a strong pipeline of new therapies that address unmet medical needs.

-

Johnson & Johnson Services, Inc. is a significant player in the immunotherapy drugs market, offering diverse therapies to treat various cancers and autoimmune diseases. The company has developed several approved immunotherapy drugs recognized for their effectiveness and safety. Johnson & Johnson focuses on innovation and quality, ensuring that its products meet rigorous standards while addressing the medical needs of patients. The company emphasizes strategic partnerships to enhance research capabilities and expand market access, which allows it to stay competitive in the rapidly evolving immunotherapy landscape.

Key Immunotherapy Drugs Companies:

The following are the leading companies in the immunotherapy drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Amgen Inc.

- Novartis AG

- AbbVie Inc.

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd

- Johnson & Johnson Services, Inc.

- AstraZeneca

- GSK plc.

- Sanofi

- Bayer AG

Recent Developments

-

In February 2024, AbbVie acquired ImmunoGen, significantly enhancing its oncology portfolio. ImmunoGen's lead product, ELAHERE, specifically targets folate receptor-alpha-positive ovarian cancers. This strategic acquisition aligned with AbbVie's focus on expanding its capabilities in immunotherapy and oncology.

-

In December 2023, F. Hoffmann-La Roche completed the acquisition of Telavant Holdings, Inc., owned by Roivant Sciences and Pfizer. This deal was expected to allow Roche to develop a new therapy-RVT-3101-to treat inflammatory bowel diseases such as ulcerative colitis and Crohn's disease. The acquisition was a part of Roche's strategy to strengthen its focus on gastrointestinal health and to bring innovative treatments to patients with these conditions.

Immunotherapy Drugs Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 268.6 billion |

|

Revenue forecast in 2030 |

USD 577.2 billion |

|

Growth rate |

CAGR of 13.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Drug Type, indication, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Amgen Inc.; Novartis AG; AbbVie Inc.; Pfizer, Inc.; F. Hoffmann-La Roche Ltd; Johnson & Johnson Services, Inc.; AstraZeneca; GSK plc.; Sanofi; Bayer AG. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Immunotherapy Drugs Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global Immunotherapy Drugs Market based on drug type and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies

-

Immunomodulator

-

Vaccine

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Autoimmune Diseases

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."