- Home

- »

- Medical Devices

- »

-

Immunoassay Market Size & Share, Industry Report, 2030GVR Report cover

![Immunoassay Market Size, Share & Trends Report]()

Immunoassay Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Technology (Radioimmunoassay, Enzyme Immunoassays), By Application (Therapeutic Drug Monitoring, Oncology), By Specimen (Blood), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-066-8

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Immunoassay Market Summary

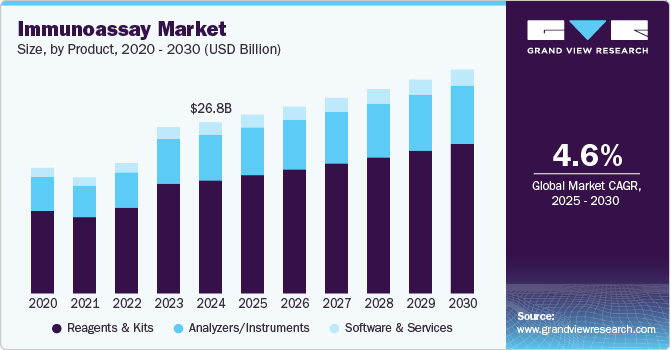

The global immunoassay market size was estimated at USD 26.83 billion in 2024 and is projected to reach USD 35.10 billion by 2030, growing at a CAGR of 4.59% from 2025 to 2030. Immunoassay play a crucial role in tailoring treatments to individual patients by identifying biomarkers that predict responses to specific therapies.

Key Market Trends & Insights

- North America immunoassay market held the largest revenue share at 47.43% in 2024.

- Asia Pacific is set to record the fastest CAGR.

- Based on product, In 2024, kits and reagents led the market with a 66.10% share.

- Based on application, The infectious disease application in the immunoassay industry led the market with a 66.10% share and is expected to grow at a CAGR of 5.43% over the forecast period.

- In terms of technology, enzyme immunoassays secured the dominant market share in 2024 of 63.90%.

Market Size & Forecast

- 2024 Market Size: USD 26.83 Billion

- 2030 Projected Market Size: USD 35.10 Billion

- CAGR (2025-2030): 4.59%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising prevalence of cancer, cardiovascular diseases, and autoimmune disorders has driven the need for targeted therapies, where immunoassay help determine the most effective treatment for patients. This approach minimizes adverse effects and enhances treatment efficacy, improving patient outcomes. The shift from a one-size-fits-all treatment approach to personalized medicine is a primary driver of market expansion. Additionally, pharmaceutical companies are increasingly integrating immunoassay into drug development pipelines to improve the success rate of novel therapeutics, further accelerating market growth.

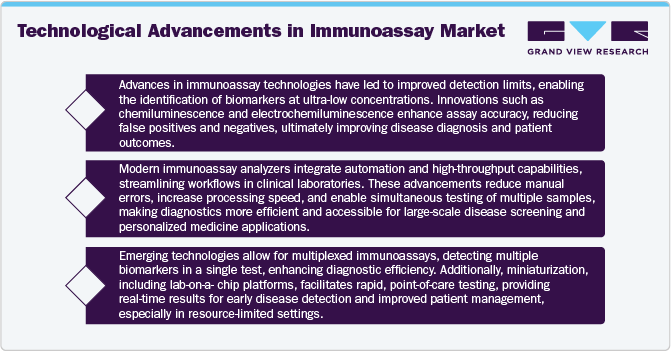

One of the key factor fueling the growth of the market is the rapid advancement in diagnostic technologies. Innovations in lateral flow assays, enzyme-linked immunosorbent assay (ELISA), and radioimmunoassay have significantly improved the accuracy and efficiency of biomarker identification. These technological advancements enable faster and more precise detection of infectious agents, cancer biomarkers, genetic markers, drugs toxins and hormones which are critical for personalized treatment decisions. Artificial intelligence (AI) and machine learning (ML) are also playing an essential role in enhancing diagnostic accuracy and data interpretation, enabling clinicians to make informed treatment choices. The growing utilization of these cutting-edge diagnostic tools in research labs and healthcare facilities is fueling market growth as healthcare professionals aim to enhance patient care through accurate, data-informed insights. The shift towards point of care testing (POCT) for rapid and accurate diagnosis is a major driver. The ability of immunoassays in providing quick results in emergency care, outpatient clinic and even home settings is responsible for its growing demand. The increasing popularity of digital health and telemedicine is leading to a wider adoption of digital immunoassays that connect with mobile applications or cloud-based platforms to enhance the management of patient outcomes.

The growing prevalence of chronic diseases has fueled continuous advancements in immunoassay technologies. The emergence of new infectious diseases, increasing concerns over antibiotic resistance, and the rising demand for personalized medicine have intensified the need for highly sensitive, specific, and rapid immunoassay tests. To meet these evolving healthcare demands, various companies are investing in innovative solutions. Diamond Diagnostics, for instance, is dedicated to improving immunoassay diagnostics by producing high-quality, cost-effective consumables and accessories for immunoassay analyzers. These innovations are driving market expansion, ensuring healthcare providers have access to reliable and advanced diagnostic tools.

Beyond technological advancements, strategic collaborations among industry leaders are playing a crucial role in market growth. Companies are increasingly forming partnerships to enhance immunoassay capabilities, support therapeutic progress, and promote clinical adoption. A key example is the partnership between Beckman Coulter, Inc. and Fujirebio in July 2023, which focuses on advancing immunoassay applications in neurodegenerative disease research, clinical trials, routine diagnostics, and reimbursement processes. By leveraging their combined expertise and resources, such collaborations are accelerating innovation and improving the availability of cutting-edge diagnostic solutions.

Mainstream Immunoassays for Detection of HCoVs Infections

Methods

Applications

Advantages

Limitations

ELISA

Diagnosis in the absence of PCR laboratory conditions; supplemental tests with PCR to improve diagnostic accuracy; seroepidemiological survey; evaluation of vaccine efficacy

High throughput; can be automated; semiquantitative or quantitative

Requires basic laboratory technician and equipment

WB

Confirmatory test for diagnosis or research

Quantitative determination; multiple target detection in one test

Operation complex; high requirement for experience and equipment; time-consuming

IFA

Confirmatory test for diagnosis or research

High sensitivity and specificity

Operation complex; high requirement for experience and equipment; time-consuming

ICT

POCT; self-testing

Rapid and easy to operate; no requirement for laboratory and technician

Relatively low specificity and sensitivity; high false-negative rate; qualitative determination

Immunosensor

POCT

Portable; rapid and easy to operate; low LOD

Unstable performance; high economic cost

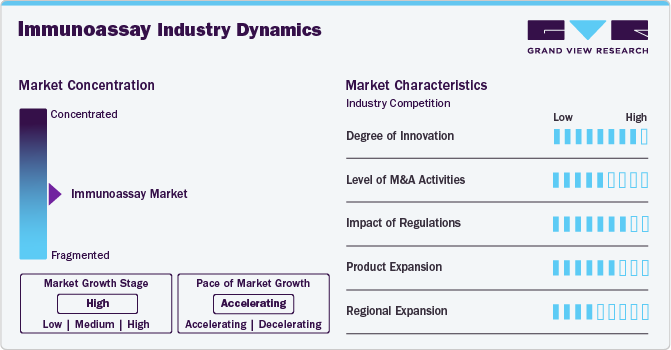

Market Concentration & Characteristics

The immunoassay sector is experiencing swift technological advancements, with significant progress in areas such as multiplex assays, detection utilizing nanotechnology, and the incorporation of biosensors. These advancements enable the simultaneous identification of multiple analytes, improving diagnostic efficiency and expanding the uses of immunoassays. The incorporation of artificial intelligence (AI) and machine learning (ML) into the interpretation of immunoassay data is transforming the accuracy of diagnostics. AI algorithms assist in recognizing patterns and making predictions based on the results of immunoassays, especially in fields like oncology, cardiology, and diagnostics for infectious diseases.

M&As are also used to form strategic partnerships between immunoassay companies and companies involved in pharmaceutical development, clinical trials, and biotech innovations. These partnerships help immunoassay firms expand for personalized medicine and offer more targeted treatments.

The USFDA (Food and Drug Administration) and in Europe, the EMA (European Medicines Agency) and CE-marking regulations ensure that immunoassay products meet high standards of safety, performance, and quality. Immunoassay manufacturers must submit comprehensive data on clinical validation, accuracy, precision, and sensitivity of their tests before they can receive approval for market use. This pre-market evaluation ensures only reliable and effective assays are available in the market shaping product development strategies and ensuring high standards in precision medicine.

As personalized medicine continues to grow, immunoassay companies are focusing on creating customized tests that cater to individual patient needs. These tests may detect specific genetic markers, protein expression profiles, or immune system responses, enabling healthcare providers to offer tailored treatments. The demand for new immunoassays to detect infectious diseases (COVID-19, Zika, Ebola, HIV, hepatitis) is driving product expansion.

The global adoption of immunoassay is increasing, with emerging markets such as North America, Asia-Pacific, Latin America and Middle East and Africa witnessing rapid growth. Point-of- care testing (POCT), personalized medicines and infectious disease testing are the market trends influencing expansion. Rising healthcare investments, improved regulatory frameworks, and growing awareness of precision medicine are driving expansion. Expanding into these regions requires navigating different regulatory environments, understanding local healthcare needs, and forming strategic partnerships to increase access and improve healthcare outcomes globally.

Product Insights

In 2024, kits and reagents led the market with a 66.10% share, driven by increasing demand for personalized medicine and targeted therapies for diseases. Amongst all the kits ELISA and Rapid test kits are the emerging players in the market. These components play a crucial role in detecting specific antigens that help determine a patient’s eligibility for precision treatments, particularly in oncology, infectious diseases, and rare genetic disorders. The expansion of lateral flow assays, enzyme-linked immunosorbent assays (ELISA), chemiluminescent assays and radiological assays has further fueled market growth, enabling rapid, accurate, and high-throughput testing. The market in 2024 is marked by diverse product innovations and expanding services that cater to both clinical diagnostics and non-healthcare applications. As regulations change, especially regarding in-vitro diagnostic regulations (IVDR) in Europe and FDA guidelines in the U.S., firms are offering regulatory consulting services to assist manufacturers in managing the intricate approval procedures.

However, the software and services of immunoassays segment is projected to grow at the fastest CAGR during the forecast period and are delivering testing services for clinical and research uses. Numerous hospitals, private laboratories, and research institutions depend on external services for diagnostic testing based on immunoassays. Firms are broadening their range of services to encompass automated testing, management of laboratory operations, and data analysis services for extensive diagnostic and research initiatives. With the growing use of complex diagnostic systems and advanced immunoassay technologies, there is an increasing need for training services to ensure proper usage and interpretation of test results. Manufacturers are expanding their services to include technical support, product training, and consulting services for healthcare providers and research organizations.

Application Insights

The infectious disease application in the immunoassay industry led the market with a 66.10% share and is expected to grow at a CAGR of 5.43% over the forecast period. This substantial share is attributed to the global increase in infectious diseases and a heightened emphasis on early detection and personalized treatment approaches. Immunoassay in infectious diseases aim to optimize medication choices and manage risk factors effectively. Advancements in biomarker discovery and targeted therapies further contribute to the expansion of this segment, enabling healthcare providers to tailor treatments to individual patient profiles, thereby improving outcomes and reducing adverse effects. As technology continues to advance, the role of immunoassays in personalized medicine, point-of-care testing, and early detection will become even more significant.

Oncology and autoimmune diseases are projected to grow at a significant growth during the forecast period. Immunoassays are critical for the detection of tumor markers, which help in the early diagnosis, monitoring, and management of cancers. According to WHO (February 2022), approximately 400,000 children develop cancer annually worldwide. Additionally, the World Cancer Research Fund International reported 18.09 million cancer cases diagnosed globally in 2020, highlighting the rising need for precise diagnostic tools. The demand for immunoassays continues to surge as pharmaceutical companies develop targeted therapies for various cancers, including prostate, breast, ovarian and colorectal cancer. Increased regulatory approvals and collaborations between diagnostic and pharmaceutical firms are expected to further drive the expansion of oncology-focused solutions.

Technology Insights

Enzyme immunoassays secured the dominant market share in 2024 of 63.90% focusing on personalized medicine, cancer diagnostics, cardiovascular disease testing, and infectious disease detection. It is a widely used technique in the market, offering highly sensitive and specific detection of various biomarkers. This technology has played a significant role in clinical diagnostics, environmental testing, and research. Another emerging type is microarray-based immunoassays use a solid surface to capture multiple different biomarkers simultaneously. A range of antibodies or antigens is placed on a chip, and the presence of specific biomarkers is detected. A new emerging technological field of “Lab-on-a-chip” technologies consolidates various laboratory tasks onto a single chip, enabling compact and quick testing. These devices can execute immunoassays in a small and convenient format. Researchers are currently pursuing innovative methods to enhance these vital immunoassays, as stated by scientists at Fujirebio, a Tokyo-based research and development-focused company The development of iTACT (Immunoassay for total antigen including complex using pretreatment) enhances measurement of target antigens and removes interference from autoantibodies that leads to more sensitivity and accuracy. Regulatory authorities of Japan, Taiwan and Vietnam received regulatory approval for iTACT. Recently, Fujirebio achieved another significant advancement with the creation of a Lumipulse immunoassay designed to verify the accumulation of amyloid-β in patients with Alzheimer’s disease. This assay has been submitted to USFDA for approval rather than using the invasion techniques of specimen collection. Following a five-year partnership in development with their US affiliate, Fluxus, Fujirebio is thrilled to unveil their highly sensitive, next-generation detection technology. This Fluxus system is able to detect single molecules and can quantify antigens at low concentrations of samples.

However, the others segment is projected to grow at the fastest CAGR during the forecast period. One such segment is Electrochemiluminescence Immunoassays (ECLIA), which combines electrochemical and luminescence detection to provide highly sensitive and specific results, widely used in clinical diagnostics and pharmaceutical research. Western Blot Immunoassays are another segment, primarily utilized for confirmatory testing in infectious disease diagnostics, including HIV and Lyme disease detection. Nephelometric and Turbidimetric Immunoassays rely on light scattering techniques to measure antigen-antibody reactions, frequently employed in protein quantification and autoimmune disease diagnostics. Additionally, Nanoparticle-Based Immunoassays leverage nanotechnology for enhanced signal detection, improving sensitivity and reducing assay time. Biosensor-Based Immunoassays, integrating microfluidics and bioreceptors, are gaining popularity for real-time and point-of-care applications. These diverse immunoassay technologies continue to drive innovation, expanding diagnostic possibilities across various healthcare sectors.

Specimen Insights

Blood held the largest market share of 41.54% in 2024, being the largest specimen used for performing immunoassays. In immunoassays, various components of blood can be analyzed, such as plasma, serum and whole blood and the type of blood sample used depends on the test and the biomarker of interest. Blood contains a variety of biomolecules such as proteins, antibodies, and hormones, which can be measured using immunoassays. This makes it a highly versatile specimen for detecting a wide range of diseases and conditions. The ability to measure proteins, antibodies, and other analytes from blood makes it invaluable for diagnosing a broad range of diseases. Techniques such as ELISA, Western blot, chemiluminescent assay and rapid antigen test are widely use blood, ensuring accurate diagnosis and treatment selection. The increasing prevalence of cancer, chronic diseases and cardiovascular diseases coupled with the advancements in molecular pathology, is fueling the demand for immunoassay.

Urine is expected to be the fastest-growing segment over the forecast period, driven by its non-invasive nature, ease of collection, and widespread application in disease diagnostics. Urine-based immunoassays are extensively used for detecting infectious diseases, kidney disorders, pregnancy, drug abuse, and certain cancers, fueling market expansion. The rising prevalence of chronic diseases and the increasing demand for point-of-care testing have further accelerated the adoption of urine-based immunoassays. Advancements in technology, such as highly sensitive enzyme and fluorescence immunoassays, have improved detection accuracy, enabling early diagnosis and better patient outcomes. Additionally, growing workplace drug screening programs and regulatory support for drug testing in sports and rehabilitation centers are propelling market demand. The increasing integration of automation in laboratory testing and the development of rapid urine immunoassay kits are also enhancing efficiency and accessibility, contributing to the steady growth of this segment in the global market.

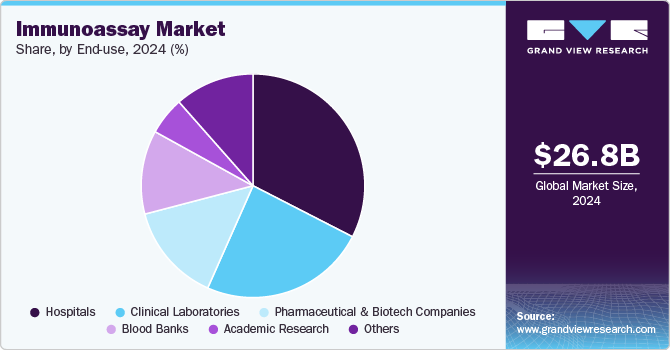

End-use Insights

In 2024, the hospitals in immunoassay industry held a 32.54% share. Hospitals typically offer a comprehensive range of cancer diagnostic tests to address the increasing cancer burden and aging populations. With the increasing popularity of immunoassays, hospitals are quickly embracing cutting-edge technologies to improve early cancer detection and tailor treatment approaches to individual patients. With ongoing advancements in technology, especially in high-throughput systems and digital diagnostics, hospitals are increasingly moving away from traditional immunoassays in favor of more advanced, automated, and high-precision methods.

Others are projected to grow at a CAGR of 5.45% during the forecast period. These organizations are heavily involved in research and development, focusing on targeted therapies that require precise biomarker identification. Immunoassay play a crucial role in facilitating effective clinical trials and optimizing patient selection, thereby enhancing drug efficacy and safety profiles. Additionally, the increasing prevalence of precision medicine has prompted companies to collaborate with diagnostic manufacturers or develop in-house testing capabilities. Regulatory support for co-development and streamlined approvals further accelerates adoption. As these partnerships and R&D initiatives continue to expand, pharmaceutical and biotechnology companies will drive robust market growth.

Regional Insights

North America immunoassay market held the largest revenue share at 47.43% in 2024, primarily supported by robust healthcare systems, a high incidence of chronic illnesses, and a growing awareness of new diagnostic technologies. Hospital and clinical laboratories across the region are driving innovation through the development of cutting-edge diagnostic methods. These factors collectively position North America for continued growth in the immunoassay market over the forecast period.

U.S. Immunoassay Market Trends

U.S. immunoassays market is a major contributor to diagnostic technology. Technological advancements, periodic regulatory FDA approvals for novel tests, and growing competition among biotechnology companies further strengthen market growth prospects in the country.

Europe Immunoassay Market Trends

Europe immunoassay market is led by nations such as Germany, France, and the UK. The area features a strong healthcare infrastructure and a high need for diagnostic tests, especially in the fields of oncology, infectious diseases, and cardiology. Strong regulatory framework, high healthcare investments and widespread use of immunoassay are the drivers for this market. Germany’s rising disease incidence also contribute to market expansion. Overall, these factors position Europe for sustained growth in immunoassay.

UK immunoassay market is propelled by the rising prevalence of chronic diseases, which is fueling the demand for advanced immunoassay analyzers in diagnostics. In the UK, over 5.6 million people have diabetes, with 90% affected by type 2 diabetes, according to Diabetes UK. Government initiatives, such as the NHS Diabetes Prevention Programme (DPP), developed in collaboration with Public Health England and Diabetes UK, are actively working to reduce the disease’s impact. Industry leaders are also contributing to these efforts by advancing immunoassay-based diagnostics. For example, LumiraDx is expanding the commercialization of its Rapid Microfluidic Immunoassay HbA1c Test, improving diabetes detection and management across various healthcare facilities. These developments highlight the crucial role of immunoassay technologies in addressing the growing burden of diabetes and enhancing early diagnosis, treatment, and disease monitoring, ultimately driving the growth of the immunoassay market.

Immunoassay market in Germany is primarily driven by increasing demand for early diagnosis, chronic disease management, and oncology diagnostics. Germany is also a major producer and exporter of diagnostic devices, with numerous global and regional players setting up manufacturing facilities or partnerships in the country. Automated lab solutions, point-of-care testing and personalized medicines are the upcoming market trends. In vitro diagnostic regulations and compliance with European standards facilitate high standards of quality, safety and accuracy.

Asia Pacific Immunoassay Market Trends

Asia Pacific is set to record the fastest CAGR, propelled by healthcare reforms, infrastructure enhancements, and a large patient pool. The APAC region is witnessing rapid growth in the immunoassay market, fueled by emerging economies like, Japan, China, and India. Growing healthcare infrastructure ,rising prevalence of chronic diseases and improving healthcare facilitiesare the key drivers for rising demand of immunoassays. The region’s high burden of chronic diseases, including cancer, rising population underscores the need for effective diagnostic solutions. China’s market growth is supported by lifestyle changes, dietary shifts, and an aging population, while Japan’s focus on technological innovations through substantial government funding underlines the region’s strong growth potential.

Japan’s immunoassay market is witnessing growth, driven by a rising prevalence of chronic diseases and investments in healthcare initiatives. Japan’s regulatory framework ensures strict approval process along with harmonizing global standards. Japan’s government has been investing in healthcare and preventive care, which encourages the use of advanced diagnostic technologies, including immunoassays. This dynamic market environment is expected to continue leading in the adoption of advanced diagnostics, driven by technological innovations in biomarker detection and automated testing systems.

Latin America Immunoassay Market Trends

Latin America presents profitable prospects in the immunoassay sector, fueled by the swift development of precision medicine and numerous research and development projects. Increasing healthcare awareness and rising demand for diagnostic tests due to the growing burden of diseases like cancer, cardiovascular diseases, and infectious diseases. Brazil’s healthcare sector is characterized by a mix of public and private providers, with public health being managed by the Unified Health System(SUS) and private healthcare playing a substantial role in urban centers.

Middle East & Africa Immunoassay Market Trends

The Middle East and Africa (MEA) region offers significant opportunities for growth, though many parts still lack sufficient screening initiatives.Both private and public sectors in the MEA region are increasing their healthcare budgets, contributing to greater adoption of advanced diagnostics, including immunoassays, across hospitals, clinics, and point-of-care settings. Governments regulatory systems are country specific and stringent processes lead to good quality medicines. South Africa, in particular, is expected to witness a surge in immunoassay adoption, driven by rising government involvement and growing awareness of personalized treatment benefits. These developments underscore the MEA region’s potential for steady market growth in the coming years.

Key Immunoassay Company Insights

Leading players in the market, such as Abbott; Siemens Healthineers; Danaher Corporation (Beckman Coulter); bioMérieux SA; Quidel Corporation; Sysmex Corporation; Ortho Clinical Diagnostics; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Becton, Dickinson, and Company; Thermo Fisher Scientific, Inc., are actively developing innovative Companies are undertaking strategic initiatives such as product collaborations, geographic expansion, and strategic agreements for product portfolio expansion to maximize their market share. To sustain their presence in the market, industry players are further concentrating on collaborations, acquisitions and mergers, and product approval.

Key Immunoassay Companies:

The following are the leading companies in the immunoassay market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- bioMérieux SA

- Quidel Corporation

- Sysmex Corporation

- Ortho Clinical Diagnostics

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- Becton, Dickinson, and Company

- Thermo Fisher Scientific, Inc.

Recent Developments

-

In January 2025, Anbio Biotechnology, a leader in diagnostic innovation, announced the launch of its Dry CLIA Solution ADL-1000. This groundbreaking technology is designed to provide fast, reliable, and cost-effective diagnostic results, catering to various clinical settings and meeting the increasing demand for efficient workflows and high-performance testing.

-

In April 2024, Mindray addressed evolving customer demands by introducing its New Solutions for Mid-Volume Laboratories, featuring two stand-alone analyzers and two integrated solutions. With a compact design and high efficiency, these innovations highlight Mindray’s commitment to advancing chemiluminescence immunoassay and clinical chemistry technologies.

-

In March 2023, F. Hoffmann-La Roche Ltd. collaborated with Eli Lily and Company to support the development of Roche’s Elecsys Amyloid Plasma Panel (EAPP).

Immunoassay Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.04 billion

Revenue forecast in 2030

USD 35.10 billion

Growth Rate

CAGR of 4.59% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, specimen, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Siemens Healthineers; Danaher Corporation (Beckman Coulter); bioMérieux SA; Quidel Corporation; Sysmex Corporation; Ortho Clinical Diagnostics; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Becton, Dickinson, and Company; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immunoassay Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immunoassay market report based on product, specimen, technology, application, end-use, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Reagents & Kits

-

ELISA Reagents & Kits

-

Rapid Tests Reagents & Kits

-

ELISPOT Reagents & Kits

-

Western Blot Reagents & Kits

-

Other Reagents & Kits

-

-

Analyzers/Instruments

-

Open Ended Systems

-

Closed Ended Systems

-

-

Software & Services

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Therapeutic Drug Monitoring

-

Oncology

-

Cardiology

-

Endocrinology

-

Infectious Disease Testing

-

Autoimmune Diseases

-

Others

-

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

Radioimmunoassay (RIA)

-

Enzyme Immunoassays (EIA)

-

Chemiluminescence Immunoassays (CLIA)

-

Fluorescence Immunoassays (FIA)

-

-

Rapid Test

-

Others

-

-

Specimen Outlook (Revenue, USD Million; 2018 - 2030)

-

Blood

-

Saliva

-

Urine

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Blood Banks

-

Clinical Laboratories

-

Pharmaceutical and Biotech Companies

-

Academic Research Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immunoassay market size was estimated at USD 26.83 billion in 2024 and is expected to reach USD 28.045 billion in 2025.

b. The global immunoassay market is expected to grow at a compound annual growth rate of 4.59% from 2025 to 2030, reaching USD 35.10 billion by 2030.

b. North America dominated the immunoassay market, with a share of 47.43% in 2024. The U.S.'s constant adoption of innovative techniques and the presence of developed healthcare infrastructure are factors fueling the immunoassay market.

b. Some key players operating in the immunoassay market include Siemens Healthineers, BD (Becton, Dickinson & Company), BioMérieux SA, Abbott, F. Hoffmann-La Roche AG, Danaher , Ortho-clinical diagnostics, Sysmex Corporation, Thermo Fisher Scientific, Inc., and Quidel Corporation.0

b. Key factors that are driving the immunoassay market growth include an increase in chronic & infectious diseases globally, a rise in the geriatric population prone to such chronic and infectious diseases, and high demand for portable and automated immunoassays.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.