Immunoassay Analyzers Market Size, Share & Trends Analysis Report By Product (Chemiluminescence Immunoassays, Fluorescence Immunoassay, Radioimmunoassay), By Application (Oncology, Cardiology), By End-use, By Region And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-992-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Immunoassay Analyzers Market Trends

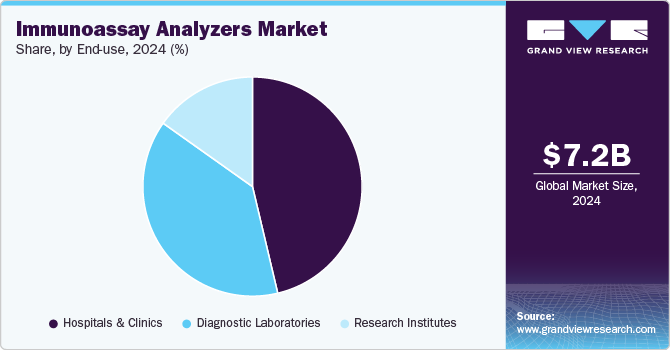

The global Immunoassay analyzers market size was estimated at USD 7.18 billion in 2024 and is expected to grow at a CAGR of 4.13% from 2025 to 2030. The increasing prevalence of chronic diseases, including both infectious and non-infectious conditions, is a significant driver of market growth for immunoassay analyzers. As the burden of diseases such as cancer and cardiovascular conditions continues to rise, technological advancements and the application of immunoassay analyzers are expanding rapidly. These advancements play a crucial role in early diagnosis, disease monitoring, and treatment planning. The World Health Organization (WHO) reported approximately 20 million new cancer cases in 2022, with a projected increase in diagnoses reaching 53.5 million in the coming years. This surge in chronic illnesses is fueling the demand for innovative immunoassay solutions, leading companies to develop more advanced and effective diagnostic technologies.

The outbreak of the COVID-19 pandemic further emphasized the need for rapid and accurate diagnostic tools. The emergence of the SARS-CoV-2 virus created an urgent demand for accelerated diagnostic methods that could offer both precision and affordability. While RT-PCR tests were widely used for early detection, they were often considered expensive and resource-intensive. This led to the widespread deployment of immunoassay analyzers for detecting antibodies, providing a more cost-effective and efficient alternative. Companies responded swiftly to this demand by launching advanced immunoassay solutions. For instance, Agilent Technologies, Inc. introduced the Agilent Dako SARS-CoV-2 enzyme-linked immunoassay kit, designed to detect SARS-CoV-2 antibodies in human serum or plasma. The pandemic heightened awareness about the capabilities of immunoassay analyzers, accelerating technological developments and market expansion.

The increasing prevalence of chronic diseases has driven continuous advancements in immunoassay technologies. The emergence of new infectious diseases, growing concerns over antibiotic resistance, and the rising demand for personalized medicine have spurred the need for highly sensitive, specific, and rapid immunoassay tests. Various companies are investing in innovative solutions to meet these evolving healthcare needs. Diamond Diagnostics, for example, is committed to enhancing immunoassay diagnostics by manufacturing high-quality, cost-effective consumables and accessories for immunoassay analyzers. Such innovations contribute to the expansion of the market, ensuring that healthcare providers have access to reliable and advanced diagnostic tools.

In addition to technological advancements, strategic collaborations among key industry players are significantly contributing to market growth. Companies are increasingly forming partnerships to strengthen their immunoassay capabilities, support therapeutic advancements, and facilitate clinical adoption. A notable example is the collaboration between Beckman Coulter, Inc. and Fujirebio in July 2023. This partnership aims to enhance immunoassay applications in neurodegenerative disease research, clinical trials, routine diagnostics, and reimbursement processes. By combining expertise and resources, these collaborations are driving innovation and improving the accessibility of advanced diagnostic solutions.

Mainstream immunoassays for detection of HCoVs infections

|

Methods |

Applications |

Advantages |

Limitations |

|

ELISA |

Diagnosis in the absence of PCR laboratory conditions; supplemental tests with PCR to improve diagnostic accuracy; seroepidemiological survey; evaluation of vaccine efficacy |

High throughput; can be automated; semiquantitative or quantitative |

Requires basic laboratory technician and equipment |

|

WB |

Confirmatory test for diagnosis or research |

Quantitative determination; multiple target detection in one test |

Operation complex; high requirement for experience and equipment; time-consuming |

|

IFA |

Confirmatory test for diagnosis or research |

High sensitivity and specificity |

Operation complex; high requirement for experience and equipment; time-consuming |

|

ICT |

POCT; self-testing |

Rapid and easy to operate; no requirement for laboratory and technician |

Relatively low specificity and sensitivity; high false-negative rate; qualitative determination |

|

Immunosensor |

POCT |

Portable; rapid and easy to operate; low LOD |

Unstable performance; high economic cost |

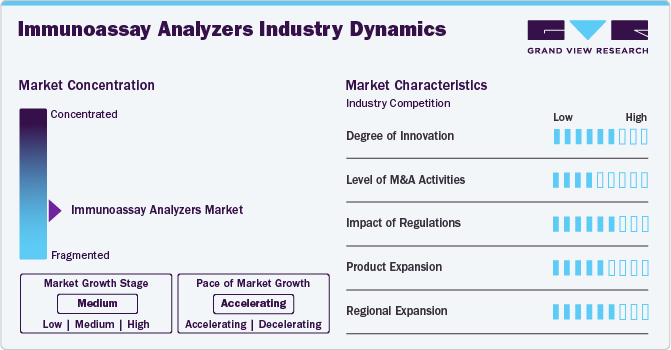

Market Concentration & Characteristics

The immunoassay analyzer market is witnessing rapid innovation driven by advancements in biotechnology, artificial intelligence, and automation. Companies are developing highly sensitive and specific analyzers that provide faster and more accurate results. Emerging technologies, such as multiplex assays and microfluidics, are improving diagnostic efficiency. Continuous R&D investments and innovation in immunoassay techniques are expected to enhance early disease detection, making diagnostics more accessible and reliable globally.

Mergers and acquisitions (M&A) are reshaping the immunoassay analyzer market as companies seek to expand their product portfolios and geographical reach. Large diagnostic firms are acquiring smaller, innovative companies to integrate cutting-edge technology and strengthen market position. Recent M&A activities focus on enhancing diagnostic capabilities, improving cost efficiency, and increasing global distribution networks, contributing to the overall growth and consolidation of the immunoassay industry.

Regulatory frameworks play a crucial role in shaping the immunoassay analyzer market, ensuring safety, accuracy, and compliance. Stringent guidelines from agencies like the FDA, EMA, and ISO affect product approvals and market entry. Evolving regulatory policies, particularly concerning diagnostic accuracy and clinical validation, influence product development strategies. Companies must adapt to regulatory changes while maintaining innovation to meet quality and compliance standards in different global markets.

Product expansion in the immunoassay analyzer market is being driven by continuous advancements in diagnostic technology. Companies are developing next-generation analyzers with enhanced automation, multiplexing capabilities, and integration with digital health solutions. The introduction of compact, high-throughput, and portable immunoassay devices caters to point-of-care testing needs. Expansion into specialized diagnostic areas, including oncology and infectious diseases, further accelerates the adoption of innovative immunoassay solutions.

The immunoassay analyzer market is expanding across diverse geographical regions, with emerging markets playing a key role in growth. Companies are increasing their presence in Asia Pacific, Latin America, and the Middle East due to rising healthcare investments and an increasing burden of chronic diseases. Strategic partnerships, distribution agreements, and regulatory approvals are enabling market penetration, ensuring that advanced diagnostic solutions reach underserved regions and contribute to global healthcare improvements.

Product Insights

The consumables and accessories segment dominated the immunoassay analyzer market, accounting for a 36.53% share in 2024. This dominance is driven by the presence of several key players offering essential consumables required for immunoassay analyzers. Companies such as Diamond Diagnostics, Gyros Protein Technologies AB, and PerkinElmer Inc. are continuously innovating and manufacturing consumables to support various immunoassay analyzers. For example, Diamond Diagnostics provides consumables for leading immunoassay systems, including Beckman Coulter Olympus AU, Diamond Carelyte Plus, Diamond Smartlyte Plus, and Siemens Advia Chemistry. The rising prevalence of chronic diseases and the increased adoption of immunoassay analyzers for diagnostics are fueling the demand for consumables and accessories, driving market growth.

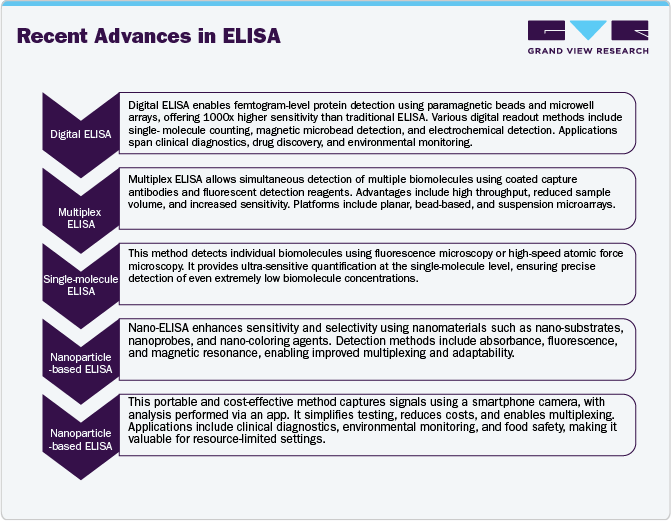

The enzyme-linked immunoassay (ELISA) segment is projected to grow at the fastest CAGR during the forecast period. ELISA is widely utilized for detecting soluble substances such as antibodies, proteins, peptides, and hormones. The increasing demand for accurate and efficient diagnostic solutions is pushing key market players to expand their offerings in this segment. Leading companies such as Thermo Fisher Scientific Inc., Promega Corporation, and Bio-Rad Laboratories, Inc. are continuously enhancing their ELISA products to meet growing diagnostic needs. The increasing research applications and advancements in ELISA technology, including digital and multiplex ELISA, are expected to further propel market expansion.

Application Insights

The infectious disease testing segment accounted for the largest market revenue share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The demand for rapid and accurate detection of infectious and parasitic diseases is a major driving force behind this growth. According to the World Health Organization (WHO), hepatitis remains a significant global health threat, being the second leading cause of death worldwide, claiming approximately 1.3 million lives annually. Similarly, tuberculosis continues to be a major infectious disease burden, necessitating efficient diagnostic solutions.

To address this growing need, companies are developing enzyme immunoassay (EIA) tests that enable the detection of infectious diseases, including hepatitis antibodies, in human serum. For instance, in April 2024, Beckman Coulter launched the DxI 9000 Immunoassay Analyzer assays for hepatitis testing, designed to provide accurate and rapid detection, assisting healthcare professionals in diagnosing infections efficiently. The increasing prevalence of infectious diseases and ongoing innovations in diagnostic technology are expected to sustain the growth of this segment.

Moreover, advancements in immunoassay techniques, such as point-of-care testing (POCT) and multiplex immunoassays, are expanding the application of immunoassay analyzers beyond traditional laboratory settings. The integration of artificial intelligence (AI) and automation in immunoassay diagnostics is further improving accuracy, efficiency, and turnaround time, making infectious disease testing more accessible and reliable.

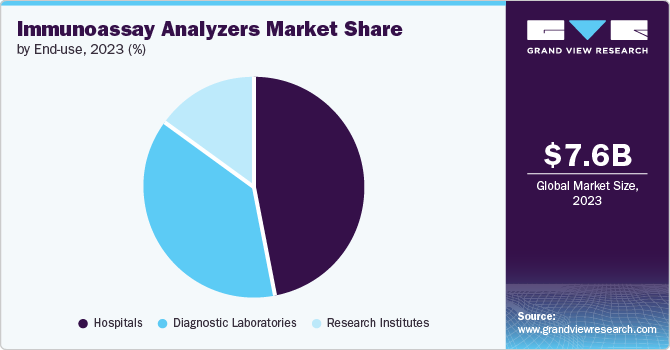

End-use Insights

Hospitals and clinics held the largest market revenue share in 2024, driven by the rising prevalence of infectious diseases and the need for advanced diagnostic and treatment solutions. Immunoassay analyzers play a crucial role in hospitals and clinics by detecting and quantifying analytes in biological samples through antigen-antibody reactions. Due to the technical complexity of these procedures, they require skilled healthcare professionals, reinforcing the dominance of this segment in the market.

For instance, Abbott’s antibody-based immunoassay solutions are extensively used in hospitals and laboratories across India to determine the extent of COVID-19 infection in the population. The integration of immunoassay analyzers in hospital settings has led to faster and more accurate disease diagnosis, improving patient outcomes.

Diagnostic laboratories are also a critical segment in the immunoassay analyzer market, playing a fundamental role in disease detection, early diagnosis, and treatment decisions. Approximately 70% of medical decisions rely on laboratory diagnostic results, underscoring the importance of accurate and efficient testing solutions. Leading companies are actively providing immunoassay analyzers to laboratories to enhance diagnostic capabilities. For instance, Beckman Coulter offers a range of immunoassay analyzers, including Access 2+ Analyzer, UniCel Dxl 600 Analyzer, UniCel Dxl 800 Analyzer, and Dxl 9000 Analyzer, which are widely used in diagnostic laboratories. These analyzers enhance testing efficiency, throughput, and accuracy, further propelling market growth.

In addition, advancements in decentralized testing and the increasing adoption of point-of-care immunoassays in outpatient clinics, primary healthcare centers, and emergency departments are expanding the market reach of immunoassay analyzers. As healthcare systems worldwide emphasize early disease detection and precision medicine, the demand for high-performance immunoassay analyzers in hospital and clinical settings is expected to rise steadily.

Regional Insights

In 2024, North America immunoassay analyzer market led the market, accounting for 47.40% of the global share. The region’s growth is primarily driven by the presence of key industry players and continuous technological advancements in assay analyzers. Companies such as Thermo Fisher Scientific are contributing to market expansion through innovation. For example, in August 2023, Thermo Fisher launched the EXENT Solution after obtaining IVDR Certification, making it easier to integrate into clinical laboratories.

U.S. Immunoassay Analyzers Market Trends

The U.S. immunoassay analyzers market dominated the North American market, holding an 88.6% share in 2023. Government initiatives and financial support are fostering innovation in diagnostic testing. For instance, Maxim Biomedical secured USD 49.5 million in funding from the U.S. Department of Health and Human Services to strengthen domestic diagnostic test manufacturing capabilities.

Regulatory approvals from the U.S. Food and Drug Administration (FDA) are also boosting market growth by ensuring product authenticity and enhancing patient outcomes. In August 2023, Abbott received FDA approval for its Alinity H-Series hematology system, enabling advanced blood count testing in laboratories. Key market players in the U.S. include Thermo Fisher Scientific Inc., Abbott, Beckman Coulter, Inc., and Diamond Diagnostics.

Europe Immunoassay Analyzers Market Trends

Europe holds the position of the second-largest market for immunoassay analyzers, with several leading companies focusing on technological advancements for infectious disease treatment. Key industry players such as Roche Diagnostics, bioMérieux SA, and Siemens Healthineers AG are driving market growth through innovation and strategic partnerships.

The increasing prevalence of chronic diseases and an aging population are also fueling market demand. Companies are responding with innovative immunoassay solutions to improve patient care. For instance, Anbio Biotechnology introduced a handheld point-of-care fluorescent immunoassay (FIA) device, enabling rapid and precise testing for various analytes, including enzymes, infectious diseases, and hormones.

The growing incidence of chronic diseases is driving demand for advanced diagnostic solutions, such as immunoassay analyzers. According to Diabetes UK, over 5.6 million people in the country have diabetes, with 90% diagnosed with type 2 diabetes.

Government initiatives, such as the NHS Diabetes Prevention Programme (DPP), a collaboration between Public Health England and Diabetes UK, aim to mitigate the impact of diabetes. Industry players are also supporting these efforts. For instance, LumiraDx is expanding the commercialization of its Rapid Microfluidic Immunoassay HbA1c Test, enhancing diabetes diagnostics across multiple healthcare centers.

Germany immunoassay analyzers market is a key player in Europe’s immunoassay analyzer market, driven by strong healthcare infrastructure and technological advancements. Companies like Siemens Healthineers and Roche Diagnostics are at the forefront of innovation. Increasing cases of chronic diseases and government support for advanced diagnostics fuel market growth, promoting early disease detection and improved patient outcomes.

Asia Pacific Immunoassay Analyzers Market

The Asia Pacific immunoassay analyzers market is projected to experience the fastest growth over the forecast period. The rising prevalence of chronic diseases has intensified the demand for advanced diagnostic and treatment solutions. According to the World Health Organization, the Southeast Asia region accounted for nearly two-thirds of deaths in 2021 due to cardiovascular disease, cancer, and diabetes.

In response, companies are developing and launching innovative products to improve early disease detection and treatment. For example, in February 2021, Zybio Inc. introduced the Chemiluminescence Immunoassay Analyzer, designed to detect SARS-CoV-2, cardiac markers, diabetes, and bone metabolism disorders. The COVID-19 pandemic further accelerated the region’s market growth, increasing awareness and adoption of immunoassay analyzers.

China Immunoassay Analyzers Market Trends

China has one of the fastest-growing aging populations globally, contributing to a surge in chronic disease cases. To address this, the government has launched initiatives such as the Proteomics Research Initiative, which aims to map human proteome levels and explore multiplexed immunoassay platforms such as those developed by Olink and SomaLogic.

Domestic manufacturers are also playing a significant role in market growth. Companies such as Getein Biotech Inc. and Biobase Biodustry are expanding their product offerings, including immunofluorescence test kits and immunoassay analyzers, to meet rising demand for advanced diagnostic solutions.

Japan immunoassay analyzers market growth is fueled by an aging population and rising chronic disease prevalence. The country is a leader in technological advancements, with companies such as Fujirebio and Sysmex innovating immunoassay solutions. Government initiatives supporting early diagnostics and AI-integrated analyzers are accelerating market expansion, particularly in cancer detection and infectious disease testing.

Latin America Immunoassay Analyzers Market

The Latin American market is expanding due to rising demand for infectious disease diagnostics, including dengue, Zika, and tuberculosis. Countries such as Brazil and Mexico are investing in healthcare infrastructure, increasing immunoassay adoption. Companies such as bioMérieux and Abbott are enhancing regional presence, improving accessibility to advanced diagnostics and fostering market growth.

Middle East and Africa Immunoassay Analyzers Market Trends

Market growth in the Middle East and Africa is driven by increasing healthcare investments and government initiatives to improve diagnostics. The rising prevalence of chronic diseases and infectious outbreaks, such as HIV and malaria, boosts immunoassay adoption. Companies such as Siemens Healthineers and Randox Laboratories are expanding operations, enhancing regional access to advanced diagnostic solutions.

Key Immunoassay Analyzers Company Insights

Some of the key players operating in the market include Siemens Healthineers AG; BIOMÉRIEUX; Abbott; QuidelOrtho Corporation; Sysmex Corporation; BD; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd; Beckman Coulter, Inc.; DiaSorin S.p.A.; and among others. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Immunoassay Analyzers Companies:

The following are the leading companies in the immunoassay analyzers market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers AG

- BIOMÉRIEUX

- Abbott

- QuidelOrtho Corporation

- Sysmex Corporation

- BD

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd

- Beckman Coulter, Inc.

- DiaSorin S.p.A.

Recent Developments

-

In January 2025, Anbio Biotechnology, a leader in diagnostic innovation, announced the launch of its Dry CLIA Solution ADL-1000. This groundbreaking technology is designed to provide fast, reliable, and cost-effective diagnostic results, catering to various clinical settings and meeting the increasing demand for efficient workflows and high-performance testing.

-

In April 2024, Mindray addressed evolving customer demands by introducing its New Solutions for Mid-Volume Laboratories, featuring two stand-alone analyzers and two integrated solutions. With a compact design and high efficiency, these innovations highlight Mindray’s commitment to advancing chemiluminescence immunoassay and clinical chemistry technologies.

-

In January 2024, Fujirebio and Agappe formed a business collaboration in CLIA-based immunoassay to advance their Contract Development and Manufacturing Organization (CDMO) strategy.

Immunoassay Analyzers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.47 billion |

|

Revenue forecast in 2030 |

USD 9.15 billion |

|

Growth rate |

CAGR of 4.13% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Siemens Healthineers AG; BIOMÉRIEUX; Abbott; QuidelOrtho Corporation; Sysmex Corporation; BD; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd; Beckman Coulter, Inc.; DiaSorin S.p.A. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Immunoassay Analyzers Market Report Segmentation

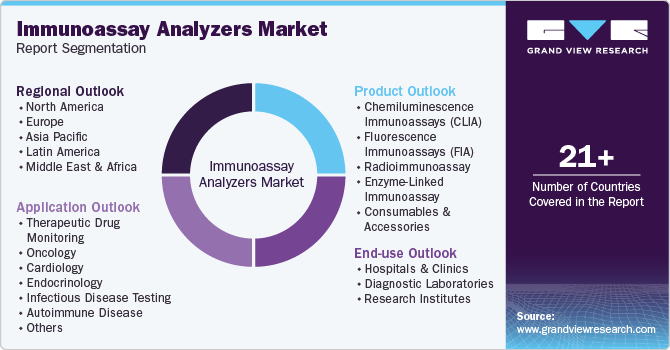

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Immunoassay analyzers market report on the basis of product, application, end use, region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemiluminescence Immunoassays (CLIA)

-

Fluorescence Immunoassays (FIA)

-

Radioimmunoassay

-

Enzyme-Linked Immunoassay

-

Consumables and Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Drug Monitoring

-

Oncology

-

Cardiology

-

Endocrinology

-

Infectious Disease Testing

-

Autoimmune Disease

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Research Institutes

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the immunoassay analyzers market with a share of 47.40% in 2024. This is attributable to the presence of key industry players and continuous technological advancements in assay analyzers.

b. Some key players operating in the immunoassay analyzers market include Siemens Healthineers AG, BIOMÉRIEUX, Abbott, QuidelOrtho Corporation, Sysmex Corporation, BD, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Beckman Coulter, Inc., DiaSorin S.p.A.

b. Key factors that are driving the market growth include increasing prevalence of chronic diseases, including both infectious and non-infectious conditions, is a significant driver of market growth for immunoassay analyzers.

b. The global immunoassay analyzers market size was estimated at USD 7.18 billion in 2024 and is expected to reach USD 7.47 billion in 2025.

b. The global immunoassay analyzers market is expected to grow at a compound annual growth rate of 4.13% from 2025 to 2030 to reach USD 9.15 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."