- Home

- »

- Medical Devices

- »

-

Immuno-oncology Clinical Trials Market Size Report, 2030GVR Report cover

![Immuno-oncology Clinical Trials Market Size, Share & Trends Report]()

Immuno-oncology Clinical Trials Market Size, Share & Trends Analysis Report By Phase, By Design (Interventional Trials, Observational Trials, Expanded Access Trials), By Indication, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-273-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

“2030 immuno-oncology clinical trials market value to reach USD 18.7 billion”

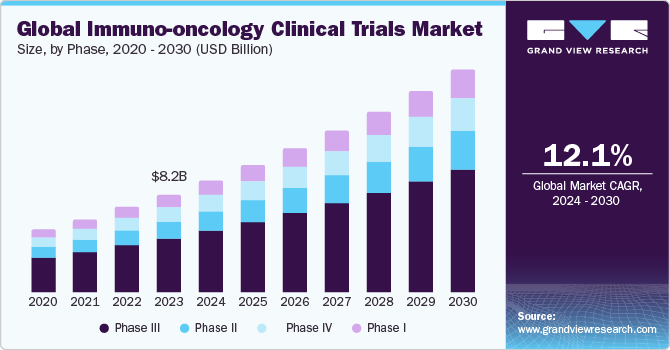

The global immuno-oncology clinical trials market size was estimated at USD 8.24 billion in 2023 and is expected to grow at a CAGR of 12.1% from 2024 to 2030. The rising incidence of cancer worldwide and the growing use of immunotherapy emphasize the ongoing quest to harness the immune system to improve patient outcomes, offering new hope for effective treatments and enhanced cancer care.

Clinical trials in immuno-oncology (IO) are designed to improve patient results by using the immune system to fight cancer. Progress in comprehending how the immune system interacts with cancer cells has resulted in innovative immunotherapies. Biotech firms are investing significantly in studying and developing immune checkpoint inhibitors, CAR-T cell therapy, cancer vaccines, and cytokine treatments. These treatments are leading to a rise in IO trials to evaluate the safety and effectiveness for various types of cancer and patient populations. The industry’s dedication to innovation drives the expansion of IO trials worldwide.

Furthermore, the National Institute of Health forecasts that, by 2023, approximately 2 million individuals in the U.S. are expected to be diagnosed with cancer. Breast cancer is estimated to be the most widespread form, impacting approximately 297,790 females and 2,800 males. It is anticipated that prostate cancer will be the most frequent diagnosis among men and the second most prevalent overall, with approximately 288,300 cases.

Therapies targeting PD-1/PD-L1 and CTLA-4, which inhibit T-cell immune function to boost the body’s immune responses, have made the most significant breakthroughs in IO. In addition to PD-1/PD-L1 and CTLA-4 inhibitors, CAR-T (chimeric antigen receptor T-cell) therapy is well-liked for IO treatment. CAR-T treatments involve using an individual’s T-cells, which are taken out, modified to target cancer, and returned to the patient’s system.

Phase Insights

The phase III trials segment dominated the market with 53.8% of the revenue share in 2023. Oncology trials typically have fewer participants, are the most expensive, and involve larger sample sizes, resulting in a higher cost per participant. The average price of a single Phase III trial participant is spread across a smaller number of individuals, making it more costly. This unique characteristic of oncology trials presents a significant financial challenge for pharmaceutical companies and research institutions.

The phase I trials segment is anticipated to witness the fastest CAGR of 13.5% over the forecast period. This surge is driven by the increasing demand for Phase I trials, which serve as the initial testing ground for new treatments in human subjects. The growth is attributed to advancements in cancer biology, innovative drug discovery methods, and novel therapeutic approaches.

Design Insights

The interventional trials segment dominated the market and accounted for the largest revenue share of 78.5% in 2023. Trials in interventional oncology aim to demonstrate that novel treatments can achieve comparable efficacy to existing standards of care while offering improved patient outcomes and reduced side effects. This goal is crucial for advancing cancer care, as it enables patients to benefit from more effective and tolerable therapies.

The observational trials segment is anticipated to grow at the fastest CAGR of 12.2% during the forecast period. Observational trials offer researchers a unique opportunity to study the real-world impact of immunotherapy treatments on diverse patient populations, untainted by the restrictions of traditional clinical trials. By observing actual treatment outcomes, scientists can identify biomarkers and track long-term effects that may be missed in shorter, randomized trials, providing valuable insights into the efficacy and safety of these therapies.

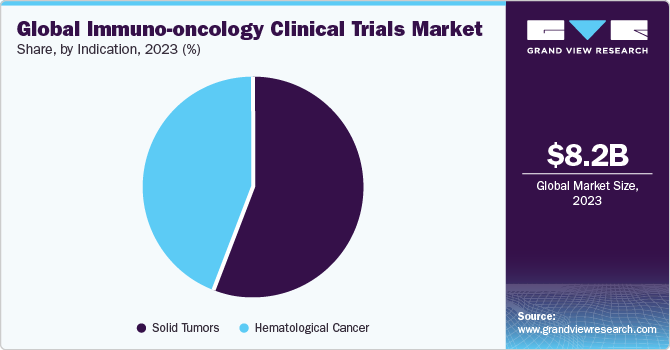

Indication Insights

The solid tumors segment generated the highest revenue in 2023 and accounted for more than 55.9% of the total share. The global increase in drug research and development expenditure has propelled segment growth to a great extent. Lifestyle changes such as excessing smoking and consumption of alcohol have indirectly impacted the incidence of cancer, thus increasing the demand for cancer therapy worldwide.

The hematological cancers segment is projected to be the fastest-growing indication segment from 2024 to 2030 with a CAGR of 12.2%. The rising incidence of blood cancers worldwide is driven by an aging population and increased awareness and early diagnosis, consequently aiding segment growth. Moreover, the development of novel targeted therapies is fueling this growth, allowing for more effective treatment options and improved patient outcomes.

Regional Insights

The North America immuno-oncology clinical trials market dominated with the largest revenue share of 50.3% in 2023. The growing demand for personalized medicine, increased government funding, supportive initiatives, and a heightened focus on research and development have all contributed to the region’s market expansion.

U.S. Immuno-oncology Clinical Trials Market Trends

The immuno-oncology clinical trials market in the U.S. led the region in 2023 due to the presence of numerous renowned cancer hospitals and research institutes across the country, equipped with advanced infrastructure to conduct complex clinical trials at multiple centers.

Europe Immuno-oncology Clinical Trials Market Trends

The immuno-oncology clinical trials market in Europe is lucrative due to the rising prevalence of cancer. The increasing prevalence of various types of cancer, including melanoma, lung cancer, and breast cancer, is driving the demand for innovative and effective treatment options. Substantial investments in research and development by pharmaceutical and biotechnology companies in the region further accelerate this growth.

The Germany immuno-oncology clinical trials market is projected to grow significantly due to its large patient population, advanced healthcare infrastructure, and well-established regulatory framework. The country has seen a notable increase in trials investigating checkpoint inhibitors, CAR-T cell therapies, and other immunotherapies across various cancer types. Moreover, the country's prominence in the global industry is attributed to the strong presence of pharmaceutical and biotechnology companies and government support for research and development initiatives.

The immuno-oncology clinical trials market in the UK is fueled by its well-established healthcare infrastructure, robust regulatory environment, and prominent academic and research institutions. The country has witnessed a significant surge in immuno-oncology trials, particularly in areas such as melanoma, lung cancer, and breast cancer. The collaborative efforts between the National Health Service, universities, and pharmaceutical companies have enabled the rapid development and testing of innovative immunotherapies in the UK, driving the growth of the market.

Asia Pacific Immuno-oncology Clinical Trials Market Trends

The immuno-oncology clinical trials market in Asia Pacific is anticipated to register the fastest CAGR of 13.1% throughout the forecast period. Biotech firms are increasingly shifting immune-oncology clinical research to the Asia Pacific region, where trials have shown promising results in melanoma, lung cancer, and other types of cancer. Over 600 sites across the Asia Pacific region have participated in clinical trials, with China, Australia, and South Korea being major hubs.

The China immuno-oncology clinical trials market has seen rapid growth in recent years, driven by factors like a large patient population, favorable regulatory environment, and local biotech companies expanding their portfolios. The country has become a global leader in cell therapy trials, with 89% of CAR-T trials initiated by academia and hospitals. The country is prioritizing oncology innovation to address its growing cancer burden.

The immuno-oncology clinical trials market in India is rapidly emerging as a major market globally, with international sponsors opting for the country’s cost-effective clinical practices. India’s high incidence of breast, lung, stomach, and colorectal cancers drives demand. The country’s regulatory agency is expediting drug approvals and the increasing availability of trials by implementing strict criteria, making India an attractive location for IO research.

Key Immuno-oncology Clinical Trials Company Insights

Key players in the market are undertaking strategic initiatives such as collaborations, mergers and acquisitions, and geographic expansion, investing heavily in research and development to discover and develop new immunotherapeutic medications.

Key Immuno-oncology Clinical Trials Companies:

The following are the leading companies in the immuno-oncology clinical trials market. These companies collectively hold the largest market share and dictate industry trends.

- MEDPACE

- Novartis

- Exscientia

- Syneous Health

- AstraZeneca

- IQ BIOTECH

- BioNtech

- IQVIA Holdings

- ICON, Plc

- Covance, Inc.

Recent Developments

-

In May 2024, Novartis acquired Mariana Oncology, a preclinical-stage biotech company, to strengthen its radioligand therapy pipeline. The deal expanded Novartis’ research infrastructure and clinical supply capabilities, with a portfolio of radioligand programs across solid tumor indications.

-

In April 2024, AstraZeneca and Daiichi Sankyo’s development Enhertu (trastuzumab deruxtecan) received approval in the U.S. to treat adult patients with inoperable or advanced HER2-positive (IHC 3+) solid tumors after previous systemic treatment with no other viable options available.

Immuno-oncology Clinical Trials Market Report Scope

Report Attribute

Details

Market Size value in 2024

USD 9.4 billion

Revenue forecast in 2030

USD 18.7 billion

Growth rate

CAGR of 12.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, design, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

MEDPACE; Novartis; Exscientia; Syneous Health; AstraZeneca; IQ BIOTECH; BioNtech; IQVIA Holdings; ICON, Plc; Covance, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research need.

Global Immuno-oncology Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For his study, Grand View Research has segmented the global immuno-oncology clinical trials market report based on phase, design, indication, and region:

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solid Tumors

-

Hematological Cancer

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immuno-oncology clinical trials market size was estimated at USD 8.24 billion in 2023 and is expected to reach USD 9.4 billion in 2024.

b. The global immuno-oncology clinical trials market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 18.7 billion by 2030.

b. The phase III segment dominated the immuno-oncology clinical trials market with 53.6% of revenue share in 2023.

b. Some key players operating in the immuno-oncology clinical trials market include ICON Plc; Wuxi AppTec; PRA Health Sciences; SGS SA; Syneos Health; Eli Lilly and Company; Novo Nordisk A/S; Pfizer; and Clinipace.

b. Key factors that are driving the immuno-oncology clinical trials market growth include increasing cases of cancer across the globe, globalization of clinical trials, the rising need for personalized medicines, and the growing demand for advanced technologies.

b. The interventional trials dominated the immuno-oncology clinical trials market and accounted for the largest revenue share of 78.6 % in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."