- Home

- »

- Advanced Interior Materials

- »

-

Immersion Cooling Market Size, Share, Industry Report 2030GVR Report cover

![Immersion Cooling Market Size, Share & Trends Report]()

Immersion Cooling Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application, By Cooling Liquid (Mineral Oil, Fluorocarbon-based Fluids, Deionoized Water, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-226-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Immersion Cooling Market Summary

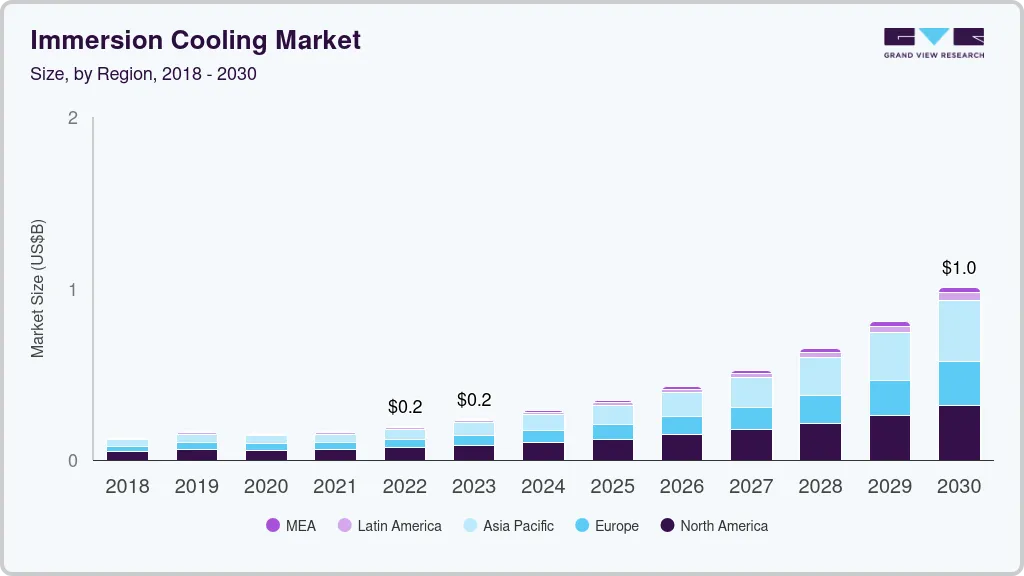

The global immersion cooling market size was estimated at USD 286.8 million in 2024 and is projected to reach USD 1,006.6 million by 2030, growing at a CAGR of 23.6% from 2025 to 2030. The establishment of data centers globally to address the rapidly increasing use of artificial intelligence (AI) tools across industries is a primary market driver, as these facilities generally witness high energy consumption that presents challenges to operational efficiency.

Key Market Trends & Insights

- The North America immersion cooling market accounted for a leading global revenue share of 35.4% in 2024.

- The U.S. accounted for a dominant revenue share in the regional immersion cooling industry in 2024.

- By product, the single-phase immersion cooling segment accounted for the largest revenue share of 70.6% in the global market in 2024.

- By application, the high-performance computing (HPC) segment accounted for the largest revenue share in 2024.

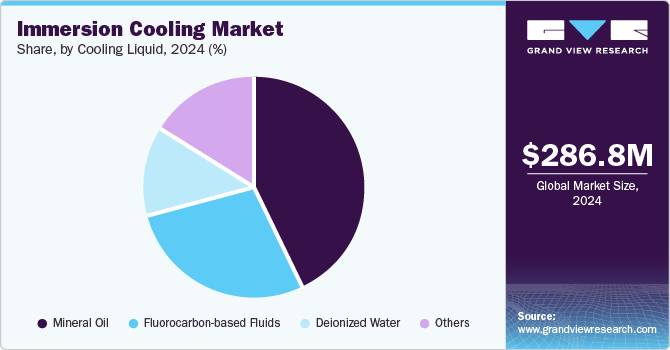

- By cooling liquid, the mineral oil segment accounted for a leading revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 286.8 Million

- 2030 Projected Market Size: USD 1,006.6 Million

- CAGR (2025-2030): 23.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The use of immersion cooling systems reduces energy consumption by 50%, compared to conventional air cooling technologies, which drives their demand. Governments worldwide are launching several regulatory policies targeting a substantial improvement in energy efficiency for data centers, which has compelled owners of such facilities to invest in advanced immersion cooling solutions.Immersion cooling, also known as liquid submersion cooling, has been commonly used for cooling power distribution components, including transformers. However, in recent years, it has gained traction in additional areas, with the establishment of innovative data centers and the widespread adoption of technologies such as big data, 5G, AI, cloud computing, and the Internet of Things (IoT). The constant growth in demand for computational power, particularly with the popularity of cloud services, edge computing, and other emerging technologies, has created a strong emphasis on improving data center processing capabilities and energy efficiency. A report by the International Energy Agency (IEA) stated that globally, data centers consumed 460 Terawatt hours (TWh) of electricity in 2022, which can be expected to rise to 1,000 TWh by 2026. Computing and cooling power are the most energy-intensive processes in these facilities, with the growing investment in resource-intensive graphics processing units (GPUs) expected to sustain high energy consumption in the coming years. As a result, the demand for immersion cooling systems has expanded rapidly, with data center operators experimenting with efficient heat reuse and cooling technologies.

The intensive computational requirements of mining cryptocurrencies such as Bitcoin are known to generate significant amounts of heat. A report published by Polytechnique Insights in October 2024 stated that the yearly electricity consumption attributed to Bitcoin mining ranged from 155 TWh to 172 TWh. Continued expansion of the cryptocurrency industry is thus expected to increase further energy consumption, which can prove harmful to the environment in the long term. Immersion cooling systems efficiently manage the heat produced by mining hardware (ASICs, GPUs), offering a more cost-effective and reliable solution than air cooling techniques. By maintaining consistent and lower operating temperatures, immersion cooling substantially reduces the thermal stress on components, thereby prolonging the lifespan of mining equipment.

Globally, governments and regulatory bodies in several regions have implemented, or are in the process of implementing, regulations that can address growing energy consumption concerns in data centers, creating a positive outlook for the immersion cooling industry. For instance, in March 2024, the European Commission adopted a new regulation for establishing a scheme that rates the sustainability of data centers across the European Union (EU). As mandated by the revised Energy Efficiency Directive, data center operators are required to submit key performance indicators to the European database. This reporting commenced in September 2024 and will continue through May 2025 and in subsequent years. The scheme has been designed to enhance transparency in data center operations and promote innovative designs that reduce water and energy consumption in these facilities while encouraging renewable energy usage and waste heat reuse.

Product Insights

The single-phase immersion cooling segment accounted for the largest revenue share of 70.6% in the global market in 2024. This system is an inexpensive, efficient, and basic cooling technique wherein sub-systems, electrical components, and devices are fully immersed in the single-phase dielectric heat transfer fluid. The segment is anticipated to sustain a strong demand in the coming years, owing to lower tank and coolant costs, high dielectric strength, low environmental impact, high coolant heat capacity, and high biodegradability compared to two-phase systems. According to an article published in The Register, the Power Usage Effectiveness (PUE) for traditional data centers, which was around 1.58 in 2022, can be reduced to between 1.05 and 1.10 using single-phase immersion cooling. These advantages have helped drive segment expansion as data center operators increasingly become aware of the need to improve PUE to address sustainability concerns.

The two-phase segment is expected to expand at the highest CAGR during the forecast period. This system is gaining traction as a cutting-edge solution for cooling high-performance computing environments, such as data centers, cryptocurrency mining, and high-performance computing (HPC) systems. Two-phase immersion cooling is particularly suitable for HPC environments where dense, high-performance hardware requires robust and efficient cooling. The system is also highly scalable, making it suitable for small-scale deployments as well as large hyperscale data centers. Companies are significantly investing in the development of two-phase cooling solutions, thus addressing the changing requirements of operators. For instance, at the SC24 event held in November 2024, Opteon, a brand of The Chemours Company, demonstrated the Opteon 2P50 two-phase immersion cooling liquid. The company claims that this developmental solution reduces cooling energy consumption by as much as 90%, total energy usage by 40%, and physical space requirements by 60%.

Application Insights

The high-performance computing (HPC) segment accounted for the largest revenue share in the global market in 2024. Immersion cooling solutions have showcased several operational advantages in the rapidly developing computing industry, including lower latency, the potential for heat reuse programs in industrial and urban areas, fast deployment with edge-ready solutions, and the ability to cool chip densities required for zero water waste. HPC applications, including scientific simulations, machine learning, and big data analytics, often require significant computational power. This leads to corresponding high levels of heat generation, with traditional air cooling methods proving inadequate to manage the increasing thermal load effectively. Immersion cooling addresses this challenge by offering superior thermal transfer and energy efficiency.

The artificial intelligence (AI) segment is expected to advance at the fastest CAGR in the immersion cooling industry from 2025 to 2030. AI tasks, particularly deep learning, rely heavily on GPUs, Tensor Processing Units (TPUs), and other specialized accelerators that process large datasets and complex algorithms. These hardware components generate a lot of heat, especially when running for extended periods. This leads to a significant increase in electricity consumption across computing facilities, expanding the application scope of immersion cooling systems. Moreover, the growing awareness and adoption of Generative AI tools and models by organizations to provide more value-based services to their customers are expected to increase energy consumption in data processing facilities further, creating growth opportunities for companies operating in this market.

Cooling Liquid Insights

The mineral oil segment accounted for a leading revenue share in the global market for immersion cooling in 2024. Mineral oil has been conventionally used to improve efficiency in the cooling process, which ensures simplicity in the facility design compared to traditional air cooling systems, thus offering benefits in terms of cost savings. Mineral oil is clear and oily and is used as a single-phase dielectric owing to its high boiling point. The ability of this liquid to be mixed from different sources and batches provides flexibility during deployment and operations. Furthermore, mineral oil has moderate thermal conductivity compared to water-based liquids, which makes it effective at transferring heat away from components. It absorbs heat from the submerged components and helps cool them down, maintaining operational efficiency.

The fluorocarbon-based fluids segment in the immersion cooling industry is expected to advance at the fastest CAGR from 2025 to 2030. These fluids are a form of synthetic dielectric liquid made from fluorinated compounds, primarily containing carbon, fluorine, and other elements such as hydrogen or chlorine. They are non-conductive and do not allow electrical current to pass through them, making them ideal for use in cooling electronic components. The dielectric properties of fluorocarbon fluids are a major feature driving their adoption among data center operators. They do not conduct electricity and thus are able to safely immerse electrical components such as processors, graphics cards, memory, and other high-voltage systems without the risk of short circuits or electrical damage. This makes them highly reliable for electronic cooling, especially in environments where traditional cooling methods are less efficient or pose a risk of asset damage.

Regional Insights

The North America immersion cooling market accounted for a leading global revenue share of 35.4% in 2024. The region’s well-established IT and telecommunications infrastructure, coupled with increasing competition among tech-based companies to provide innovative solutions to their customers, has led to the widespread adoption of high-performance computing systems. This has driven the need for more efficient and sustainable cooling solutions in data centers, cloud computing, and cryptocurrency mining sectors. For instance, as per a report by ENCOR Advisors, there were 124 data centers in Canada in 2024, with 117 colocation data centers and 30 data center providers. The widespread presence of such high-volume data processing facilities thus highlights the need to ensure process efficiency, optimize space management, and adhere to environmental sustainability norms, all of which require advanced immersion cooling systems.

U.S. Immersion Cooling Market Trends

The U.S. accounted for a dominant revenue share in the regional immersion cooling industry in 2024, owing to the presence of large-scale data centers in the economy and several regional companies offering cooling solutions for these locations. Furthermore, the trend of cryptocurrency mining has grown significantly in the U.S. in recent years, with a report by Earthjustice stating that the country accounted for 38% of the global crypto mining activity in 2021, increasing from just 4% in 2019. The high energy consumption and heat generation associated with these operations have thus led to the urgent requirement for efficient heat management solutions, driving the growth of the immersion cooling market. Companies are expanding their presence to cater to nationwide consumers in the technology sector. For instance, in November 2024, Submer announced the opening of its new headquarters in Houston, Texas, which would house the company’s R&D, manufacturing, and product support operations. Such developments serve to drive market expansion.

Europe Immersion Cooling Market Trends

Europe accounted for a substantial revenue share in the global market for immersion cooling in 2024, aided by the presence of technologically well-developed economies such as Italy, Germany, the UK, and the Netherlands. These countries have invested heavily in data centers that require high-performance computing servers operating at fast speeds. Such processes, however, lead to excessive heat generation that drives up cooling costs, creating a risk of lower profits and operational output for these facilities. To address these issues, data centers in the region are adopting advanced immersion cooling systems, as they are noticeably more efficient compared to conventional cooling techniques. The ability of immersion cooling systems to reduce energy consumption and operational and maintenance costs is anticipated to propel their demand in Europe.

Asia Pacific Immersion Cooling Market Trends

Asia Pacific is anticipated to advance at the highest CAGR in the immersion cooling market during the forecast period. The fast pace of urbanization in emerging economies such as India, China, and South Korea, coupled with the establishment of multinational companies that leverage large volumes of data, has created a significant demand for technologies that can maintain the smooth operation of computing systems. The widespread adoption of AI-based solutions among different verticals, such as healthcare, retail, and technology, has created a substantial workload on data centers. This has created an urgent requirement for effective cooling technologies that can help manage operational costs in the long run while adhering to stringent sustainability norms. In October 2024, the Hong Kong University of Science and Technology (HKUST) introduced Hong Kong’s largest liquid immersion cooling system, designed for AI and high-performance computing applications.

China accounted for a dominant revenue share in the regional market in 2024, owing to the economy being recognized as a major player in the global technology and cryptocurrency sectors. The presence of large-scale data centers, industrial-scale cryptocurrency mining operations, and a growing focus on sustainability have all contributed to the increasing adoption of advanced cooling solutions such as immersion cooling. China has seen significant growth in its cloud computing and data center infrastructures, driven by technological leaders such as Alibaba, Tencent, Baidu, and others. These data centers need increasingly efficient cooling solutions to support their rapidly expanding infrastructure. In July 2021, the country’s Ministry of Industry and Information Technology (MIIT) introduced regulations aimed at improving the power efficiency of data centers, leading to a significant interest in immersion cooling systems. Policymakers have established a power utilization efficiency (PUE) target of 1.3 for a majority of the data centers, which is expected to positively shape market demand in the economy.

Key Immersion Cooling Company Insights

Some major companies involved in the global immersion cooling industry include DUG Technology, Submer, and Midas Immersion Cooling, among others.

-

Submer is a Barcelona, Spain-based company specializing in developing high-quality immersion cooling solutions for data centers and IT infrastructure. Submer has introduced several notable offerings over the past decade, including the SmartPod modular immersion cooling solution for data centers and the MicroPod immersion cooling solution for edge computing applications. In March 2022, the company opened a gigafactory in Houston, Texas, allowing it to fulfill orders of up to one gigawatt from customers annually.

-

Midas Immersion Cooling is a Texas-based company that develops immersion cooling technologies for data centers and Bitcoin mining operations. The company is known for its Midas XCI Immersion Cooling system, which it claims reduces total power consumption by over 40% and capital expenditure by 50% and generates space savings of 60% compared to conventional air cooling. Midas offers a range of tanks that cater to different requirements and applications. These include the 12U Midas XCI Mini Tank, the 50U Midas XCI Tank, the Midas ASICE 2.0 Tank for ASIC mining, and the Midas XCI Containerized Data Center.

Key Immersion Cooling Companies:

The following are the leading companies in the immersion cooling market. These companies collectively hold the largest market share and dictate industry trends.

- Fujitsu

- DUG Technology

- Green Revolution Cooling, Inc.

- Submer

- LiquidStack Holding B.V.

- Midas Immersion Cooling

- Aecorsis BV

- DCX POLSKA SP. Z O.O.

- LiquidCool Solutions

- STULZ GMBH

Recent Developments

-

In October 2024, Submer announced that it would showcase its SmartPod EVO S and SmartPod EXO immersion cooling solutions at the SC24 event held the following month in Atlanta, Georgia. Through the SmartPod EXO immersion cooling pod, the company displayed its Targeted Flow immersion cooling technology, which it has developed in collaboration with Intel. The technology functions through the injection of pressurized fluid into immersion cold plates and servers, effectively cooling CPUs beyond one kilowatt and optimizing performance.

-

In June 2024, Asperitas announced the launch of the Direct Forced Convection (DFC) technology that offers optimized performance in the generic computing, high-performance computing, supercomputing, and AI segments. The DFC technology provides a cooling capacity exceeding 3.6kWper U, which helps ensure that every high power density component at the chip and chassis levels is precision cooled with very low power overhead. This allows operators to stack high-power servers in a smaller footprint without presenting any overheating issues, boosting data center efficiency.

Immersion Cooling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 348.9 million

Revenue forecast in 2030

USD 1,006.6 million

Growth rate

CAGR of 23.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, cooling liquid, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Netherlands, Russia, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Fujitsu; DUG Technology; Green Revolution Cooling, Inc.; Submer; LiquidStack Holding B.V.; Midas Immersion Cooling; Aecorsis BV; DCX POLSKA SP. Z O.O.; LiquidCool Solutions; STULZ GMBH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immersion Cooling Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immersion cooling market report based on product, application, cooling liquid, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-phase

-

Two-phase

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

High-performance Computing

-

Edge Computing

-

Cryptocurrency Mining

-

Artificial Intelligence

-

Others

-

-

Cooling Liquid Outlook (Revenue, USD Million, 2018 - 2030)

-

Mineral Oil

-

Fluorocarbon-based Fluids

-

Deionized Water

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.