- Home

- »

- Medical Devices

- »

-

Image-guided Therapy Systems Market Size Report, 2030GVR Report cover

![Image-guided Therapy Systems Market Size, Share & Trends Report]()

Image-guided Therapy Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Endoscope, MRI, X-ray Fluoroscopy), By Connectivity Technology (Cardiac Surgery, Neurosurgery), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-536-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Image-guided Therapy Systems Market Summary

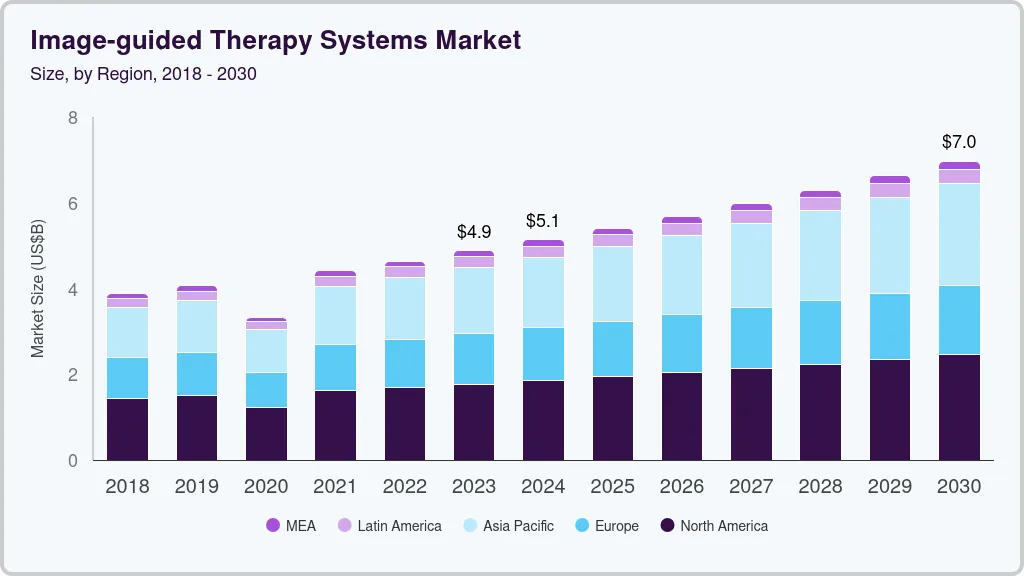

The global image-guided therapy systems market size was estimated at USD 5.13 billion in 2024 and is projected to reach USD 6.97 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The rise in the geriatric population and shifting preference for minimally invasive surgeries, along with technological advancements in imaging systems, are the key factors driving the market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- The image-guided therapy systems market in the U.S. emerged as the largest market in North America in 2024.

- In terms of product, the endoscopes segment dominated the global industry and accounted for the largest share of 33.4% in 2024.

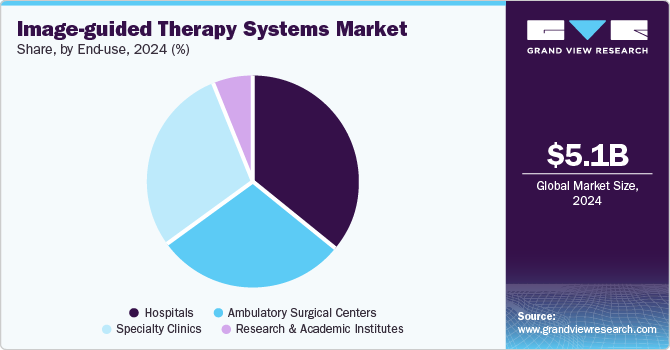

- In terms of end use, hospitals held the dominant position in the market with the largest revenue share of 36.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.13 Billion

- 2030 Projected Market Size: USD 6.97 Billion

- CAGR (2025-2030): 5.2%

- North America: Largest market in 2024

The increased burden of chronic diseases, such as cancer, coupled with a rise in the number of initiatives for cancer radiotherapy, is also positively impacting the market growth. For instance, according American Cancer Society, in 2022, approximately 20 million new cancer cases were diagnosed globally, with 9.7 million deaths. By 2050, cases are projected to rise to 35 million due to population growth. Asia accounted for 49% of new cases, with China alone accounting for 24%.

Image-guided therapy systems are advanced medical technologies that combine real-time imaging modalities with therapeutic tools, enabling clinicians to visualize and target treatments with precision. This integration allows for minimally invasive procedures, which have become increasingly popular due to their benefits of reduced patient trauma, shorter recovery times, and improved clinical outcomes. The market for these systems is experiencing substantial growth, driven by several key factors. Advancements in medical imaging technology, such as enhanced resolution and real-time imaging capabilities, play a crucial role in expanding the market.

As the demand for minimally invasive surgeries continues to rise across various medical specialties, the adoption of image-guided therapy systems accelerates. Furthermore, the increasing incidence of chronic diseases necessitates the use of these systems for precise and targeted therapies. In addition, technological innovations that enhance procedural efficiency and growing investments in healthcare infrastructure also contribute significantly to market growth. Furthermore, rising healthcare expenditures worldwide and a focus on research and development foster the introduction of more sophisticated systems, sustaining the market's upward trajectory.

Collaborations between industry players and healthcare institutions are pivotal in driving innovation and market expansion. Moreover, ongoing initiatives in areas such as cancer radiotherapy, supported by both public and private investments, further boost market opportunities. The integration of advanced technologies, such as digital surgery platforms that combine operating room and software integration, is expected to create new market opportunities.

Product Insights

The endoscopes segment dominated the global image-guided therapy systems industry and accounted for the largest share of 33.4% in 2024. Increased adoption of robot-assisted endoscopic surgeries and the high cost of the systems are the key factors behind its largest revenue share. In addition, the high volume of endoscope-guided surgeries for various interventions has also contributed to its expansion. Furthermore, the growing incidences of cancer and gastrointestinal diseases have increased the demand for interventional endoscopic systems, thereby driving the segment. Moreover, technological advancements in endoscopy and subsequent product launches are also expected to drive the segments’ growth in the market.

Magnetic resonance imaging (MRI) is expected to grow at a CAGR of 5.4% over the forecast period, owing to the promising growth opportunities. Technological advancements and the wide application range of these therapies in treatment planning, localization and delivery, and treatment response assessment are the key factors responsible for the segment growth. In addition, these systems have major applications in areas, such as radiation oncology, neurology, and trauma care. Therefore, the rising burden of such diseases is expected to boost product demand further.

Connectivity Technology Insights

The cardiac surgery segment led the market and accounted for the largest revenue share of 30.1% in 2024. Cardiovascular diseases (CVDs) are the leading cause of death globally. The rise in the geriatric population, coupled with the increasing burden of such diseases, is the major factor contributing to the segment growth. In addition, the market is driven by advancements in real-time imaging technologies, such as 3D and 4D ultrasound, and the integration of hybrid operating rooms. These technologies enhance procedural accuracy and reduce recovery times. Furthermore, innovations such as instant Wave-Free Ratio (iFR) technology improve lesion assessment, contributing to increased efficiency and patient safety.

The neurosurgery segment is likely to expand at a lucrative CAGR of 6.0% over the forecast period. The growing incidences of accidents and trauma cases and the high prevalence of neurological disorders are the major factors driving this segment. Increasing collaborations among key companies for developing new image-guided therapy systems are also fueling the segment growth. In addition, AR systems such as MARIN enhance precision by overlaying virtual information onto real-world anatomy, improving target localization and reducing procedure times. This integration of advanced imaging with AR enhances surgical outcomes and patient safety, driving market expansion.

End-use Insights

The hospitals segment held the dominant position in the market with the highest revenue share of 36.0% in 2024. The increased number of various surgeries and high adoption of image-guided therapy systems in the hospitals are the primary factors driving the segment. Hospitals are adopting these systems owing to the increasing need for cost-effectively optimizing clinical workflows. Furthermore, hospitals also benefit from favorable reimbursement structures and the availability of advanced imaging technologies, which enhance patient care and procedural outcomes. Moreover, the rising demand for minimally invasive procedures further supports this growth.

The ambulatory surgery centers (ASCs) segment is expected to grow at the fastest CAGR of 5.7% from 2025 to 2030, owing to the advantages offered by these healthcare settings such as reduced waiting time and significant cost savings. In addition, high preference for minimally invasive surgeries and reduced hospital stays in the ASCs are also driving the segment. Furthermore, the growing trend of same-day surgery in developed economies due to significant cost savings and optimum care delivery also contributes to the segment growth.

Regional Insights

North America image-guided therapy systems market dominated the global market and held the largest revenue share of 36.1% in 2024 and is expected to maintain its lead over the forecast period. Improved healthcare infrastructure, technological advancements, and quick adoption of advanced radiation therapies are the factors fueling the growth of this market. In addition, the growing geriatric population base, coupled with the rising cases of chronic diseases, is also contributing to the regional market growth. Furthermore, product launches and collaborations by major companies enhance market expansion, while regulatory support fosters innovation and technological advancements.

U.S. Image-guided Therapy Systems Market Trends

The image-guided therapy systems market in the U.S. emerged as the largest market in North America in 2024, accounting for the highest revenue share. This growth is attributed to favorable initiatives undertaken by private companies in the field of minimally invasive interventional and surgical techniques. Furthermore, the country’s large patient base and innovative healthcare technologies, which drive the adoption of image-guided therapy systems are expected to contribute to the markets’ growth in the coming years.

Asia Pacific Image-guided Therapy Systems Market Trends

Asia Pacific image-guided therapy systems market is projected to exhibit the fastest CAGR of 6.4% over the forecast period. The growing geriatric population, increasing cases of target diseases, and improving healthcare infrastructure are the factors responsible for its rapid growth. In addition, economic growth and government initiatives to improve healthcare access contribute to market expansion. Furthermore, the region's large population and rising healthcare spending create opportunities for image-guided therapy systems. Moreover, this growth is further supported by partnerships between local and international healthcare companies, enhancing technological capabilities.

Japan image-guided therapy systems market led the Asia Pacific market and held the largest revenue share in 2024, driven by its aging population and the need for advanced medical technologies. In addition, government support for healthcare innovation and a strong focus on precision medicine enhance the adoption of image-guided therapy systems. Japan's advanced research environment also fosters the development of new technologies, contributing to market growth. Furthermore, the country's high healthcare standards ensure a strong demand for precise medical interventions, driving the market forward.

Europe Image-guided Therapy Systems Market Trends

Europe image-guided therapy systems marketgrowth is expected to be fueled by advanced healthcare systems and a high demand for precise medical interventions. In addition, regulatory support for innovative medical technologies and a strong presence of key market players contribute to market expansion. Furthermore, collaborations between European countries facilitate the sharing of best practices and technologies, further enhancing the market's growth potential. This collaborative environment supports the adoption of advanced imaging technologies across the region.

The growth of image-guided therapy systems market in Germany is expected to be driven by its robust healthcare infrastructure and strong research environment. Furthermore, Germany's central location in Europe facilitates collaboration with other countries, fostering the exchange of innovative technologies and practices. This environment supports the development and adoption of image-guided therapy systems, enhancing patient care and procedural outcomes.

Key Image-guided Therapy Systems Company Insights

Key players in the global image-guided therapy system industry include Koninklijke Philips N.V., Analogic Corporation, GE Healthcare, and others. These business entities employ strategies such as product innovation, strategic alliances, and investments to enhance their market position. Furthermore, they focus on expanding product portfolios, improving technological capabilities, and increasing global presence through mergers and acquisitions, ultimately strengthening their competitive edge.

-

Medtronic manufactures a wide range of products, including cardiac devices such as pacemakers and defibrillators, insulin pumps, and neurostimulation systems. It operates in segments such as cardiovascular, medical-surgical, neuroscience, and diabetes. Medtronic's products span from diagnosis to recovery, focusing on advanced therapies such as image-guided surgery and robotic guidance systems.

-

Siemens Healthineers specializes in medical imaging, diagnostics, and therapy systems. It operates in segments such as imaging, diagnostics, and advanced therapies, offering solutions such as MRI, CT, and ultrasound systems. Siemens Healthineers also provides image-guided therapy systems, enhancing precision in medical procedures. Its products are designed to improve patient outcomes through advanced imaging and diagnostic technologies.

Key Image-guided Therapy Systems Companies:

The following are the leading companies in the image-guided therapy systems market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Medtronic

- Siemens Healthineers

- Analogic Corporation

- GE Healthcare

- Varian Medical Systems, Inc.

- Brainlab AG

- Olympus Corporation

- Stryker

Recent Developments

-

In November 2024, Philips India introduced its new Azurion image-guided therapy system to intervention lists across various specialties. The system features enhanced imaging capabilities and streamlined workflows, designed to improve treatment outcomes for cardiovascular and neurovascular diseases. The Azurion includes features such as rapid transitioning between 2D and 3D imaging, comprehensive table-side control, and AI-powered remote monitoring for proactive service. Showcased at Philips Innovation Campus in Bengaluru, the system aims to enhance efficiency, precision, and patient care, while also reducing costs.

-

In October 2024, Philips and Medtronic Neurovascular announced a strategic partnership to advocate for improved access to timely stroke care. The collaboration aims to raise awareness, improve treatment access, and leverage technology, including image-guided therapy systems, to enhance stroke diagnosis and treatment. Both companies have also strengthened their partnership with the World Stroke Organization, joining the WSO Advocacy Coalition to address the global burden of stroke.

-

In October 2024, GE HealthCare launched the Versana Premier, a versatile ultrasound system designed to enhance clinical efficiency across specialties such as OBGYN, MSK, and cardiology. The system features AI-enabled tools for improved workflow and diagnostic accuracy. Its VisionBoost Architecture and XDclear probes offer exceptional image quality. Automation features and enhanced ergonomics aim to simplify diagnostics. While primarily an ultrasound system, its advanced imaging capabilities can complement image-guided therapy systems in various clinical settings, providing clinicians with clearer, faster, and more accurate diagnostic information.

-

In September 2024, Medtronic expanded its AiBLE ecosystem for spine surgery through new technologies and a partnership with Siemens Healthineers. This expansion integrates advanced imaging, navigation, and artificial intelligence to enhance precision and efficiency in image-guided therapy systems used in spinal procedures. The collaboration aims to provide surgeons with real-time data and insights, optimizing surgical planning and execution. Key innovations include AI-driven tools for personalized surgical approaches and improved visualization capabilities.

Image-guided therapy system Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.40 billion

Revenue forecast in 2030

USD 6.97 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, connectivity technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Koninklijke Philips N.V.; Medtronic; Siemens Healthineers; Analogic Corporation; GE Healthcare; Varian Medical Systems, Inc.; Brainlab AG; Olympus Corporation; Stryker.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

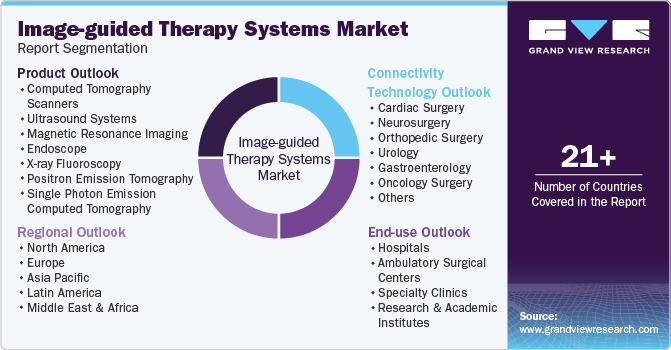

Global Image-Guided Therapy System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global image-guided therapy system market report based on product, connectivity technology, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography (CT) Scanners

-

Ultrasound Systems

-

Magnetic Resonance Imaging (MRI)

-

Endoscope

-

X-ray Fluoroscopy

-

Positron Emission Tomography (PET)

-

Single Photon Emission Computed Tomography (SPECT)

-

-

Connectivity Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Surgery

-

Neurosurgery

-

Orthopedic Surgery

-

Urology

-

Gastroenterology

-

Oncology Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

Research & Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.