- Home

- »

- Medical Devices

- »

-

Image-Guided And Robot-Assisted Surgical Procedures Market 2030GVR Report cover

![Image-Guided And Robot-Assisted Surgical Procedures Market Size, Share & Trends Report]()

Image-Guided And Robot-Assisted Surgical Procedures Market (2024 - 2030) Size, Share & Trends Analysis Report By Specialty (Gynecologic, Urologic, General, Cardiothoracic), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-417-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Image-Guided And Robot-Assisted Surgical Procedures Market Summary

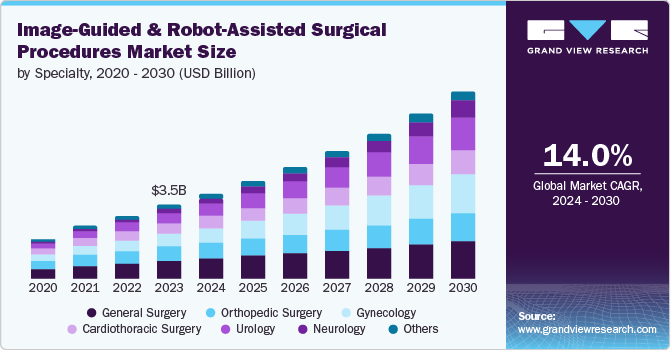

The global image-guided and robot-assisted surgical procedures market size was valued at USD 3.5 billion in 2023 and is anticipated to reach USD 8.9 billion by 2030, growing at a CAGR of 14.0% from 2024 to 2030. This growth is attributed to the rising incidence of chronic diseases, particularly cancer.

Key Market Trends & Insights

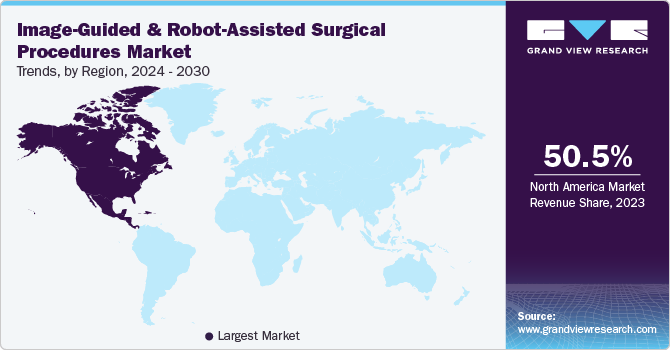

- The North America dominated the global market and accounted for the largest revenue share of 50.5% in 2023.

- The U.S. is dominated North America market at a share of 88.2% in 2023.

- By speciality, general surgery segment dominated the market and accounted for the largest revenue share of 24.2% in 2023.

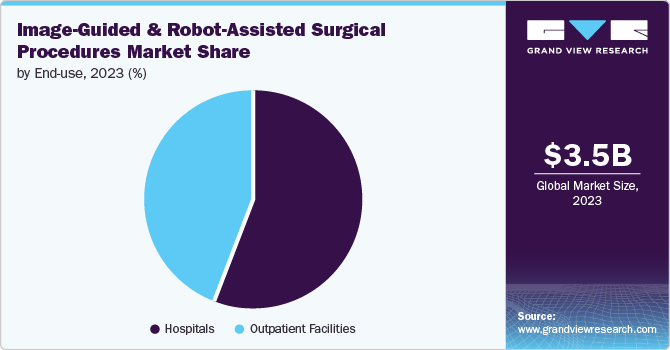

- By end-use, hospitals segment led the market, accounting for the largest revenue share of 56.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.5 Billion

- 2030 Projected Market Size: USD 8.9 Billion

- CAGR (2024-2030): 14.0%

- North America: Largest market in 2023

In addition, technological advancements, such as integrating robotics and augmented reality, create new market growth opportunities. Furthermore, increasing complex and critical surgeries and trauma cases result in market growth.

The robotic set-up is well-equipped and connected by IoT (Internet of Things) with surgical instruments and other essential components. Furthermore, the market is backed by various factors, such as increasing demand for advanced healthcare services worldwide, innovations and progressions in medical devices and equipment technology, a growing geriatric population, growth in healthcare investments, and awareness regarding diseases and early diagnosis and treatment. The technologically enhanced system minimizes surgical errors and provides better patient outcomes.

In addition, renowned hospitals worldwide are spending more on healthcare equipment, fueling the market for image-guided and robot-assisted surgical procedures. These procedures benefit from more visualization and image-guided assistance and improve surgical results. This system ensures surgeons perform surgeries with correctness and accuracy, resulting in fewer problems, patient safety, and improved final results.

Specialty Insights

General surgery dominated the market and accounted for the largest revenue share of 24.2% in 2023. This growth is driven by the increasing demand for minimally invasive surgeries, which enhance patient recovery times and reduce complications, leading to a rise in their adoption. Technological advancements in imaging and robotic systems improve surgical precision and outcomes. Additionally, the growing prevalence of chronic diseases necessitates more advanced surgical interventions. Furthermore, significant investments in healthcare infrastructure and rising healthcare expenditures also contribute to market growth in this sector.

Neurology is projected to grow at a CAGR of 22.7% over the forecast years owing to the rising prevalence of neurological disorders such as intracerebral hemorrhage (ICH), chronic pain, and traumatic brain injuries boosts the market for image-guided and robot-assisted processes for neurosurgery. In addition, implementing image-guided & robotic-assisted surgery technology in neurological surgeries resulted in benefits compared to traditional surgeries, such as higher accuracy and minimized errors.

End-use Insights

Hospitals led the market, accounting for the largest revenue share of 56.4% in 2023. The high volume of surgical procedures performed in highly equipped and well-established healthcare services, i.e., hospitals, and the access to advanced surgical infrastructure results in the demand for these tech-assisted surgeries in hospitals. Hospitals highly utilize image-guided and robot-assisted technologies to provide minimally invasive procedures, offering patients convenient and easy access to enhanced surgical care and safety. Therefore, image-guided and robot-assisted surgical procedures have become crucial as a more practice-enhancing, patient-friendly, and economical option to traditional open surgeries.

Outpatient facilities are projected to grow at a CAGR of 14.5% over the projected years. The slightly invasive nature of robotic surgery allowed many procedures to be done on an outpatient basis, using high-tech devices to attain image assistance and robotic guidance in the surgery. The surgical teams can practice general robotic or critical surgical procedures in outpatient facilities using image-guided and robotic-assisted surgery. Therefore, outpatient facilities are expected to grow to enhance overall development and achieve better results.

Regional Insights

The North America image-guided and robot-assisted surgical procedures market dominated the global market and accounted for the largest revenue share of 50.5% in 2023. Image-guided and robot-assisted surgery procedures have become more common due to robust technological innovations in healthcare in the region's developed economy. The market is further anticipated to surge due to increased complex surgeries and trauma cases.

U.S. Image-Guided And Robot-Assisted Surgical Procedures Market Trends

The image-guided and robot-assisted surgical procedures market in the U.S. is dominated at a market share of 88.2% in 2023. The country's vital healthcare facilities and continuous research and development resulted in improved and innovative technological solutions. Furthermore, emerging technologies played crucial roles in supporting and enhancing the proficiencies of surgeons. In addition, image-guided and robot-assisted surgeries are more prevalent in the U.S. as hospital expenditure on medical equipment rises.

Asia Pacific Image-Guided And Robot-Assisted Surgical Procedures Market Trends

The Asia Pacific image-guided and robot-assisted surgical procedures market is anticipated to grow at a CAGR of 18.5% over the projected years. These treatments use robotic technology under the direction of competent surgeons to perform complicated surgical operations, and they are being used in countries such as China, Japan, India, and South Korea.

The image-guided and robot-assisted surgical procedures market in China is expected to grow significantly owing to the rising government initiatives to increase healthcare spending on medical devices and equipment, augmented with continuous innovations and investments by key companies in enhanced technology for image-guided and robot-assisted surgical procedures. Furthermore, rising rates of chronic disease and growing public awareness of the importance of early diagnosis fuel the market expansion. Therefore, image-guided and robot-assisted surgery procedures are becoming important as more practice-enhancing, low-error surgeries, and fast patient recovery periods.

Europe Image-Guided And Robot-Assisted Surgical Procedures Market Trends

Europe image-guided and robot-assisted surgical procedures market is expected to grow substantially owing to increasing investments in medical technology, which leads to enhanced surgical precision and reduced errors. In addition, the rising incidence of chronic diseases necessitates advanced surgical solutions, while the demand for minimally invasive procedures boosts market expansion. Furthermore, technological advancements, such as augmented reality integration, improve surgical outcomes.

The growth of the image-guided and robot-assisted surgical procedures market in the UK is driven by the country's strong presence in terms of technological advancements, mainly in healthcare, which leads to improved outcomes for image-guided and robot-assisted surgical procedures. Hence, with the growing personalized healthcare services, with a greater emphasis on patient care and better surgical results, there is a high demand for surgical technologies that provide accurate visualization, increased agility, and enhanced surgical precision, boosting the market for image-guided and robot-assisted surgery procedures.

Key Image-Guided And Robot-Assisted Surgical Procedures Company Insights

Some of the key companies in the image-guided and robot-assisted surgical procedures market include Crouse Health, TH Medical, St. Clair Hospital, University of Washington, Atlantic Health System, HCA Healthcare UK, Apollo Hospitals Enterprise Ltd. in the market are focusing on the development of image-guided and robot-assisted surgical procedures to gain a competitive edge in the industry.

-

Crouse Health is a not-for-profit organization based in Central New York. It is licensed for 506 acute-care adult beds and 57 bassinets. Annually, it serves over 23,000 inpatients, 56,000 emergency service visits, and over 600,000 outpatients across a 16-county region.

-

Apollo Hospitals Enterprise Ltd. operates as an integrated healthcare services provider, offering a comprehensive range of services, including hospitals, pharmacies, primary care, diagnostic clinics, and various retail health models. Additionally, it provides telemedicine services across multiple countries.

Key Image-Guided And Robot-Assisted Surgical Procedures Companies:

The following are the leading companies in the image-guided and robot-assisted surgical procedures market. These companies collectively hold the largest market share and dictate industry trends.

- Crouse Health

- TH Medical

- St. Clair Hospital

- University of Washington

- Atlantic Health System

- HCA Healthcare UK

- Apollo Hospitals Enterprise Ltd.

- Medanta The Medicity

- George Washington University Hospital

- Charité - Universitätsmedizin Berlin

Recent Developments

-

In December 2023, Crouse Health added advanced Mako SmartRobotics to their Comprehensive Robotic Surgery Program, offering Central New York to orthopedic patients the Mako robotic technology. This addition to the robotics service line showcased their dedication and consistency for continuous research and development to provide the community with enhanced, better, and comprehensive healthcare service.

Image-Guided And Robot-Assisted Surgical Procedures Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.1 billion

Revenue forecast in 2030

USD 8.9 billion

Growth rate

CAGR of 14.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specialty, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Crouse Health; TH Medical; St. Clair Hospital; University of Washington; Atlantic Health System; HCA Healthcare UK; Apollo Hospitals Enterprise Ltd.; Medanta The Medicity; George Washington University Hospital; Charité - Universitätsmedizin Berlin

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Image-Guided And Robot-Assisted Surgical Procedures Market Report Segmentation

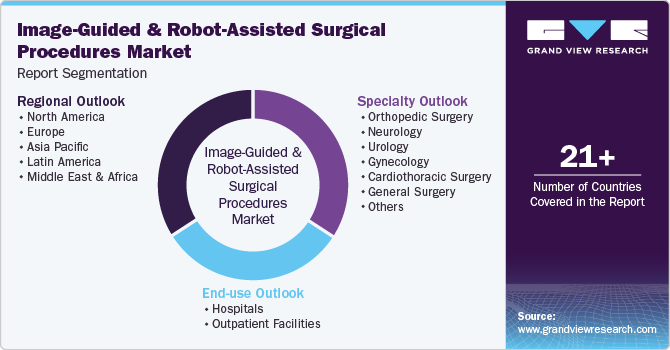

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global image-guided and robot-assisted surgical procedures market report based on specialty, end-use, and region.

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgery

-

Neurology

-

Urology

-

Gynecology

-

Cardiothoracic Surgery

-

General Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.