- Home

- »

- Medical Devices

- »

-

Iliac Stent Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Iliac Stent Market Size, Share & Trends Report]()

Iliac Stent Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Self-expandable Stents, Balloon-expandable Stents), By Artery Lesions (Common Iliac Artery Lesions, Severe Calcified Lesion), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-206-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Iliac Stent Market Size & Trends

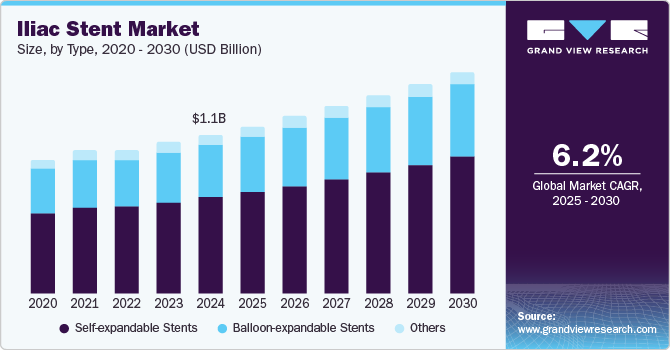

The global iliac stent market size was valued at USD 1.14 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2030. Iliac stents are small mesh tubes used to support narrowed iliac arteries. The growth of the market can be attributed to growing advancements in medical technology, increasing prevalence of peripheral artery diseases, and expanding awareness about minimally invasive procedures as an effective treatment option. According to an article published by the NCBI in March 2022, more than 2 million people in the U.S. undergo a stent procedure yearly.

The increasing prevalence of peripheral artery diseases (PAD) is expected to boost the demand for iliac stents. According to the American Heart Association, nearly 8.5 million adults, or 7% of the U.S. population, suffer from PAD. PAD narrows and blocks the arteries in peripheral vascular systems, including iliac arteries, thereby, placement of iliac stents allows to restore blood flow in those arteries. Moreover, aortoiliac occlusive disease (AIOD) is a type of PAD that affects the infrarenal aorta and iliac arteries. Similar to other conditions affecting arteries, AIOD restricts blood circulation to distant organs by restricting blood vessels or causing plaque embolization. Iliac stents are implanted to expand the narrowed or obstructed arteries, thereby reinstating normal blood flow and relieving symptoms linked to AIOD.

In addition, the growing geriatric population across the world is expected to boost the iliac stents market. According to an article by WebMD LLC, the incidence of PAD increases with advancing age, whereby nearly 25% of the U.S. population aged 70 and above is diagnosed with PAD. According to the Population Reference Bureau data, the number of Americans aged 65 is expected to increase from 58 million in 2022 to 82 million in 2050 and is projected to account for nearly 23% of the population in 2050, from 17% in 2022. Moreover, similar growth in the senior population across countries is expected to provide lucrative opportunities for the iliac stents market players.

Market Concentration & Characteristics

Technological advancements have supported new product development and aligned procedures with enhanced patency. According to an article published by the NCBI in February 2023, self-expanding covered stents provided exceptional results in the treatment of obstructive disease of the external iliac artery. Moreover, it was stated that < 8 mm-diameter stent reduces primary patency rates, with results portraying patency at 89.8% in 42 months.

The iliac stents market is characterized by a low level of M&A activities undertaken by leading players in the last three years. Several key companies undertook expansion measures in 2017 - 18 to gain entry into the iliac stents marketplace.

The iliac stents market is experiencing heightened regulatory scrutiny, with various regulatory and government authorities actively working to implement more rigorous guidelines. Stringent monitoring of the manufacturing process of iliac stents and post-marketing assessment by regulatory bodies, including the FDA, is likely to limit the market growth. For instance, in March 2022, the FDA issued a Class I product recall notice to Atrium Medical for its product, iCast Covered Stent, in the U.S. The product recall reason stated that the catheter hub separated from the delivery system, while the delivery system was removed from the person, causing fatal injuries or death.

Some of the key players in the market are focusing on introducing novel products that can cater to specific needs of patients. For instance, in August 2023, Suzhou Innomed Medical Device Co., Ltd. received approval from the China NMPA for its venous stent system indicated to be applied in the iliofemoral vein for treating non-thrombotic iliac vein compression.

Key companies in the iliac stents market are also focusing on market expansion. For instance, in November 2022, Medtronic, a key med-tech player, announced its expansionary plans in Costa Rica by allocating USD 65 million to launch a new manufacturing unit, completion of which is expected to finish by 2024.

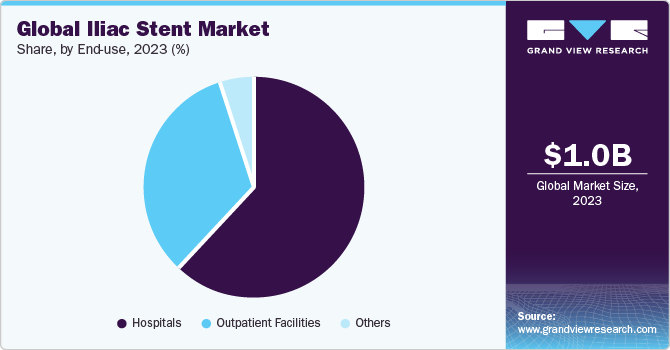

End-use Insights

Hospitals segment accounted for largest share of 61.7% of the iliac stents market in 2023. Hospitals are equipped with specialized facilities, such as cardiac catheterization labs and interventional radiology suites, where iliac stent placement is performed. According to NCBI, more than 300,000 procedures are performed in cardiac catheterization labs annually in the UK. Furthermore, patients with peripheral artery disease (PAD), including iliac artery occlusive disease, are often referred to hospitals by primary care physicians or specialists for further evaluation and treatment. Hospitals serve as referral centers where patients receive comprehensive care, including diagnostic imaging, medical management, and interventional procedures like iliac stent placement.

Outpatient facilities sector is projected to witness highest growth rate over the forecast period. Iliac stenting is performed using minimally invasive techniques such as percutaneous angioplasty and stenting, often necessitating local anesthesia and smaller incisions, which leads to reduced post-operative pain and shorter recovery time, which alleviates the procedure preference in ambulatory surgery centers or specialized clinics. Furthermore, outpatient stent placements are often cost-effective for both patients and healthcare providers compared to inpatient procedures performed in hospitals, which drives the segment demand. According to an article by Becker's Healthcare in September 2022, it was projected that by mid-2020s, ambulatory surgical centers will perform 33% of all cardiology procedures in the U.S., growing by nearly 23% from 2018.

Type Insights

Self-expandable stent segment led iliac stents market and accounted for 60.4% of global revenue in 2023. Self-expandable stents are designed to expand and hold open the narrowed or blocked iliac arteries, restoring proper blood flow to the lower extremities. This helps alleviate symptoms associated with iliac artery occlusive disease, such as leg pain, cramping, and numbness. Furthermore, self-expandable iliac stents are constructed from durable materials that help maintain the long-term patency of the treated artery. Furthermore, favorable long-term clinical study results are expected to instill confidence in healthcare providers.

Balloon-expandable stents segment is expected to witness considerable growth over forecast period. Balloon-expandable stents are positioned using angioplasty balloons, allowing for precise positioning and controlled expansion within the narrowed or blocked iliac artery. Furthermore, these stents are constructed from materials with high radial strength, such as stainless steel or cobalt-chromium alloys, which allow significant outward force against the arterial wall, effectively holding it open and resisting compression or collapse.

Artery Lesions Insights

Common iliac artery lesions segment accounted for largest revenue share of 60.5% in 2023. Common iliac artery lesions are abnormalities or conditions that affect arteries that branch off from the aorta and supply blood to the pelvis and lower limbs. Some of the common iliac artery lesions are atherosclerosis, stenosis, occlusion, aneurysm, dissection, and others. The growing cases of patients suffering from high cholesterol and obesity are expected to boost the demand for iliac stents, as these conditions cause plaque buildup, which narrows or blocks artery lumen. According to an article published by the National Institutes of Health in March 2022, nearly half of the U.S. adults aged between 45 and 84 suffer from silent atherosclerosis.

The complete obstructive lesion segment is expected to witness considerable growth over the forecast period. This lesion refers to a total blockage or occlusion of the iliac artery caused by severe atherosclerosis or the formation of a blood clot (thrombus). Iliac stents are one of the primary treatment options for such lesions, as they can effectively reopen the blocked artery and maintain long-term patency. Furthermore, the growing fatality attributed to blood clots is expected to boost the demand for iliac stents. According to the National Blood Clot Alliance, nearly 274 people die each day from blood clots.

Regional Insights

North America iliac stent market dominated the market and accounted for 43.7% share in 2023. Growth in the region is driven by a high disease prevalence, rising consumer awareness, proactive government measures, technological advancements, and improvements in healthcare infrastructure. Moreover, presence of major companies involved in manufacturing iliac stents, such as Abbott, Medtronic, and W. L. Gore & Associates, is anticipated to drive market growth.

U.S. Iliac Stent Market Trends

The iliac stents market in the U.S. held the largest share in 2023. The increasing awareness about the disease, rising R&D for novel therapeutics, and growing prevalence of artery diseases are some of the key factors propelling market growth. According to the CDC, coronary artery disease accounts for 25% or 610,000 deaths annually in the U.S.

Europe Iliac Stent Market Trends

Europe's iliac stent market is the second largest market in 2023. Peripheral arterial disease (PAD) is one of the most common conditions in Europe. According to an article published by the NCBI in 2021 - 22, the prevalence of PAD was estimated at 17.8% in the population aged between 45 and 55. In addition, other multicenter studies from the Northern Europe region have stated that the prevalence of PAD was extremely high in the elderly.

The iliac stent market in the UK is estimated to grow at a significant CAGR over the forecast period. Demand for iliac stents in the UK continues to rise due to aging populations and increasing prevalence of peripheral artery disease. According to the Center for Ageing Better, nearly 19% or 11 million people in England were aged 65 and over. Technological advancements and favorable reimbursement policies are also driving market growth.

France iliac stent market is expected to grow over the forecast period. Growth is primarily driven by advancements in medical technology and a surge in vascular interventions. Increasing adoption of endovascular procedures and government initiatives also support market development. According to an article by the European Journal of Vascular & Endovascular Surgery in 2022, steady growth was seen in the French region for ambulatory endovascular revascularization procedures between 2015 & 2019, with authors projecting growth in the forthcoming years.

The iliac stent market in Germany held the largest share of the Europe market and is mainly driven by the growing preference for minimally invasive procedures. Furthermore, favorable healthcare infrastructure, enhanced insurance coverage, and rising awareness of peripheral artery disease contribute to market expansion. According to the IGES Institute, nearly 73.2 million Germans are covered by statutory health insurance.

Asia Pacific Iliac Stent Market Trends

Asia Pacific iliac stent market is anticipated to witness significant growth during the forecast period. Growing regulatory practices in third-world countries, increasing cardiovascular disease burden across growing economies such as India and China, and increasing geriatric population in developed countries are key factors driving the iliac stents market in this region.

The iliac stent market in China is estimated to grow at a significant CAGR over the forecast period. The changing regulatory framework is expected to propel product launches, positively impacting market growth. For instance, in January 2024, Zylox-Tonbridge Medical Technology Co., Ltd. received marketing approval from the National Medical Products Administration (NMPA) for its peripheral venous stent system.

Japan iliac stent market is expected to grow over the forecast period due to an increase in the geriatric population prone to peripheral diseases. Moreover, presence of key players such as Terumo Corporation is expected to drive growth in the country. However, factors such as the absence of national health insurance coverage for venous stenting and hindered macroeconomic activities are expected to restrain growth in the forecast period.

Latin America Iliac Stents Market Trends

The iliac stents market in Latin America is estimated to grow over the coming years owing to increasing government spending, the presence of skilled healthcare professionals, growing focus by multinational pharmaceutical companies on untapped markets, and rising patient awareness.

Brazil iliac stents market is expected to grow at a significant growth rate over the forecast period due to positive economic growth following financial and political stability in the country. In addition, the Brazilian government states the per capita healthcare spending to increase from USD 848 in 2020 to USD 1,165 in 2030.

MEA Iliac Stents Market Trends

The iliac stents market in MEA is growing due to the high economic development and improved healthcare facilities. Economic development and the presence of high unmet medical needs in emerging economies, such as South Africa, are primary factors driving market growth.

Saudi Arabia iliac stents market is expected to grow at a lucrative rate over the forecast period. High unmet clinical needs, rising disposable income, and increasing prevalence of peripheral artery disease (PAD) are expected to create opportunities for market growth in Saudi Arabia. According to an article by the MDPI in 2021 - 22, prevalence of PAD was estimated at 12% in the country.

Key Iliac Stent Company Insights

Some of the key established players operating in iliac stents market include Abbott, Boston Scientific Corporation, Medtronic, W. L. Gore & Associates, Inc., Terumo Corporation, and Cook. These companies are collaborating with regional players to expand their services geographically. iVascular, Limflow, and Vesper Medical are some of the emerging market participants in the iliac stents market. Emerging players focus more on collaborating with various research institutions to improve their clinical reach across the healthcare ecosystem.

Key Iliac Stent Companies:

The following are the leading companies in the iliac stents market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Abbott

- Boston Scientific Corporation

- W. L. Gore & Associates, Inc.

- Medtronic

- Cook

- Terumo Corporation

- iVascular

- Getinge AB

- Biotronik SE & Co KG

Recent Developments

-

In February 2024, W.L. Gore & Associates, Inc. received approval from the U.S. FDA for its Viabahn VBX stent graft. The product offers enhanced strength as compared to bare metal stents in treating complex iliac occlusive disease.

-

In October 2023, Getinge AB announced the commercial availability of its product, iCast covered stent system to treat iliac arterial occlusive disease in the U.S.

-

In May 2022, iVascular announced the beginning of a trial for its latest product, the advanced covered stent named iCover. This product is designated for treating de novo aortoiliac lesions in individuals experiencing symptomatic arteriopathy of the lower limbs.

Iliac Stents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.21 billion

Revenue forecast in 2030

USD 1.64 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, artery lesions, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD; Abbott; Boston Scientific Corporation; W. L. Gore & Associates, Inc.; Cook; Medtronic; iVascular; Terumo Corporation; Biotronik SE & Co KG; Getinge AB.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Iliac Stent Market Report Segmentation

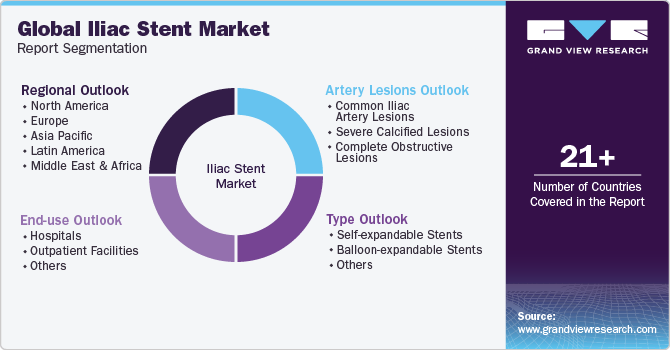

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global iliac stent market report based on type, artery lesions, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-expandable Stents

-

Balloon-expandable Stents

-

Others

-

-

Artery Lesions Outlook (Revenue, USD Million, 2018 - 2030)

-

Common Iliac Artery Lesions

-

Severe Calcified Lesions

-

Complete Obstructive Lesions

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the iliac stent market with a share of 43.7% in 2023. This can be attributed to the growing geriatric population, increasing expenditure on healthcare infrastructure, and strong reimbursement scenario in countries like the U.S. In addition, the high prevalence of peripheral arterial disease is expected to drive the market.

b. Some of the key players in the iliac stents market are Abbott, Medtronic, BD, Boston Scientific Corporation, iVascular, Terumo Corporation, W.L. Gore & Associates, Inc., Cook, Getinge AB, and Biotronik SE & Co KG.

b. Key factors that are driving the iliac stent market growth include growing advancements in medical technology, increasing prevalence of peripheral artery diseases, and expanding awareness about minimally invasive procedures as an effective treatment option.

b. The global iliac stent market size was estimated at USD 1.14 billion in 2024 and is expected to reach USD 1.64 billion in 2024

b. The global iliac stent market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 1.64 billion by 2030

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.