Ice Hockey Equipment Market Size, Share & Trends Analysis Report By Product (Protective Wear, Sticks, Skates, Other), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-995-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Ice Hockey Equipment Market Size & Trends

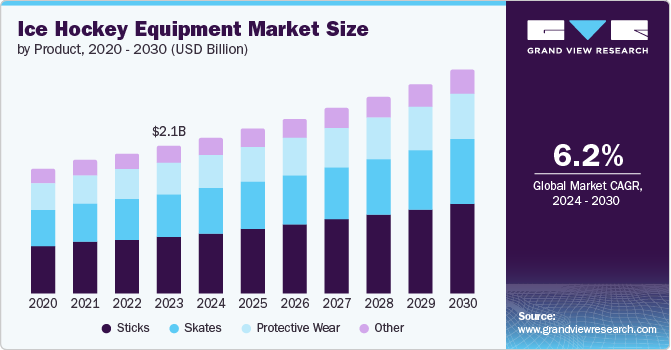

The global ice hockey equipment market size was valued at USD 2.06 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030. Ice hockey is a team sport played on a purpose-built hockey rink in an arena. A rise in the occurrence and viewership of international sporting events such as the Winter Olympics, IIHF Asia and Oceania Championship, World Championships, and Stanley Cup is expected to boost the popularity of this sport in the coming years. With celebrity endorsements and promotion by well-known players, awareness regarding ice hockey among the young generations is rapidly increasing. The easy accessibility of synthetic ice hockey arenas is expected to propel the demand for related equipment such as skates and sticks.

Traditionally originating from North America and Europe, ice hockey is rapidly gaining traction in Asia Pacific countries such as China, Japan, and Australia. Professional hockey clubs are emerging in substantial numbers, and international players are participating in these events. This has become possible owing to technological advancements in preparing artificial ice rinks. For instance, China accounts for over 100 synthetic indoor ice hockey rinks. This regional expansion, fueled by factors such as hosting international tournaments and assistance via government programs, presents significant growth opportunities for equipment manufacturers.

The International Ice Hockey Federation (IIHF) and National Hockey League (NHL) are prominent bodies responsible for governing, developing, and organizing worldwide events for ice hockey. IIHF manages worldwide hockey tournaments and has 83 member countries. The body organizes various campaigns and programs worldwide to promote ice hockey. Meanwhile, the NHL is a major professional ice hockey league in North America and comprises teams from the U.S. and Canada. NHL awards the Stanley Cup annually to the NHL playoff champion. The combined efforts of these bodies have elevated the popularity of the sport, resulting in an increasing number of ice hockey players in otherwise untapped regions, leading to growth in demand for ice hockey equipment.

Product Insights

Sticks accounted for the highest revenue share of 38.7% in 2023 in the global market. A hockey stick is essential for playing ice hockey, and its design and build material have evolved significantly over the years. For instance, wooden sticks were used by players earlier. However, they were replaced by more durable aluminum sticks. Players use sticks made from composite materials such as fiberglass, carbon fiber, and boron fiber. Although more expensive than aluminum and wood sticks, these materials give players the required strength and ease of maneuverability, owing to their lightweight nature and elastic potential energy. Since professional ice hockey players change their sticks at least twice a year, there is a steady demand for this market, particularly in Europe and North America.

Skates segment is expected to grow at a significant CAGR during the forecast period. Ice hockey skates comprise boots, laces, a blade, and a blade holder. The design and specifications of skates for players and the goalkeeper are different. Boots are made from molded plastic, giving skates the required shape and strength. Players frequently change skates as they are in continuous contact with the hard ice surface and require constant sharpening of their blades to achieve optimum speed and mobility. Additionally, as players grow in height and weight, they require new skates as their feet develop. This consistent need for upkeep and upgrades drives market demand for this segment.

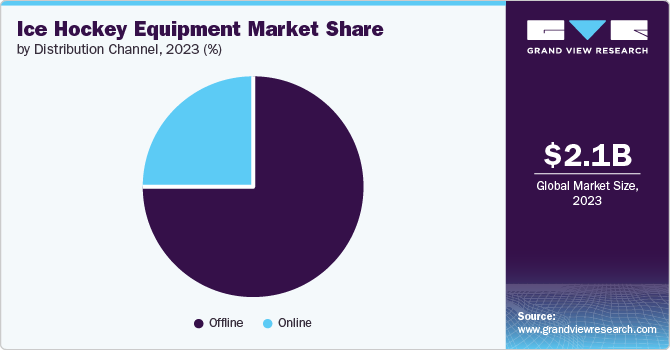

Distribution Channel Insights

Offline channels dominated the market in 2023. Ice hockey equipment, particularly protective gear, requires a proper fit for optimal performance and safety. Skates and sticks are manually prepared by skilled professionals, as per players' shape and size. Offline stores allow customer interaction with knowledgeable salespeople who can offer proper sizing and selection guidance based on individual needs. Additionally, the quality and build of ice hockey equipment are better evaluated through physical interaction in a store. Players assess factors such as weight, flex, and material composition, leading to a higher perceived value and trust in their purchase decisions. These factors allow the offline segment to dominate this market.

Meanwhile, the online segment is expected to grow at the fastest CAGR during the forecast period. This is owing to the widespread proliferation of e-commerce stores globally. One of the limitations of offline stores is that customers must travel to these stores to purchase physical products. Online stores provide ease of shopping through the comfort of home. Additionally, with advancements in technology, customers are now able to choose the accurate size of equipment using 3D and Lidar scanning on their smartphones. These developments and a wide range of products offered at competitive pricing are anticipated to drive this segment’s growth.

Regional Insights

North America accounted for the highest revenue share of 63.4% in 2023. Ice hockey enjoys immense popularity in North America, particularly in Canada, where it is considered the national sport. The U.S. and Canada have extensive league structures catering to all age groups, from youth programs to adult recreational leagues. The presence of well-established professional leagues, such as the National Hockey League (NHL) in the U.S. and Canada, increases participation from the newer generation of players. Consequently, the requirement for safety gear to avoid injuries to vital body parts while playing has led to a steady market growth in this region.

U.S. Ice Hockey Equipment Market Trends

The U.S. is expected to grow at a significant CAGR during the forecast period. Increased participation in ice hockey competitions and government initiatives to promote youth involvement in the sport are driving the domestic market growth. Additionally, the Stanley Cup is considered one of the major ice hockey events organized by the National Hockey League every year; out of 32 teams participating in the league playoff championship, 25 teams belong to the U.S. Hence, such factors fuel the country's market growth.

Europe Ice Hockey Equipment Market Trends

Europe held a significant revenue share in this market in 2023. The Champions Hockey League is a highly popular tournament with participation from over 24 teams hailing from 13 nations. Countries such as Sweden, Finland, and the Czech Republic are dominant names in this sport, consistently ranking high in international competitions. This fame and popularity of ice hockey in Europe translates to a sizeable and active participant base. From professional leagues to well-established grassroots programs, Europe witnesses a constant influx of new players, leading to a steady demand for premium equipment.

The Swedish Ice Hockey Association governs and maintains the ice hockey culture in Sweden. The Swedish team is one of the most successful ice hockey teams globally and is part of the Big Six, which has involved the dominant national teams globally since the 1950s. The country’s national ice hockey team's achievements have given rise to a passionate and active ice hockey community. Such a robust domestic market serves as a valuable testing ground for new equipment, allowing Swedish companies to refine their offerings before presenting them internationally.

Rest of the World Ice Hockey Equipment Market Trends

The popularity of ice hockey outside Europe and North America has gained traction in the past few decades. It can be attributed to international championships such as the Winter Olympics and the Ice Hockey World Championship organized by IIHF. Emerging and talented players from these regions have participated in professional leagues, fostering further popularity among native audiences. Additionally, government efforts from countries such as China, Japan, and Australia have helped boost the acceptance and popularity of this sport.

The Chinese Ice Hockey Association is the governing body for ice hockey in China. The presence of world-class teams such as HC Kunlun Red Star offers a fertile ground for budding ice hockey enthusiasts. China’s government has actively promoted winter sports, including ice hockey, to achieve its goal of engaging 300 million people in winter sports by 2022. This initiative has spurred significant investments in infrastructure, development programs, and professional leagues, which has led to increased domestic demand for ice hockey equipment.

Key Ice Hockey Equipment Company Insights

Some key companies involved in the ice hockey equipment market include Bauer Hockey (Peak Achievement Athletics Inc.); CCM Hockey (Birch Hill Equity Partners); and STX.

-

Bauer is a U.S.-based manufacturer of ice hockey equipment such as helmets, gloves, shin guards, elbow pads under protective wear, sticks, skates, and hockey gear. Vapor, Supreme, and Bauer X are some of its famous brands catering to the specific needs of professional and amateur players. The company offers backpacks and apparel required for sports as well. Bauer specialized in making skates and was the first company to incorporate blades permanently into boots.

-

CCM is a Canada-based hockey equipment company owned by Birch Hill Equity Partners. Their product range includes skates, sticks, shoulder pads, elbow pads, helmets, knee pads, netkeeper gear, throat collars, and team uniforms designed for the AHL (American Hockey League). The goalie pads offered by CCM are used in professional tournaments such as the NHL.

Key Ice Hockey Equipment Companies:

The following are the leading companies in the ice hockey equipment market. these companies collectively hold the largest market share and dictate industry trends.

- Warrior Sports (New Balance)

- Bauer Hockey (Peak Achievement Athletics Inc.)

- Sherwood (Canadian Tire Corporation)

- True Temper Sports

- CCM Hockey (Birch Hill Equity Partners)

- STX

- ROCES SPORT S.R.L

- Vaughn Hockey

- Winnwell

- GRAF SKATES AG

Recent Developments

-

In March 2024, Aetrex, which specializes in foot scanning technology, partnered with Bauer to launch Bauer Fitlabs. These advanced in-store 3D foot scanning stations will leverage Albert 2 Pro scanners from Aetrex to analyze an athlete's unique foot type and offer customized skate and orthotic recommendations for optimal performance.

-

In February 2024, CCM Hockey announced its collaboration with Scotiabank to develop and provide opportunities in women’s hockey. The efforts are targeted towards gender empowerment by working with local organizations and increasing registrations in girls’ hockey, thus making the game more accessible for girls from grassroots levels and all ages.

-

In January 2024, Arizona Coyotes, a professional ice hockey team from the U.S., launched its apparel collaboration with Bauer Hockey. The collaboration is expected to offer new apparel designs to customers and is also anticipated to connect the athletes with fans better to enjoy ice hockey and its unique styles.

Ice Hockey Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.17 billion |

|

Revenue Forecast in 2030 |

USD 3.13 billion |

|

Growth rate |

CAGR of 6.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Rest of the World |

|

Country scope |

U.S., Canada, Rest of North America, Czech Republic, Sweden, Finland, Germany, Austria, China, Japan |

|

Key companies profiled |

Bauer Hockey (Peak Achievement Athletics Inc.); CCM Hockey (Birch Hill Equity Partners); STX; Warrior Sports (New Balance); Sherwood (Canadian Tire Corporation); True Temper Sports; ROCES SPORT S.R.L; Vaughn Hockey; Winnwell; GRAF SKATES AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Ice Hockey Equipment Market Report Segmentation

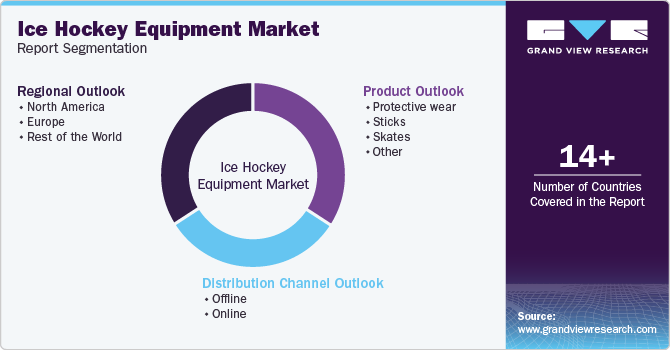

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ice hockey equipment market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protective wear

-

Sticks

-

Skates

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Czech Republic

-

Sweden

-

Finland

-

Germany

-

Austria

-

-

Rest of the World

-

Japan

-

China

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."