Hysteroscopy Instruments Market Size, Share & Trends Analysis Report By Product (Handheld Instruments, Hysteroscopes), By Usability (Reusable, Disposable), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-405-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hysteroscopy Instruments Market Trends

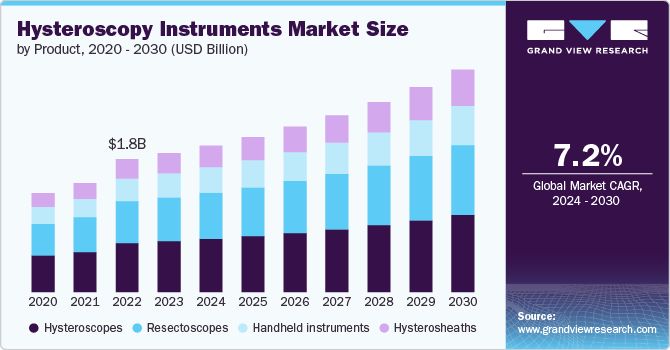

The global hysteroscopy instruments market size was estimated at USD 1.90 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. The increasing prevalence of gynecological disorders such as abnormal uterine bleeding and fibroids is boosting demand for hysteroscopic instruments. Advancements in minimally invasive surgical techniques have made hysteroscopy a preferred option, offering reduced recovery times and fewer complications.

Rising awareness, early diagnosis of gynecological conditions, and improved healthcare infrastructure, particularly in developing regions, further propel market expansion. In addition, introducing innovative instruments with enhanced visualization and precision drives adoption among healthcare providers, fueling market growth.

The increasing prevalence of gynecological disorders, including abnormal vaginal bleeding, uterine fibroids, cervical cancer, ovarian cysts, and endometriosis, is a significant driver of the hysteroscopy instruments market. Among these conditions, cervical cancer is particularly notable due to its rising incidence globally. As the fourth most common cancer in women worldwide, the prevalence of cervical cancer is increasing at an alarming rate, largely driven by factors such as obesity, which heightens the risk of developing this disease.

According to the International Agency for Research on Cancer, there were approximately 662,301 new cases of cervical cancer globally in 2022, with 348,874 deaths occurring due to this disease in the same year. This rising burden of cervical cancer is intensifying the demand for early diagnosis and treatment, which directly impacts the hysteroscopy procedures market.

Table 1 Number of new cases of cervical cancer

|

Country |

Number of New Cases, GLOBOCAN (2022) |

|

Asia |

397,082 |

|

Africa |

125,699 |

|

Latin America and the Caribbean |

63,171 |

|

Europe |

58,219 |

|

North America |

15,654 |

|

Oceania |

2,476 |

Healthcare providers are increasingly adopting advanced hysteroscopy instruments due to their precision, improved visualization, and minimally invasive nature, which enhances patient outcomes and reduces recovery times. This trend is further bolstered by advancements in technology, which have led to the development of more sophisticated and user-friendly hysteroscopy instruments, making the procedure more accessible and efficient.

According to Practical Radiation Oncology data published in April 2024, the information on vaginal dilator use during radiation therapy (RT) for anal cancer underscores the need for managing vaginal stenosis, a common side effect of pelvic radiation. As awareness grows about the importance of monitoring and maintaining vaginal health during and after RT, the demand for diagnostic and therapeutic procedures, such as hysteroscopy, increases. Hysteroscopy instruments are essential for evaluating and treating radiation-induced vaginal changes, thus driving demand in the hysteroscopy instruments market as healthcare providers seek effective tools to manage these complications.

The hysteroscopy instruments market is experiencing significant growth, driven by continuous innovation and investment in research and development by key industry players. Companies are increasingly focusing on developing minimally and non-invasive surgical instruments that meet the specific needs of healthcare providers and patients.

For instance, in June 2022, UroViu Corp introduced the Hystero-V, a single-use hysteroscope designed to integrate seamlessly with UroViu’s Always Ready endoscopy platform. This innovation eliminates the need for equipment reprocessing, significantly reducing the time and resources required for procedures. The Hystero-V is designed with ease of use, portability, and efficiency in mind, making procedures smoother and more comfortable for both medical professionals and patients.

In another example, India Medtronic Private Limited, a subsidiary of Medtronic plc, launched the TruClear system in November 2022. This advanced mechanical hysteroscopic tissue removal system is engineered to safely and effectively address intrauterine abnormalities (IUA) with minimal pain, scarring, and damage to healthy tissues. The introduction of such technologically advanced devices highlights the growing preference for minimally invasive procedures in the medical field.

The cumulative benefits offered by these innovations-such as reduced procedure times, increased safety, and improved patient outcomes-are driving the demand for hysteroscopy instruments, propelling market growth and solidifying the market's expansion.

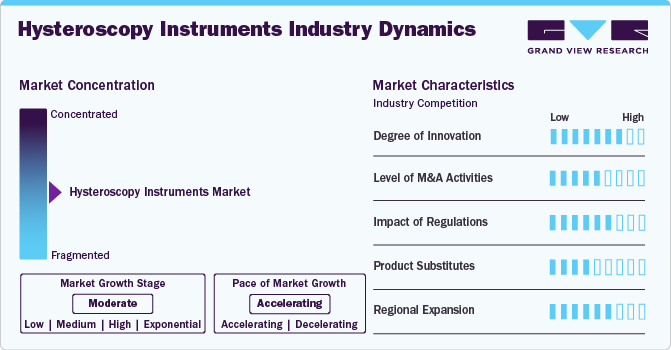

Industry Dynamics

The hysteroscopy instruments market is characterized by moderate to high industry concentration, with a few key players dominating the market. Major companies such as Medtronic, KARL STORZ, and Olympus hold significant market shares, driven by their strong R&D capabilities, extensive product portfolios, and global distribution networks. The market is competitive, with continuous innovation focused on developing advanced, minimally invasive instruments. Barriers to entry are relatively high due to the need for regulatory approvals and substantial investment in technology. The market also features strategic collaborations, mergers, and acquisitions aimed at expanding product offerings and market reach.

The hysteroscopy instruments industry is marked by a high degree of innovation, driven by the demand for minimally invasive procedures and improved patient outcomes. Companies are continually advancing technology to develop more precise, user-friendly instruments, such as single use hysteroscopes and systems with enhanced imaging capabilities. For instance, according to NewsScope data published in August 2022, the mini-resectoscope, introduced by Giampietro Gubbini in 2010 and later advanced by Karl Storz, represents a major innovation in minimally invasive gynecologic surgery. Its smaller 5mm diameter eliminates the need for cervical dilation, reducing risks such as uterine perforations. Versatile and efficient, it handles most intrauterine pathologies, though it has limitations with larger fibroids. The mini-resectoscope is particularly suited for transitioning from operating room to office-based procedures, offering a familiar tool with improved safety and efficiency.

Regulations in the hysteroscopy instruments industry significantly impact product development, safety, and market access. Strict regulatory standards from bodies such as the FDA and EMA ensure that devices meet high safety and efficacy benchmarks before approval. These regulations mandate rigorous clinical testing and compliance with manufacturing practices, influencing design and innovation. While stringent regulations help ensure patient safety and device reliability, they can also lead to higher costs and extended timeframes for product development and market entry. Companies must navigate these regulatory requirements carefully to achieve approval and successfully introduce new technologies to the market.

Mergers and acquisitions in the hysteroscopy instruments industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in February 2021, CooperSurgical, Inc. acquired AEGEA Medical. The acquisition will help the firm expand its product portfolio in relation to women's health.

In the hysteroscopy instruments industry, key product substitutes include alternatives such as ultrasound and magnetic resonance imaging (MRI) for diagnostic purposes, and endometrial ablation devices for treatment of abnormal bleeding. Ultrasound offers a non-invasive method for initial diagnostics, while MRI provides detailed imaging of the uterine cavity, albeit less frequently used than hysteroscopy. Endometrial ablation, while not a direct substitute, serves as a treatment alternative for certain conditions that hysteroscopy might diagnose or treat. These substitutes impact the market by offering different approaches to uterine pathology management, influencing the demand for hysteroscopy instruments based on clinical needs and patient preferences.

Regional expansion in the hysteroscopy instruments industry is driven by increasing healthcare investments and rising awareness of minimally invasive procedures globally. In North America and Europe, advanced healthcare infrastructure and high demand for innovative gynecological solutions fuel market growth. Meanwhile, emerging markets in Asia-Pacific and Latin America are experiencing rapid expansion due to improving healthcare facilities, rising disposable incomes, and growing patient populations. For instance, in March 2022, the Gemelli Polyclinic in Rome unveiled the world’s largest integrated hysteroscopy center. This state-of-the-art facility features advanced hysteroscopy technologies and aims to enhance diagnostic and therapeutic gynecological care. The center's establishment underscores the growing emphasis on specialized, high-quality medical environments for improved patient outcomes.

Product Insights

The hysteroscopes segment accounted for the largest market share of 36.4% in 2023, due to its critical role in diagnosing and treating various gynecological conditions. Hysteroscopes offer advanced imaging and minimally invasive options, essential for procedures such as fibroid removal, polyp detection, and endometrial biopsy. Their ability to provide direct visualization of the uterine cavity enhances diagnostic accuracy and treatment effectiveness, contributing to their widespread use. Technological advancements, such as high-definition imaging and flexible designs, further boost their adoption. As healthcare providers increasingly prioritize minimally invasive techniques for better patient outcomes, the demand for hysteroscope instruments remains strong, solidifying their dominant market position.

The hysterosheaths segment shows the fastest CAGR over the forecast period. This growth is driven by the increasing adoption of hysteroscopy procedures and advancements in sheath technology that enhance procedure safety and patient comfort. For instance, in January 2019, Hologic Inc. has introduced the Omni hysteroscope in the U.S. This versatile three-in-one modular scope features advanced visualization for diagnostic and therapeutic hysteroscopic procedures. This innovative device is suitable for use in various settings, including surgical centers, physician offices, and operating rooms. The expressions that support our sayings are,

“Featuring three easily interchangeable sheaths in one scope, our new Omni scope gives physicians excellent visualization capabilities with the convenience of seeing and treating pathology in a more streamlined procedure.”

- Edward Evantash, M.D., medical director and vice president of Global Medical Affairs at Hologic.

Hysterosheaths, which protect both the hysteroscope and the patient, are crucial for reducing risk of infection and improving the overall efficiency of minimally invasive gynecological surgeries. Innovations such as improved materials and designs that offer better visibility and ease of use contribute to their rising demand.

Usability Insights

The disposable segment accounted for the largest market share of 65.5% in 2023. This trend is driven by the growing preference for single-use devices due to their convenience, reduced risk of cross-contamination, and elimination of reprocessing costs. For instance, in July 2024, Duomed became the first company to supply PVC-free disposable bipolar forceps. This innovation highlights a commitment to environmental sustainability and patient safety by eliminating PVC, a material associated with environmental and health concerns. The new forceps combine eco-friendliness with convenience and safety in medical procedures.

Disposable hysteroscopes and related instruments offer enhanced safety and efficiency, which are crucial in maintaining high standards of hygiene in medical procedures. In addition, the increasing focus on infection control and the ease of use associated with disposable products contribute to their widespread adoption. This segment’s growth reflects a broader shift towards more practical and hygienic solutions in healthcare settings.

The reusable segment shows the fastest CAGR over the forecast period. This growth is driven by the increasing emphasis on cost-efficiency and sustainability in healthcare settings. Reusable instruments offer long-term financial benefits due to their durability and lower per-procedure cost compared to disposables. In addition, advancements in sterilization technologies and the growing focus on environmental sustainability support the rise of reusable instruments. These factors contribute to their increasing adoption as healthcare facilities seek to balance cost management with high standards of safety and efficacy in gynecological procedures.

Application Insights

The operative hysteroscopy segment accounted for the largest market share of 62.6% in 2023 and shows the fastest CAGR over the forecast period. Operative hysteroscopy allows for direct visualization and intervention within the uterine cavity, addressing conditions such as fibroids, polyps, and abnormal bleeding with precision. Its capability to combine diagnostic and therapeutic functions in one procedure enhances its appeal, driving widespread adoption. Technological advancements, such as improved imaging and instrument designs, further boost its usage. The segment's dominance reflects its significant impact on improving patient outcomes and expanding the range of treatable conditions in gynecological care.

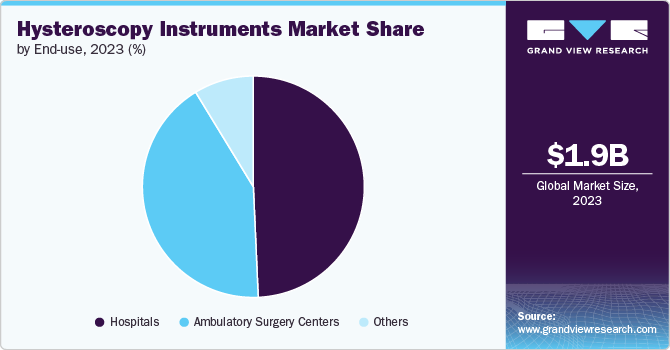

End-use Insights

The hospitals segment accounted for the largest revenue share of 49.3% in 2023 and shows the fastest CAGR over the forecast period. Hospitals are equipped with advanced facilities and a wide range of hysteroscopy instruments to handle complex cases, from diagnostics to surgeries.

The extensive use of hysteroscopic procedures for treating conditions such as fibroids, polyps, and abnormal bleeding drives significant demand for these instruments. In addition, hospitals benefit from economies of scale, investing in state-of-the-art technology and specialized staff. This concentration of resources and procedures in hospitals contributes to their dominant revenue share in the market.

Regional Insights

North America hysteroscopy instruments market dominated the overall global market and accounted for the 44.7% revenue share in 2023. The region's growth is driven by supportive government regulations and reimbursement policies, the presence of major industry players, increased product approvals and commercialization, and heightened awareness of diagnostic and treatment options. In addition, the market benefits from rising demand for minimally invasive procedures and increased investment in gynecological system R&D.

U.S. Hysteroscopy Instruments Market Trends

The hysteroscopy instruments market in the U.S. held a significant share of North America's hysteroscopy instruments market in 2023. According to Rochester Regional Health, approximately 65,000 myomectomies are conducted annually in the U.S., which is anticipated to boost market growth. In addition, the rising incidence of cervical cancer, with about 13,920 cases reported in 2022 by the International Agency for Research on Cancer, is also a significant factor driving market expansion.

Europe Hysteroscopy Instruments Market Trends

The hysteroscopy instruments market in Europe has seen significant growth due to the region's advanced technology and established infrastructure, which support numerous healthcare facilities and high-quality patient care. The rising incidence of conditions such as uterine fibroids, polyps, cervical cancer, and abnormal vaginal bleeding, coupled with an increase in surgical procedures, is driving market expansion. In addition, the presence of major industry players and the introduction of advanced products are contributing to growth. Europe's high disposable income, well-developed healthcare infrastructure, and skilled professionals further accelerate the market's development.

The UK hysteroscopy instruments market is growing due to the increasing use of procedures for treating uterine abnormalities, such as polyps, fibroids, and uterine cancer. The rising prevalence of these conditions is expected to drive market growth. In addition, increased healthcare spending may foster technological advancements in surgeries, creating growth opportunities for key players. The government's provision of free healthcare services has led to high demand for gynecological treatments. Moreover, gynecology clinics, regulated by the Human Fertilization & Embryology Authority, are increasingly using hysteroscopy in fertility treatments. The rise in couples seeking Assisted Reproduction Technology (ART) is anticipated to further boost market growth.

The hysteroscopy instruments market in France is driven by the country’s high healthcare spending, which ensures access to quality, patient-focused care. France's robust healthcare infrastructure effectively meets its citizens' needs, supported by government initiatives and improved individual lifestyles, which have led to reduced mortality rates. Technological advancements and supportive government policies are expected to further propel market growth. In addition, the rising number of surgical procedures to treat uterine fibroids is boosting the demand for hysteroscopy instruments. French guidelines recommend hysteroscopic resection for fibroids under 4 cm, particularly when fertility is a concern, contributing to the market's expansion.

The Germany hysteroscopy instruments market is experiencing notable growth, driven by the strong reputation of German manufacturers for producing high-quality medical devices. The country's rigorous quality control and strict safety regulations further enhance this reputation, earning the trust of healthcare providers and boosting sales. Germany’s healthcare system, recognized for its pioneering public health support and the oldest national social health insurance system, including schemes such as Statutory Health Insurance (SHI), is enhancing healthcare infrastructure. This support allows more people to access advanced treatments, thereby increasing the demand for hysteroscopy instruments.

Asia Pacific Hysteroscopy Instruments Market Trends

The Asia Pacific hysteroscopy instruments market is expanding due to a large patient base and increasing demand for advanced yet affordable healthcare solutions, which present significant growth opportunities. The rise in clinical trials and significant R&D investments by global companies, especially in untapped Asian markets offering low-cost services, are key drivers. In addition, the growing incidence of women’s health issues and the resulting increase in surgical procedures are boosting market growth. Emerging economies such as Singapore and South Korea are experiencing technological advancements, increased investments, better reimbursement scenarios, and a thriving medical tourism sector, all contributing to market expansion.

The hysteroscopy instruments market in Japan is set for rapid growth due to a significant rise in gynecological cancers. Ovarian cancer rates have tripled, uterine corpus cancer (mainly endometrial) has increased 15-fold, its mortality rate has tripled, and cervical intraepithelial cancer prevalence has risen tenfold. This high incidence of endometrial, uterine, and cervical cancers is expected to drive the adoption of hysteroscopy instruments in Japan.

The China hysteroscopy instruments market is growing rapidly, driven by the rising incidence of gynecological disorders and government initiatives aimed at reducing treatment risks. In addition, the ongoing development of medical infrastructure and increased investments by both government and private sectors to promote safer, cost-effective healthcare solutions are key factors fueling market expansion.

The hysteroscopy instruments market in India is growing due to the high prevalence of chronic diseases such as cervical cancer, endometriosis, and menorrhagia, along with increased government cancer screening initiatives. Cervical cancer, the most common among Indian women, accounts for 6%–29% of all female cancer cases. However, medium to high procedure costs may limit growth.

Latin America Hysteroscopy Instruments Trends

The Latin American hysteroscopy instruments market is growing due to the rising incidence of gynecological disorders and an increasing number of related surgeries. A 2022 study highlights that Cuba, Brazil, Argentina, Mexico, and Chile have the highest endometrial cancer rates in the region, driving demand for gynecological healthcare solutions and boosting the market.

The hysteroscopy instruments market in Saudi Arabia is expected to grow, fueled by rising disposable income and urbanization. Significant government investment in healthcare infrastructure, such as USD 71.0 billion over five years aligned with Vision 2030, supports this growth. In addition, the focus on minimally invasive surgeries further drives market expansion.

Key Hysteroscopy Instruments Company Insights

The competitive scenario in the hysteroscopy instruments market is highly competitive, with key players such as Stryker, Inc., Medtronic and Olympus holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Hysteroscopy Instruments Companies:

The following are the leading companies in the hysteroscopy instruments market. These companies collectively hold the largest market share and dictate industry trends.

- KARL STORZ

- Olympus

- Richard Wolf GmbH

- Stryker

- Medtronic

- B. Braun

- Cooper Surgical

- Hologic

- Medicon

- Boston Scientific

Recent Developments

-

In June 2024, Materna Medical launched a groundbreaking virtual clinical trial to evaluate the Milli Vaginal Dilator for treating vaginismus symptoms. This innovative approach allows participants to join remotely, reflecting the growing trend of virtual healthcare solutions. The trial aims to assess the effectiveness of this non-invasive treatment for improving patient outcomes.

-

In October 2023, A recent study highlighted by ASTRO reveals that sexual activity and regular vaginal dilation are linked to fewer side effects after cervical cancer treatment. Engaging in these activities helps maintain vaginal health and function, reducing complications such as vaginal stenosis, which can occur post-radiation therapy.

-

In June 2023, Olympus Corporation announced plans to establish Digital Excellence Centers (DECs) after acquiring London-based Odin Vision. Odin Vision specializes in cloud-AI endoscopy and offers a diverse portfolio of commercially available computer-aided detection/diagnostic solutions and an innovative lineup of cloud-enabled applications.

Hysteroscopy Instruments Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.00 billion |

|

Revenue forecast in 2030 |

USD 3.04 billion |

|

Growth rate |

CAGR of 7.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

KARL STORZ; Olympus; Richard Wolf GmbH; Stryker; Medtronic; B. Braun; Cooper Surgical Hologic; Medicon; Boston Scientific |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hysteroscopy Instruments Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hysteroscopy instruments market report on the basis of product, usability, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld instruments

-

Forceps

-

Scissors

-

Dilators

-

Other Handheld Instruments

-

-

Hysteroscopes

-

Rigid

-

Flexible

-

-

Resectoscopes

-

Bipolar

-

Unipolar

-

-

Hysterosheaths

-

-

Usability Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Hysteroscopy

-

Operative Hysteroscopy

-

Myomectomy

-

Polypectomy

-

Endometrial Ablation

-

Tubal Sterilization

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hysteroscopy instruments market size was estimated at USD 1.90 billion in 2023 and is expected to reach USD 2.00 billion in 2024.

b. The global hysteroscopy instruments market is expected to grow at a compound annual growth rate of 7.20% from 2024 to 2030 to reach USD 3.04 billion by 2030.

b. North America dominated the hysteroscopy instruments market with a share of 44.7% in 2023.

b. Some of the key players operating in the hysteroscopy instruments market include KARL STORZ, Olympus, Richard Wolf GmbH, Stryker, Medtronic, B. Braun, Cooper Surgical, Hologic, Medicon, and Boston Scientific.

b. Key factors that are driving the hysteroscopy instruments market growth include the increasing prevalence of gynecological disorders such as uterine abnormalities, abnormal uterine bleeding, uterine fibroids, fertility disorders, amongst other gynecological disorders.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."