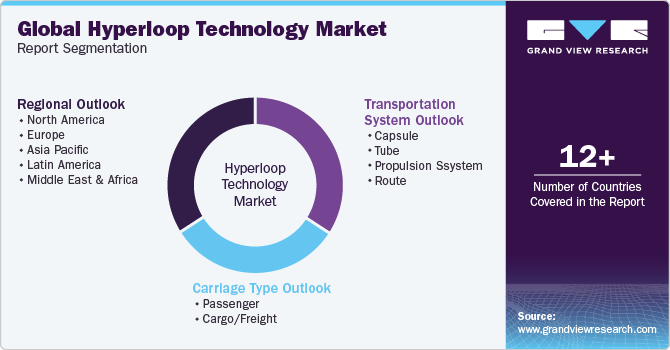

Hyperloop Technology Market Size, Share & Trends Analysis Report By Transportation System (Capsule, Tube), By Carriage Type (Passenger, Cargo/Freight), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-278-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Hyperloop Technology Market Size & Trends

The global hyperloop technology market size was estimated at USD 1.83 billion in 2023 and is expected to grow at a CAGR of 41.9% from 2024 to 2030. The increased demand for faster modes of transportation is driving the market growth. The low cost of the technology compared to other modes of transportation, as well as its energy efficiency and potential opportunity for decongestion of traffic is expected to create new growth avenues for the market.

The increasing demand for sustainable and efficient transportation solutions drives the growth of hyperloop technology. With growing concerns about climate change and urban congestion, there is a growing need for alternative modes of transportation that can reduce reliance on fossil fuels and alleviate traffic congestion. Hyperloop systems, powered by renewable energy sources and operating in low-friction environments, offer a capable solution to these challenges by providing high-speed, energy-efficient transportation with minimal environmental impact. The International Energy Agency reports that the use of biofuels in vehicles has significantly increased from less than 0.5% in 1990 to around 3.5% in 2022.

Innovation and development in materials such as carbon composites and advancements in magnetic levitation, propulsion, and control systems are making hyperloop systems more feasible and cost-effective to build and operate. The proliferation of digital modeling, simulation, and automation innovations is driving the adoption of hyperloop technology. These advancements enable design optimization, improve safety, and reduce construction and operational costs. As a result, the market is experiencing increased adoption.

Supportive government policies and initiatives aimed at fostering innovation and investments in infrastructure are driving the growth of the hyperloop technology market. Governments worldwide recognize the potential of hyperloop technology to address transportation challenges and stimulate economic growth. By providing funding, regulatory support, and incentives for hyperloop projects, governments are encouraging private sector investment and collaboration, paving the way for the development and commercialization of hyperloop systems on a global scale. For instance, in July 2023, Hardt Hyperloop, a company based in the Netherlands, received funding of over USD 13 million from a group of investment partners. The partners are the European Innovation Council (EIC) Fund, Investment Fund Groningen, and the Dutch regional investment fund InnovationQuarter. This funding enables the European Hyperloop Center (EHC) project to be completed. The project involves the development of a test vehicle for the hyperloop technology; the testing operations were planned to begin by 2024.

The high capital costs associated with building hyperloop infrastructure present a significant barrier to market entry. Constructing a hyperloop system requires substantial investments in land acquisition, tunneling, track construction, propulsion systems, passenger terminals, and other infrastructure components. The financial sustainability of hyperloop projects depends on securing funding from public and private sources and investment from infrastructure developers, transportation companies, and government agencies. However, hyperloop systems' long-term return on investment and revenue generation potential still need to be determined, particularly in comparison to existing transportation modes such as high-speed rail and air travel.

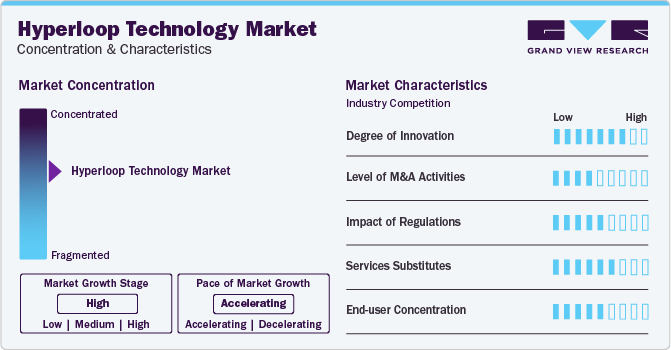

Market Concentration & Characteristics

Hyperloop technology industry growth stage is high and the pace is accelerating. The industry is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive ecosystem.

The industry is a rapidly evolving transportation industry, offering the potential for high-speed, energy-efficient transportation in vacuum-sealed tubes. Characterized by innovation, investment, and collaboration, the industry is witnessing significant advancements as companies race to develop and commercialize hyperloop systems.

The industry is also led by competition and collaboration among stakeholders, including technology firms, transportation companies, government agencies, and research institutions. This collaboration is driving innovation in engineering and design to overcome technical challenges such as propulsion, levitation, vacuum sealing, and passenger safety. For instance, in May 2023, TuTr Hyperloop, a deep technology startup nurtured by the Indian Institute of Technology Madras (IIT Madras), is teaming up with the institute to foster Intellectual Property (IP) in hyperloop technology. Additionally, the startup partnered with Tata Steel to develop the advancement and widespread implementation of hyperloop technology. The objective of this collaboration is to chart out a roadmap leading to the establishment of an operational demonstration route by 2030.

Transportation System Insights

The tube segment accounted for the largest revenue share of 37.5% in 2023. Hyperloop systems use low-pressure tubes to propel pods at high speeds through a near-vacuum environment, offering a promising alternative to traditional modes of transportation such as cars, trains, and airplanes. Hyperloop tube networks are resilient to natural disasters, extreme weather events, and other disruptions that can impact traditional transportation infrastructure. Operating in a controlled, sealed environment makes hyperloop tubes less susceptible to damage from floods, earthquakes, and hurricanes, ensuring uninterrupted service and reliable transportation in adverse conditions.

The route segment is anticipated to witness the fastest growth during the forecast period. Hyperloop routes connect cities and regions more seamlessly, adopting economic development and integration across different geographical areas. By reducing travel times between major urban centers, hyperloop routes facilitate business and leisure travel, encourage investment in underserved regions, and promote the growth of secondary cities and satellite communities along the route corridors.

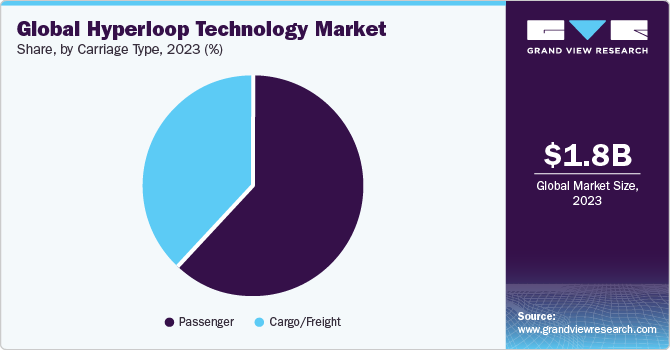

Carriage Type Insights

The passenger segment accounted for the largest revenue share in 2023 due to significant growth driven by the need for faster, more efficient, and sustainable transportation solutions in urban and intercity environments with the help of government support and technological advancement. For instance, in January 2024, ArcelorMittal announced a partnership with the Indian Institute of Technology Madras (IIT Madras) and TuTr Hyperloop, a start-up associated with IIT Madras. The teams are currently developing economical hyperloop technologies that will be used for cargo and passenger transportation on a large scale.

The carriage/freight segment is anticipated to witness the fastest growth during the forecast period. As global trade and e-commerce continue to expand, there is a growing demand for faster and more cost-effective logistics solutions to move goods across long distances. Various companies and research institutions are actively working on designing, testing, and implementing hyperloop prototypes and infrastructure components.

Regional Insights

North America dominated the market with a share of 36.2% in 2023 due to the increasing demand for sustainable transportation solutions. The growing awareness of climate change and environmental impacts has fueled demand for hyperloop technology to reduce carbon emissions and promote eco-friendly travel. For instance, in October 2023, HyperloopTT, a US-based transportation and technology licensing company, launched plans to develop HyperloopTT Express Freight. This new freight transport capsule system aims to improve shipping with its speed, sustainability, and efficiency. The system was designed in collaboration with Tangerine, a transportation design consultancy that delivers product innovation.

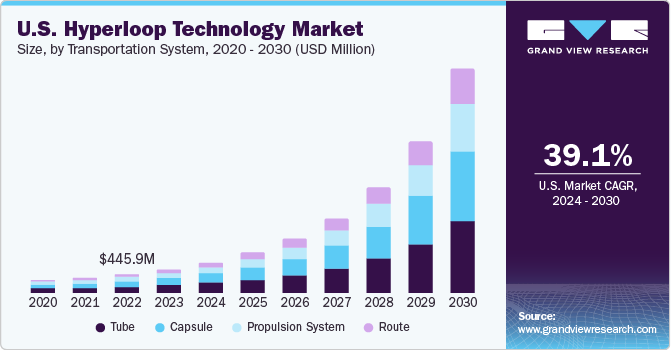

U.S. Hyperloop Technology Market Trends

The U.S. accounted for 30.5% of the global market in 2023. Increasing demand for sustainable and efficient transportation solutions fuels the expansion of the market. With growing concerns about environmental sustainability, congestion, and the limitations of traditional modes of transportation, there is a growing demand for transformative alternatives. Hyperloop technology significantly reduces carbon emissions, alleviates traffic congestion, and enhances overall transportation efficiency by providing ultra-fast, energy-efficient, and low-impact transit options.

Asia Pacific Hyperloop Technology Market Trends

The Asia Pacific region is anticipated to witness the fastest CAGR during the forecast period. The region is prone to natural disasters such as earthquakes, typhoons, and floods, disrupting traditional transportation infrastructure and hindering emergency response efforts. With its elevated and enclosed infrastructure design, Hyperloop technology offers inherent resilience to natural disasters and extreme weather events, making it a more reliable transportation option in disaster-prone regions. Additionally, the energy-efficient and low-impact nature of Hyperloop systems aligns with efforts to mitigate climate change and reduce carbon emissions, contributing to the region's broader sustainability goals and resilience strategies.

The hyperloop technology market in China is expected to grow over the forecast period. The increasing emphasis on smart city development and digital transformation initiatives in the country creates opportunities to integrate hyperloop technology into broader urban mobility ecosystems. Governments are implementing innovative solutions to address urban mobility challenges and enhance the efficiency and sustainability of transportation networks. Hyperloop systems offer a holistic approach to urban mobility that aligns with the vision of smart and connected cities in China.

The India hyperloop technology market is expected to witness significant regional growth over the forecast period. The strategic importance of hyperloop technology in enhancing connectivity and promoting regional development is driving investment in India. Hyperloop systems connect major cities and economic centers across the country, facilitating the movement of goods, people, and services with unprecedented speed and efficiency. This connectivity offers new opportunities for trade, commerce, and investment, driving economic development in both urban and rural areas. Moreover, hyperloop technology bridges the gap between India's urban centers and peripheral regions, promoting balanced regional development and inclusive growth.

Middle East & Africa Hyperloop Technology Market Trends

The market in Middle East & Africa is expected to witness significant growth during the forecast period due to government initiatives and investments to support the development of hyperloop technology. For instance, in October 2021, DP World, a Dubai-based hyperloop technology company announced the launch of cargo transport between Dubai and Abu Dhabi in minutes. Virgin Hyperloop has advanced its cargo delivery launch plans by five years, aiming to launch commercially by the mid-decade and reduce travel times from over an hour to 12 minutes.

Key Hyperloop Technology Company Insights

Some of the key players operating in the market includeHardt B.V., HyperloopTT, and TRANSPOD.

-

Hardt B.V. is a European hyperloop technology company with testing facilities in the Netherlands and a key player in the creation of the European Hyperloop Center, collaborating with regulatory bodies to commercialize hyperloop technology globally.

-

HyperloopTT is a U.S.-based company that specializes in the development of hyperloop systems. The company's mission revolves around establishing a safe, sustainable, and efficient means of moving passengers and goods.

-

TRANSPOD is a Canada-based company specializing in advancing ultra-high-speed ground transportation systems catering to the transportation sector. At its core is the Transpod system, a sustainable and cost-effective solution aimed at interconnecting cities while diminishing dependency on fossil fuels.

Key Hyperloop Technology Companies:

The following are the leading companies in the hyperloop technology market. These companies collectively hold the largest market share and dictate industry trends.

- Hardt B.V.

- Hyper Chariot

- HyperloopTT

- Space Exploration Technologies Corporation

- TRANSPOD

- TUM Hyperloop

- Zeleros

Recent Developments

-

In January 2024, Hyperloop Transportation Technologies (HyperloopTT), strengthened the joint venture between two Italian industrial firms, Webuild and Leonardo, by becoming their technology provider. This strategic move aimed to develop the world's inaugural commercial hyperloop system within Italy.

-

In February 2023, The Hyperloop Association was formed, consisting of seven leading hyperloop companies, including Hardt, Hyperloop Transportation Technologies, Swisspod Technologies, Hyperloop One, Nevomo, TransPod, and Zeleros. This new high-speed transportation system association aimed to significantly reduce journey times and be more energy-efficient and sustainable than the current mode of mass transportation.

Hyperloop Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.38 billion |

|

Revenue forecast in 2030 |

USD 19.42 billion |

|

Growth rate |

CAGR of 41.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Transportation system, carriage type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Hardt B.V.; Hyper Chariot; HyperloopTT; Space Exploration Technologies Corporation; TRANSPOD; TUM Hyperloop; Zeleros |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hyperloop Technology Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hyperloop technologymarketreport based on transportation system, carriage type, and region:

-

Transportation System Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsule

-

Tube

-

Propulsion System

-

Route

-

-

Carriage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger

-

Cargo/Freight

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hyperloop technology market size was estimated at USD 1.83 billion in 2023 and is expected to reach USD 2.38 billion in 2024

b. The global hyperloop technology market is expected to grow at a compound annual growth rate of 41.9% from 2023 to 2030 to reach USD 19.42 billion by 2030

b. North America dominated the hyperloop technology market with a share of 36.2% in 2023, owing to increasing demand for sustainable transportation solutions. The growing awareness of climate change and environmental impacts has fueled demand for hyperloop technology as a means to reduce carbon emissions and promote eco-friendly travel.

b. Some key players operating in the hyperloop technology market include Hardt B.V., Hyper Chariot, HyperloopTT, Space Exploration Technologies Corporation, TRANSPOD, TUM Hyperloop, Zeleros

b. Factors such as the demand for high-speed transportation solutions to alleviate urban congestion and enhance connectivity and the growing focus on efficient, eco-friendly transportation infrastructure

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."