Hyperconnectivity Market Size, Share & Trends Analysis Report By Component (Software, Services), By Product (Cloud Platforms, Middleware Software), By Organization Size, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-011-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Hyperconnectivity Market Size & Trends

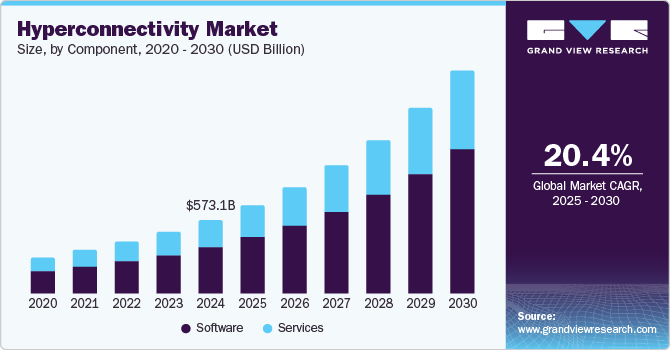

The global hyperconnectivity market size was estimated at USD 573.06 billion in 2024 and is projected to grow at a CAGR of 20.4% from 2025 to 2030. The development of smart cities, homes, and workplaces is leading to widespread connectivity, driving the creation of innovative business models, products, technologies, platforms, and services. Advancements largely influence this growing trend toward connected living in content streaming, sophisticated software, and integrated networks. The increasing demand for these technologies, along with progress in areas such as the Internet of Things (IoT), cloud services, mobility, and artificial intelligence (AI), is propelling market expansion.

A more digital and connected world is changing how applications work in offices, homes, cities, and industries like healthcare and automotive. Consumers now expect a seamless, personalized, and cohesive experience, which can only be delivered when connected devices, data streams, and networks operate in complete synchronization. Achieving this level of hyperconnectivity is a significant challenge for companies, as it demands a culture of continuous innovation, active engagement, and a commitment to creativity. This growing complexity is driving the need for hyperconnectivity solutions, not just among large enterprises but also across small and medium-sized businesses (SMEs) as they strive to meet these rising expectations.

As digitalization continues to expand, the demand for stronger cybersecurity measures is becoming increasingly crucial. With the rise of interconnected devices, data breaches, and cyber threats are more prevalent, making it essential for businesses and individuals to prioritize data protection. Advanced cybersecurity technologies are being developed to safeguard sensitive information, ensure privacy, and maintain trust in digital platforms. These innovations include enhanced encryption, AI-driven threat detection, and real-time monitoring systems. The evolving nature of cyberattacks also calls for continuous adaptation, requiring companies to stay ahead of emerging threats. As a result, cybersecurity has become a top priority across industries, driving investments in more robust, scalable, and resilient security solutions.

Component Insights

The software segment held the dominant revenue share of 62.2% in 2024. The software segment dominates because it provides the essential tools for managing and integrating the vast networks of connected devices and systems. Software solutions enable seamless communication, data exchange, and synchronization across different platforms, which are critical for creating a hyperconnected environment. These platforms offer scalability and flexibility, allowing businesses to adapt quickly to growing connectivity demands. Moreover, software helps manage complex data flows and ensures that devices operate in harmony, enhancing the overall user experience. The need for sophisticated software to support hyperconnectivity is driving its dominance in this market.

The services segment is providing substantial benefits to the market by facilitating the integration and management of interconnected systems. As organizations seek to optimize their operations, the demand for consulting, system integration, and managed services is increasing. These services help businesses navigate the complexities of hyperconnectivity, ensuring that various technologies work seamlessly together. By utilizing expert guidance and customized solutions, organizations can enhance efficiency, improve customer experiences, and drive innovation. As a result, the services segment is becoming a vital component in maximizing the potential of hyperconnectivity across various industries.

Product Insights

The cloud platforms segment held the dominant revenue share in 2024. This dominant share is due to the ability cloud platforms to provide scalable, flexible, and cost-effective solutions. Cloud platforms enable businesses to manage vast amounts of data, connect multiple devices, and facilitate real-time communication across different locations. Their on-demand nature allows companies to scale their operations quickly and efficiently, meeting the growing demands of hyperconnectivity without investing heavily in physical infrastructure. Moreover, cloud platforms offer enhanced security features and seamless integration with other technologies, making them a preferred choice for businesses looking to streamline connectivity. The rising adoption of cloud services across industries has further solidified the dominance of this segment in the market.

The middleware software segment is anticipated to experience significant CAGR over the forecast period. Middleware acts as a bridge between different software applications, enabling seamless communication and data exchange among diverse systems and devices. As organizations increasingly adopt complex architectures with multiple interconnected components, the need for effective middleware solutions becomes critical. These solutions facilitate integration, streamline processes, and enhance interoperability, which is essential for achieving the benefits of hyperconnectivity. Furthermore, the growing demand for real-time data processing and analytics in various applications is driving the adoption of middleware software, making it a vital component in the hyperconnectivity ecosystem.

Organization Size Insights

The large enterprises segment held the dominant revenue share in 2024. This large share is attributed to their substantial investments in technology and infrastructure. These organizations often require advanced solutions to manage complex networks and large volumes of data generated by interconnected systems. Large enterprises typically have the resources to implement comprehensive hyperconnectivity strategies, which include adopting cloud services, middleware, and advanced security measures. Moreover, they benefit from economies of scale, allowing them to leverage connectivity to enhance efficiency, improve decision-making, and drive innovation. As a result, the growing trend of digital transformation among large enterprises is solidifying their dominance in the market.

The small and medium enterprises (SMEs) segment is anticipated to witness notable growth in the market over the forecast period. As digital transformation becomes increasingly essential, SMEs are recognizing the value of interconnected systems to enhance operational efficiency and customer engagement. With limited resources, these businesses often seek cost-effective solutions that offer scalability and flexibility, making cloud-based services and middleware attractive options. Moreover, the rise of affordable technologies has empowered SMEs to adopt hyperconnectivity solutions that were previously accessible only to larger organizations. This growing adoption is enabling SMEs to compete more effectively in the digital sector, driving their increasing presence in the market.

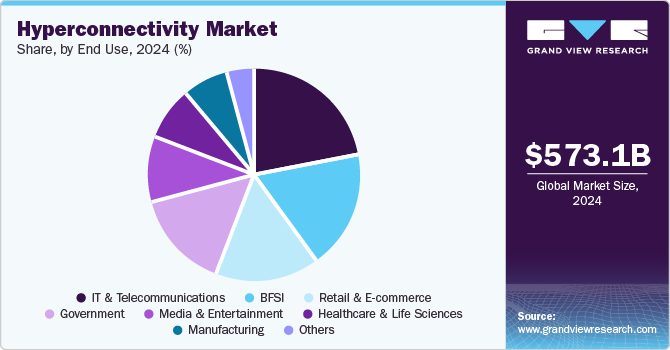

End Use Insights

The IT & Telecommunications segment held the dominant revenue share in 2024 due to its foundational role in enabling connectivity and communication across various platforms. This industry provides the infrastructure and technologies necessary for seamless data exchange and real-time interactions among connected devices. As organizations increasingly rely on digital solutions, IT and telecommunications, firms are pivotal in developing and implementing the tools needed for effective hyperconnectivity. Moreover, advancements in networking technologies, such as 5G and cloud services, have further propelled the growth of this segment. Consequently, the ongoing demand for enhanced connectivity solutions ensures that IT and telecommunications remain at the forefront of the market.

The healthcare and life sciences sector is also significantly influencing the market. This industry benefits from advanced connectivity solutions that enhance patient care, streamline operations, and facilitate data sharing among various stakeholders. With the rise of telemedicine, wearable devices, and electronic health records, the need for seamless communication and integration of systems has become increasingly important. Hyperconnectivity allows for real-time monitoring of patient health and improved collaboration among healthcare providers, ultimately leading to better outcomes. As technology continues to advance, the demand for hyperconnectivity solutions within healthcare and life sciences is expected to grow substantially.

Regional Insights

The North America hyperconnectivity market dominated the globally in terms of revenue share of 40.5% in 2024. The North American market is driven by its advanced technological infrastructure and high adoption rates of digital solutions. The region benefits from a well-established ecosystem of technology providers and a diverse range of industries embracing hyperconnectivity. Moreover, the North American government’s support for digital transformation initiatives encourages investment in connected systems and solutions. The strong focus on cybersecurity within the region also plays a crucial role in ensuring the safe integration of hyperconnected environments.

U.S. Hyperconnectivity Market Trends

The hyperconnectivity market in the U.S is significantly influenced by the concentration of leading technology companies and startups. This concentration fosters innovation and development in hyperconnectivity technologies, setting trends that are often emulated globally. Moreover, the U.S. government actively promotes digital initiatives, which further accelerates investment in connected solutions. The country's advanced research and development capabilities also contribute to breakthroughs in hyperconnectivity applications across various sectors.

Europe Hyperconnectivity Market Trends

Europe hyperconnectivity market is witnessing substantial growth, fueled by a strong emphasis on digital transformation and smart city initiatives. The European Union's regulatory framework promotes the adoption of innovative technologies, which encourages businesses to integrate hyperconnected solutions. Countries such as Germany, France, and the UK are at the forefront, investing in advanced connectivity infrastructure and IoT applications. Moreover, the region's focus on sustainability and energy efficiency drives demand for smart solutions that leverage hyperconnectivity.

Asia Pacific Hyperconnectivity Market Trends

The hyperconnectivity market in Asia-Pacific is rapidly emerging as a key player, primarily due to the region's growing population and increasing smartphone penetration. Countries such as China, India, and Japan are investing heavily in digital infrastructure and IoT technologies, driving the demand for hyperconnected solutions. The rapid urbanization in Asia-Pacific cities creates opportunities for smart city projects that rely on advanced connectivity. Moreover, the rise of e-commerce and digital services in this region encourages businesses to adopt hyperconnectivity to improve operational efficiency.

Key Hyperconnectivity Company Insights

Some of the key companies in the market include IBM Corporation, Microsoft, Oracle Corporation, Orange IT solutions, PathPartner Technology, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Microsoft has advanced hyperconnectivity through its cloud computing platform, Azure, which enables seamless integration of services and applications. The company promotes collaboration with tools such as Microsoft Teams, enabling users to connect in real-time across various devices. Microsoft enhances data connectivity and insights through the use of artificial intelligence and machine learning, leading to more efficient decision-making processes. Moreover, its focus on security and compliance ensures that users can confidently engage in hyperconnected environments.

-

Broadcom Inc. has made significant strides in hyperconnectivity by providing a wide range of semiconductor and infrastructure software solutions that enhance network performance. The company’s innovations in chip technology enable faster and more reliable communication across various devices and platforms. By focusing on advanced networking and connectivity solutions, Broadcom supports the growing demand for data centers and cloud services. These developments facilitate seamless connectivity for businesses and consumers, promoting a more integrated digital ecosystem.

Key Hyperconnectivity Companies:

The following are the leading companies in the hyperconnectivity market. These companies collectively hold the largest market share and dictate industry trends.

- Avaya

- Extreme Networks

- Fujitsu Limited

- Iberdrola SA

- IBM Corporation

- Microsoft

- Oracle Corporation

- Orange IT solutions

- PathPartner Technology

- Broadcom Inc.

- Samsung Electronics Co., Ltd.

Recent Developments

-

In July 2024, Oracle Corporation collaborated with Google LLC to introduce the Oracle Interconnect for Google Cloud Platform (GCP), providing a dedicated, low-latency private connection between Google Cloud and Oracle Cloud Infrastructure. This integrated service enables customers to run mission-critical workloads, access best-in-class services from both providers, and benefit from features such as high bandwidth, on-demand provisioning, and a collaborative support model, all without incurring cross-cloud data transfer charges.

-

In May 2024, Broadcom partnered with Dell Technologies, a U.S.-based software company, to develop scalable, interconnected enterprise AI solutions, focusing on custom accelerators and robust networking technologies. This collaboration aims to handle massive AI workloads by enhancing connectivity across data centers, ensuring efficiency and performance for next-gen AI applications.

-

In March 2024, Samsung launched its connected lifestyle experience store, Samsung BKC, in Mumbai, highlighting AI and hyperconnectivity for tech-savvy Indian consumers. The store enables visitors to explore the latest AI innovations across various products, including televisions, digital appliances, and smartphones, all designed to enhance the connected experience.

-

In October 2023, Microsoft has collaborated with Tietoevry, a software company in Finland, to enhance cloud transformation for enterprises and public sector organizations in the Nordic region. This collaboration aims to combine Microsoft’s Azure cloud platform with Tietoevry’s industry expertise to develop innovative solutions and services that use artificial intelligence and advanced data analytics.

-

In May 2023, Oracle Corporation announced partnerships with e&, A UAE-based telecommunications and technology company. This partnership aims to expand its cloud footprint to OCI, modernizing applications through Oracle Fusion Cloud HCM to support business growth in a world defined by hyper-connectivity and digitalization.

Hyperconnectivity Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 688.76 billion |

|

Revenue forecast in 2030 |

USD 1,742.09 billion |

|

Growth rate |

CAGR of 20.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Component, product, organization size, end use, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil, Australia, South Korea, KSA, UAE, South Africa |

|

Key companies profiled |

Avaya, Extreme Networks, Fujitsu Limited, Iberdrola SA, IBM Corporation, Microsoft, Oracle Corporation, Orange IT Solutions, PathPartner Technology, Broadcom Inc., Samsung Electronics Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hyperconnectivity Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hyperconnectivity market report based on component, product, organization size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprise Wearable Devices

-

Middleware Software

-

Cloud Platforms

-

Business Solutions

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare & Life Sciences

-

IT & Telecommunications

-

Government

-

Manufacturing

-

Retail & E-commerce

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hyperconnectivity market size was estimated at USD 573.1 billion in 2024 and is expected to reach USD 688.8 billion in 2025.

b. The global hyperconnectivity market is expected to grow at a compound annual growth rate of 20.4% from 2025 to 2030 to reach USD 1,742.1 billion by 2030.

b. North America dominated the hyperconnectivity market with a share of 40.5% in 2024. This is attributable to its advanced technological infrastructure and widespread adoption of digital transformation initiatives.

b. Some key players operating in the hyperconnectivity market include Avaya, Extreme Networks, Fujitsu Limited, Iberdrola SA, IBM Corporation, Microsoft, Oracle Corporation, Orange IT Solutions, PathPartner Technology, Broadcom Inc., Samsung Electronics Co., Ltd.

b. Key factors that are driving the market growth include increasing demand for seamless connectivity, advancements in IoT and 5G technologies, rising adoption of smart devices, and growing investments in communication infrastructure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."