Hyper-converged Infrastructure Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-035-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

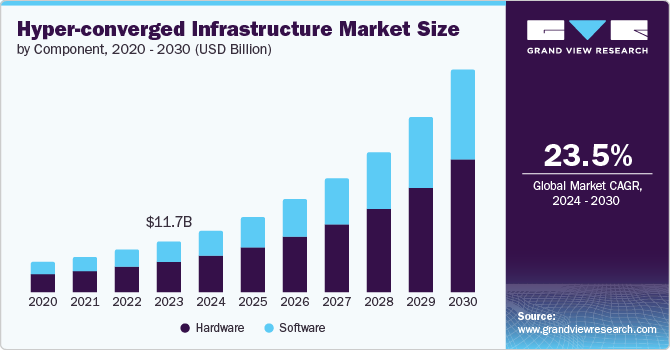

The global hyper-converged infrastructure market size was valued at USD 11.69 billion in 2023 and is projected to grow at a CAGR of 23.5% from 2024 to 2030. Some of the key growth drivers for this market are rising awareness about the benefits associated hyper-converged infrastructure (HCI), enhanced disaster recovery assistance provided by the HCI, and growing digital transformation activities in application industries such as retail and healthcare. Additionally, the increasing need for disaster recovery and data security in the IT and telecommunication industries has driven market growth.

Hyper-converged Infrastructure (HCI) decreases the need for extensive IT server and storage management resources. . HCI has assisted oragnisations in reducing the capital and operational expenses through combining storage, computing and networking resources into single infrastructure. Data transfer and installation of hybrid cloud is simplified with HCI solution. Increasing adoption of data virtualization due to remote work culture has contributed for the rising demand of HCI solutions in recent years

Data center virtualization and consolidation of separate infrastructural components is crucial for organizations willing to streamline the IT infrastructure and reduced expenses. Hyper-converged infrastructure has helped organizations to merge various components into one system for simplified data center management. HCI combines virtualization technologies to optimize the allocation and utilization of computing resources, resulting in enhanced performance and decreased hardware usage. HCI's scalability and flexibility has made it a perfect fit for data center consolidation and virtualization projects. These aspects are expected to fuel growth for this market in approaching years.

Component Insights & Trends

Hardware segment dominated the market and accounted for a share of 62.9% in 2023. Hardware-based HCL provides increased levels of integration and optimization, leading to significant improvements in crucial areas such as data transfers between storage and CPU. It is optimal when high performance is crucial for tasks such as real-time data analysis and when business requires hardware modularity and scalability. For instance, hardware HCI allows a company to effortlessly incorporate new HCI devices without worrying about compatibility and support for management software. Some of the instances of hardware-based HCI are the Dell EMC VxRack System Flex and the HPE SimpliVity 380 and 2600 platforms.

Software segment is expected to experience the fastest CAGR during the forecast period. The software method allows a company to experience HCI advantages without requiring significant hardware expenditures. Various vendors offer HCI softwares, such as VMware vSAN and VMware HCI software; Nutanix Acropolis, with the AHV virtualization platform; Microsoft's Azure Stack, the on-premises Azure version; and also OpenStack. These innovations in software-based HCL are contributing towards market growth.

Enterprise Size Insights & Trends

Large enterprises segment accounted for the largest revenue share in 2023. This is attributable to the growing focus on enhancing operational effectiveness and strengthening backup and disaster recovery efforts by large organizations. Additionally, growing acceptance of remote work culture is encouraging organisations to adopt Virtual Desktop Infrastructure (VDI), and setting up a private cloud structure, due to which the demand for HCI has increased. Moreover, utilizing cloud infrastructure services such as services over the internet is gaining popularity among large organizations.

Small and Medium Sized Enterprises (SMEs) segment is expected to register the fastest CAGR from 2024 to 2030. According to National Action Plans on Business and Human Rights information managed by Danish Institute for Human Rights (DIHR), approximately 400 million SMEs are operating around the world as backbone of multiple economies, while contributing to more than 60% of the overall employment. Small businesses opt to enhance operational effectiveness, deploy significant infrastructure, boost Remote Branch Office/Office (ROBO) IT effectiveness/service, and ramp up server virtualization. The expected increase in demand for hyper-converged infrastructure is believed to be driven by the benefits it offers to enterprises during the forecast period.

Application Insights & Trends

Virtualizing critical applications segment accounted for the largest revenue share in 2023. This is attributed to the advantages provided by virtualization such as it enabling users to operate various operating systems at the same time and offering portability and compatibility with multiple operating systems. Virtualizing critical applications on HCI provides an advantage to keep critical applications accessible even during the disaster recovery.

Virtual Desktop Infrastructure (VDI) segment is projected to experience the fastest CAGR during the forecast period. This is attributed to the modern trends such as Bring Your Device (BYOD), and the increase in remote or work from home profiles. With global and regional expansion, frequent business travels by executives and decision makers, growing collaborations and shared technology know-hows are generating greater demand for this segment.

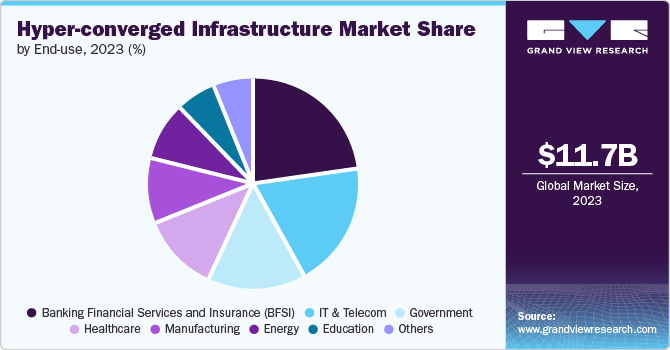

End-use Insights & Trends

The Banking Financial Services and Insurance (BFSI) segment dominated the market in 2023. The key driving factor is the increasing need for storing and safeguarding data in this industry. The pandemic has sparked an acceleration of digitization efforts in the banking and finance industry, which were already gaining momentum. Banks and other financial institutions are constantly adopting the latest hyper-converged infrastructure to support increased workloads from remote transactions. Banks are inclined towards reassessing their offerings because of the increasing demand for digital banking services and the decreasing interest rates.

Education segment is projected to grow at the fastest CAGR over the forecast period. The adoption of HCI in education has assisted institutes and organisations in numerous functions such as disaster recovery, cloud services and hardware consolidation. The cost reduction and critical application support are couple of main key driving factors fueling growth for this market. For instance, in April 2024, Macquarie University expedited its digital transformation effort with Kyndryl and Amazon Web Services (AWS) by shifting its workloads to the hybrid cloud environment.

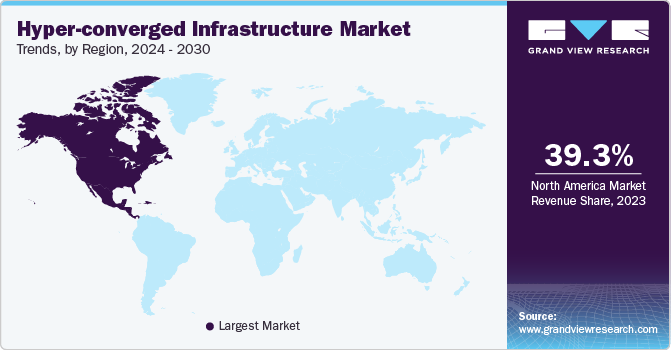

Regional Insights & Trends

North America hyper-converged infrastructure market dominated the global industry with share of 39.3% in 2023. The need for infrastructure to accommodate virtual systems has grown because of the increasing adoption of remote work culture and the enforcement of bring-your-own-device (BYOD) policies. Consequently, HCI is projected to gain a larger market share in North America owing to constant growth in a number of organisations opting to transform digitally to attain cost reduction and a hybrid cloud environment. Furthermore, the increase in use of HCI has caused a rising need for software-defined storage. Partnerships and collaborations between the key players are also playing a significant role in North America HCI market.

U.S. Hyper-converged Infrastructure Market Trends

The Hyper-converged Infrastructure market in the U.S. held largest revenue share of regional industry and accounted for 76.6% in 2023. This is attributed to factors such as growing number of businesses and institutions opting to embrace hyper-coverage infrastructure solutions, cost reductions offered by the HCI adoption, and presence of large enterprises offering HCI solutions in the domestic market.

Europe Hyper-converged Infrastructure Market Trends

The hyper-converged infrastructure market in Europe was identified as a lucrative region in this industry. Increasing investments in the establishment of data centers and digital services through transformation initiatives is driving the market growth. Businesses in the region have been focusing on initiating digital transformations to accommodate the rapid changes in work culture, types of devices used by the companies, emergence of connected devices technology and rising prevalence of remote work culture.

United Kingdom hyper-converged infrastructure market is expected to experience a noteworthy CAGR during the forecast period. This market is primarily driven by the aspects such as the large number of data centres present in the country, the growing number of businesses adopting HCI solutions to attain scalability and virtualizing critical applications, and the increased availability of HCI solutions provided by the prominent organisations operating in technology and innovation industry.

Asia Pacific Hyper-converged Infrastructure Market Trends

Asia Pacific hyper-converged infrastructure market is anticipated to witness significant growth during forecast period. This market is primarily driven by the factors such as growing awareness related to data management and disaster recovery benefits provided by the HCI solutions, rising focus on VDI and virtualization servers, and use of infrastructure-as-a-service (IaaS) solutions. China, Japan, South Korea, Singapore, and India are leading the way in promoting HCI adoption and fostering innovation.

Hyper-converged infrastructure market in China held largest revenue share of the regional industry. This is attributed to variety of factors such as rising adoption of HCI solutions by industries such as banking, IT & telecom, and healthcare, entry of multiple global companies operating in HCI solutions industry and an increase in remote work culture.

Key Hyper-converged Infrastructure Company Insights

Some of the key companies in the hyper-converged infrastructure market include Dell Inc., Nutanix, Cisco Systems, Inc., Hewlett Packard Enterprise Development LP, and others. Owing to rising number of new entrants and growing competition in the industry, key companies in this market are adopting strategies such as merger & acquisitions, technological advancements in product & services portfolio, collaborations, post-sale service assistance, geographical expansions and more.

-

Dell Inc., one of the prominent companies in technology industry, focuses on building a broad portfolio through strategic partnerships and by providing HCI solutions, worldwide. It also offers contemporary and conventional storage options such as all-flash arrays, and software-defined storage.

-

Cisco Systems, Inc., an American conglomerate operating in the digital communication technologies industry, offers technology innovations such as enterprise network security, hyper-converged infrastructure, software development, networking solutions, and so on. It combines individuals, technology, and larger networks to provide effective solutions.

Key Hyper-converged Infrastructure Companies:

The following are the leading companies in the hyper-converged infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

- Dell Inc.

- Nutanix

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- NetApp

- Broadcom

- Quantum Corporation

- Scale Computing

- Microsoft

Recent Developments

-

In May 2024, Microsoft announced investment of US$2.2 billion for period of four years in providing aid Malaysia's digital revolution including cloud and AI transformation, marking its biggest investment in the country in 32 years.

-

In November 2023, Broadcom Inc., one of the major market participants in the technology industry, acquired VMware, Inc, a prominent organization operating in virtualization technology and cloud computing.

Hyper-converged Infrastructure Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 14.04 billion |

|

Revenue forecast in 2030 |

USD 49.75 billion |

|

Growth rate |

CAGR of 23.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, enterprise size, application, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa |

|

Key companies profiled |

Dell Inc.; Nutanix; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; NetApp; Broadcom, Quantum Corporation; Scale Computing; Microsoft |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hyper-converged Infrastructure Market Report Segmentation

This report forecasts revenue growth at global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hyper-converged infrastructure market report based on component, enterprise size, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Sized Enterprises

-

Large Enterprises

-

-

Application Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Virtualizing Critical Applications

-

Data Centre Consolidation

-

Remote office/branch office

-

Backup and disaster recovery

-

Virtual Desktop Infrastructure (VDI)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Banking Financial Services and Insurance (BFSI)

-

IT and telecom

-

Government

-

Healthcare

-

Manufacturing

-

Energy

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."