- Home

- »

- Renewable Chemicals

- »

-

Hydroxyethyl Methyl Cellulose Market Report, 2022-2030GVR Report cover

![Hydroxyethyl Methyl Cellulose Market Size, Share & Trends Report]()

Hydroxyethyl Methyl Cellulose Market (2022 - 2030) Size, Share & Trends Analysis Report By Application (Construction, Pharmaceuticals, Food), By Region (North America, APAC), And Segment Forecasts

- Report ID: GVR-4-68039-918-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

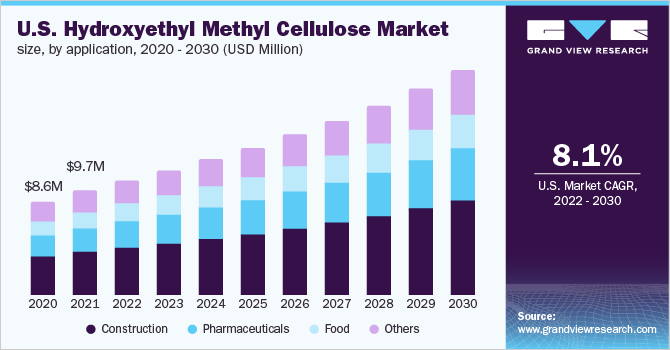

The global hydroxyethyl methyl cellulose market size was valued at USD 47.2 million in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.1% from 2022 to 2030. The demand for the product is attributed to the increased application scope in the construction industry worldwide. Hydroxyethyl methyl cellulose (HEMC) is extensively used in the cement mortar and is an essential plaster & cement slurry input. It is a non-ionic cellulose ether derived from the addition of ethylene oxide to methylcellulose. This compound is used as a film-forming agent, adhesive, stabilizer, binder, and gelling agent. HEMC is also used as a water retention agent.

Cotton linter is the key raw material used for producing HEMC. The raw material is soaked in sodium hydroxide solution followed by the addition of methyl chloride with constant stirring for a given time, which results in alkalization of the slurry. The temperature of the solution is then lowered to 30–35 degrees Celsius and ethylene oxide is then added to the same. The solution is then neutralized with glacial acetic acid. Glyoxal cross-linked aging is then done along with fast washing using water. The last step involves distillation, drying, and grounding to get the final product, i.e., HEMC.

The compound is widely used in many industrial applications including ceramic, cosmetics & personal care, food & beverages, paint & coatings, food & beverages, & ink & oil drilling because of its water retention capacity, as an emulsifier, thickening agent, and others. The increasing demand for HEMC in the construction industry is likely to drive the demand for the compound over the forecast years. In the food processing industry, HEMC is used as an emulsifier, adhesive, dispersion, suspension, and retention agent.

It has excellent texturing and finds a wide range of applications in bakery products. Bakery & confectionery products mainly comprise breakfast cereals, frozen bakery, frozen desserts, chocolates, cakes, and other similar baked goods. Rising consumer awareness and increased preference for healthier low-fat diets are expected to drive the cereals demand over the forecast period, which, in turn, is expected to boost the demand for HEMC.

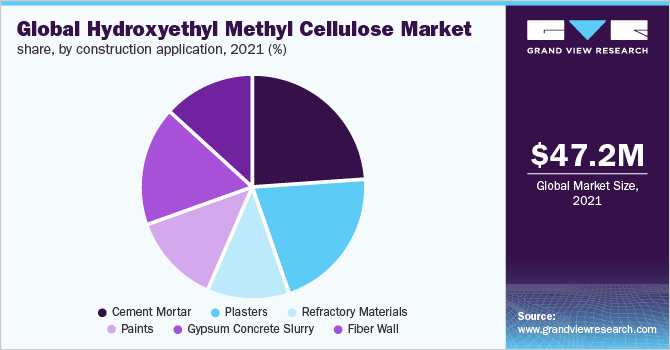

Applications Insights

In terms of value, the construction application segment accounted for the maximum share of more than 38.5% of the global revenue in 2021. The growth is attributed to the rise in demand for cement mortar, which is widely used in residential and industrial construction activities. HEMC has a greater impact on the properties & hydration of cement mortars with Portland cement and calcium sulfoaluminate cement. HEMC decreases the fluidity and consistency, thereby reducing the flowability of cement mortar. It improves the water retention ability and decreases the bulk density. Moreover, it decreases the drying shrinkage and improves the tensile bond strength.

The increasing content of HEMC can lower the compressive and flexural strengths. It also extends the settling time of the cement mortar. In the pharmaceutical industry, HEMC is used as a pore-forming agent, hydrophilic gel matrix material, and coating agent for sustained-release preparation. It can also be used as a dispersion, thickening, and suspension agent. This, in turn, will increase the product demand over the forecasted period. In addition, HEMC is used in the medical field as an emulsification, water-retaining, adhesion, and film-forming agent. The product is used as an excipient in several pharmaceutical products, such as suspensions, oral tablets, and topical gel preparations.

The hydroxyethyl groups in HEMC make it more readily soluble in water and solutions have a higher coagulation temperature. The food application segment is anticipated to register the fastest CAGR over the forecast period. The growth is attributed to its wide application scope in the food industry. HEMC is used as an adhesion, film formation, emulsification, dispersing, suspending, and water retention agent. As an emulsifier, it is used to hinder the separation of two mixed liquids and texturing ingredients. The texturing factor of the product is particularly used in bakery products to achieve a certain texture & size and to produce gluten-free products.

Regional Insights

Asia Pacific accounted for the largest share of 35.0% in 2021. The growth was attributed to the increase in high infrastructural spending in countries, such as China, India, Malaysia, and Indonesia, owing to the emergence of new business enterprises. North America was the second-largest region, in terms of volume, in 2021 and is anticipated to witness a steady CAGR over the forecast period. The growth in the demand is due to a rise in the construction industry in North American countries, such as the U.S., Canada, and Mexico, and the high adoption of sustainable and advanced construction practices.

Moreover, rapid commercial growth in North America is expected to open avenues for various companies to expand in the hospitality and retail sectors. Europe is expected to grow at a significant CAGR, in terms of value, from 2022 to 2030. The growth is attributed to the rapid expansion of the food & beverage industry in the region. Also, factors, such as rising health concerns among consumers and growing demand for convenience foods, are expected to drive the HEMC market over the forecast period. The most popular food items consumed in this region are meat, bakery, dairy, and farinaceous products.

Key Companies & Market Share Insight

With the emergence of new business enterprises, there has been an increase in competition among players in the industry. Manufacturers are continuously trying to advance their units and strengthen their presence across the globe. For instance, in August 2021, Akzo Nobel N.V. announced the development of a new manufacturing facility to address the rising demand for additives for fast-growing paints and coatings end-users. A majority of the companies have integrated their business operations across the value chain to incur maximum profit at the lowest investment. The global companies are also focusing on capacity expansions, signing partnership agreements with distributors, and various other operational strategies to gain an edge in the competitive market space. Some of the top players in the global hydroxyethyl methyl cellulose market include:

-

Dow. Inc.

-

Ashland

-

Akzo Nobel N.V.

-

Lotte Fine Chemical

-

Celotech Chemical Co. Ltd.

Hydroxyethyl Methyl Cellulose Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 51.3 million

Revenue forecast in 2030

USD 103.0 million

Growth rate

CAGR of 9.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD thousands/million, volume in tons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Dow. Inc.; Ashland; Akzo Nobel N.V.; Lotte Fine Chemical; Celotech Chemical Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hydroxyethyl methyl cellulose market report on the basis of application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Pharmaceuticals

-

Food

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydroxyethyl methyl cellulose market size was valued at USD 47.2 million in 2021 and is expected to reach USD 51.3 million in 2022.

b. The global hydroxyethyl methyl cellulose market is anticipated to grow at a compound annual growth rate (CAGR) of 9.1% from 2022 to 2030 to reach USD 103.0 million by 2030.

b. Construction applications accounted for 38.9% of the total market share in terms of value in 2021. The growth is attributed to increasing demand for cement mortar which is widely used in residential and industrial construction activities.

b. Some of the top players in the HEMC market include Dow. Inc., Ashland, Akzo Nobel N.V., Lotte Fine Chemical, and Celotech Chemical Co. Ltd.

b. The demand for HEMC is driven by increased application in the construction industry worldwide. HEMC is extensively used in the cement mortar and is an essential plaster & cement slurry input.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.