- Home

- »

- Advanced Interior Materials

- »

-

Hydronic HVAC Systems Market Size, Industry Report, 2030GVR Report cover

![Hydronic HVAC Systems Market Size, Share & Trends Report]()

Hydronic HVAC Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hydronic Boilers, Radiant Heating System), By Application (Commercial, Industrial), By Fuel Type (Natural Gas, Electricity), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-521-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydronic HVAC Systems Market Summary

The global hydronic HVAC systems market size was estimated at USD 19.02 billion in 2024 and is projected to reach USD 26.96 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. The hydronic HVAC systems industry is increasingly driven by a growing demand for energy-efficient and environmentally friendly solutions in both residential and commercial applications.

Key Market Trends & Insights

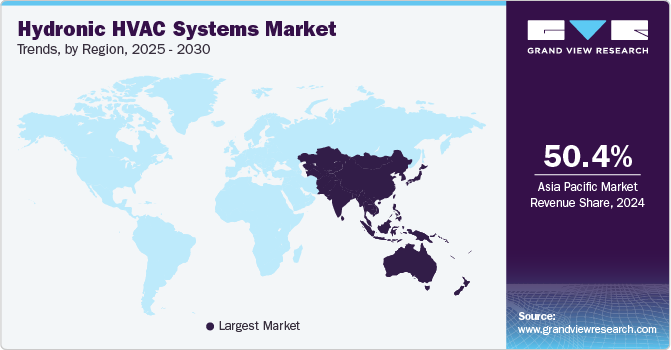

- Asia Pacific region led with a 50.4% revenue share of the global hydronic HVAC systems industry in 2024.

- The hydronic HVAC systems industry in the U.S. is expected to grow at a CAGR of 6.1% from 2025 to 2030.

- By product, the hydronic boilers product segment accounted for a revenue share of 23.4% in 2024.

- By application, the commercial application segment accounted for a revenue share of 42.9% in 2024.

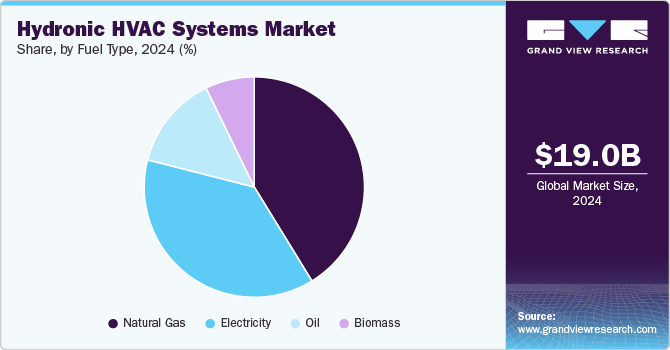

- By fuel type , the natural gas fuel type segment accounted for a revenue share of 41.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.02 Billion

- 2030 Projected Market Size: USD 26.96 Billion

- CAGR (2025-2030): 6.3%

- Asia Pacific: Largest market in 2024

With the rising focus on sustainability and reducing carbon footprints, these systems are gaining popularity due to their ability to deliver consistent heating and cooling while using less energy compared to traditional HVAC systems. In addition to energy efficiency, the hydronic HVAC market is benefiting from the rise in green building initiatives and regulatory standards that encourage the use of sustainable building practices. The systems are highly adaptable and are increasingly being incorporated into new constructions, as well as in retrofitting older buildings to meet modern standards. Hydronic systems’ ability to provide zoned heating and cooling, combined with their lower operational costs, is making them a preferred choice for both commercial and residential projects.

Market Concentration & Characteristics

The market for hydronic HVAC systems is characterized by a diverse range of products that cater to different heating and cooling needs across various sectors. These systems use water as the medium for heat transfer, offering significant energy efficiency and comfort. The market includes several types of products, such as boilers, heat pumps, radiators, and fan coils, with varying features designed to meet specific requirements for residential, commercial, and industrial applications. With growing awareness of energy conservation and sustainability, demand for these systems has surged, particularly in regions where energy efficiency regulations and green building standards are becoming stricter.

In terms of market concentration, the hydronic HVAC systems industry remains moderately fragmented, with numerous manufacturers competing in both regional and global markets. Key players in the market include established companies with a long history in HVAC solutions, such as Daikin, Bosch, and Trane, alongside smaller regional players offering customized solutions. This fragmentation is driven by the wide range of customer preferences, which necessitates the availability of various product offerings, from low-cost to premium systems, and from simple to advanced smart technologies.

Market concentration is higher in regions with more stringent energy efficiency regulations and greater investment in smart technologies. Asia Pacific stands out as a market with a high concentration of industry leaders, largely due to the region’s focus on sustainability and energy-saving initiatives. As a result, major players in Asia Pacific have developed a significant market share, leveraging their extensive product portfolios, brand recognition, and expertise in meeting specific local regulatory standards.

In contrast, emerging markets in Asia Pacific and Latin America are still evolving in terms of industry concentration. While there are regional players offering affordable products suited to local conditions, the market in these areas is expected to experience growth with the increasing adoption of energy-efficient and sustainable building solutions. In these markets, lower competition and the rising focus on energy-efficient building solutions present opportunities for new players and innovative technologies to gain traction.

Drivers, Opportunities & Restraints

The growing demand for energy-efficient and sustainable building solutions is a key driver for the hydronic HVAC systems market. With increasing concerns about carbon emissions and rising energy costs, both residential and commercial sectors are shifting towards hydronic systems due to their energy-saving capabilities. Additionally, the integration of smart control systems in hydronic HVAC solutions has further boosted their appeal by enhancing performance and reducing operating costs. Regulatory standards and government incentives also play a vital role in promoting the adoption of these systems.

High initial installation costs of hydronic HVAC systems, including boilers, pumps, and piping, can be a significant barrier for many consumers, particularly in price-sensitive markets. The complexity of installation and the need for skilled professionals for maintenance and service can also hinder the widespread adoption of these systems. Moreover, the reliance on water as the medium for heat transfer may be challenging in areas facing water scarcity or limited access to reliable water sources.

As urbanization continues to rise, there is a growing opportunity for the expansion of hydronic HVAC systems in new residential and commercial buildings, particularly in regions with high construction activities. The increasing trend toward retrofitting older buildings with energy-efficient solutions presents a significant market opportunity, especially in developed markets. Additionally, with the rise of green building certifications and energy-efficient building standards, hydronic systems can become a critical component in meeting sustainability goals.

Product Insights

The hydronic boilers product segment accounted for a revenue share of 23.4% in 2024. The demand for hydronic boilers is increasing due to their energy efficiency and ability to provide consistent heating in residential and commercial spaces. Additionally, the growing emphasis on sustainable energy solutions and energy-saving technologies has boosted the adoption of these systems.

The demand for heat pumps is on the rise, driven by their versatility in both heating and cooling applications, and their ability to significantly reduce energy consumption. With rising environmental awareness and incentives for green technology, heat pumps are gaining popularity as an eco-friendly alternative to traditional heating systems.

Application Insights

The commercial application segment accounted for a revenue share of 42.9% in 2024. In commercial spaces such as offices, hotels, and retail establishments, hydronic HVAC systems are used for their energy efficiency and ability to maintain consistent indoor climates, enhancing comfort for occupants while reducing operational costs.

In industrial applications, hydronic HVAC systems are widely employed due to their ability to efficiently regulate temperature across large facilities, such as manufacturing plants, warehouses, and distribution centers. These systems are especially favored for their consistent performance in demanding environments, where maintaining optimal temperatures is critical for both machinery operation and worker comfort.

Fuel Type Insights

The natural gas fuel type segment accounted for a revenue share of 41.2% in 2024. Natural gas is a popular fuel type for hydronic HVAC systems due to its efficiency and cost-effectiveness in heating. It is commonly used in residential and commercial settings for its ability to provide consistent and reliable heat with lower emissions compared to other fossil fuels. Systems powered by natural gas are known for their quick response time and high heat output, making them ideal for colder climates.

Electricity-powered hydronic HVAC systems offer a clean and efficient alternative to fossil fuel-based systems, particularly in areas where electricity is sourced from renewable energy. These systems are typically easier to install and maintain as they do not require fuel storage or ventilation systems. Electric boilers are often used in smaller residential or commercial applications, providing quiet and low-maintenance heating solutions.

Regional Insights

The demand for hydronic HVAC systems in North America is rising due to growing awareness of energy efficiency and sustainability. With increasing environmental regulations and a focus on reducing carbon footprints, both residential and commercial buildings are transitioning toward hydronic systems, which provide energy-efficient solutions for heating and cooling.

U.S. Hydronic HVAC Systems Market Trends

The hydronic HVAC systems industry in the U.S. is expected to grow at a CAGR of 6.1% from 2025 to 2030. In the U.S., the demand for hydronic HVAC systems is being driven by the push for energy-efficient heating solutions and the growing focus on sustainability. With advancements in technology and the availability of both natural gas and electric systems, hydronic solutions are increasingly popular in both residential and commercial sectors, particularly in colder regions.

The hydronic HVAC systems market in the Canada is expected to grow at a CAGR of 6.8% from 2025 to 2030. Canada's cold climate and focus on reducing carbon emissions contribute to the growing demand for hydronic HVAC systems. These systems are well-suited for residential, commercial, and industrial applications, offering efficient heating solutions for large spaces.

Europe Hydronic HVAC Systems Market Trends

Europe is experiencing a significant rise in the demand for hydronic HVAC systems, driven by strict energy regulations and the region's commitment to sustainable building practices. The focus on reducing carbon emissions and improving energy efficiency in both new and existing buildings has led to a growing adoption of hydronic systems in residential, commercial, and industrial sectors across Europe.

Germany's hydronic HVAC systems market held 32.4% share in the Europe market. In Germany, demand for hydronic HVAC systems is particularly strong due to the country’s focus on energy-efficient solutions and sustainability. With increasing regulations on carbon emissions and energy use, hydronic systems offer an eco-friendly and cost-effective option for residential, commercial, and industrial applications.

UK’s hydronic HVAC systems market is driven by growing country's commitment to meeting net-zero emissions targets. As the government incentivizes energy-efficient systems for residential and commercial buildings, hydronic solutions are becoming more popular.

Asia Pacific Hydronic HVAC Systems Market Trends

Asia Pacific region led with a 50.4% revenue share of the global hydronic HVAC systems industry in 2024. The demand for hydronic HVAC systems in Asia Pacific is experiencing rapid growth, fueled by urbanization, industrialization, and a rising demand for energy-efficient solutions. The region's expanding construction sector, along with increasing awareness of sustainability and energy efficiency, is driving the adoption of hydronic systems, particularly in high-end residential, commercial, and industrial buildings.

China hydronic HVAC systems market held largest revenue share in the Asia Pacific market. In China, the demand for hydronic HVAC systems is being driven by the government's emphasis on energy-efficient construction and environmental sustainability. As the country continues to grow its urban population, hydronic systems are being adopted in new residential, commercial, and industrial developments.

The hydronic HVAC systems market in the India is expected to grow at a CAGR of 6.7% from 2025 to 2030. With a growing focus on energy efficiency and sustainable building practices, both residential and commercial developers are adopting hydronic systems for their ability to provide consistent and energy-efficient heating and cooling solutions.

Middle East & Africa Hydronic HVAC Systems Market Trends

In the Middle East and Africa, demand for hydronic HVAC systems is on the rise as countries in the region look for energy-efficient cooling and heating solutions in both residential and commercial sectors. The region's extreme temperatures and growing focus on sustainability and energy-efficient technologies are pushing the adoption of hydronic systems.

Saudi Arabia hydronic HVAC systems market is experiencing growth due to the rising demand for hydronic HVAC systems as part of its efforts to reduce energy consumption and improve building sustainability. With extreme temperatures in the region, there is a strong need for energy-efficient cooling solutions, and hydronic systems provide an ideal solution. Government initiatives to promote energy efficiency in residential, commercial, and industrial buildings further drive the adoption of hydronic systems in the country.

Latin America Hydronic HVAC Systems Market Trends

In Latin America, the demand for hydronic HVAC systems is growing as the region focuses on energy efficiency and improving the sustainability of its buildings. Countries in the region are increasingly adopting hydronic systems in both residential and commercial buildings as a way to reduce energy consumption and operational costs.

Brazil hydronic HVAC systems market is witnessing growth due to a rising demand for hydronic HVAC systems driven by the need for energy-efficient cooling and heating solutions in both residential and commercial applications. As the country grows its infrastructure and emphasizes sustainable building practices, hydronic HVAC systems are being seen as a reliable solution.

Key Hydronic HVAC Systems Company Insights

Some of the key players operating in the market include Daikin Industries, Ltd., Trane Technologies, and Carrier.

-

Daikin Industries, Ltd. is a global leader in air conditioning and refrigeration systems, offering innovative HVAC solutions across residential, commercial, and industrial sectors. The company is renowned for its energy-efficient products, including hydronic HVAC systems, and is committed to sustainability and reducing environmental impact. Daikin operates worldwide, providing solutions that meet the growing demand for high-performance, eco-friendly climate control systems.

-

Trane Technologies is a leading global provider of heating, ventilation, and air conditioning (HVAC) systems, focusing on energy-efficient and sustainable solutions. The company offers a wide range of hydronic HVAC products designed for residential, commercial, and industrial applications. Trane is committed to enhancing the quality of air and comfort while reducing environmental footprints through advanced, high-performance technologies.

Key Hydronic HVAC Systems Companies:

The following are the leading companies in the hydronic HVAC systems market. These companies collectively hold the largest market share and dictate industry trends.

- Daikin Industries, Ltd.

- Trane Technologies

- Carrier

- Johnson Controls International PLC

- Bosch Thermotechnology

- Viessmann Group

- Fujitsu General Limited

- Mitsubishi Electric Corporation

- Grundfos

- Lennox International Inc.

- Ariston Thermo Group

- Danfoss

- KSB SE & Co. KGaA

- Wilo SE

- A. O. Smith Corporation

Recent Developments

-

In March 2024, U.S. Boiler introduced a hydronic heat pump designed for residential use. The company highlighted that the new system is ideal for both new constructions and retrofitting projects, and it can function as a standalone heat source or in dual-fuel setups. It has a 5-ton capacity, with a rating of 60,000 British thermal units (BTUs) per hour (MBH).

-

In March 2023, Panasonic Corporation has revealed its plans to fast-track its growth strategy for the HVAC company in the European market, focusing on the hydronic systems, and air-to-water heat pump industries. Further, the company invested an additional 15 billion yen in its Czech Plant to boost manufacture of A2W heat pumps.

Hydronic HVAC Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.86 billion

Revenue forecast in 2030

USD 26.96 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, fuel type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Daikin Industries, Ltd.; Trane Technologies; Carrier; Johnson Controls International PLC; Bosch Thermotechnology; Viessmann Group; Fujitsu General Limited; Mitsubishi Electric Corporation; Grundfos; Lennox International Inc.; Ariston Thermo Group; Danfoss; KSB SE & Co. KGaA; Wilo SE; A. O. Smith Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydronic HVAC Systems Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the hydronic HVAC systems market report based on product, application, fuel type, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hydronic Boilers

-

Heat Pumps

-

Radiant Heating System

-

Chillers

-

Air Conditioning Units

-

Fancoils

-

AHU

-

Cooling Tower

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Healthcare Facilities

-

Retail Stores

-

Restaurants

-

Workspaces/Office

-

Schools & Educational Institutions

-

Other Commercial Applications

-

-

Residential

-

Industrial

-

-

Fuel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Natural Gas

-

Oil

-

Electricity

-

Biomass

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hydronic HVAC systems market size was estimated at USD 19.02 billion in 2024 and is expected to reach USD 19.86 billion in 2025.

b. The hydronic HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 and reach USD 26.96 billion by 2030.

b. The commercial application segment accounted for a revenue share of 42.9% in 2024. In commercial spaces such as offices, hotels, and retail establishments, hydronic HVAC systems are used for their energy efficiency and ability to maintain consistent indoor climates, enhancing comfort for occupants while reducing operational costs.

b. Some of the key players operating in the hydronic HVAC systems market include Daikin Industries, Ltd., Trane Technologies, Carrier, Johnson Controls International PLC, Bosch Thermotechnology, Viessmann Group, Fujitsu General Limited, Mitsubishi Electric Corporation, Grundfos, Lennox International Inc., Ariston Thermo Group, Danfoss, KSB SE & Co. KGaA, Wilo SE, A. O. Smith Corporation.

b. The hydronic HVAC systems market is increasingly driven by a growing demand for energy-efficient and environmentally friendly solutions in both residential and commercial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.