- Home

- »

- Consumer F&B

- »

-

Hydrolyzed Wheat Protein Market Size, Industry Report 2030GVR Report cover

![Hydrolyzed Wheat Protein Market Size, Share & Trends Report]()

Hydrolyzed Wheat Protein Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverages, Personal Care), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-091-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrolyzed Wheat Protein Market Summary

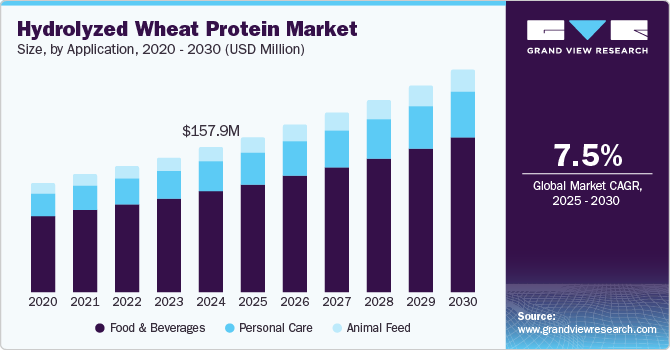

The global hydrolyzed wheat protein market size was valued at USD 157.89 million in 2024 and is projected to reach USD 243.93 Million by 2030, growing at a CAGR of 7.5% from 2025 to 2030. Increasing consumer awareness of the benefits of hydrolyzed wheat protein in personal care and cosmetic products is a significant driver.

Key Market Trends & Insights

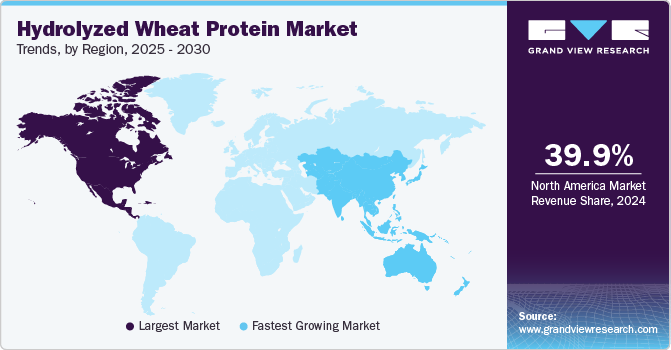

- North America hydrolyzed wheat protein industry dominated the global market with the largest revenue share of 39.9% in 2024.

- U.S. hydrolyzed wheat protein industry is expected to grow significantly over the forecast period.

- By application, food & beverages segmant dominated the market with the largest revenue share in 2024.

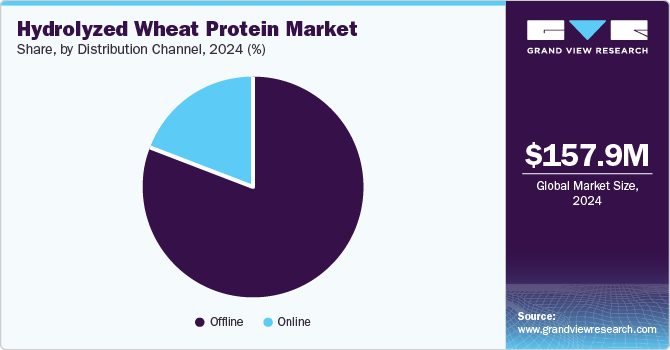

- By distribution channel, offline segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 157.89 Million

- 2030 Projected Market Size: USD 243.93 Million

- CAGR (2025-2030): 7.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The protein's properties, which include moisturizing, strengthening, and repairing capabilities, make it highly sought after in hair and skin care formulations. The rising demand for plant-based and natural ingredients in beauty and personal care products is also propelling the market.

As consumers become more conscious of the ingredients in their products, they are shifting towards cleaner and more sustainable options, which include hydrolyzed wheat protein. The food and beverage industry also contributes to market growth, as hydrolyzed wheat protein is used as a functional ingredient to enhance the nutritional profile of various products. Furthermore, advancements in extraction and processing technologies are improving the quality and efficacy of hydrolyzed wheat protein, making it more appealing to manufacturers and consumers alike.

Hydrolyzed wheat proteins have the ability to retain moisture within the skin, thus preventing and protecting the skin from drying out. The application can help reduce the appearance of wrinkles and fine lines caused by aging and extreme exposure to UV light; hence is often used as the main ingredient in anti-aging products. Additionally, the ingredient helps repair damaged hair follicles, thereby improving hair texture. As a result, it finds application in several hair care products.

Technological advancements in the cosmetics industry and growing appeal of natural and organic substitutes in countries like India and China are other factors driving the market. Growing acceptance of organic ingredients is a trend brought on by changing lifestyle and dietary habits of consumers, along with a rising need to stay healthy. This has been a crucial factor driving demand. A thriving e-commerce sector has enabled products and ingredients to be sold through online channels, allowing easy access and convenient payment methods.

Application Insights

Food & beverages dominated the market with the largest revenue share in 2024. Hydrolyzed wheat protein is increasingly used in the food and beverage industry as a functional ingredient due to its nutritional benefits and versatile applications. It enhances various food products' texture, flavor, and nutritional profile, including bakery items, beverages, snacks, and meat substitutes. The rising demand for plant-based and natural ingredients in food products is propelling the market, as consumers seek healthier and more sustainable options. Additionally, hydrolyzed wheat protein is valued for its high protein content and amino acid profile, making it an ideal ingredient for protein-rich and fortified food products. The growing trend of health and wellness, coupled with the increasing popularity of plant-based diets, is further boosting the demand for hydrolyzed wheat protein in the food and beverages segment.

The personal care segment is expected to grow at the fastest CAGR of 7.9% over the forecast period. Consumers are increasingly seeking natural and plant-based ingredients in their personal care products, favoring options that are gentle on the skin and hair. Hydrolyzed wheat protein is valued for its moisturizing, strengthening, and repairing properties, making it an ideal ingredient for various personal care products such as shampoos, conditioners, lotions, and creams. The rising awareness about the benefits of using hydrolyzed wheat protein to improve hair and skin health is significantly boosting demand. Additionally, the influence of social media and beauty influencers promoting natural and organic personal care routines is driving market growth. The expanding availability of hydrolyzed wheat protein-based personal care products through various retail channels, including online platforms, is making them more accessible to a broader audience.

Distribution Channel Insights

Offline dominated the market with the largest revenue share in 2024. Physical retail outlets, including supermarkets, health food stores, and specialty shops, allow consumers to physically inspect products, ensuring they meet their quality expectations. This hands-on experience builds consumer confidence in the products they purchase. Additionally, in-store promotions, discounts, and product demonstrations attract a significant number of customers. The convenience of purchasing hydrolyzed wheat protein during regular shopping trips also boosts the popularity of the offline channel. The extensive availability of these products in brick-and-mortar stores ensures they are easily accessible to a wide range of consumers.

The online channel is expected to grow at the fastest CAGR over the forecast period. The convenience and accessibility offered by online shopping are major drivers, allowing consumers to purchase hydrolyzed wheat protein products from the comfort of their homes. E-commerce platforms provide various options, detailed product descriptions, customer reviews, and ratings, helping consumers make informed decisions. Digital marketing and social media advertising are effectively reaching a broader audience, boosting online sales. Exclusive online discounts, promotions, and subscription services further incentivize consumers to shop for hydrolyzed wheat protein products online. The rise of tech-savvy consumers who prefer the flexibility and convenience of online shopping is also contributing to the growth of the online channel.

Regional Insights

North America hydrolyzed wheat protein industry dominated the global market with the largest revenue share of 39.9% in 2024. The increasing awareness of the health benefits associated with hydrolyzed wheat protein in various applications, including food and beverages, personal care, and cosmetics, is a significant driver. Consumers in North America are highly conscious of health and wellness, favoring products that offer functional benefits and are derived from natural ingredients. The presence of well-established manufacturers and brands in the region also contributes to market growth, as these companies are continuously innovating and introducing new products to meet consumer demand. Additionally, North America's high disposable income levels enable consumers to invest in premium and high-quality products, further supporting the market. The extensive distribution networks and the availability of hydrolyzed wheat protein products through various retail channels, including supermarkets, health food stores, and e-commerce platforms, ensure easy access for consumers.

U.S. Hydrolyzed Wheat Protein Market Trends

The U.S. hydrolyzed wheat protein industry is expected to grow significantly over the forecast period. Increasing health consciousness among consumers and a growing awareness of the benefits of plant-based proteins are major drivers. With a significant portion of the population being lactose intolerant, hydrolyzed wheat protein offers a suitable alternative. The rise in vegan and vegetarian diets also fuels demand, as these consumers seek high-protein, plant-based options. Additionally, the trend toward functional foods that offer added health benefits supports market growth.

Europe Hydrolyzed Wheat Protein Market Trends

The European hydrolyzed wheat protein industry held a considerable share in 2024. Consumers here are highly health-conscious and prefer products with natural and transparent ingredients, which aligns with the clean label trend. Another significant driver is the high consumption of bakery and confectionery products that utilize hydrolyzed wheat protein as a functional ingredient. Moreover, favorable government policies and regulatory support for natural and organic ingredients boost the market's growth.

Asia Pacific Hydrolyzed Wheat Protein Market Trends

Asia Pacific hydrolyzed wheat protein industry is expected to grow at the fastest CAGR of 8.4% over the forecast period. The growing middle-class population, particularly in emerging economies such as China and India, is increasingly seeking healthier dietary options. The demand for dietary supplements is on the rise, and hydrolyzed wheat protein is a favored ingredient due to its nutritional benefits. Additionally, the market is boosted by the increasing demand for cholesterol-free food products and baked goods with lower levels of saturated fat. Government initiatives promoting the use of sustainable and eco-friendly products further support market growth in the Asia Pacific region.

Key Hydrolyzed Wheat Protein Company Insights:

Some key companies in the hydrolyzed wheat protein market include ADM, Agridient B.V, MGP, ROQUETTE AMILINA, Cargill, Incorporated, Manildra Group, and others.

-

ADM is a global food processing and commodities trading corporation headquartered in the U.S. It provides a wide range of agricultural products and services. ADM offers hydrolyzed wheat protein as part of its wheat protein products.

-

Agridient B.V. is a global supplier of ingredients and chemicals for the food, feed, and manufacturing industry. Under its HWG 2009 product line, Agridient offers lightly hydrolyzed wheat protein, which is used in instant drink mixes, nutritional bars, and other nutritional snack products.

Key Hydrolyzed Wheat Protein Companies:

The following are the leading companies in the hydrolyzed wheat protein market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Agridient B.V

- MGP

- ROQUETTE AMILINA

- Cargill, Incorporated

- Manildra Group

- Crespel & Deiters GmbH & Co. KG

- CropEnergies AG

- Kroener-Staerke GmbH

- Roquette Frères

Hydrolyzed Wheat Protein Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 169.59 million

Revenue forecast in 2030

USD 243.93 million

Growth rate

CAGR of 7.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Distribution Channel, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, UAE

Key companies profiled

ADM; Agridient B.V; MGP; ROQUETTE AMILINA; Cargill, Incorporated; Manildra Group; Crespel & Deiters GmbH & Co. KG; CropEnergies AG; Kroener-Staerke GmbH; Roquette Frères

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrolyzed Wheat Protein Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydrolyzed wheat protein market report based on application, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Personal Care

-

Animal Feed

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.