Hydrogen Technology Testing, Inspection, And Certification Market Size, Share & Trends Analysis Report By Service Type (Testing, Inspection), By Testing Type, By Application, By Process, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-468-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

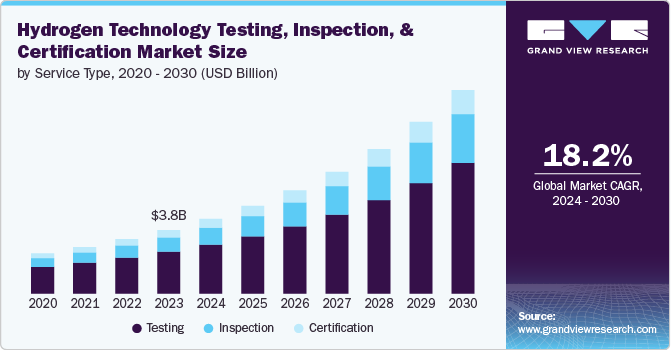

The global hydrogen technology testing, inspection, and certification market size was estimated at USD 3.79 billion in 2023 and is expected to grow at a CAGR of 18.2% from 2024 to 2030. This high share is driven by the increasing adoption of hydrogen as a clean energy source and the need for stringent safety and performance standards. As countries prioritize hydrogen in their energy transition strategies, the demand for reliable testing, inspection, and certification (TIC) services is surging. These services ensure that hydrogen production, storage, and distribution technologies meet regulatory requirements and safety standards, fostering stakeholder confidence. Innovations in hydrogen applications, such as fuel cells and hydrogen-powered vehicles, require comprehensive testing and certification to mitigate risks and enhance operational efficiency.

Advancements in TIC methodologies and technologies, including integrating digital solutions such as IoT and AI for real-time monitoring and assessment, support the market. Furthermore, collaborations between governments, research institutions, and private sectors are pivotal in developing standardized protocols and certifications, which are essential for market growth. Regions like Europe and Asia Pacific are at the forefront of this market, fueled by substantial investments in hydrogen infrastructure and ambitious decarbonization targets. As the global hydrogen economy evolves, the market is poised for robust expansion, offering opportunities for specialized service providers to cater to diverse industries. With rising environmental awareness and technological advancements, the TIC sector will play a crucial role in ensuring the safety and sustainability of hydrogen technologies, ultimately contributing to a greener energy future.

Future opportunities in the hydrogen TIC market are vast, driven by increasing investments in hydrogen infrastructure and the scaling of hydrogen fuel cell technologies. As countries implement stricter regulations and safety standards for hydrogen usage, demand for TIC services is expected to surge. In addition, the growing focus on green hydrogen, produced through renewable energy sources, opens new avenues for TIC companies to support certification processes, ensuring sustainability and efficiency. The market will continue to thrive as hydrogen adoption accelerates across industries, creating numerous growth prospects for TIC providers.

Service Type Insights

The testing segment led the market in 2023, accounting for over 65.0% share of the global revenue. As hydrogen-based systems, including fuel cells and storage solutions, gained traction, ensuring their safety, efficiency, and performance became paramount. Testing is essential for detecting potential hazards like leaks, material degradation, or equipment failure, especially in high-pressure environments. With the global push towards hydrogen as a clean energy alternative, regulatory bodies imposed stricter standards on hydrogen applications, further driving the demand for comprehensive testing services. Moreover, increased research and development activities in hydrogen infrastructure, transportation, and production contributed to the testing segment's dominant position in the TIC market.

The inspection segment is predicted to foresee significant growth in the coming years. As hydrogen production, storage, and transportation systems expand, regular inspections are essential to prevent risks like leaks, structural failures, and equipment malfunctions. The growth in hydrogen refueling stations, pipelines, and industrial applications has heightened the need for ongoing monitoring and compliance with evolving safety standards. Moreover, stringent regulatory frameworks and industry-specific requirements across sectors like energy, automotive, and manufacturing drive the demand for specialized inspection services, ensuring operational safety and reliability in the rapidly expanding hydrogen economy.

Testing Type Insights

The hydrogen permeation and compatibility testing segment accounted for the largest market revenue share in 2023. Hydrogen permeation can lead to material degradation, embrittlement, and leaks, posing significant safety risks. As hydrogen adoption expands across industries, ensuring the compatibility of materials such as metals, polymers, and composites with hydrogen environments becomes critical. This type of testing is vital for components used in storage, transportation, and fuel cell systems. The growth is further driven by the need for advanced testing solutions to meet stringent regulatory standards and ensure that hydrogen systems operate safely and efficiently under various conditions.

The pressure cycle, leakage, and tightness testing segment is anticipated to exhibit the highest CAGR over the forecast period. Hydrogen is stored and transported under extreme pressure, making systems prone to leakage and potential failures. This testing ensures tanks, pipelines, and other components can withstand repeated pressure cycles without degradation. The rising deployment of hydrogen infrastructure, such as refueling stations and storage facilities, increases the need for rigorous testing to prevent leaks and ensure system tightness.

Application Insights

The refining & chemical segment accounted for the largest market revenue share in 2023. Hydrogen is critical in refining operations, such as hydrocracking and desulfurization, to produce cleaner fuels. As industries aim to meet stricter environmental regulations, demand for hydrogen-based processes is rising, driving the need for rigorous testing and inspection. Furthermore, hydrogen is increasingly used as a feedstock in the chemical industry to produce ammonia, methanol, and other chemicals. The growing emphasis on sustainable and efficient hydrogen usage in these sectors heightens the need for TIC services to ensure safety, compliance, and process optimization, fueling strong segment growth.

The mobility segment is anticipated to exhibit the highest CAGR over the forecast period due to the rapid expansion of hydrogen-powered vehicles and transportation infrastructure. With the increasing adoption of hydrogen fuel cell vehicles (FCEVs) in the automotive, trucking, and public transportation sectors, there is a growing need for rigorous testing and certification to ensure safety, performance, and regulatory compliance. Hydrogen storage systems, fuel cells, and refueling stations require detailed inspections and testing for pressure resistance, leakage, and material compatibility. As governments and industries invest heavily in hydrogen mobility solutions to reduce carbon emissions, the demand for TIC services in this segment is surging, driving its projected high growth rate.

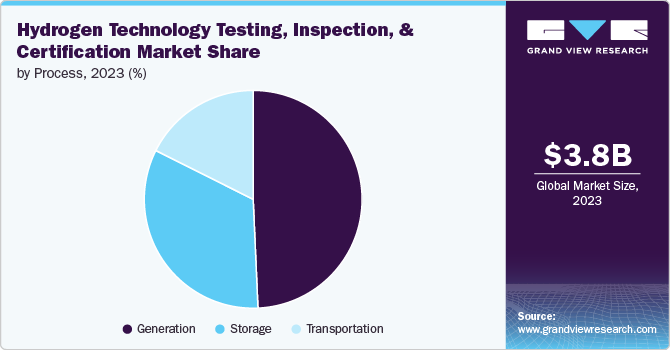

Process Insights

The generation segment accounted for the largest market revenue share in 2023 due to the rising emphasis on green hydrogen production and the need for stringent quality control in hydrogen generation technologies. As industries shift towards low-carbon hydrogen, particularly through electrolysis and other renewable methods, ensuring efficiency, safety, and compliance is critical. The TIC of hydrogen generation plants is crucial for meeting regulatory requirements and optimizing production performance. In addition, advancements in hydrogen generation technologies and increasing investments in scaling hydrogen production globally are driving the demand for TIC services.

The storage segment is anticipated to witness significant growth in the coming years. As hydrogen is often stored under high pressure or in liquid form at extremely low temperatures, rigorous testing and inspection are required to prevent potential hazards such as leaks, material degradation, or system failures. With the expansion of hydrogen-powered transportation and industrial applications, demand for large-scale storage solutions like tanks, pipelines, and underground facilities is increasing. This growth is further fueled by the need to comply with strict safety standards, making TIC services essential for ensuring the reliability and safety of hydrogen storage infrastructure.

Regional Insights

The hydrogen technology testing, inspection, and certification market in the North America region is anticipated to register the highest CAGR over the forecast period. The region's strong focus on developing a hydrogen economy, supported by government policies and private sector initiatives, has driven the demand for comprehensive TIC services. Key factors include substantial funding for hydrogen research and development, establishing hydrogen refueling networks, and partnerships to scale hydrogen production and utilization. In addition, North America's stringent regulatory requirements and safety standards have bolstered the need for rigorous testing and certification processes.

U.S. Hydrogen Technology Testing, Inspection, And Certification Market Trends

The U.S. hydrogen technology TIC Market is expected to grow at a CAGR of 17.6% from 2024 to 2030. The U.S. government’s supportive policies, including substantial investments in hydrogen research, development, and commercialization, drive the demand for extensive TIC services. The rapid expansion of hydrogen refueling stations, fuel cell vehicle deployments, and large-scale hydrogen production projects necessitate rigorous testing and certification to meet safety and regulatory standards.

Asia Pacific Hydrogen Technology Testing, Inspection, And Certification Market Trends

Asia Pacific TIC Market dominated with a revenue share of over 30.0% in 2023 due to its rapid industrialization and significant investments in hydrogen technology. Countries like China, Japan, and South Korea lead the charge in hydrogen adoption, driven by their ambitious energy transition goals and commitment to reducing greenhouse gas emissions. The growth is fueled by substantial government funding for hydrogen infrastructure projects, such as refueling stations and production facilities, as well as advancements in fuel cell technologies.

Europe Hydrogen Technology Testing, Inspection, And Certification Market Trends

The hydrogen technology TIC market in Europe is expected to witness significant growth over the forecast period due to its aggressive push towards a hydrogen-based economy as part of its broader Green Deal and sustainability goals. European countries invest heavily in hydrogen infrastructure, including production, storage, and refueling stations, driven by stringent climate targets and regulatory frameworks. The European Union's commitment to reducing carbon emissions and enhancing energy security fosters significant demand for advanced TIC services to ensure safety and environmental standards compliance.

Key Hydrogen Technology Testing, Inspection, And Certification Company Share Insights

Key hydrogen technology TIC companies include SGS SA, Bureau Veritas SA, Intertek Group plc, and DEKRA SE. Companies active in the market focus aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in July 2024, UL Solutions Inc. announced its acquisition of TesTneT Engineering GmbH, a prominent Germany-based company specializing in hydrogen system and component testing. This acquisition strengthens UL Solutions Inc.'s expertise in alternative fuels and bolsters its capacity to contribute to global decarbonization initiatives.

Key Hydrogen Technology Testing, Inspection, And Certification Companies:

The following are the leading companies in the hydrogen technology testing, inspection, and certification market. These companies collectively hold the largest market share and dictate industry trends.

- SGS SA

- Bureau Veritas SA

- Intertek Group plc

- DEKRA SE

- TÜV SÜD

- DNV GL

- TÜV Rheinland

- Applus+

- TÜV NORD GROUP

- UL LLC

Recent Developments

-

In January 2024, Baker Hughes Company launched a new Hydrogen Testing Facility designed to validate its NovaLT industrial turbines for operation with hydrogen blends up to 100%. The facility features a test bench capable of full-load testing and offers complete fuel flexibility, accommodating pressures up to 300 bars and a storage capacity of 2,450 kg. This new Hydrogen Testing Facility will be a central hub for Baker Hughes Company’s collaborations with clients within the expanding hydrogen economy.

-

In November 2023, Element Materials Technology, a London-based provider of TIC services, initiated the first phase of a USD 10 million investment program. This investment involves acquiring advanced hydrogen testing equipment and expanding its global team dedicated to hydrogen technologies.

-

In September 2023, Intertek Group plc, a global leader in Total Quality Assurance, enhanced its quality, safety, and sustainability services by launching Intertek Hydrogen Assurance. This comprehensive advisory and assurance platform offers companies unparalleled access to hydrogen expertise and engineering resources, supporting their projects and processes throughout the hydrogen value chain.

Hydrogen Technology Testing, Inspection, And Certification Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.43 billion |

|

Revenue forecast in 2030 |

USD 12.11 billion |

|

Growth rate |

CAGR of 18.2% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, process, testing type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

SGS SA; Bureau Veritas SA; Intertek Group plc; DEKRA SE; TÜV SÜD; DNV GL; TÜV Rheinland; Applus+; TÜV NORD GROUP; UL LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hydrogen Technology Testing, Inspection, And Certification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global hydrogen technology testing, inspection, and certification market report based on service type, process, testing type, application, and region.

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Testing

-

Inspection

-

Certification

-

-

Process Outlook (Revenue, USD Billion, 2017 - 2030)

-

Generation

-

Storage

-

Transportation

-

-

Testing Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Overpressure, Burst, And Flow Testing

-

Pressure Cycle, Leakage, And Tightness Testing

-

Hydrogen Permeation And Compatibility Testing

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Mobility

-

Refining & Chemical

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global hydrogen technology TIC market size was estimated at USD 3.79 billion in 2023 and is expected to reach USD 4.43 billion in 2024.

b. The global hydrogen technology TIC market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 12.11 billion by 2030.

b. Asia Pacific dominated the hydrogen technology TIC market with a share of 30.5% in 2023 due to its rapid industrialization and significant investments in hydrogen technology. Countries like China, Japan, and South Korea are leading the charge in hydrogen adoption, driven by their ambitious energy transition goals and commitment to reducing greenhouse gas emissions.

b. Some key players operating in the hydrogen technology TIC market include SGS SA, Bureau Veritas SA, Intertek Group plc, DEKRA SE, TÜV SÜD, DNV GL, TÜV Rheinland, Applus+, TÜV NORD GROUP, UL LLC.

b. Key factors that are driving the hydrogen technology TIC market growth include increasing use of hydrogen as a clean energy source in various sectors, and stringent regulatory frameworks and supportive government policies aimed at reducing carbon emissions and promoting hydrogen infrastructure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."