- Home

- »

- Sustainable Energy

- »

-

Hydrogen Generation Market Size And Share Report, 2030GVR Report cover

![Hydrogen Generation Market Size, Share & Trends Report]()

Hydrogen Generation Market Size, Share & Trends Analysis Report By System (Merchant, Captive), By Technology (Steam Methane Reforming, Coal Gasification), By Application, By Source, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-517-5

- Number of Report Pages: 132

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Hydrogen Generation Market Size & Trends

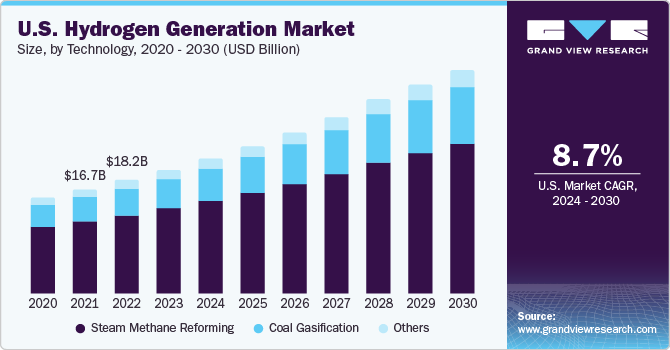

The global hydrogen generation market size was estimated at USD 170.14 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030. Demand for cleaner fuel and increasing government regulations for desulphurization of petroleum products. Hydrogen is an effective energy carrier, and this attribute is expected to contribute significantly to its further penetration into newer markets. Global electricity demand is anticipated to witness an increase of nearly two-thirds of current demand over the forecast period. Focus on projects related to distributed power & utility is anticipated to bolster industry’s growth.

U.S. is among the early adopters of clean energy solutions in world for sectors such as power generation, manufacturing, and transportation. The U.S. Department of Energy (DOE) and Department of Transportation (DOT) introduced a Hydrogen Posture Plan in December 2006. This plan was aimed at enhancing research and development (R&D) and validating technologies that can be employed for setting up hydrogen infrastructure.

This plan provided deliverables set by the Federal government to support development of hydrogen infrastructure in the country. It was developed following the National Hydrogen Energy Vision and Roadmap. Development and construction of cost-effective and energy-saving hydrogen stations across the country are among key objectives planned by government agencies. All these factors are expected to propel hydrogen generation demand in the U.S.

German Ministry of Transport took an initiative in June 2012 to establish a countrywide hydrogen network and boost hydrogen infrastructure for hydrogen refueling stations. As a part of this initiative, the ministry signed a letter of intent (LoI) with industry players such as Total; The Linde Group; Air Products and Chemicals, Inc.; Daimler AG; and Air Liquide. Under its terms, these industry players were given a target to construct at least 50 hydrogen fueling stations by 2015 in metropolitan cities and major corridors in Germany.

Market Dynamics

Shifting focus on cleaner energy along with favorable government regulations are preponderance for hydrogen generation market. Global energy crisis has fostered research and exploration in alternative sources of energy generation, as well as several sustainable conservation initiatives. Sustainability in energy generation is a vast field and includes numerous steps that are required to be implemented in primary stages since their potential environmental and commercial impacts can be substantial.

Over the past two decades, research on clean fuels along with desulfurization of petroleum products has gained momentum giving an impetus to studies on environmental catalysis across the world. U.S. EPA regulations currently governing production and distribution of diesel fuels and gasoline, have witnessed a marked increase in air emission levels in comparison to statistics presented over the past twenty years.

Technology Insights

Based on technology type, global market is divided into steam methane reforming, coal gasification, and others. Steam methane reforming process is a mature and advanced technology in hydrogen generation. Growing global demand for hydrogen generation is a crucial driving factor for steam methane reformers technology, as this is the most economical hydrogen generation method. Other growth driving factors include operational benefits such as high conversion efficiency associated with steam methane reforming process. Steam methane reforming segment is expected to maintain its lead during the forecast period.

Coal gasification hold a revenue share of more than 34.0% in 2023. Coal gasification which uses coal as a raw material for producing hydrogen has been in practice for nearly two centuries, moreover, is it also recognized as a mature technology for hydrogen generation. U.S. has a huge domestic resource in coal. Use of coal to generate hydrogen for transportation sector is expected to aid America in reducing its dependency on imported petroleum products.

Technologies in “others” segment include electrolysis and pyrolysis process and electrolyzers. Over the last decade, there has been an increase in new electrolysis installations with an aim to produce hydrogen from water, wherein PEM technology is gaining a significant market share as the process emits only oxygen as a byproduct without carbon emission. Presently most electrolysis projects are in Europe; however, new and upcoming projects have been announced in Australia, China, and America.

Source Insights

Natural gas led hydrogen generation industry with a revenue share of more than 72.0% in 2023. Hydrogen is produced from natural gas reforming which produces hydrogen, carbon monoxide, and carbon dioxide. Hydrogen production from natural gas is the cheapest method of producing hydrogen. Hydrogen production from natural gas is expected to keep its lead in the forecast period.

System Insights

Based on system, the merchant generation segment led with a revenue share of about 60.0% in 2023. Merchant generation of hydrogen means hydrogen is produced at a central production facility and is transported and sold to a consumer by bulk tank, pipeline, or cylinder truck. In many countries such as the U.S., Canada, and Russia there is an extensive existing natural gas pipeline network that could be used to transport and distribute hydrogen. Merchant generation segment is expected to retain its leading position from 2024 to 2030.

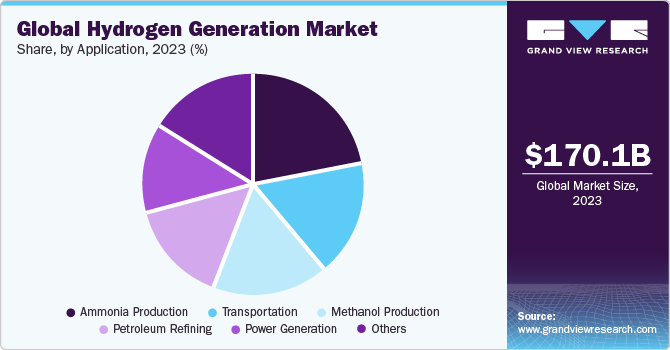

Application Insights

Ammonia production accounted for the largest revenue share of above 21.0% in 2023. It is expected to maintain its lead throughout the forecast period. Ammonia’s potential as a carbon-free fuel, hydrogen carrier, and energy store represents an opportunity for renewable hydrogen technologies to be deployed at an even greater scale. Hydrogen is typically produced on-site at ammonia plants from a fossil fuel feedstock. Natural gas is the most common feedstock, which feeds a steam methane reforming (SMR) unit. Coal can also be used to produce ammonia via a partial oxidation (POX) process.

Market is anticipated to witness steady growth across all segments as the demand for hydrogen increases. Methanol is currently considered one of the most useful chemical products and is a promising building block for obtaining more complex chemical compounds, such as acetic acid, methyl tertiary butyl ether, dimethyl ether, methylamine, etc. Methanol is the simplest alcohol, appearing as a colorless liquid with a distinctive smell. It can be produced by converting CO2 and H2 and is expected to benefit by significantly reducing CO2 emissions in atmosphere.

Hydrogen-based power generation technology has comfortably positioned itself in mature markets, such as North America and Europe, where clean yet effective energy is one of the primary aspects. Hydrogen-based power generation, which is cost-effective and a reliable source of power generation, is generating optimistic demands.

Turning crude oil into various end-user products such as transport fuels and petrochemical feedstock are some of the major applications of hydrogen. Hydrotreatment and hydrocracking are the main hydrogen-consuming processes in refineries. Hydrotreatment is used to remove impurities, especially Sulphur, and accounts for a large share of refinery hydrogen use globally. Hydrocracking is a process that uses hydrogen to upgrade heavy residual oils into higher-value oil products.

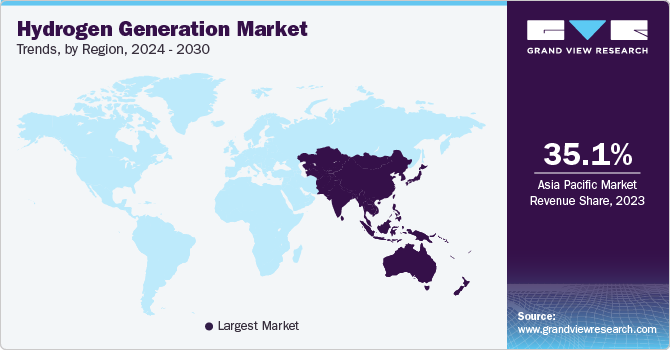

Regional Insights

Asia Pacific accounted for the largest revenue share of over 35.14% in 2023.China led it in 2023, in terms of revenue. Presence of a high number of refineries in major countries such as China and India has resulted in driving the utilization of hydrogen generation. Furthermore, governments in some Asia Pacific countries such as Japan and Australia are evaluating greener and cleaner technologies for hydrogen generation.

Regional hydrogen producers are looking to expand their geographical reach and target countries like Vietnam, Indonesia, and South Africa among other developing nations, to boost their revenue. U.S.-based market players like Praxair Inc. and Air Liquide are looking to expand their operations in countries with increasing demand for hydrogen as part of their strategic growth plans.

Expansion of hydrogen generation industry in North America has been underway for several years. Industry has grown at a brisk pace with contributions from each application and technology. Methanol production and ammonia production are the fastest growing sectors with countries such as the U.S. and Canada witnessing significant growth in the last five years.

Growth in hydrogen generation is expected on account of fuel cell development and deployment in Europe, which is witnessing an increase due to the projects announced by European Commission (EU) through organizations such as Fuel Cells and Hydrogen Joint Undertaking (FCH JU). These projects have been announced with an objective of increasing adoption of fuel cell vehicles in Europe and this will aid in development of supportive hydrogen infrastructure for fuel cell vehicles in major European countries.

Key Companies & Market Share Insights

Hydrogen generation industry is competitive with key participants involved in R&D and constant innovation done by vendors has become one of the most important factors for companies to perform in this industry. For instance, Matheson Tri-Gas, Inc. acquired Linde HyCO business that produces hydrogen, carbon monoxide, or syngas. This acquisition is expected to promote expansion of company’s capabilities and serve petrochemical and refining industries.

Air Liquide announced that it will manufacture and market renewable liquid hydrogen to the U.S. West Coast mobility market. This large-scale project is expected to produce 30 tons of liquid hydrogen per day using biogas technology.

Key Hydrogen Generation Companies:

- Air Liquide International S.A

- Air Products and Chemicals, Inc

- Hydrogenics Corporation

- INOX Air Products Ltd.

- Iwatani Corporation

- Linde Plc

- Matheson Tri-Gas, Inc.

- Messer

- SOL Group

- Tokyo Gas Chemicals Co., Ltd.

Hydrogen Generation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 186.58 billion

Revenue forecast in 2030

USD 317.39 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in million metric tons, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, system, source, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Russia; China; India; Japan; South Korea; Australia; Brazil; Colombia; Paraguay Saudi Arabia; UAE; South Africa; Egypt

Key companies profiled

Linde Plc; Messer; Air Products and Chemicals, Inc; Air Liquide International S.A; INOX Air Products Ltd.; Matheson Tri-Gas, Inc.; SOL Group; Iwatani Corporation; Hydrogenics Corporation; Tokyo Gas Chemicals Co., Ltd.; Taiyo Nippon Sanso Corporation; Teledyne Technologies Incorporated; Hygear; Claind; Advanced Specialty Gases Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Generation Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each sub-segment from 2018 to 2030. Forthis study, Grand View Research has segmented the global hydrogen generation market report based on technology, application, system, source, and region:

-

Technology Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

-

Steam Methane Reforming

-

Coal Gasification

-

Others

-

-

Application Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

-

Methanol production

-

Ammonia Production

-

Petroleum Refining

-

Transportation

-

Power Generation

-

Others

-

-

System Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

-

Captive

-

Merchant

-

-

Source Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

-

Natural Gas

-

Coal

-

Biomass

-

Water

-

-

Regional Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Colombia

-

Paraguay

-

-

Middle East & Africa

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global hydrogen generation market size was estimated at USD 170.14 billion in 2023 and is expected to reach USD 186.58 billion in 2024.

b. The global hydrogen generation market is expected to grow at a compounded annual growth rate of 9.3% from 2024 to 2030 to reach USD 317.39 billion by 2030.

b. The Asia Pacific dominated the hydrogen generation market in terms of revenue with the highest share of 35.14% in 2023. This is attributable to rising healthcare awareness coupled with cloud-based technology acceptance and constant research and development initiatives.

b. Some key players operating in the hydrogen generation market include Linde Plc; Messer; Air Products and Chemicals, Inc; Air Liquide International S.A; INOX Air Products Ltd.; Matheson Tri-Gas, Inc.; SOL Group; Iwatani Corporation.

b. Key factors driving the hydrogen generation market growth include rising demand for petroleum coke in the steel industry; development in the cement and power generation industries; growth in the supply of heavy oils globally and favorable government initiatives regarding the sustainable and green environment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."