- Home

- »

- Renewable Energy

- »

-

Hydrogen Electrolyzer Market Size And Share Report, 2030GVR Report cover

![Hydrogen Electrolyzer Market Size, Share & Trends Report]()

Hydrogen Electrolyzer Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Alkaline, Solid Oxide Electrolyzer), By Application, By Power Rating, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-341-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Electrolyzer Market Summary

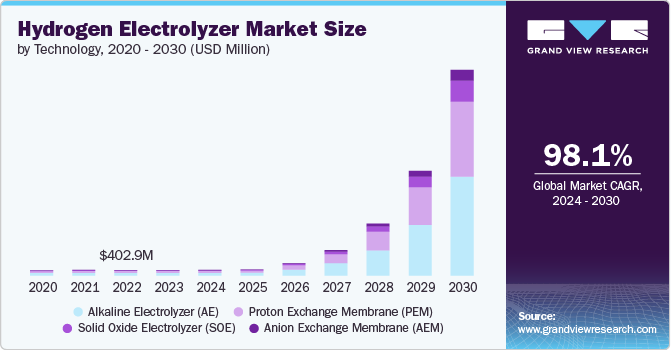

The global hydrogen electrolyzer market size was estimated at USD 517.80 million in 2023 and is projected to reach USD 63.72 billion by 2030, growing at a CAGR of 98.1% from 2024 to 2030. This market stands at the forefront of a monumental shift towards sustainable energy solutions.

Key Market Trends & Insights

- North America hydrogen electrolyzer market accounted for over 18.00% revenue share in 2023.

- U.S. dominates the hydrogen electrolyzer market in North America and accounted for a share of over 70.00% in 2023.

- By technology, proton exchange membrane (PEM) segment led the market and accounted for over 49.00% revenue share in 2023.

- By application, the energy segment led the market and accounted for over 35.00% revenue share in 2023.

- By power rating, the

Market Size & Forecast

- 2023 Market Size: USD 517.80 Million

- 2030 Projected Market Size: USD 63.72 Billion

- CAGR (2024-2030): 98.1%

- North America: Largest market in 2023

This valuation underscores the emerging importance of hydrogen as a key player in the transition to green energy, driven by the pressing need to combat climate change and reduce global carbon emissions. Governments around the world are increasingly implementing stringent policies and offering incentives to promote the adoption of clean energy technologies, including hydrogen.

This regulatory push, combined with significant public and private investments in hydrogen infrastructure, is setting the stage for rapid market growth. Hydrogen electrolyzers, which play a critical role in producing green hydrogen from renewable energy sources, are gaining traction as indispensable tools in this global energy transition.

Technological advancements are significantly bolstering the market, making hydrogen production more efficient and cost-effective. Continuous improvements in materials, design, and engineering are enhancing the performance and scalability of electrolyzers, facilitating their adoption across various sectors such as transportation, industrial processes, and energy storage. The integration of hydrogen production with renewable energy sources, like wind and solar power, is particularly transformative.

By utilizing excess renewable energy to produce hydrogen, challenges related to energy storage and grid stability are effectively addressed, paving the way for a more resilient and sustainable energy system. This synergy between hydrogen and renewable energy not only supports the broader adoption of clean energy technologies but also reinforces the crucial role of hydrogen electrolyzers in achieving a carbon-neutral future. As the market continues to evolve, hydrogen electrolyzers are poised to become central to the global energy landscape, driving innovation and fostering an environmentally sustainable energy ecosystem.

Drivers, Opportunities & Restraints

The market is propelled by the urgent need to reduce carbon emissions and tackle climate change. Governments around the world are implementing stringent regulations and offering incentives to promote clean energy alternatives, positioning hydrogen as a key element in the transition to a sustainable energy system. Substantial public and private investments in hydrogen infrastructure are creating a robust foundation for market growth, as countries strive to meet ambitious climate targets and reduce their reliance on fossil fuels.

Technological advancements are significantly enhancing the efficiency and cost-effectiveness of hydrogen electrolyzers. Innovations in materials and engineering, such as advanced catalysts and improved membrane technologies, are making hydrogen production more economically viable. These improvements are enabling the deployment of hydrogen electrolyzers on a larger scale, facilitating their integration into diverse applications across various industries, including transportation, manufacturing, and energy storage. As a result, the market is experiencing increased interest and investment from stakeholders seeking to capitalize on the potential of hydrogen as a sustainable energy source.

Opportunities in the hydrogen electrolyzer market are vast, particularly in the transportation and industrial sectors. Hydrogen fuel cells are emerging as a viable alternative to traditional fossil fuels, offering a clean and efficient energy solution for vehicles, from cars to heavy-duty trucks and even ships. The expansion of hydrogen refueling infrastructure, supported by government initiatives and private investments, is driving the demand for electrolyzers to produce the necessary hydrogen fuel. Additionally, the industrial sector is increasingly using hydrogen as a feedstock and energy source for processes such as steel production and chemical manufacturing, driving further demand for electrolyzers. The integration of hydrogen production with renewable energy sources, such as wind and solar power, presents a transformative opportunity, addressing energy storage and grid balancing challenges while promoting a sustainable and resilient energy system. This synergy is expected to significantly boost the market as the global focus on renewable energy intensifies.

Technology Insights

Proton exchange membrane (PEM) segment led the market and accounted for over 49.00% revenue share in 2023. This dominance is largely attributed to PEM electrolyzers' superior efficiency and performance characteristics. They operate at lower temperatures and use a solid polymer electrolyte, which enhances safety and durability. These electrolyzers are particularly effective in producing high-purity hydrogen, which is crucial for applications in sectors such as transportation and renewable energy integration. The ability of PEM technology to quickly adapt to variable power inputs from renewable sources like wind and solar energy makes it an ideal choice for supporting the global transition to sustainable energy systems.

PEM electrolyzers are also favored for their compact and modular design, which allows for easy scalability and integration into various infrastructures, from small-scale distributed energy systems to large industrial hydrogen production plants. This flexibility is essential for meeting the diverse needs of industries ranging from automotive to chemical manufacturing and power generation. Ongoing advancements in PEM technology, such as the development of more cost-effective and durable membrane materials, continue to enhance its attractiveness and drive widespread adoption. As a result, the PEM segment's substantial revenue share underscores its critical role in the hydrogen electrolyzer market, supported by increasing demand for clean hydrogen production solutions and continuous innovation in the field.

Application Insights

The energy segment led the market and accounted for over 35.00% revenue share in 2023. This dominance is largely due to the increasing integration of hydrogen technologies within the energy sector, particularly for power-to-gas applications and renewable energy storage. By converting surplus renewable energy into hydrogen, electrolyzers help stabilize the grid and maximize the use of intermittent energy sources like wind and solar power. This process not only enhances energy security but also supports the global shift towards cleaner energy systems, reducing reliance on fossil fuels and lowering carbon emissions.

Additionally, significant investments in hydrogen infrastructure and the development of large-scale hydrogen production projects are propelling the energy segment's growth. Energy companies and utilities are adopting hydrogen electrolyzers to produce green hydrogen, which serves as a versatile energy carrier for various applications, including power generation, heating, and industrial processes. The use of green hydrogen is crucial for meeting stringent climate targets and regulatory requirements aimed at decarbonizing the energy sector. As technological advancements continue to improve the efficiency and cost-effectiveness of hydrogen production, the energy segment is expected to maintain its leading position, driving further innovation and expansion in the global hydrogen electrolyzer market.

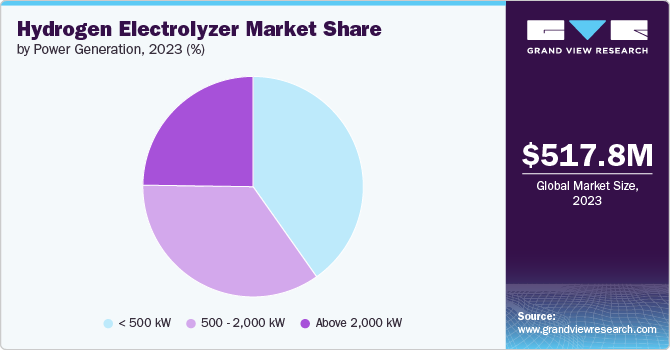

Power Rating Insights

The <500 kW segment led the market and accounted for more than 40.00% of revenue share in 2023. This segment's prominence can be attributed to its suitability for small to medium-scale hydrogen production applications, which are increasingly in demand across various sectors. These smaller electrolyzers are particularly favored for their flexibility and cost-effectiveness, making them ideal for decentralized energy systems, pilot projects, and research and development initiatives. They are often used in applications such as fueling stations for hydrogen-powered vehicles, small-scale industrial processes, and renewable energy integration projects.

The popularity of the <500 kW segment is also driven by the growing emphasis on distributed hydrogen production, which aims to enhance energy security and reduce dependency on centralized production facilities. These electrolyzers are easier to install and maintain, offering a practical solution for businesses and municipalities looking to adopt hydrogen technology without significant capital investment. Furthermore, advancements in technology are continuously improving the efficiency and reducing the costs of smaller electrolyzers, making them an attractive option for a wide range of applications. As the global push for clean energy intensifies, the <500 kW segment is expected to maintain its strong market position, supporting the transition to a more sustainable and decentralized energy landscape.

Regional Insights

North America hydrogen electrolyzer market accounted for over 18.00% revenue share in 2023. The region’s growth is driven by increasing investments in clean energy infrastructure and government initiatives promoting hydrogen adoption. The region's robust industrial base and commitment to reducing carbon emissions are fostering the deployment of electrolyzers across various sectors, including transportation and energy storage.

U.S. Hydrogen Electrolyzer Market Trends

U.S. dominates the hydrogen electrolyzer market in North America and accounted for a share of over 70.00% in 2023. Thisis poised for expansion, supported by federal funding and initiatives aimed at accelerating the development of hydrogen technologies. Key players in the energy sector are investing in hydrogen production facilities, particularly in states like California and Texas, to meet growing demand from industries and transportation sectors transitioning to cleaner energy sources.

Hydrogen Electrolyzer Market in Canada is expected to grow at significant CAGR of 101.1%. Canada's hydrogen electrolyzer market is gaining momentum, driven by its vast renewable energy resources and ambitious climate targets. Government incentives and partnerships are promoting hydrogen as a key component of Canada's energy transition strategy. Electrolyzer projects are particularly prominent in provinces like British Columbia and Alberta, where hydrogen production is being integrated with oil sands operations and renewable energy projects.

Asia Pacific Hydrogen Electrolyzer Market Trends

The Asia Pacific region is a hotspot for hydrogen electrolyzer market growth, fueled by rapid industrialization, urbanization, and government initiatives promoting clean energy. Countries like Japan, South Korea, and Australia are leading the adoption of hydrogen technologies, driven by efforts to reduce dependence on fossil fuels and mitigate air pollution.

Hydrogen Electrolyzer Market in China accounted for largest share of over 59.00% in 2023, and experiencing substantial growth, supported by ambitious targets to achieve carbon neutrality by 2060. The government's focus on hydrogen as a strategic energy source is driving investments in electrolyzer manufacturing and deployment. Provinces like Inner Mongolia and Qinghai are emerging as hubs for hydrogen production projects leveraging renewable energy sources.

India Hydrogen Electrolyzer Market is expected to progress with a CAGR of 97.5% over forecast period. India's hydrogen electrolyzer market is in its nascent stages but poised for rapid development, driven by increasing renewable energy capacity and government initiatives promoting hydrogen as a clean fuel alternative. The country's focus on green hydrogen production and storage is expected to drive demand for electrolyzers, particularly in sectors such as transportation and industrial manufacturing.

Europe Hydrogen Electrolyzer Market Trends

Europe is at the forefront of the global hydrogen electrolyzer market, with countries like Germany, France, and the Netherlands leading in hydrogen infrastructure development. The European Green Deal and national hydrogen strategies are driving investments in electrolyzer projects aimed at decarbonizing industries, transportation, and power generation.

Hydrogen electrolyzer market in Germany accounted for market revenue share of more than 30.00% in 2023, supported by strong government incentives and the country's leadership in renewable energy adoption. Electrolyzer manufacturers and energy companies are collaborating to scale up hydrogen production capacity, with projects focused on integrating electrolyzers with wind and solar power installations.

Italy hydrogen electrolyzer market is expected to grow at a significant rate with CAGR of 96.45%, propelled by government support for hydrogen infrastructure and industrial decarbonization efforts. The country's strategic location and commitment to renewable energy make it an attractive market for electrolyzer deployments in sectors such as chemical manufacturing and transportation.

Central & South America Hydrogen Electrolyzer Market Trends

Central and South America are emerging markets for hydrogen electrolyzers, driven by efforts to diversify energy sources and reduce carbon emissions. Countries like Chile and Brazil are exploring opportunities in green hydrogen production, supported by abundant renewable energy resources such as solar and wind.

Middle East & Africa Hydrogen Electrolyzer Market Trends

The Middle East and Africa are increasingly focusing on hydrogen electrolyzer technologies to leverage their vast renewable energy potential and diversify their economies. Countries like Saudi Arabia and Morocco are investing in electrolyzer projects to produce green hydrogen for domestic use and export, positioning the region as a key player in the global hydrogen economy.

Key Hydrogen Electrolyzer Company Insights

Mergers and acquisitions are on the rise to expand geographical reach and expertise. Companies are also focusing on advancements in electrolyzer efficiency, scalability, and integration with renewable energy sources. Furthermore, the trend leans towards offering full-service solutions encompassing construction, maintenance, and even financing, catering to the diverse needs of industries such as transportation, industrial manufacturing, and energy companies.

Key Hydrogen Electrolyzer Companies:

The following are the leading companies in the hydrogen electrolyzer market. These companies collectively hold the largest market share and dictate industry trends.

- thyssenkrupp nucera

- John Cockerill

- Nel ASA

- Plug Power Inc.

- Siemens Energy

- Enapter S.r.l.

- Cummins Inc.

- ITM Power

- McPhy Energy S.A.

- Topsoe

Recent Developments

-

In September 2023, Enapter AG announced to expand its product portfolio with the launch of AEM Flex 120 a modular electrolyzer designed for scalability and ease of deployment of industrial and refuelling hydrogen projects.

-

In June 2023, Air Liquide collaborated with Siemens Energy to develop, manufacture, and deploy large-scale PEM electrolyzers for large-scale hydrogen production facilities.

-

In June 2023, ITM Linde Electrolysis GmbH signed a memorandum of understanding (MOU) with Neste to form a joint venture to develop and deliver a 100 MW electrolyzer plant for green hydrogen production in Finland.

Hydrogen Electrolyzer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.05 billion

Revenue forecast in 2030

USD 63.72 billion

Growth Rate

CAGR of 98.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, capacity forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, power rating, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; South Korea; Australia; Germany; Russia; UK; Italy; Qatar; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

thyssenkrupp nucera; John Cockerill; Nel ASA; Plug Power Inc.; Siemens Energy,; Enapter S.r.l.; Cummins Inc.; ITM Power; McPhy Energy S.A.; Topsoe, PERIC Hydrogen Technologies Co., Ltd; Sunfire GmbH, H-TEC SYSTEMS GmbH; LONGi; Beijing SinoHy Energy Co., Ltd.; h2e Power; Next Hydrogen; Asahi Kasei Corporation.; iGas energy GmbH; Bloom Energy; OxEon Energy, LLC.; Green Hydrogen Systems; HydrogenPro; Erre Due s.p.a.; Ohmium

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Electrolyzer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydrogen electrolyzer market based on the technology, application, power rating, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Alkaline Electrolyzer (AE)

-

Proton Exchange Membrane (PEM)

-

Solid Oxide Electrolyzer (SOE)

-

Anion Exchange Membrane (AEM)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy

-

Power Generation

-

CHP

-

-

Mobility

-

Industrial

-

Chemical

-

Industries

-

-

Grid Injection

-

-

Power Generation Outlook (Revenue, USD Million, 2018 - 2030)

-

<500 kW

-

500-2,000 kW

-

>2,000 kW

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

Norway

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Qatar

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hydrogen electrolyzer market size was estimated at USD 517.80 million in 2023 and is expected to reach USD 1.05 billion in 2024.

b. The global hydrogen electrolyzer market is expected to grow at a compound annual growth rate of 98.11% from 2024 to 2030 to reach USD 63.72 billion by 2030.

b. Based on the technology, proton exchange membrane (PEM) segment led the market and accounted for over 49.00% revenue share in 2023. This dominance is largely attributed to PEM electrolyzers' superior efficiency and performance characteristics.

b. Some of the key players operating in this industry include John Cockerill, Nel ASA, Plug Power Inc., Siemens Energy, Enapter S.r.l., Cummins Inc., ITM Power, McPhy Energy S.A., among others.

b. Key factors driving the market growth include innovations in materials and engineering, such as advanced catalysts and improved membrane technologies, which are making hydrogen production more economically viable. These improvements are enabling the deployment of hydrogen electrolyzers on a larger scale.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.