- Home

- »

- Advanced Interior Materials

- »

-

Hydraulic Workover Unit Market Size, Industry Report, 2030GVR Report cover

![Hydraulic Workover Unit Market Size, Share & Trends Report]()

Hydraulic Workover Unit Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Workover, Snubbing), By Installation, By Application, By Capacity (Below 150 Tons), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-354-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydraulic Workover Unit Market Summary

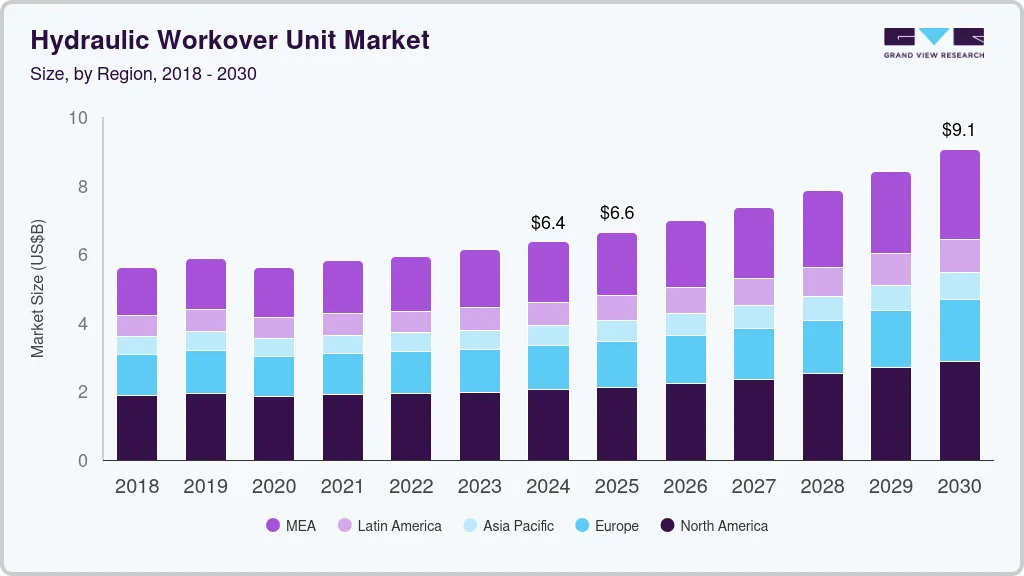

The global hydraulic workover unit market size was estimated at USD 6,357.1 million in 2024 and is projected to reach USD 9,059.2 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The hydraulic workover unit industry is driven primarily by the growing demand for efficient and cost-effective solutions in drilling, completing, and repairing wells, especially in the oil & gas industry.

Key Market Trends & Insights

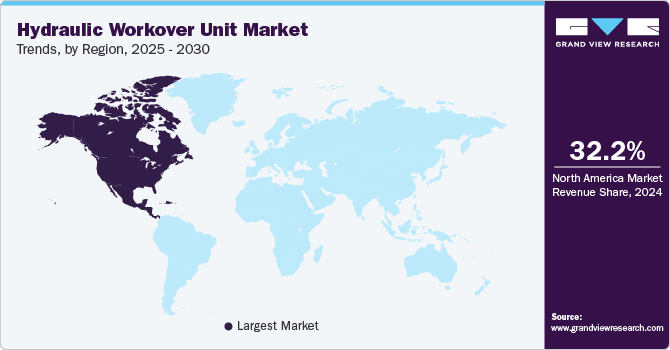

- North America dominated the hydraulic workover unit market with the largest revenue share of 32.2% in 2024.

- The hydraulic workover unit market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By service, the workover service segment led the market with the largest revenue share of 78.1% in 2024.

- By installation,the skid mounted installation segment led the market with the largest revenue share of 60.1% in 2024.

- By application, the onshore segment led the market with the largest revenue share of 66.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,357.1 Million

- 2030 Projected Market Size: USD 9,059.2 Million

- CAGR (2025 - 2030): 6.4%

- North America: Largest market in 2024

In addition, the integration of digital technologies, such as remote monitoring and automation, is improving operational efficiency and safety. The market is also witnessing a shift towards higher-capacity units, particularly in offshore applications, to meet the demands of deepwater drilling and complex well interventions. North America continues to be a leading market, with a significant share attributed to the proliferation of shale gas production and unconventional oil reserves.

Drivers, Opportunities & Restraints

The escalating need for well intervention and maintenance, particularly in aging oilfields, is propelling the demand for hydraulic workover units. These units offer cost-effective and efficient solutions for well servicing, enabling operators to extend the life of wells and enhance production rates. As over 65% of global oil production stems from mature fields, the reliance on HWUs for tasks like snubbing and enhanced oil recovery is increasing, especially in regions like North America and the Middle East.

A significant barrier to the widespread adoption of hydraulic workover units is their substantial capital investment and ongoing operational expenses. The sophisticated technology and machinery involved, coupled with the need for skilled labor, contribute to high costs. In addition, fluctuations in oil prices can impact the financial viability of deploying such equipment, particularly for small and medium-sized enterprises.

Advancements in automation and digital monitoring technologies present substantial opportunities for the hydraulic workover unit industry. The integration of artificial intelligence, real-time data analytics, and remote operation capabilities can enhance operational efficiency, reduce human error, and improve safety. These innovations are particularly beneficial in offshore and deepwater operations, where complex interventions are required.

Service Insights

The workover service segment led the market with the largest revenue share of 78.1% in 2024. The hydraulic workover unit industry for workover services has been witnessing notable growth, driven by the critical need for repair, maintenance, and enhancement of existing wells in the oil and gas sector. Workover services represent a significant segment of the market, given their essential role in extending the life of wells, increasing production, and ensuring operational safety and environmental compliance.

The snubbing services segment is anticipated to grow at the fastest CAGR during the forecast period, due to the rising demand for well intervention operations that require the handling of wellbore pressures. Snubbing services, a subset of workover operations involving the insertion or removal of tubing or tools from wells under pressure, increasingly rely on hydraulic workover units for their capability to safely and efficiently manage operations in live wells.

Installation Insights

The skid mounted installation segment led the market with the largest revenue share of 60.1% in 2024. Skid-mounted hydraulic workover units are particularly valued for their ease of transportation and quick setup times, making them ideal for operations in remote or difficult-to-access locations. Their compact footprint allows for operations in limited space environments, which is a significant advantage in densely packed oil fields or when dealing with environmental and logistical constraints.

The hydraulic workover unit industry for trailer-mounted installations is experiencing substantial growth, which is primarily attributable to the mobility, versatility, and rapid deployment capabilities of these units. Trailer-mounted hydraulic workover units can be quickly transported to and from sites. These offer significant advantages for operations requiring swift responses, such as emergency well repairs, well deepening, and plug and abandonment activities.

Application Insights

The onshore segment led the market with the largest revenue share of 66.3% in 2024. The market is driven by the escalating demand for efficient and economical solutions for well maintenance, repair, and drilling operations in onshore oil & gas fields. This demand is further amplified by the continuous development of onshore resources and the need for sustainable production levels, especially in mature fields where enhancing the recovery of existing wells becomes crucial.

Hydraulic workover units, known for their versatility, mobility, and capability to operate under various well conditions, are increasingly preferred for onshore projects due to their ability to conduct operations quickly and safely, without the need for a full drilling rig setup. Their cost-effectiveness, combined with the ability to perform a wide range of workover and drilling tasks, makes them an attractive option for onshore operators looking to optimize production while adhering to stringent environmental and safety standards.

The hydraulic workover unit industry is experiencing robust growth in offshore applications, primarily fueled by the increasing complexity and depth of offshore oil and gas exploration and production activities. As offshore fields become more challenging, with operations often conducted in deeper waters and more demanding environments, the need for reliable, efficient, and flexible workover solutions has surged. Hydraulic workover units, with their compact size and capability to operate in a wide range of offshore platforms, including jack-ups, platforms, and floating production systems, offer a vital solution.

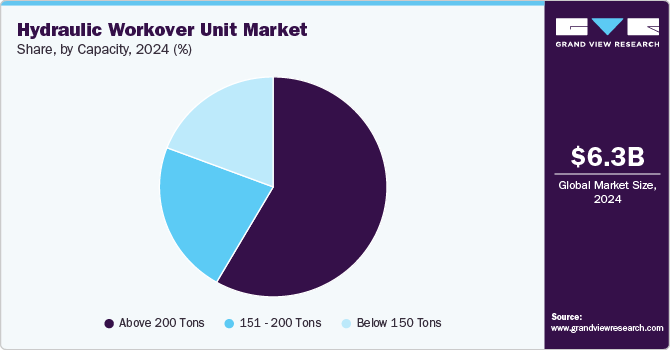

Capacity Insights

The above 200 tons capacity segment led the market with the largest revenue share of 58.3% in 2024, primarily due to their optimal balance of power, versatility, and operational scope suited for a wide array of well intervention and workover applications. This capacity range is especially beneficial for medium to deep well operations, where more substantial lifting and pulling capabilities are required, but without the extensive footprint and logistics of larger units.

The below 150 tons segment is anticipated to grow at a significant CAGR during the forecast period, driven by their adaptability and efficiency in performing workovers, completions, and well interventions for shallow to medium-depth wells. These lighter units are particularly favored for their mobility, ease of transportation, and quick rig-up and rig-down capabilities, making them ideal for operations in constrained spaces and environments where a smaller operational footprint is required.

Regional Insights

North America dominated the hydraulic workover unit market with the largest revenue share of 32.2% in 2024. The North America market is experiencing robust growth, driven by the region's large oil & gas production, mainly in the U.S. and Canada. North America, home to some of the world's largest and most productive oil and gas fields, including the Permian Basin, Eagle Ford Shale, and the Western Canadian Sedimentary Basin, significantly contributes to the demand for hydraulic workover units. These units are crucial for well maintenance, completion, and intervention operations, catering to both conventional and unconventional resources.

U.S. Hydraulic Workover Unit Market

The hydraulic workover unit market in the U.S. accounted for the largest market revenue share in North America in 2024. The U.S. remains a dominant player in the North America market, driven by extensive shale oil and gas production. Operators increasingly favor modular and high-capacity HWUs for efficient well interventions in unconventional reservoirs. Technological innovations, such as automation and digital monitoring, are enhancing operational efficiency and safety.

The Canada hydraulic workover unit market is expected to grow at a significant CAGR of 5.6% from 2025 to 2030. The Canada market is characterized by a strong emphasis on environmental sustainability and regulatory compliance. Operators are adopting eco-friendly and energy-efficient HWUs to align with stringent environmental standards.

Europe Hydraulic Workover Unit Market Trends

The hydraulic workover unit market in Europe is influenced by the need to enhance production from mature and aging oilfields. Operators are investing in advanced HWUs equipped with real-time monitoring systems and automation to optimize well interventions. Countries like Germany are leading in integrating eco-friendly technologies, ensuring compliance with the EU's stringent environmental regulations.

The Germany hydraulic workover unit marketis driven by technological innovation and a strong commitment to environmental sustainability. Operators are focusing on developing HWUs that are both efficient and environmentally friendly, incorporating advanced monitoring systems to enhance operational performance. The emphasis on reducing emissions and energy consumption aligns with Germany's stringent environmental policies.

The hydraulic workover unit market in the UK is driven by the need to maximize production from its North Sea oilfields. Operators are increasingly adopting high-capacity HWUs capable of handling complex well interventions. The focus is on enhancing operational efficiency and safety, with a growing trend towards automation and digitalization in workover operations.

Asia Pacific Hydraulic Workover Unit Market Trends

The hydraulic workover unit market in the Asia Pacific is anticipated to grow at a significant CAGR during the forecast period, fueled by increasing energy demand and expanding oil and gas exploration activities. Countries like China and India are investing in advanced HWUs to optimize production from mature and offshore oilfields. The adoption of modular and high-capacity units is on the rise, catering to the diverse operational needs of the region.

The China hydraulic workover unit market held a significant share in the Asia Pacific region. The market is driven by the country's focus on enhancing production from its offshore and onshore oilfields. Operators are investing in high-capacity HWUs capable of handling complex well interventions in high-pressure environments. The emphasis is on reducing reliance on imported equipment by developing indigenous manufacturing capabilities, aligning with the government's 'Made in China' initiative.

The hydraulic workover unit market in India is expected to grow at the fastest CAGR of 6.5% from 2025 to 2030. The India market is witnessing growth due to increased offshore exploration and production activities. Collaborations with foreign partners are enhancing technological capabilities, leading to the development of adaptable and efficient HWUs.

Middle East & Africa Hydraulic Workover Unit Market Trends

The hydraulic workover unit market in the Middle East & Africa is experiencing significant growth, driven by increasing production from mature oilfields and the need for enhanced oil recovery (EOR) techniques. Countries like Saudi Arabia are investing in high-capacity HWUs to optimize well interventions and maximize production. The market is characterized by a growing demand for modular and mobile units that offer flexibility and reduced rig-up times.

The Saudi Arabia hydraulic workover unit market is influenced by the country's vast oil reserves and ongoing exploration and production activities. Operators are focusing on deploying advanced HWUs capable of handling complex well interventions in both onshore and offshore fields. The emphasis is on enhancing operational efficiency and safety, with a growing trend towards automation and digitalization in workover operations.

Latin America Hydraulic Workover Unit Market Trends

The hydraulic workover unit market in Latin America is driven by the need to enhance production from mature oilfields and deepwater reserves. Countries like Brazil are investing in high-capacity HWUs to optimize well interventions in challenging offshore environments. The market is characterized by a growing demand for modular and mobile units that offer flexibility and reduced rig-up times.

The Brazil hydraulic workover unit market is expanding due to the country's focus on deepwater oil exploration and production. Operators are adopting advanced HWUs capable of handling complex well interventions in ultra-deepwater fields. The emphasis is on enhancing operational efficiency and safety, with a growing trend towards automation and digital monitoring in workover operations.

Key Hydraulic Workover Unit Market Company Insights

Some of the key players operating in the hydraulic workover unit industry include Halliburton, National Oilwell Varco, Archer, and Cudd Energy Services.

-

Halliburton is engaged in the business of providing products and services to the energy industry, with a significant presence in the hydraulic workover unit (HWU) industry. Hydraulic workover units offered by Halliburton are part of its Production Enhancement segment, showcasing the company's emphasis on improving operational efficiencies and reservoir performance. These units are designed to perform a wide range of operations, allowing for workover operations without the need for a conventional rig.

-

Cudd Energy Services, a leading service provider in the oil and gas industry, offers a broad range of specialized solutions, including hydraulic workover operations. As a division of RPC, Inc., Cudd Energy Services has established a strong presence in the hydraulic workover unit (HWU) market, serving clients across various geographical regions.

High Arctic Energy Services Inc., Basic Energy Services, and Superior Energy Services are some of the emerging market participants in the hydraulic workover unit industry.

-

High Arctic Energy Services Inc. is known for providing specialized oilfield equipment and services to the natural gas and oil industries. Established and having built a reputation over the years, High Arctic operates primarily in Canada and Papua New Guinea. In Canada, the company's services revolve around the provision of drilling support and production services, including snubbing services (a method of performing work on oil and gas wells), hydraulic workover, nitrogen services, and equipment rentals.

-

Basic Energy Services dedicated its operations to a broad spectrum of services critical to the daily functions and operational efficiency of oil and gas exploration and production. These services encompass well servicing, which includes maintenance, repair, and completion of wells, in addition to fluid services that ensure the appropriate transportation, storage, and disposal of the fluids used in or produced by drilling and completion processes.

Key Hydraulic Workover Unit Companies:

The following are the leading companies in the hydraulic workover unit market. These companies collectively hold the largest market share and dictate industry trends.

- Halliburton

- National Oilwell Varco

- Archer

- Cudd Energy Services

- Precision Drilling Corporation

- High Arctic Energy Services Inc.

- Basic Energy Services

- Superior Energy Services

- Velesto Energy

- Canadian Energy Equipment Manufacturing FZE

- PT Elnusa Tbk

- Uzma Berhad

- ZYT Petroleum Equipment Co., Ltd

Recent Developments

-

In April 2025, Boots & Coots International Well Control signed a three-year contract, with a two-year extension option, with Algeria's Sonatrach to provide hydraulic workover/snubbing services. Worth USD 28 million, this contract adds to the company’s existing agreements in Algeria and includes deploying two additional 150K hydraulic workover units. Operations are expected to begin in Q4 2025.

-

In April 2024, PV Drilling signed a contract to purchase a new hydraulic workover unit (HWU), marking a key move for its business. This acquisition will enable PV Drilling to expand into workover and P&A programs while integrating additional services from its subsidiaries, including wireline, casing/tubing running, and coil tubing. The goal is to enhance the value chain, offering clients high-quality services at competitive prices.

-

In March 2023, EEST Energy Services (Thailand), a leading offshore contractor and service provider operating globally, has been awarded a contract valued at USD 9 million by Hibiscus Petroleum Berhad, Malaysia. The contract encompasses the delivery of services for well workover/replacement and well plugging and abandonment. These services will be carried out employing the EEST-502 hybrid hydraulic conversion unit, showcasing the innovative solutions EEST Energy Services brings to the industry.

Hydraulic Workover Unit Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,636.6 million

Revenue forecast in 2030

USD 9,059.2 million

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Service, installation, application, capacity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Russia; Norway; UK; Netherlands; Germany; China; Japan; India; Indonesia; Brazil; Argentina; Kuwait; Saudi Arabia; UAE; Nigeria; Iraq; Qatar

Key companies profiled

Halliburton; National Oilwell Varco; Archer

Cudd Energy Services; Precision Drilling Corporation; High Arctic Energy Services Inc.; Basic Energy Services; Superior Energy Services; Velesto Energy; Canadian Energy Equipment Manufacturing FZE; PT Elnusa Tbk; Uzma Berhad; ZYT Petroleum Equipment Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydraulic Workover Unit Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydraulic workover unit market report based on the service, Installation, application, capacity, and region.

-

Service (Revenue, USD Million, 2018 - 2030)

-

Workover

-

Snubbing

-

-

Installation (Revenue, USD Million, 2018 - 2030)

-

Skid Mounted

-

Trailer Mounted

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Offshore

-

Onshore

-

-

Capacity (Revenue, USD Million, 2018 - 2030)

-

Below 150 Tons

-

151 - 200 Tons

-

Above 200 Tons

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Norway

-

UK

-

Netherlands

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Kuwait

-

Saudi Arabia

-

UAE

-

Nigeria

-

Iraq

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global hydraulic workover unit market size was estimated at USD 6,357.1 million in 2024 and is expected to reach USD 6,636.6 million in 2025.

b. The global hydraulic workover unit market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 9,059.2 million by 2030.

b. North America dominated the hydraulic workover unit market with a revenue share of 32.2% in 2024. The hydraulic workover unit market in North America has been experiencing significant growth and development, primarily due to the region's robust energy sector and ongoing technological advancements.

b. Some of the key players operating in the hydraulic workover unit market include Halliburton, National Oilwell Varco, Archer, Cudd Energy Services, Precision Drilling Corporation, High Arctic Energy Services Inc., Basic Energy Services, Superior Energy Services, Velesto Energy, Canadian Energy Equipment Manufacturing FZE, PT Elnusa Tbk, Uzma Berhad, ZYT Petroleum Equipment Co., Ltd

b. The demand for the hydraulic workover unit market is attributed to the growing demand for efficient and cost-effective solutions in drilling, completing, and repairing wells, especially in the oil and gas industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.