Hydraulic Cylinder Market Size, Share & Trends Analysis Report By Function (Double-acting, Single-acting), By Product (Welded, Telescopic), By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-957-6

- Number of Report Pages: 193

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Energy & Power

Hydraulic Cylinder Market Size & Trends

The global hydraulic cylinder market size was valued at USD 15.32 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2022 to 2030. Increasing adoption of hydraulic cylinders in numerous industries such as material handling, construction and infrastructure, marine, and earthmoving is fueling the industry growth. The outbreak of COVID-19 has led to significant volatility in global commodity prices, thereby impacting the demand and supply of raw materials. Lockdown restrictions were imposed across countries to curb the spread of the virus, which led to a severe fallout for the global economy. The pandemic led to a deep recession and impacted production activities, which impacted hydraulic cylinder demand.

In North America, the U.S. had the most confirmed cases of coronavirus, followed by Canada and Mexico. The supply and distribution chains were adversely affected due to the COVID-19 outbreak, which negatively impacted the market growth in the region. The U.S. government is trying to propel the country's growth by investing significantly in various industries such as construction and infrastructure, energy, transportation, pharmaceutical and medicine, and EV infrastructure. For instance, in November 2021, the U.S. government signed a more than USD 1 trillion bipartisan infrastructure plan, thus fueling the growth of the hydraulic cylinder industry.

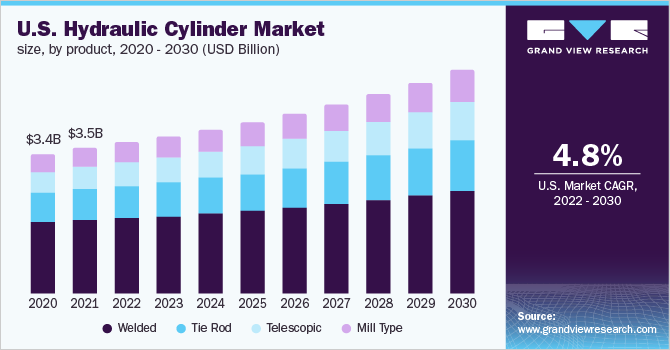

The U.S. is one of the major markets for hydraulic cylinders in the world, considering the presence of numerous machinery and equipment manufacturers in the country. The U.S. economy expanded owing to the goods and services produced in the U.S., which increased on a year-on-year basis. The country’s economy remains volatile due to geopolitical turbulence from the Russia-Ukraine conflict, increasing inflation, and the negative impact of the COVID-19 outbreak.

Function Insights

The double-acting segment dominated the market and accounted for over 70.0% share of the global revenue in 2021. Double-acting hydraulic cylinders find applications in large-scale engines such as ship motors, steam engines, industrial furnaces, earthmoving, and other construction equipment. The increase in the product demand within the aforementioned applications is expected to propel the demand for double-acting hydraulic cylinders over the forecast period.

The single-acting hydraulic cylinder is expected to expand at a CAGR of 3.9% over the forecast period. These cylinders find application in hydraulic jacks, factory automation settings, handling packages, handling materials, clamping, drilling with the handheld machine, and punching. The growth of the aforementioned applications is expected to augment the use of single-acting hydraulic cylinders over the forecast period.

Product Insights

The welded segment led the industry and accounted for more than 50.0% share of the global revenue in 2021. Welded hydraulic cylinders find applications in various industries such as construction, oil and gas, mining, waste handling and material handling, and heavy equipment. The rise in the consumption of welded hydraulic cylinders in these industries is expected to augment the segment growth.

The telescopic segment is likely to expand at a significant CAGR of 5.3% over the forecast period. These cylinders can be made as double-acting or single-acting cylinders, which allow them to be used for a wide range of applications. These cylinders are used for material handling, waste handling, trucks used in construction, and various applications in the agriculture industry.

Mill-type cylinders are used in various industries such as energy, oil and gas, mining, defense, machine tools, molding, automotive, plastic processing, primary metal refining, and rubber and tie processing. Increasing investment in the aforementioned industries is expected to increase the demand for mill-type hydraulic cylinders over the forecast period.

Tie rod cylinders have a wide range of applications such as clamping, bending, shearing and forging, pressing, and counterbalancing. Increasing demand for these cylinders owing to their short delivery time and cost-effectiveness is expected to propel industry growth over the forecast period.

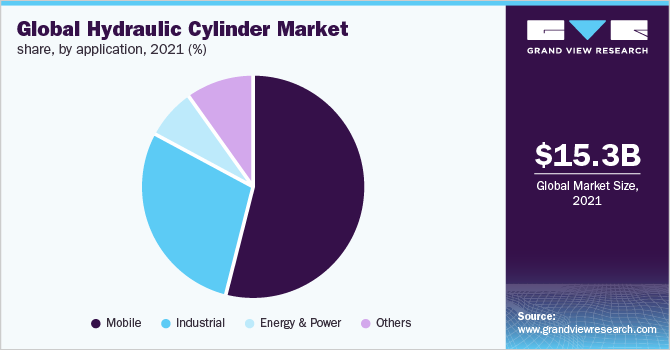

Application Insights

The mobile application segment led the market and accounted for over 50.0% share of the global revenue in 2021. Hydraulic cylinder is widely used in mobile applications such as loaders, excavators, mobile cranes, and telescopic loader. The increasing investment by government and private players in the aforementioned industries is propelling the demand for hydraulic cylinders in mobile applications.

Hydraulic cylinder-based equipment has a huge demand in industrial applications. Such equipment is used in various industrial processes such as forging, milling, drilling, casting, pressing, and sheering. Hydraulic cylinders are used in various types of machinery such as steel plant equipment, pulp and paper machinery, presses, and forklifts.

The demand for hydraulic cylinders has significantly increased in the energy and power segment, in applications such as wind turbines, gates of actuation, and valve actuation. The increasing consumption of energy has driven new power projects, which are expected to propel the demand for hydraulic cylinders over the forecast period.

Other applications of hydraulic cylinders include equipment and machinery utilized in the aerospace and defense and agricultural industries. Hydraulic cylinder is extensively used in aerospace and defense applications such as aircraft brakes and wheels, engine systems, flight control, and armored personnel carriers. Growth in aircraft production and rising investments in the defense industry are expected to benefit industry growth over the coming years.

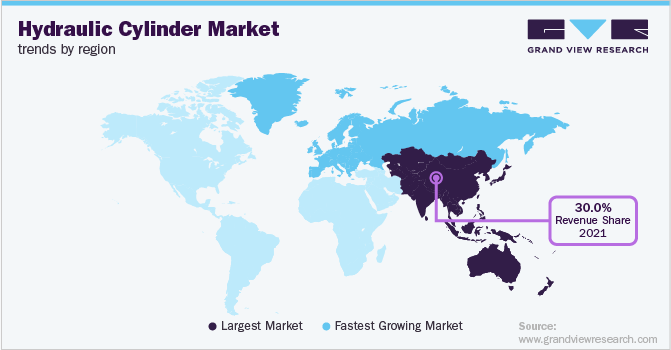

Regional Insights

Asia Pacific led the market and accounted for over 30.0% share of the global revenue in 2021. Asia Pacific is one of the largest consumers of hydraulic cylinders in the world owing to the increasing requirement for hydraulic equipment in various industries, such as infrastructure and construction, automotive, renewables, machine tooling, and logistics.

Countries in North America are focused on accelerating their economic growth rate by investing in infrastructure and construction, oil and gas, transportation, aviation, logistics, and shipping industries. The growth of these industries is anticipated to augment the demand for hydraulic cylinders in North America over the forecast period.

The European region is likely to expand at a CAGR of 3.3% over the forecast period. The renovation and decarbonization of buildings in Europe are expected to increase the consumption of hydraulic-based equipment such as excavators, bulldozers, trucks, and cranes in the region. This is expected to fuel the growth in Europe over the forecast period.

Key Companies & Market Share Insights

The global market is quite competitive, due to the presence of both international and local producers. To increase industry penetration and fulfill changing technological demands, global hydraulic cylinder manufacturers use a variety of methods such as acquisitions, collaborations, new product development, and geographic growth.

In April 2022, Daikin Industries, Ltd. announced a purchase agreement with Duplomatic MS S.p.A., an Italian hydraulic equipment manufacturer. This acquisition is expected to help Diakin Industries, Ltd. enter the European industrial equipment market. Some prominent players in the global hydraulic cylinder market include:

-

Eaton

-

SMC Corporation

-

Liebherr

-

PARKER HANNIFIN CORP

-

Caterpiller

-

Bosch Rexroth AG

-

Lehigh Fluid Power, Inc.

-

Hengli hydraulic

-

WEBER-HYDRAULIK GMBH

-

Burnside Autocyl

-

Pacoma GmbH

-

Charvát Group s.r.o

-

Southern Hydraulic Cylinder, Inc.

-

Yates Industries Inc.

-

Texas Hydraulics

Hydraulic Cylinder Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 15.83 billion |

|

Revenue forecast in 2030 |

USD 22.16 billion |

|

Growth Rate |

CAGR of 4.2% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Function, product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Eaton; SMC Corporation; Liebherr; PARKER HANNIFIN CORP; Caterpiller; Bosch Rexroth AG; Lehigh Fluid Power, Inc.; Hengli Hydraulic; WEBER-HYDRAULIK GMBH; Burnside Autocyl; Pacoma GmbH; Charvát Group s.r.o; Southern Hydraulic Cylinder, Inc.; Yates Industries Inc.; Texas Hydraulics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

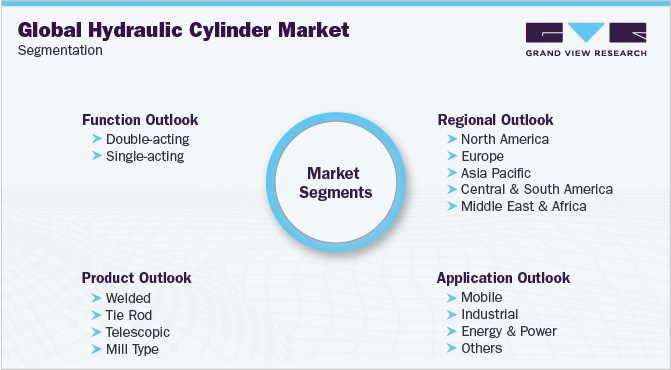

Global Hydraulic Cylinder Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global hydraulic cylinder market report based on function, product, application, and region:

-

Function Outlook (Revenue, USD Million, 2017 - 2030)

-

Double-acting

-

Single-acting

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Welded

-

Tie Rod

-

Telescopic

-

Mill Type

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Mobile

-

Industrial

-

Energy & Power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydraulic cylinder market size was estimated at USD 15.32 billion in 2021 and is expected to reach USD 15.83 billion in 2022

b. The hydraulic cylinder market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2022 to 2030 to reach USD 22.16 billion by 2030

b. Asia Pacific dominated the hydraulic cylinder market with a revenue share of 32.9% in 2021. The market is growing owing to the increasing requirement for hydraulic equipment in various industries, such as infrastructure & construction, automotive, renewables, machine tooling, and logistics

b. Some of the key players operating in the hydraulic cylinder market include Eaton, SMC Corporation, Liebherr, PARKER HANNIFIN CORP, Caterpiller, Bosch Rexroth AG, Lehigh Fluid Power, Inc., Hengli hydraulic, WEBER-HYDRAULIK GMBH, Burnside Autocyl, Pacoma GmbH, Charvát Group s.r.o, Southern Hydraulic Cylinder, Inc., Yates Industries Inc., Texas Hydraulics

b. The key factors that are driving the hydraulic cylinder machine market include increasing adoption of hydraulic cylinders in numerous industries such as material handling, construction & infrastructure, marine, and earthmoving

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."