- Home

- »

- Automotive & Transportation

- »

-

Hybrid Train Market Size, Share And Growth Report, 2030GVR Report cover

![Hybrid Train Market Size, Share & Trends Report]()

Hybrid Train Market (2024 - 2030) Size, Share & Trends Analysis Report By Propulsion Type, By Speed (Below 100 Km/h, 100 - 200 Km/h, Above 200 Km/h), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-369-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hybrid Train Market Summary

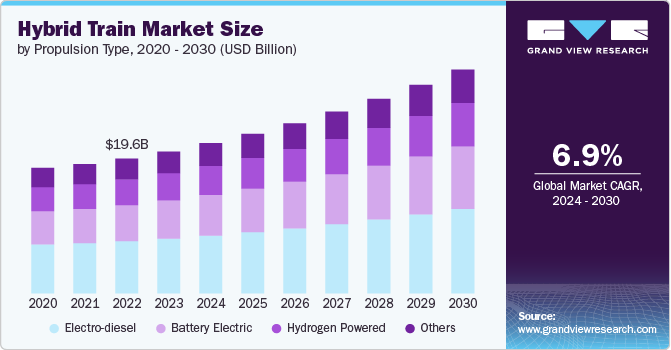

The global hybrid train market size was estimated at USD 20.67 billion in 2023 and is projected to reach USD 32.62 billion by 2030, growing at a CAGR of 6.9% from 2024 to 2030. The increasing focus on sustainability across the global transportation sector and technological advancements in hybrid train propulsion systems and energy storage are some of the major factors behind the growth of the hybrid train market.

Key Market Trends & Insights

- Europe dominated the market in 2023 and accounted for a 32.61% share of the global revenue.

- The U.S. hybrid train market is expected to grow at a significant CAGR from 2024 to 2030.

- By propulsion type, the electro-diesel segment dominated the market in 2023 and accounted for 38.56% share of global revenue.

- By speed, the above 200 Km/h segment dominated the market in 2023.

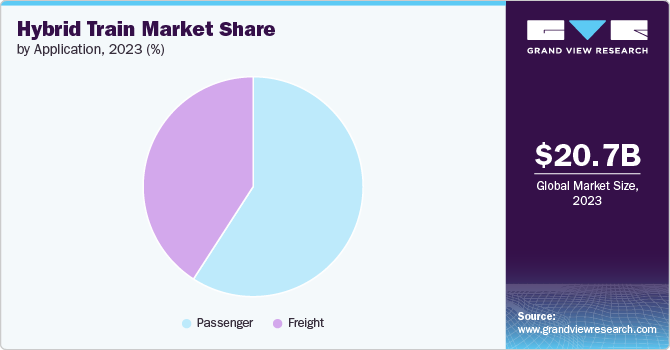

- By application, the passenger segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 20.67 Billion

- 2030 Projected Market Size: USD 32.62 Billion

- CAGR (2024-2030): 6.9%

- Europe: Largest market in 2023

Government incentives and policies promoting the adoption of eco-friendly rail solutions are further boosting the market growth. In addition, the integration of smart technologies, such as digital signaling and predictive maintenance, into hybrid train systems is expected to improve the market’s growth from 2024 to 2030.Technological advancements are pivotal in driving the growth of the hybrid train market. Innovations such as regenerative braking, advanced energy storage systems, and more efficient power management are enhancing the performance and efficiency of hybrid trains. These advancements not only improve fuel efficiency but also extend the lifespan of train components. As technology continues to evolve, the adoption of more advanced hybrid train systems is expected to increase in the coming years.Public-private partnerships are becoming increasingly common in the hybrid train market. Governments are collaborating with private companies to share the financial burden and risks associated with the development of hybrid train projects. These partnerships are facilitating the deployment of advanced hybrid train technologies and infrastructure. For instance, in February 2023, Utah State University and the ASPIRE Engineering Research Center announced a collaboration with Swiss-based Stadler Rail, a Swiss manufacturer of railway rolling stock, to develop and assess a battery-powered passenger train called FLIRT. The project aims to develop and construct a battery-powered two-car trainset. The Battery FLIRT, a lightweight, single-decker train, is designed for routes without continuous overhead electric infrastructure, allowing emission-free travel and supporting longer routes. Such initiatives are expected to bode well for the market’s growth.

Furthermore, governments and private investors are increasingly funding the development and modernization of rail infrastructure to support hybrid trains. This includes the installation of charging stations, electrified tracks, and other necessary infrastructure. The aim is to create a seamless and efficient transportation network that supports hybrid and electric trains. Such investment activities are expected to boost the market significantly from 2024 to 2030.

Hybrid trains require higher initial investment costs compared to traditional diesel trains. The upfront expenses associated with hybrid propulsion systems, advanced batteries, and other energy-efficient technologies could discourage some railway operators from investing in hybrid train fleets. Additionally, as electrification initiatives gain momentum globally, the economic and environmental benefits of all-electric trains may begin to overshadow the appeal of hybrid options. This shift towards electrification could potentially reduce the demand for hybrid trains, particularly in regions with well-established electrical infrastructure.

Propulsion Type Insights

The electro-diesel segment dominated the market in 2023 and accounted for 38.56% share of global revenue. Electro-diesel propulsion systems enable a train to operate using either electricity or diesel. The train can utilize an electric motor when power lines are available and switch to a diesel engine where this infrastructure is absent. This capability allows for continuous travel along partially electrified routes without the need to change locomotives, thereby driving the segment’s growth.

The battery electric segment is projected to witness significant growth from 2024 to 2030. The growing adoption of battery electric hybrid trains is driven by their major advantages, including zero carbon emissions, energy efficiency, and cost-effectiveness. Additionally, the easy availability of battery electric train spares helps keep maintenance costs low, encouraging multiple companies to invest in the development of battery-electric trains. These factors collectively contribute to the rapid growth of the battery-electric train segment.

Speed Insights

The above 200 Km/h segment dominated the market in 2023. Advances in hybrid technologies and train traction systems have significantly enhanced the operational speed capabilities of these trains. This evolution has led to rapid increases in the operational speeds of hybrid trains, surpassing the 200 km/h level. This speed range for high-speed hybrid trains is expected to experience substantial growth, driven by the need to reduce commuting times and alleviate congestion on rail networks.

The 100 - 200 Km/h segment is projected to witness significant growth from 2024 to 2030. The increasing development of hybrid trains with speeds between 100 Km/h and 200 km/h is a major factor behind the segment’s growth. For instance, in January 2023, CRRC Corporation Limited and Chengdu Rail Transit developed China’s first zero-emissions, hydrogen-powered passenger train. This four-car train can reach speeds of up to 160 km/h (100 mph) and has a range of 373 miles (600 km), emitting only water. Equipped with advanced features such as 5G communications, automatic wake-up, start and stop, and return to depot functionality, it also offers self-driving capabilities.

Application Insights

The passenger segment dominated the market in 2023. Hybrid trains offer economical and efficient passenger transport solutions. Many countries and cities are investing in new rail infrastructure to improve traffic congestion and offer a cost-effective transportation option for both intercity and intracity travel. The growth of this segment is further driven by rising urbanization and a growing demand for improved connectivity, comfort, reliability, and safety.

The freight segment is projected to witness significant growth from 2024 to 2030. In the global freight transport sector, rail transport is one of the most crucial modes, necessitating careful consideration of energy consumption within the transportation industry. Freight operators are increasingly adopting hybrid trains to achieve emission reduction goals and enhance fuel efficiency. Thus, an increasing focus on lowering pollutant emissions by transitioning to hybrid rail transport is propelling the segment’s growth.

Regional Insights

The hybrid train market of North America is expected to witness steady growth from 2024 to 2030. Increasing adoption of hybrid trains in countries such as the U.S., Canada, and Mexico is driving the market growth in the region. For instance, in April 2024, Canadian National announced the acquisition of a hybrid diesel-battery electric mainline locomotive from Progress Rail, a supplier of railroad and transit system products and services. The EMD locomotive will be evaluated to determine the potential opportunities and impacts of retrofitting a significant portion of the company’s fleet. Canadian National is collaborating with the Province of British Columbia on this initiative, receiving around CAD 3.2 million (USD 2.3 million) under the Clean BC Go Electric Commercial Vehicle Pilots Program.

U.S. Hybrid Train Market Trends

The U.S. hybrid train market is expected to grow at a significant CAGR from 2024 to 2030. Stricter emissions regulations and government incentives are encouraging railway operators to invest in more sustainable transportation solutions. In addition, technological advancements in battery technology are making hybrid trains more viable and attractive for both passenger and freight transport in the country.

Europe Hybrid Train Market Trends

The hybrid train market of Europe region dominated the market in 2023 and accounted for a 32.61% share of the global revenue. The significant presence of major railway manufacturers, including Alstom SA (France), Siemens AG (Germany), and Hitachi Rail STS (Italy), is a major contributor to the industry growth in Europe. Additionally, the railway industry significantly boosts the European economy, providing a solid foundation for growth. Stringent environmental regulations and ambitious sustainability goals across Europe further propel the market, as many governments offer incentives, subsidies, and grants to encourage the adoption of hybrid and electric trains, fostering a cleaner and more efficient transportation sector.

Asia Pacific Hybrid Train Market Trends

Asia Pacific hybrid train market is expected to register the highest CAGR from 2024 to 2030. Government initiatives promoting eco-friendly transportation solutions and reducing emissions can be attributed to the market growth. Countries such as China, Japan, and India are major contributors to regional growth with large-scale urban rail transit developments and the adoption of hybrid technologies. In addition, the region's commitment to sustainable transportation aligns with global environmental goals, accelerating the adoption of hybrid trains and boosting market growth.

Key Hybrid Train Company Insights

Key players operating in the market include CRRC Corporation Limited, Alstom SA, Siemens AG, Hitachi Rail STS, Wabtec Corporation, Construcciones y Auxiliar de Ferrocarriles,Hyundai Rotem Company, Talgo, and The Kinki Sharyo Co., Ltd. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Hybrid Train Companies:

The following are the leading companies in the hybrid train market. These companies collectively hold the largest market share and dictate industry trends.

- CRRC Corporation Limited

- Alstom SA

- Siemens AG

- Hitachi Rail STS

- Wabtec Corporation

- Construcciones y Auxiliar de Ferrocarriles

- Hyundai Rotem Company

- Talgo

- The Kinki Sharyo Co., Ltd.

Recent Developments

-

In April 2024, Hitachi Rail STS, a transportation company, and Trenitalia SpA, an Italian train operator, introduced the long-distance version of the hybrid battery-powered train in Europe. This initiative is part of a framework agreement in which Hitachi Rail STS will supply Trenitalia with seven intercity hybrid battery trains. These trains will utilize battery, diesel, and electric power to cut CO2 emissions by 83 percent on routes connecting Calabria, Basilicata, and Puglia.

-

In January 2024, Talgo, a Spanish rail manufacturer, in collaboration with 10 Spanish companies and organizations, is leading a project to create the world’s first high-speed train powered by hydrogen. The Hympulso initiative would build upon the foundation of the current Talgo 250 bi-mode train, integrating a novel hybrid power car that combines hydrogen fuel cells and batteries.

Hybrid Train Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.89 billion

Revenue forecast in 2030

USD 32.62 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Propulsion type, speed, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

CRRC Corporation Limited; Alstom SA; Siemens AG; Hitachi Rail STS; Wabtec Corporation; Construcciones y Auxiliar de Ferrocarriles;Hyundai Rotem Company; Talgo; The Kinki Sharyo Co. Ltd.

Customization scope

Free report customization (equivalent to up to eight analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hybrid Train Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hybrid train market report based on propulsion type, speed, application, and region:

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electro-diesel

-

Battery Electric

-

Hydrogen Powered

-

Others

-

-

Speed Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 100 Km/h

-

100 - 200 Km/h

-

Above 200 Km/h

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger

-

Freight

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hybrid train market size was estimated at USD 20.67 billion in 2023 and is expected to reach USD 21.89 billion in 2024.

b. The global hybrid train market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030, reaching USD 32.62 billion by 2030.

b. The electro-diesel segment dominated the market in 2023 and accounted for a 38.56% share of global revenue. Electro-diesel propulsion systems enable a train to operate using either electricity or diesel. The train can utilize an electric motor when power lines are available and switch to a diesel engine where this infrastructure is absent. This capability allows for continuous travel along partially electrified routes without the need to change locomotives, thereby driving the segment’s growth.

b. Some of the players operating in the hybrid train market include CRRC Corporation Limited, Alstom SA, Siemens AG, Hitachi Rail STS, Wabtec Corporation, Construcciones y Auxiliar de Ferrocarriles, Hyundai Rotem Company, Talgo, and The Kinki Sharyo Co., Ltd.

b. The increasing focus on sustainability across the global transportation sector and technological advancements in hybrid train propulsion systems and energy storage are some of the major factors behind the growth of the hybrid train market. Government incentives and policies promoting the adoption of eco-friendly rail solutions are further boosting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.