- Home

- »

- Consumer F&B

- »

-

Hybrid Seeds Market Size, Share & Growth Report, 2030GVR Report cover

![Hybrid Seeds Market Size, Share & Trends Report]()

Hybrid Seeds Market (2024 - 2030) Size, Share & Trends Analysis Report By Crop Type (Cereals & Grains, Oilseeds & Pulses), By Treatment (Treated, Untreated), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-239-4

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hybrid Seeds Market Size & Trends

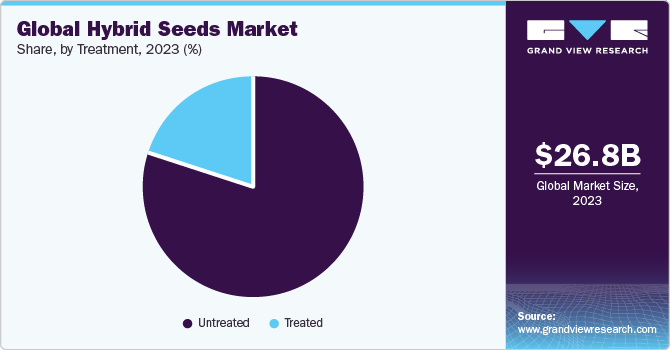

The global hybrid seeds market size was estimated at USD 26.8 billion in 2023 and is projected to grow at a CAGR of 11.0% from 2024 to 2030. The popularity of hybrid seeds has surged among farmers worldwide over the past decade due to their ability to achieve quicker harvesting compared to traditional or Open-Pollinated Variety (OPV) seeds. Hybrid seeds typically exhibit faster growth rates and maturity, allowing farmers to shorten the crop cycle and harvest their produce sooner. This rapid turnaround time not only increases the efficiency of farming operations but also enables farmers to capitalize on market opportunities by bringing their products to market more quickly.

Climate change-induced weather variability presents significant challenges to traditional crop varieties, driving increased demand for hybrid seeds with resilient traits. According to a study published by Research Gate, in 2023, the relative proportions of the 30 species showed that germination and seedling vigour are adversely affected more in dicots and self-pollinated annual species that set seeds in hotter months. Farmers seek drought-tolerant and heat-resistant hybrids to mitigate risks associated with unpredictable weather patterns, ensuring crop stability and yield consistency. As extreme weather events become more frequent, the reliability and adaptability of hybrid seeds make them a preferred choice for farmers striving to safeguard their livelihoods against climate-related disruptions.

As the global population steadily increases, the burden on agricultural productivity intensifies. With projections by the World Bank, in 2022, indicating a population of 9.7 billion by 2050, the pressure to produce more food mounts. Compounding this challenge is the shrinking agricultural workforce, with less than 2% of the population engaged in farming. Hybrid seeds play a pivotal role in addressing this challenge by significantly boosting crop yields. With their enhanced traits and genetic superiority, hybrid seeds offer the potential to increase yields. This increased productivity is essential for meeting the growing demand for food amidst demographic shifts, ensuring food security, and mitigating the risks of food scarcity in a world with limited agricultural resources

Market Concentration & Characteristics

The expansion of this market stems from rising consumer investment in multifunctional hybrid seeds. Designed with versatility in mind, these products feature interchangeable lids and modular components, offering users a range of options for diverse cooking methods and recipes.

Higher levels of innovation result in the development of unique hybrid seed varieties with enhanced traits such as higher yields, disease resistance, and drought tolerance. This product differentiation allows seed companies to capture market share by offering superior solutions to farmers.

Regulations govern the labeling and marketing of hybrid seeds, including requirements for accurate product labeling, advertising claims, and information disclosure to farmers. Compliance with these regulations ensures transparency and consumer confidence in the market.

M&A transactions can result in increased investment in research and development (R&D) for hybrid seed technologies. By combining resources and expertise, merged companies can accelerate innovation, develop new traits, and bring novel hybrid seed varieties to market more quickly.

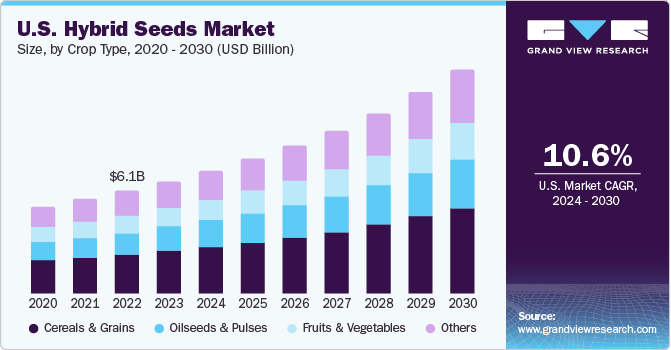

Crop Type Insights

Based on crop type, the cereals & grains segment led the market with the largest revenue share of 38.4% in 2023. Cereal and grain crops are grown in diverse agro-climatic regions around the world. Cereals and grains, such as corn, wheat, rice, and barley, are staple food crops that form the basis of many diets worldwide. The high demand for these crops necessitates the development of high-yielding and disease-resistant varieties to ensure food security and meet the needs of growing populations.

The fruits & vegetables segment is projected to grow at the fastest CAGR of 11.2% over the forecast period. Hybrid fruits and vegetables are increasing in popularity due to their ability to adapt to changing seasons and meet evolving consumer preferences. With climate change leading to more unpredictable weather patterns, hybrid seeds offer traits for resilience to extreme temperatures, drought, and other environmental stresses, ensuring more reliable yields throughout the year. In addition, as consumers become more health-conscious and demand diverse, flavorful produce, hybrid varieties are bred to offer superior taste, texture, and nutritional content.

Treatment Insights

Based on treatment, the untreated segment led the market with the largest revenue share of 79.9% in 2023. Untreated hybrid seeds are typically less expensive than treated seeds since they do not incur the additional costs associated with seed treatment processes. These seeds allow for greater diversity in seed options, as they are not limited by specific treatment formulations or requirements. The cultivators have the freedom to apply their preferred treatments, such as organic or natural methods, based on specific crop needs and environmental conditions.

The treated segment is projected to grow at the fastest CAGR of 14.8% over the forecast period. The increasing demand for treated hybrid seeds stems from their ability to protect crops from fungal infections and insect pests, resulting in reduced seed damage, higher yields, and improved crop quality. The consumers recognize these benefits, driving the popularity and demand for treated hybrid seeds in the market.

Application Insights

Based on application, the residential segment led the market with the largest revenue share of 80.7% in 2023. Many hybrid varieties are bred to be more compact or have better spacing requirements, making them suitable for cultivation in smaller garden spaces or containers commonly found in residential settings. What are the other factors that are driving the demand for these seeds. These seeds are chosen for residential cultivation for traits that make them easier to grow, such as faster germination, better weed suppression, and reduced maintenance requirements, which is advantageous for novice gardeners or those with limited time for gardening.

The commercial segment is estimated to grow at the fastest CAGR of 13.4% over the forecast period. The rise in commercial cultivation of hybrid seeds has been significantly propelled by the introduction of agritech. Leading seed breeders are leveraging advanced digital technologies such as artificial intelligence and machine learning to provide real-time actionable insights. These insights address various issues related to the development, production, and distribution of commercial seeds.

Distribution Channel Insights

Based on distribution channel, the mediators segment led the market with the largest revenue share of 55.4% in 2023. Mediators often extend credit and financing options to farmers, allowing them to purchase hybrid seeds even if they lack immediate cash flow. This financial assistance enables farmers to invest in higher-quality seeds, leading to improved crop yields and profitability. They also provide logistical support in the distribution of hybrid seeds, including transportation, storage, and handling

The direct to farmers segment is estimated is to grow at the fastest CAGR of 14.7% over the forecast period. Selling directly to farmers allows seed companies to maintain better control over the quality of their products throughout the distribution process, ensuring that farmers receive high-quality seeds that meet their expectations. By eliminating intermediaries, seed companies can capture a larger share of the value chain, leading to higher profit margins. This allows companies to reinvest in research and development efforts to further improve their seed varieties.

Regional Insights

North America dominated the hybrid seeds market with the revenue share of 29.0% in 2023. Sustainable agriculture practices, including conservation tillage, crop rotation, and integrated pest management, are gaining traction in North America. The adoption of precision agriculture practices in the region, including the use of advanced technologies like GPS, drones, and data analytics is further expected to favor demand for the hybrid seeds.

U.S. Hybrid Seeds Market Trends

The hybrid seeds market in the U.S. is projected to grow at the fastest CAGR of 10.6% from 2024 to 2030. Hybrid seeds are known for their superior yield potential and desirable traits such as disease resistance, tolerance to environmental stress, and uniformity. Farmers in the U.S. are increasingly adopting hybrid seeds to maximize their crop yields and profitability.

Asia Pacific Hybrid Seeds Market Trends

The hybrid seeds market in Asia Pacific is projected to grow at the fastest CAGR of 12.3% from 2024 to 2030. The market is fueled by population growth and the demand for higher yields and superior quality produce. With major agricultural producers like China and India, the region sees a surge in demand for seasonal fruits and vegetables yearly, further propelling the need for hybrid seeds to meet agricultural requirements efficiently.

Europe Hybrid Seeds Market Trends

The hybrid seeds market in Europe accounted for a revenue share of 34.1% in 2023. With increasing awareness of environmental concerns, there's a growing demand for hybrid seeds that support sustainable agriculture. These seeds are bred for traits such as drought resistance, pest tolerance, and improved resource efficiency, aligning with Europe's emphasis on reducing chemical inputs and promoting biodiversity. Additionally, hybrid varieties tailored for organic farming methods are gaining popularity, contributing to the expansion of the market in the region.

Key Hybrid Seeds Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Hybrid Seeds Companies:

The following are the leading companies in the hybrid seeds market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer CropScience

- Corteva Agriscience

- Syngenta

- Limagrain

- KWS

- Sakata seed

- DLF

- Longping High-tech

- Euralis Semences

- Advanta

- China National Seed Group

Recent Developments

-

In January 2021, Bayer launched four new hybrid vegetable seeds. Bayer is focusing on innovative, next-generation Seminis hybrids suited to changing consumer tastes and preferences

-

In April 2021, RACT collaborated with Bayer in order to jointly develop hybrid wheat varieties. Wheat provides about 20 percent of the proteins consumed in the world. Securing the wheat harvests through hybrid wheat production systems that help increase the yield and robustness of the crop

Hybrid Seeds Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.31 billion

Revenue forecast in 2030

USD 54.70 billion

Growth rate

CAGR of 11.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Crop type, treatment, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Bayer CropScience; Corteva Agriscience; Syngenta, Limagrain; KWS; Sakata seed; DLF; Longping High-tech; Euralis Semences; Advanta; China National Seed Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hybrid Seeds Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the hybrid seeds market report based on type, treatment, application, distribution channel, and region:

-

Crop Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Treated

-

Untreated

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct to Farmers

-

Cooperatives

-

Mediators

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hybrid seeds market was estimated at USD 26.8 billion in 2023 and is expected to reach USD 29.31 billion in 2024.

b. The global hybrid seeds market is expected to grow at a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 54.70 billion by 2030.

b. Europe dominated the hybrid seeds market with a share of around 34% in 2023. With increasing awareness of environmental concerns, there's a growing demand for hybrid seeds that support sustainable agriculture.

b. Some of the key players operating in the hybrid seeds market include Bayer CropScience, Corteva Agriscience, Syngenta, Limagrain, KWS, Sakata seed, DLF, Longping High-tech, Euralis Semences, Advanta, China National Seed Group

b. The popularity of hybrid seeds has surged among farmers worldwide over the past decade due to their ability to achieve quicker harvesting compared to traditional or Open-Pollinated Variety (OPV) seeds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.