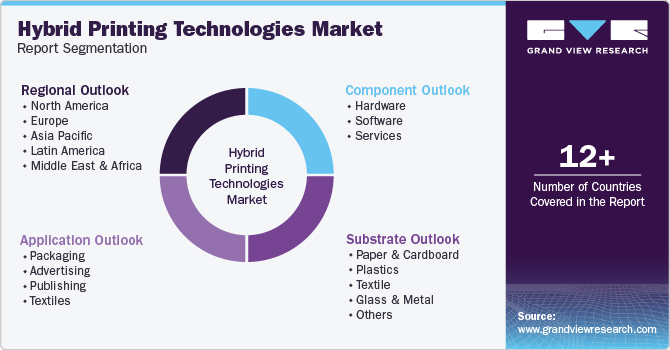

Hybrid Printing Technologies Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Substrate, By Application (Packaging, Advertising, Publishing, Textiles), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-430-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Hybrid Printing Technologies Market Trends

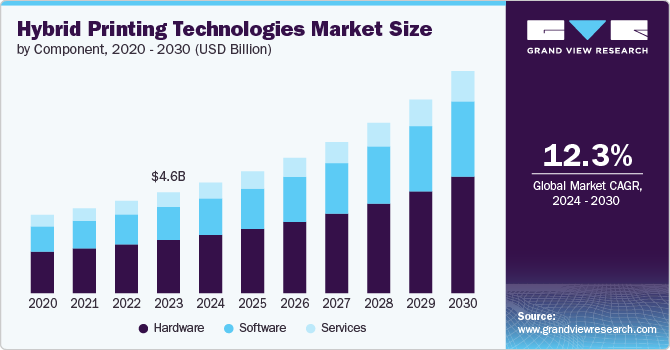

The global hybrid printing technologies market size was estimated at USD 4.59 billion in 2023 and is projected to grow at a CAGR of 12.3% from 2024 to 2030. The growth in the demand for customized printing is driving the market growth. Moreover, the growing need for shorter lead times and faster job completion has driven the adoption of hybrid printing technologies, which are among the most advanced and automated printing processes available today. Hybrid printing technology is a combination of traditional analog printing methods and digital printing techniques. This approach leverages the strengths of both types of printing, offering the high-quality output and reliability of analog printing with the flexibility, speed, and customization capabilities of digital printing.

Hybrid printing technologies offer enhanced versatility, efficiency, and quality while supporting customization and sustainability. These benefits make hybrid printing an attractive choice for a wide range of industries and applications. Hybrid printing can handle a wide variety of substrates and materials, including paper, cardboard, plastics, textiles, glass, and metal. This versatility makes it suitable for diverse applications, from packaging and labeling to textiles and advertising. Moreover, hybrid systems streamline production by integrating digital and analog processes, reducing setup times and enabling faster job completion. This leads to improved turnaround times and increases overall efficiency, which is beneficial for both small and large production runs.

The expansion of e-commerce and digital retail platforms has increased the need for high-quality packaging and labeling solutions. Hybrid printing technologies provide the capability to produce short runs of customized labels and packaging quickly, which is essential for online retailers. This has led to increased adoption of hybrid printing in the packaging sector, particularly for small to medium-sized enterprises that require flexible printing solutions.

The push towards sustainability is driving the development of eco-friendly inks, recyclable substrates, and energy-efficient hybrid printers. New hybrid printing technologies are incorporating water-based and UV-curable inks, which are less harmful to the environment. Additionally, energy-saving features such as LED curing systems are being integrated to reduce the carbon footprint of printing operations.

Companies are continually innovating and launching new hybrid printing solutions, positively impacting the growth of the hybrid printing technologies market. For instance, in January 2024, Agfa-Gevaert Group, a Belgium-based company, unveiled the Anapurna H3200, the next generation of the wide-format hybrid printer. This new model offers a 70% increase in printing speed and enhanced print quality. This new model, featuring a redesigned print engine, faster print heads, and continuous board feeding, significantly boosts productivity and versatility for sign shops and digital printers, reinforcing Agfa-Gevaert Group's commitment to innovation and meeting customer needs.

Component Insights

In terms of component, the market is classified into services, software, and hardware. The hardware segment dominated the market in 2023 and accounted for more than 52.0% share of global revenue. The segment’s growth is attributed to the advancements in printing technology and the rising demand for high-quality and customized printing. The growing need for high-resolution prints and the ability to customize products on-demand is pushing businesses to upgrade or invest in advanced hybrid printing hardware. This demand is particularly strong in industries like packaging, textiles, and advertising, where precision and personalization are critical. In May 2023, FUJIFILM Corporation announced the launch of the Acuity Prime Hybrid printer, expanding its successful Acuity Prime series. This versatile printer, designed for both rigid and flexible media, offers high productivity and exceptional print quality and is set to meet diverse needs across various applications.

The software segment is projected to witness the fastest CAGR of 12.9% from 2024 to 2030. The increasing demand for customization and personalization in printing has led to the need for advanced software solutions that enable precise control over print designs and workflows. Additionally, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into printing software is enhancing efficiency, quality, and automation capabilities, making these solutions indispensable for modern printing operations. The rise of cloud-based printing solutions is also contributing to the segment's growth, offering scalability, remote access, and seamless integration with other digital tools.

Substrate Insights

In terms of substrate, the market is classified into paper and cardboard, plastics, textile, glass & metal, and others. The paper and cardboard segment dominated the market in 2023 and accounted for more than 42.0% share of global revenue. The segment's growth is attributed to the wide use of paper and cardboard in packaging, publishing, and advertising owing to their smooth surface. Moreover, these paper and cardboard substrates come in various textures, finishes, and weights, catering to multiple printing needs. The cost-effectiveness of the substrate in comparison to other substrates drives the segment's growth.

The textile segment is projected to grow at the fastest CAGR of 13.2% from 2024 to 2030. The rising demand for customized and on-demand textile products, such as personalized apparel, home decor, and fashion accessories, drives the growth of the textile segment. Advances in hybrid printing technology have enabled higher print quality, vibrant colors, and intricate designs on textiles, meeting the needs of both mass production and niche markets. The increasing popularity of sustainable and eco-friendly printing practices is also fueling this growth, as hybrid printing allows for more efficient use of resources and reduced waste in textile production. Additionally, the expanding e-commerce and direct-to-garment printing markets are contributing to the segment's rapid expansion.

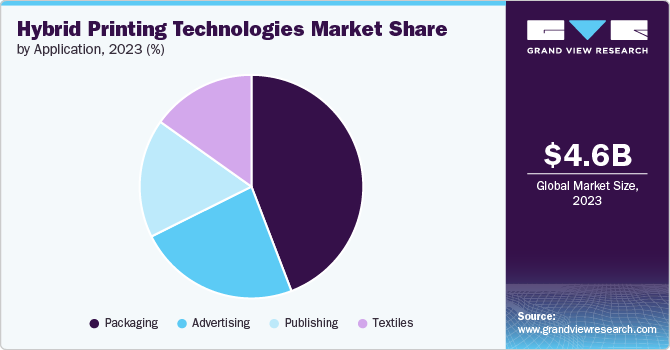

Application Insights

In terms of application, the market is classified into packaging, advertising, publishing, and textiles. The packaging segment dominated the market in 2023 and accounted for more than 44.0% share of global revenue. The increasing demand for personalized and high-quality packaging solutions drives the growth of the packaging segment. Consumers and brands are seeking innovative packaging that stands out, leading to the adoption of hybrid printing for its ability to deliver vibrant, precise, and customizable designs. Additionally, the rise of e-commerce has heightened the need for durable and aesthetically appealing packaging, further boosting the demand for hybrid printing technologies. Sustainability trends are also playing a role, as hybrid printing allows for efficient resource use and supports the production of eco-friendly packaging materials.

The textiles segment is projected to witness the fastest CAGR of 13.2% from 2024 to 2030. The segment's growth is attributed to the growth in the fashion and apparel industry. The fashion and apparel industry's expansion, especially in fast fashion and e-commerce, is driving the need for versatile and efficient printing solutions. Hybrid printing technologies enable quick turnaround times and the ability to print on a wide range of textile materials, supporting the industry's dynamic and fast-paced nature. Moreover, ongoing technological advancements in hybrid printing, including improvements in ink formulations, print heads, and software, are enhancing the quality, speed, and efficiency of textile printing. This is making hybrid printing more attractive for textile manufacturers looking to innovate and meet diverse market demands.

Regional Insights

North America dominated the global hybrid printing technologies market and accounted for a revenue share of over 32.0% in 2023. The market's growth in the region is attributed to the high technological advancements in the region. North America is a hub for technological advancements, and the continuous innovation in printing technologies, including hybrid printing, is driving market growth. The region's strong R&D capabilities and the presence of leading technology companies are contributing to the development and adoption of advanced hybrid printing solutions.

U.S. Hybrid Printing Technologies Market Trends

The hybrid printing technologies market in the U.S. is expected to grow at a CAGR of 11.5% from 2024 to 2030. The market’s growth in the country is attributed to the strong consumer demand for personalized products in the U.S. According to a 2021 survey by Accenture, an Ireland-based Information Technology (IT) company, 84% of the surveyed consumers in the U.S. said they would like to get products such as jackets and t-shirts personalized. Hybrid printing technologies enable companies to meet this demand by offering high-quality, customizable printing solutions that can be produced on a large scale.

Asia Pacific Hybrid Printing Technologies Market Trends

The hybrid printing technologies market in Asia Pacific is expected to grow at the highest CAGR of 13.2% from 2024 to 2030. The market’s growth in the region can be attributed to the growth of e-commerce and packaging needs in the region. The booming e-commerce industry in countries like China, India, and Southeast Asia is driving demand for attractive and functional packaging. Hybrid printing technologies are well-suited to meet this demand by offering high-quality, customizable packaging solutions that help businesses stand out in a competitive online market.

Europe Hybrid Printing Technologies Market Trends

The hybrid printing technologies market in Europe is expected to grow at a significant CAGR of 12.2% from 2024 to 2030. The market's growth can be attributed to the large apparel sector in the region. According to the World Trade Organization (WTO)'s 2022 World Trade Statistical Review, the European Union (EU) stands as the world's leading importer of apparel and textiles. The fashion industry's need for fast production cycles, detailed designs, and eco-friendly processes is driving the demand for hybrid printing in the region. Moreover, the strong demand for sustainable printing solutions in the region drives the market's growth.

Key Hybrid Printing Technologies Company Insights

Some of the key companies operating in the market include Ricoh, FUJIFILM Holdings Corporation, HP Development Company, L.P., Xeikon, and Agfa-Gevaert Group.

-

Ricoh is a Japanese multinational imaging and electronics company headquartered in Tokyo, Japan. Established in 1936, Ricoh has grown to become a global leader in office solutions, production printing, document management systems, and IT services. The company offers a wide range of office equipment, including multifunction printers, copiers, and scanners. Their solutions are designed to enhance office productivity and streamline document management. It operates in over 200 countries and regions worldwide, with a strong presence in North America, Europe, Asia, and other global markets.

Memjet and Colordyne Technologies are some of the emerging companies in the target market.

-

Colordyne Technologies is an American company specializing in the development of innovative digital printing solutions. Founded in 2010, the company is recognized for its focus on high-speed, high-quality digital printing technologies. The company specializes in inkjet printing technology, offering systems that provide full-color printing at high speeds, suitable for short-run and on-demand production. It has developed hybrid printing solutions that combine digital and traditional printing methods, providing flexibility and efficiency in production processes.

Key Hybrid Printing Technologies Companies:

The following are the leading companies in the hybrid printing technologies market. These companies collectively hold the largest market share and dictate industry trends.

- Müller Martini

- Mark Andy Inc.

- Xeikon

- HP Development Company, L.P.

- SCREEN Graphic Solutions Co., Ltd.

- Ricoh

- FUJIFILM Holdings Corporation

- Agfa-Gevaert Group

- Eastman Kodak Company

- BOBST

- Memjet

- Colordyne Technologies

Recent Developments

-

In March 2024, Ricoh introduced the Flora X20 UV hybrid printer, developed in partnership with Flora, a leading manufacturer of flatbed and large format digital inkjet printers, to provide sign and display specialists with enhanced production flexibility and versatility. The compact hybrid printer, featuring Ricoh's advanced printhead technology and ColorGATE RIP software, supports a wide range of media and substrates.

-

In April 2023, Memjet introduced the DuraBolt PrintBar, a wide web monochrome printing solution, along with a new service called Memjet Direct, which provides direct sales and integration support to printers. The DuraBolt PrintBar, designed for high-speed printing with 1,600 dpi quality, enables printers to create advanced hybrid printing solutions at a lower cost, while Memjet Direct offers expert support for seamless integration into existing systems.

Hybrid Printing Technologies Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.04 billion |

|

Revenue forecast in 2030 |

USD 10.12 billion |

|

Growth rate |

CAGR of 12.3% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, substrate, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Müller Martini; Mark Andy Inc.; Xeikon; HP Development Company, L.P.; SCREEN Graphic Solutions Co., Ltd.; Ricoh; FUJIFILM Holdings Corporation; Agfa-Gevaert Group; Eastman Kodak Company; BOBST; Memjet; Colordyne Technologies |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hybrid Printing Technologies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global hybrid printing technologies market report based on component, substrate, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Substrate Outlook (Revenue, USD Million, 2017 - 2030)

-

Paper and Cardboard

-

Plastics

-

Textile

-

Glass & Metal

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Packaging

-

Advertising

-

Publishing

-

Textiles

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hybrid printing technologies market size was estimated at USD 4.59 billion in 2023 and is expected to reach USD 5.04 billion in 2024.

b. The global hybrid printing technologies market is expected to grow at a compound annual growth rate of 12.3% from 2024 to 2030 to reach USD 10.12 billion by 2030.

b. North America dominated the hybrid printing technologies market with a share of over 32.0% in 2023. This is attributable to the developed technological infrastructure and the growing consumer demand for customized products.

b. Some key players operating in the hybrid printing technologies market include Müller Martini, Mark Andy Inc., Xeikon, HP Development Company, L.P., SCREEN Graphic Solutions Co., Ltd., Ricoh, FUJIFILM Holdings Corporation, Agfa-Gevaert Group, Eastman Kodak Company, BOBST, Memjet, and Colordyne Technologies.

b. Key factors driving market growth include the growing for faster job completion and shorter lead times and rising demand for customized printing.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."