- Home

- »

- Beauty & Personal Care

- »

-

Hybrid Makeup Market Size, Share & Growth Report, 2030GVR Report cover

![Hybrid Makeup Market Size, Share & Trends Report]()

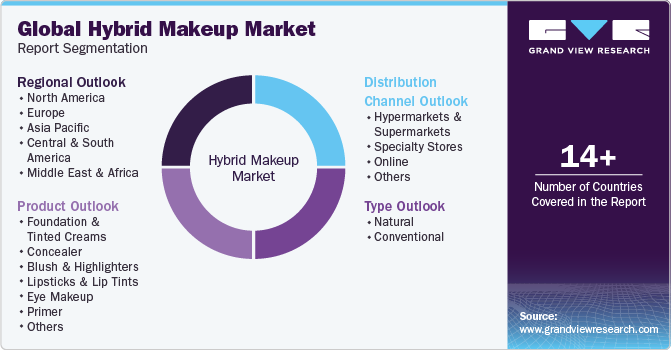

Hybrid Makeup Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Foundation & Tinted Creams, Concealer, Blush & Highlighters, Lipsticks & Lip Tints), By Type (Natural, Conventional), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-224-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hybrid Makeup Market Summary

The global hybrid makeup market size was estimated at USD 19.61 billion in 2023 and is projected to reach USD 29.43 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. Some of the key factors driving market growth include high demand for multi-functional products that offer multiple benefits, such as skin care, sun protection, and color cosmetics in one, the development of innovative formulations, rising consumer consciousness regarding the overall skin health & appearance, and preference for natural & clean beauty products.

Key Market Trends & Insights

- The North America hybrid makeup market held the largest share of 35.18% in 2023.

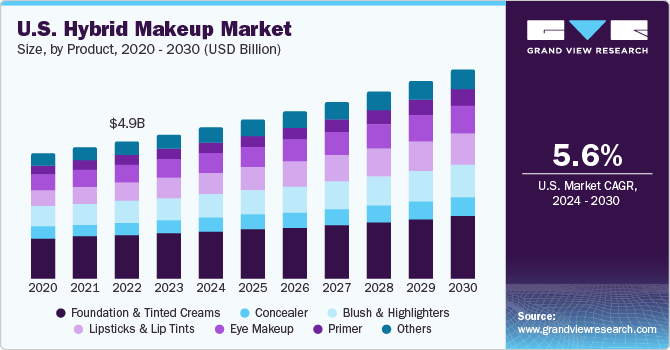

- The U.S. hybrid makeup market is expected to grow at a CAGR of 5.6% from 2024 to 2030.

- By product, the hybrid foundation & tinted creams segment held the largest share of31.63% in 2023.

- By type, the conventional hybrid makeup products segment accounted for a share of 57.8% in 2023.

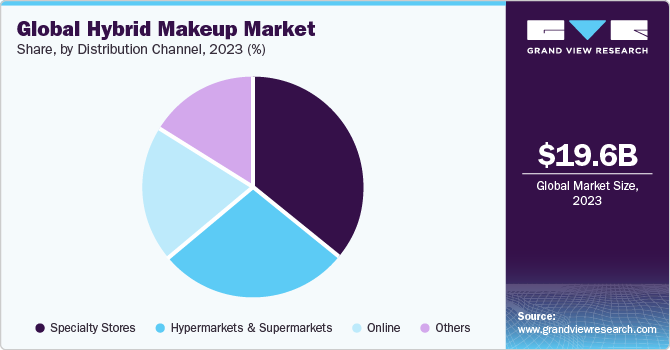

- By distribution channel, the sales of hybrid makeup products through specialty stores accounted for a share of 28.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 19.61 Billion

- 2030 Projected Market Size: USD 29.43 Billion

- CAGR (2024-2030): 6.1%

- North America: Largest market in 2023

There is an increasing consumer demand for makeup products that not only enhance appearance but also provide skincare benefits.

According to a “Green Beauty Barometer” survey, women in the age group of 35-54 years are the most aware in scrutinizing product labels, with a significant 65% actively checking the ingredients list. Women, increasingly mindful of the ingredients in their skincare & cosmetic products, are actively seeking formulations that are free from harmful chemicals and emphasize transparency in ingredient sourcing and production practices. Therefore, this consumer group is likely to drive demand for hybrid makeup products with ingredients that offer skincare benefits.

Skincare makeup hybrid products have gained popularity, promising various benefits. On the downside, while some makeup products can offer hydration and barrier protection, achieving considerable skin benefits from color cosmetics remains challenging. Certain makeup products claim to offer substantial skincare benefits but may not contain the potent concentrations of active ingredients found in dedicated skincare products. This creates skepticism among consumers who are increasingly scrutinizing ingredient labels to ensure that products live up to their claims. This has resulted in manufacturers focusing on addressing concerns about the potency of active skincare ingredients in makeup formulations.

Market Concentration & Characteristics

Market growth stage is medium, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation. Water-free sunscreen foundations, serum foundations, and oil-free makeup formulations are some of the innovative formulations in the market.

The market is challenged by a lack of clear guidelines and lack of regulations regarding hybrid makeup. In the absence of clear regulations, consumers are skeptical about the legitimacy of claims made by hybrid makeup products. However, companies marketing hybrid makeup as providing specific skincare benefits are focused on providing evidence through clinical trials or reliable studies to support these claims.

Traditional makeup products and skincare products are some of the substitutes for hybrid makeup products, which are likely to influence their demand. Certain consumers rely on substitutes that allow for a more tailored approach to skincare and makeup rather than relying on all-in-one hybrid products.

Younger consumers are likely to show an increased interest in innovative makeup products. Changing lifestyles and busy routines will drive the demand for hybrid makeup. Consumers wearing makeup for a prolonged time often seek multifunctional beauty products and are likely to show an increased interest in hybrid makeup.

Product Insights

The hybrid foundation & tinted creams segment held the largest share of31.63% in 2023. The emphasis on clean beauty and natural ingredients has become a significant driver of consumer preferences. Consumers are increasingly seeking makeup options that are perceived as healthier for the skin. Recognizing this demand, ILIA Beauty launched Super Serum Skin Tint in February 2021 featuring natural ingredients.

New product launches are supporting the growth of hybrid foundation makeup products. In January 2024, Makeup Revolution, a UK-based beauty brand launched two new complexion products: the Skin Silk Serum Foundation and the Bright Light Face Glow. The Skin Silk Serum Foundation, available at Ulta Beauty, offers a weightless formula with light-to-medium coverage and a radiant satin finish. It is infused with hyaluronic acid and a peptide complex to hydrate and plump the skin.

The lipsticks & lip tints segment is projected to grow at a CAGR of 7.3% from 2024 to 2030. This is attributed to consumer demand for versatile and innovative formulations, the rise of hybrid lip products that offer both cosmetic and skincare benefits, and the influence of celebrity endorsements & social media trends. For instance, in September 2023, Hailey Bieber, an American model, launched the Rhode Peptide Lip Tint, which is the newest addition to the brand’s skincare-based color cosmetics. The growing interest in lip care products offering nourishment is projected to drive demand for lip tints.

Type Insights

The conventional hybrid makeup products segment accounted for a share of 57.8% in 2023. The changes in lifestyle and hectic schedules have pushed consumers towards conventional hybrid makeup to enhance appearance and achieve skincare benefits without the need for multiple products Conventional hybrid makeup products are also marketed through mass-market channels and are comparatively more cost-effective than their natural counterparts.

Haus Labs, a brand by a popular celebrity Lady Gaga offers Triclone Skin Tech Concealer, which is marketed as clean, features an inclusion of biotech caffeine and niacinamide. As celebrities are increasingly promoting skincare hybrid makeup products with active ingredients, such as hyaluronic acid, niacinamide, caffeine, and peptides, it is projected to influence consumer demand.

The demand for natural hybrid makeup products is projected to grow at a CAGR of 6.6% from 2024 to 2030 due to rising consumer preference for clean beauty and environmentally conscious choices. Due to rising awareness of the potential impact of synthetic ingredients on skin health and the environment, consumers are seeking beauty products that feature natural and sustainable ingredients. According to "The State of Natural Beauty" panel discussion at Expo Westin 2023, natural products are driving 21% of the overall personal care and beauty industry’s growth.

Distribution Channel Insights

The sales of hybrid makeup products through specialty stores accounted for a share of 28.3% in 2023. Specialty stores often curate their product offerings to cater to a specific niche or category, such as beauty and cosmetics. The presence of knowledgeable staff at beauty stores allows for a more personalized shopping experience where customers can receive expert advice, recommendations, and product demonstrations. Consumers are more likely to benefit from a hands-on approach since hybrid makeup products are multifunctional. For instance, Sephora beauty stores feature a separate section for skincare-powdered makeup which is likely to enhance brand and product visibility, thereby driving sales growth.

The sales of hybrid makeup products through online channels are projected to grow at a CAGR of 6.8% from 2024 to 2030 as e-commerce platforms often feature an extensive range of beauty and skincare products, including a wide variety of hybrid makeup options. Furthermore, company websites are now offering virtual try-on tools and AR technology, allowing users to virtually test how these products will look on their skin. This interactive feature enhances the online shopping experience for consumers.

Regional Insights

The hybrid makeup market held the largest share of 35.18% in 2023 due to high demand for natural and clean beauty products. According to Jocelyn Lyle, Senior Vice President of Development and Partnerships at EWG (Environmental Working Group), 75% of Americans believe toxic chemicals in personal care products are a severe threat, according to a 2023 EWG poll. Among these, 84% were women under the age of 50 years. The growing interest in natural ingredients to protect skin health will also influence the demand for makeup products with natural ingredients offering skin-health benefits.

U.S. Hybrid Makeup Market Trends

The U.S. hybrid makeup market is expected to grow at a CAGR of 5.6% from 2024 to 2030. This growth is primarily attributed to the increasing consumer demand for products that seamlessly blend skincare benefits with traditional cosmetic features. The trend is fueled by a growing awareness of health and wellness, with consumers seeking multifunctional beauty solutions that simplify their routines.

Asia Pacific Hybrid Makeup Market Trends

Asia Pacific is anticipated to grow at a CAGR of 7.2% from 2024 to 2030. Growing disposable income levels in countries, such as China, India, and Japan, have shifted consumers towards premium beauty products and multifaceted products, such as hybrid makeup. The presence of a large younger population in these countries is driving the demand for innovative hybrid makeup formulations. As younger consumers are more experimental with beauty and makeup products, this demographic will contribute to increased acceptance of hybrid makeup products, driving regional market growth.

Key Hybrid Makeup Company Insights

Some of the key players operating in the hybrid makeup market include Clinique, ILIA Beauty,The Estée Lauder Companies, and Kosas Cosmetics.

-

ILIA Beauty is one of the key players in the market offering clean, natural, and organic skincare and makeup products. The company features a diversified product portfolio. It also offers skincare-powered makeup, which is marketed as ‘Clean’ and includes active levels of skincare ingredients to enhance skin health

-

Clinique is one of the key players in the skincare makeup hybrid market offering products, such as a foundation, to improve skin health with 3 serum technology, a dermatologist-developed foundation that reduces dark spots, tinted skin hydrator, and setting makeup powders with SPF. It also offers services such as virtual try-ons and skin analysis through face scans

e.l.f. Cosmetics, Kay Beauty, RMS Beauty, and Burt's Bees, Inc. are some of the emerging market participants in the hybrid makeup market.

- RMS Beauty, established in 2009 and founded by master makeup artist Rose-Marie Swift, is an emerging player in the market. The company offers award-winning clean hybrid makeup products, such as luminizers, concealers, bronzer, and powder blush. The company differentiates itself by offering virtual consultations and shade finders to gain consumer attention

Key Hybrid Makeup Companies:

The following are the leading companies in the hybrid makeup market. These companies collectively hold the largest market share and dictate industry trends.- ILIA Beauty

- The Estée Lauder Companies

- L'Oreal Paris

- Kosas Cosmetics

- IT Cosmetics, LLC

- CHANEL

- Clinique Laboratories, LLC

- RMS Beauty

- e.l.f. Cosmetics, Inc.

- Charlotte Tilbury Beauty Inc.

Recent Developments

-

In September 2022, Selena Gomez's cosmetics brand Rare Beauty launched the Soft Pinch Liquid Blush, which comes in 11 different colors and offers both matte and dewy finishes. The lightweight liquid formula is infused with color pigments and provides all-day wear as it includes ingredients, such as hyaluronic acid, algae extracts, flower extracts, and barrier renewal complex offering skincare benefits

-

In June 2023, Kay Beauty launched an eye makeup collection in India featuring 5 skincare ingredients that deliver vibrant colors and promote healthy skin

Hybrid Makeup Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.68 billion

Revenue forecast in 2030

USD 29.43 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast Period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; UAE; South Africa

Key companies profiled

ILIA Beauty; The Estée Lauder Companies; L'Oreal Paris; Kosas Cosmetics; IT Cosmetics, LLC; CHANEL; Clinique Laboratories, LLC; RMS Beauty; e.l.f. Cosmetics, Inc.; Charlotte Tilbury Beauty Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hybrid Makeup Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hybrid makeup market report based on product, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Foundation & Tinted Creams

-

Concealer

-

Blush & Highlighters

-

Lipsticks & Lip Tints

-

Eye Makeup

-

Primer

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Natural

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hybrid makeup market size was estimated at USD 19.61 billion in 2023 and is expected to reach USD 20.68 billion in 2024.

b. The global hybrid makeup market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 29.43 million by 2030.

b. North America dominated the hybrid makeup market with a share of more than 35.2% in 2023. The growing demand for natural and clean beauty products in the region will drive the demand for hybrid makeup products.

b. Some key players operating in the hybrid makeup market include ILIA Beauty, The Estée Lauder Companies, L'Oreal Paris, Kosas Cosmetics, IT Cosmetics, LLC, CHANEL, Clinique Laboratories, llc, RMS Beauty, e.l.f. Cosmetics, Inc, Charlotte Tilbury Beauty Inc

b. Key factors contributing to market growth include increasing demand for multi-functional products that offer multiple benefits such as skincare, sun protection, and color cosmetics in one, development of innovative formulations, growing consumer consciousness regarding the overall health and appearance of their skin, and a growing trend towards natural and clean beauty products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.