- Home

- »

- Automotive & Transportation

- »

-

Hybrid Cars Market Size, Share And Growth Report, 2030GVR Report cover

![Hybrid Cars Market Size, Share & Trends Report]()

Hybrid Cars Market Size, Share & Trends Analysis Report By Degree Of Hybridization (Full-hybrid, Plug-in-hybrid), By Vehicle Type (Sedan, Hatchback, SUV), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-267-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Hybrid Cars Market Size & Trends

The global hybrid cars market size was estimated at USD 203.09 billion in 2023 and is projected to grow at a CAGR of 11.7% from 2024 to 2030. The increasing volatility of oil prices is driving the market growth. As the prices of traditional fossil fuels fluctuate and concerns about oil supply disruptions persist, consumers are seeking alternatives that offer greater fuel efficiency and lower operating costs. Hybrid cars, with their ability to switch between gasoline and electric power, offer drivers the flexibility to navigate changing fuel prices and reduce their dependence on imported oil.

COVID-19 had a negative impact on the hybrid car industry, influencing demand and supply dynamics, consumer behavior, and industry trends. At the onset of the pandemic, widespread lockdowns and economic uncertainty led to a sharp decline in consumer spending and vehicle purchases globally. As a result, the market experienced a slowdown in sales as potential buyers deferred purchases and prioritized essential expenses. Supply chain disruptions and production halts further exacerbated the challenges faced by automakers, leading to delays in new model launches and constrained inventory levels.

Government incentives and subsidies promoting clean transportation drive growth in the market. Many countries offer tax incentives, rebates, and other financial incentives to encourage consumers to purchase hybrid vehicles. These incentives can include access to carpool lanes, tax credits for hybrid vehicle purchases, reduced registration fees, and exemptions from congestion charges. These incentives drive market adoption and reduce entry barriers for environmentally conscious buyers.

In December 2023, the Japanese government announced a decade of tax incentives to stimulate production in five key sectors, such as electric vehicles, and attract company investments. These tax incentives entail providing 400,000 yen (USD 2,755) for every battery electric vehicle and hydrogen fuel-cell car. In addition, the scheme incorporates incentives valued at half the amount for each plug-in hybrid vehicle.

The higher upfront cost of hybrid cars acts as a restraint on the market as it presents a barrier to entry for some consumers. While hybrids offer long-term savings through improved fuel efficiency, the initial purchase price can be higher than that of traditional vehicles. This upfront cost may deter price-sensitive consumers despite potential fuel savings over the vehicle's lifespan. As consumer preferences often lean towards lower initial costs, the higher upfront expense can limit the broader adoption of hybrid cars.

Market Concentration & Characteristics

The hybrid cars industry is fragmented in nature; however, the growth stage of the industry is high, and the pace is accelerating. The hybrid cars industry globally is characterized by an active and rapidly evolving landscape driven by technological advancements, comforting features, and supportive government regulations. The demand for innovative features in the automation industry, such as automated parking or 360-degree view, boosted significant growth in the region.

Governments support the hybrid car industry through various incentives and policies aimed at promoting environmentally friendly transportation. Many countries offer financial incentives such as tax credits, rebates, and reduced registration fees to encourage consumers to purchase hybrid vehicles. In some regions, governments implement favorable regulations, including emissions standards and fuel efficiency requirements, which create a conducive environment for the growth of the hybrid car industry.

The hybrid cars industry is developing and significantly concentrated, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change.

Degree of Hybridization Insights

Based on the degree of hybridization, the market is further bifurcated into mild-hybrid, full-hybrid, and plug-in-hybrid. The full-hybrid segment held the largest revenue share of 47.2% in 2023. The full-hybrid vehicles are equipped with a gasoline engine and an electric motor, allowing them to operate using either power sources independently or in combination. These vehicles utilize advanced hybrid drivetrain technology to optimize fuel efficiency, reduce emissions, and enhance performance. Full hybrids differ from mild hybrids in that they can run solely on electric power for short distances, making them more environmentally friendly and suitable for urban driving conditions. The full hybrid cars have gained traction in the automotive market due to increasing environmental concerns, government regulations promoting cleaner transportation, and consumer demand for fuel-efficient vehicles.

The plug-in-hybrid segment is anticipated to witness the fastest CAGR over the forecast period. Plug-in-hybrid cars offer the flexibility of running on electric power for shorter commutes while having an internal combustion engine for longer distances, alleviating concerns about range limitations. The expanding charging infrastructure and advancements in battery technology are making plug-in hybrids more appealing, addressing one of the critical concerns of potential buyers. As environmental awareness continues to rise, consumers are increasingly seeking vehicles that offer fuel efficiency and reduced emissions, further driving the growth of plug-in hybrid cars in the automotive market.

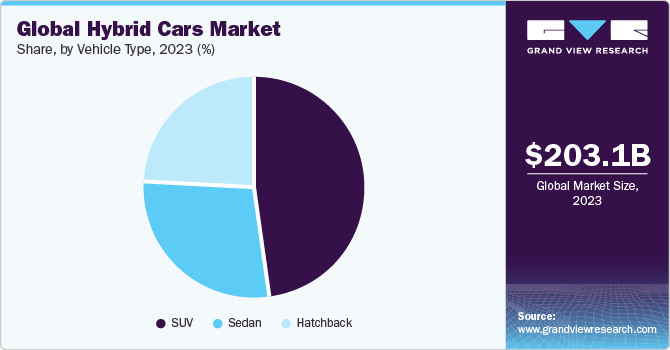

Vehicle Type Insights

Based on vehicle type, the market is segmented into sedan, hatchback, and SUV. The SUV segment held the largest revenue share in 2023. Hybrid and battery technology advancements have contributed to the increasing popularity of hybrid SUVs. Hybrid SUVs offer improved fuel efficiency, enhanced performance, and extended electric-only driving ranges compared to earlier generations of hybrid vehicles. These technological advancements have helped overcome some limitations and concerns associated with hybrid vehicles, such as range issues and higher upfront costs. The hybrid SUV market is expected to grow, driving further innovation and adoption in the automotive industry. For instance, in December 2023, Renault announced plans for a new venture in Brazil, earmarking an investment of 350 billion euros (equivalent to USD 379.12 billion) to manufacture a hybrid engine C-SUV tailored for distribution across Latin America. The new vehicle will be produced at Renault's Curitiba Veiculos de Passeio facility in Sao Jose dos Pinhais, Parana. This region is Renault's second-largest market after France.

The hatchback segment is anticipated to register the fastest CAGR over the forecast period. Changing mobility trends and urbanization have influenced consumer preferences toward smaller, more agile vehicles like hatchbacks. With their small footprint and agile handling, hatchback models are utilized for navigating crowded city streets and tight parking spaces. Similarly, the shift towards shared mobility services and ride-hailing platforms has increased demand for fuel-efficient vehicles like hybrid hatchbacks among fleet operators and transportation providers seeking to reduce operating costs and environmental impact.

Regional Insights

The North America hybrid cars market is anticipated to grow at a lucrative CAGR over the forecast period. With growing concerns about climate change and air pollution, consumers in North America are increasingly seeking greener transportation alternatives. Hybrid cars, which combine traditional gasoline engines with electric motors, offer lower emissions and improved fuel efficiency compared to conventional gasoline-powered vehicles. This environmental consciousness drives consumer interest and incentivizes the adoption of hybrid cars as a more eco-friendly transportation option.

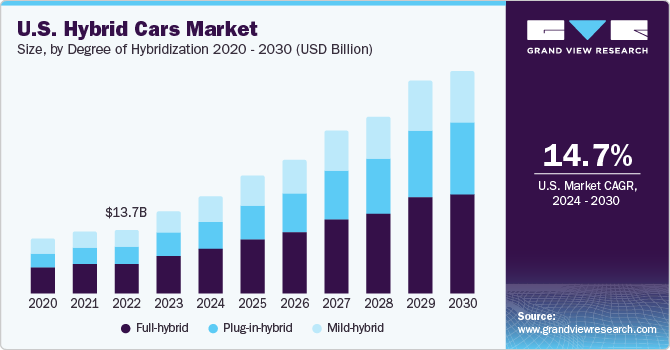

U.S. Hybrid Cars Market Trends

The hybrid cars market in the U.S. is propelled by government incentives and regulations, which play a crucial role in promoting the adoption of hybrid cars. Federal and state-level incentives, such as tax credits, rebates, and access to carpool lanes, encourage consumers to purchase hybrid vehicles by reducing their upfront costs and providing financial incentives. In addition, regulatory measures aimed at reducing greenhouse gas emissions and increasing fuel efficiency standards further incentivize automakers to produce hybrid models and invest in hybrid technology. These policy initiatives create a supportive environment for hybrid car adoption and contribute to market growth.

Asia Pacific Hybrid Cars Market Trends

The hybrid cars market in Asia Pacific dominated the global industry, with the largest revenue share of 62.2% in 2023. Rising concerns about air quality and environmental sustainability have prompted governments in countries such as India and China to implement supportive policies and incentives for hybrid vehicles, driving their adoption. According to IQAIR, in 2023, 96% of India's 1.3 billion people live in areas where air quality exceeds WHO guidelines by seven times. Central and South Asia were identified as the worst-performing regions globally, with Bangladesh, Pakistan, India, and Tajikistan being the four most polluted countries.

The China hybrid cars market growth is driven byincreasing emphasis on energy security and reduced dependence on imported oil. As the world's largest importer of crude oil, China faces energy security challenges and is diversifying its energy sources and reducing reliance on fossil fuels. Hybrid vehicles can switch between gasoline and electric power and offer a viable solution by providing greater energy efficiency and reducing oil consumption. Chinese policymakers recognize the strategic importance of promoting hybrid technologies as part of a broader strategy to enhance energy security and reduce the country's dependence on imported oil, thereby driving demand for hybrid cars in the domestic market.

The India hybrid cars market demand is propelled by the increasing availability of charging infrastructure and supportive government policies for electric mobility for hybrid and electric vehicles (EVs). While hybrid cars offer flexibility and convenience with their hybrid powertrains, they also serve as a transitional step towards full electrification. With the government's ambitious targets for electric vehicle adoption and investments in charging infrastructure development, hybrid cars can complement India's electrification efforts by familiarizing consumers with electrified drivetrains and encouraging the transition towards fully electric vehicles in the future. According to the Vahan dashboard, in 2023, India boasted 5,254 public electric vehicle (EV) charging stations, serving a total of 20.65 lakh EVs. It is projected that by 2025, India will have doubled its public charging stations to reach 10,000.

Europe Hybrid Cars Market Trends

The hybrid cars market in Europe is expected to witness significant growth during the forecast period. Governments have implemented stringent emission standards and regulations, such as Euro 6 emission standards, limiting the amount of pollutants that vehicles emit. In response to these regulations, automakers have accelerated their development and production of hybrid vehicles to meet stricter emission requirements and avoid hefty fines. As a result, consumers are incentivized to choose hybrid cars for environmental benefits and potential financial savings and incentives provided by government programs.

The UK hybrid cars market is driven by government policies and incentives promoting cleaner transportation options. The UK government has implemented various measures to incentivize the adoption of low-emission vehicles, including grants and subsidies for purchasing hybrid cars and tax incentives and exemptions for hybrid vehicle owners. In addition, initiatives such as the Ultra Low Emission Zone (ULEZ) in London and the Clean Air Zones (CAZs) in other cities have further incentivized the transition to hybrid and electric vehicles by imposing charges or restrictions on high-emission vehicles entering designated areas.

The hybrid cars market in Germany is propelled by the rise of shared mobility services and the shift towards multi-modal transportation. While shared mobility services such as ride-hailing and car-sharing have traditionally focused on conventional gasoline-powered vehicles, there is a growing interest in incorporating hybrid and electric vehicles into these fleets. As shared mobility providers in Germany seek to offer greener and more sustainable transportation options, hybrid cars are increasingly becoming part of their fleets, contributing to market growth.

Latin America Hybrid Cars Market Trends

The hybrid cars market in Latin America is driven by economic incentives and cost savings associated with the adoption of hybrid vehicles. Hybrid cars typically offer better fuel efficiency and require less frequent maintenance, resulting in lower overall ownership costs over the vehicle's lifespan. In addition, some countries in Latin America offer additional financial incentives, such as reduced registration fees or toll exemptions, for owning hybrid vehicles, further enhancing their affordability and attractiveness to consumers.

Key Hybrid Cars Company Insights

Some of the key players operating in the market includeToyota, Tesla, and BMW.

-

Toyota is continuously advancing its Hybrid Synergy Drive system. They introduced the Prius, the world's first mass-produced hybrid car, and continue to enhance their hybrid lineup with features like regenerative braking and efficient powertrain designs.

-

Tesla, primarily known for electric vehicles, has made innovative strides in hybrid technology. Their plug-in hybrid models, such as the Tesla Model S and Model X, showcase cutting-edge electric powertrains with extended range capabilities, combining elements of electric and hybrid technologies.

-

BMW has been at the forefront of luxury hybrid vehicles with its BMW iPerformance lineup. Notable for their innovative use of lightweight materials and plug-in hybrid drivetrains, BMW's hybrid models, like the i8, incorporate advanced technologies to balance performance and sustainability.

Betway, 10Bet, and LeoVegas Sport are other hybrid car market participants.

Key Hybrid Cars Companies:

The following are the leading companies in the hybrid cars market. These companies collectively hold the largest market share and dictate industry trends.

- TOYOTA MOTOR CORPORATION

- Lexus

- Honda

- BMW AG

- Tesla

- Volkswagen Group

- Chevrolet

- AUDI AG

- Mercedes-AMG GmbH

- Porsche

- Kia Corporation

Recent Developments

-

In March 2024, Toyota Group announced plans to invest 11 billion reais (USD 2.2 billion) in its Brazilian operations. This substantial investment aims to enhance production capacity in Latin America's largest economy, mainly focusing on models incorporating hybrid-flex fuel technology. Out of the total sum, 5 billion reais will be allocated towards producing new compact hybrid-flex vehicles, slated to commence production in 2025.

-

In March 2024, Stellantis partnered with the California Air Resources Board (CARB) to promote electrification by educating U.S. consumers and dealers about the advantages of electric vehicles (EVs). This collaboration is expected to prevent 10 to 12 billion metric tons of greenhouse gas emissions throughout its duration. Furthermore, it will enable U.S. customers to fully adopt its cutting-edge technologies, including five plug-in hybrids and two all-electric vehicles.

-

In March 2024, Stellantis announced an investment of 30 billion reais (USD 6.1 billion) towards strengthening the production of flex-hybrid vehicles in South America as part of its commitment to advancing eco-friendly technologies. This investment will facilitate the introduction of more than 40 new products within the next five years, alongside the implementation of innovative decarbonization measures and bio-hybrid technologies.

-

In July 2022, Renault Group partnered with Vitesco Technologies to develop and manufacture power electronics in a unified One Box unit for electric and hybrid powertrains. The configurations and assembly of the One Box will be tailored to suit different electric and hybrid powertrain variants. The majority of development platform teams will be located in Toulouse. Renault Group aims to manufacture this product at its French industrial facilities exclusively for 100 percent electric vehicles.

-

In June 2022, Toyota Kirloskar Motor (TKM), the local subsidiary of Toyota Motor Corp, partnered with Suzuki Motor Corporation to manufacture hybrid electric vehicles at the Suzuki Motor Corporation facility in Bidadi, Karnataka. These vehicles will come in two hybrid electric versions - mild and strong - and will be positioned as a mid-sized Sports Utility Vehicle (SUV). The SUV will be jointly badged by both companies, enabling Maruti Suzuki and Toyota Kirloskar Motor to market the vehicle in India and export it to African markets under different brand names. While Suzuki will provide the mild hybrid technology for the SUV, Toyota will supply the strong hybrid technology.

-

In May 2022, Honda Cars India Limited launched the New City e: HEV in the Indian market. The City e: HEV boasts Honda's innovative Self-charging and highly efficient Two Motor Electric Hybrid system paired with a refined 1.5-liter Atkinson-Cycle DOHC i-VTEC petrol engine. This combination aims to deliver top-tier electric-hybrid performance, providing an exhilarating driving experience, impressive fuel efficiency of 26.5 km/l, and minimal emissions.

Hybrid Cars Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 235.28 billion

Revenue forecast in 2030

USD 457.27 billion

Growth rate

CAGR of 11.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Degree of hybridization, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

TOYOTA MOTOR CORPORATION; Lexus; Honda; BMW AG; Tesla; Volkswagen Group; Chevrolet; AUDI AG; Mercedes-AMG GmbH; Porsche; Kia Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hybrid Cars Market Report Segmentation

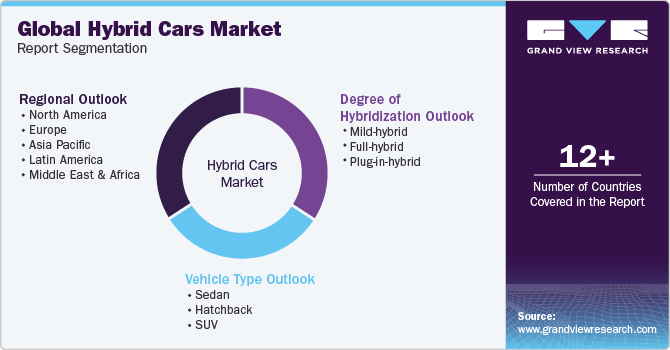

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hybrid cars marketreport based on degree of hybridization, vehicle type, and region:

-

Degree of Hybridization Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mild-hybrid

-

Full-hybrid

-

Plug-in-hybrid

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sedan

-

Hatchback

-

SUV

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hybrid cars market size was estimated at USD 203.09 billion in 2023 and is expected to reach USD 235.28 billion in 2024

b. The global hybrid cars market is expected to grow at a compound annual growth rate of 11.7% from 2024 to 2030, reaching USD 457.27 billion by 2030

b. Asia Pacific dominated the hybrid cars market with a revenue share of 62.2% in 2023. Rising concerns about air quality and environmental sustainability have prompted governments in countries such as India and China to implement supportive policies and incentives for hybrid vehicles, driving their adoption.

b. Some key players operating in the hybrid cars market include TOYOTA MOTOR CORPORATION, Lexus, Honda, BMW AG, Tesla, Volkswagen Group, Chevrolet, AUDI AG, Mercedes-AMG GmbH, Porsche, Kia Corporation

b. Factors such as the increasing volatility of oil prices are driving the growth of the hybrid cars market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."