- Home

- »

- Consumer F&B

- »

-

Hybrid Beverages Market Size, Share & Growth Report, 2030GVR Report cover

![Hybrid Beverages Market Size, Share & Trends Report]()

Hybrid Beverages Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Alcoholic Beverages, Non-alcoholic Beverages), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-358-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hybrid Beverages Market Size & Trends

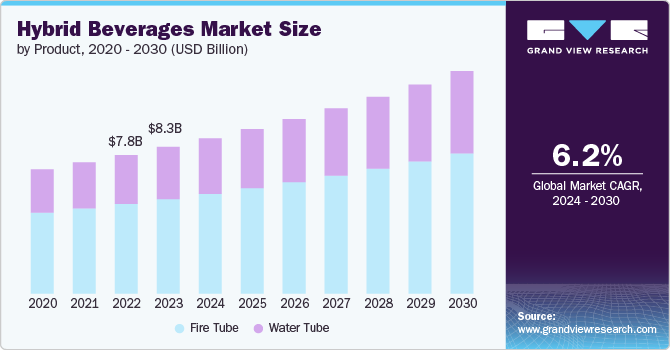

The global hybrid beverages market size was estimated at USD 8.26 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. The growth of the industry is driven by several key factors. Innovation in flavor combinations, such as Coca-Cola Plus Coffee and tea-infused cocktails, appeals to consumers seeking unique taste experiences. Health and wellness trends spur demand for functional beverages like kombucha that blend probiotics with tea or fruit juices. Convenience remains paramount, with products like energy drinks and ready-to-drink teas meeting the needs of on-the-go consumers.

Consumers are increasingly seeking healthier beverage options that provide functional benefits beyond just hydration. Hybrid beverages often combine ingredients that offer nutritional benefits, such as vitamins, minerals, antioxidants, and probiotics. Kombucha-infused teas that combine the probiotic benefits of kombucha with the antioxidants in tea. Brands such as GT's Living Foods offer a variety of kombucha-tea blends that cater to health-conscious consumers.

The rising development in processing technologies allows for innovative combinations of different beverage types while maintaining their distinct flavors and nutritional benefits. This has enabled the creation of stable and appealing hybrid beverages. Cold brew coffee combined with nitrogen infusion, such as Starbucks' Nitro Cold Brew, provides a smooth, creamy texture and a unique drinking experience.

There is a growing trend towards premium and indulgent products that offer a superior taste experience. Hybrid beverages can be positioned as premium products by using high-quality ingredients and unique flavor profiles. Many consumers are increasingly concerned about sustainability and the ethical sourcing of ingredients. Hybrid beverages often incorporate natural and organic ingredients, appealing to this segment of environmentally conscious consumers.

Product Insights

Non-alcoholic hybrid beverages accounted for a market share of 64.3% of the global revenues in 2023. Health consciousness among consumers fuels demand for beverages with natural ingredients, vitamins, and antioxidants, promoting wellness. Clean-label trends emphasize natural flavors and ingredients, appealing to those seeking transparency in their beverages. Innovation in flavors, such as exotic fruit infusions and botanical extracts, satisfies consumers' desire for unique taste experiences. Functional benefits, like energy-boosting properties or digestive health support, cater to specific consumer needs.

The alcoholic hybrid beverages market is projected to grow at a significant CAGR from 2024 to 2030. Consumers seek unique and innovative flavor combinations that offer new taste experiences beyond traditional options. Craft cocktails that blend traditional spirits with exotic fruits, herbs, botanicals, or unconventional ingredients like chili peppers or smoked woods appeal to adventurous consumers looking for novel drinking experiences.

Distribution Channel Insights

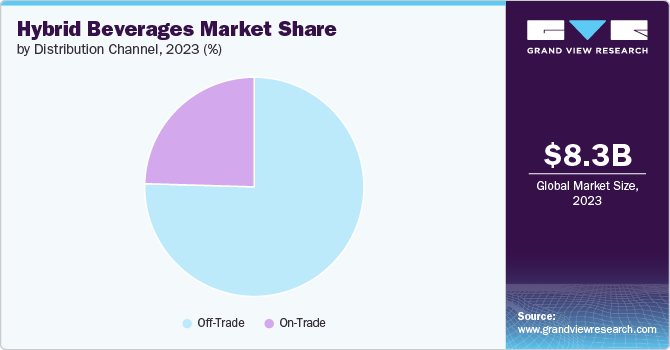

Sales of hybrid beverages through off-trade channels accounted for a share of 75.5% of the global revenues in 2023. Off-trade channels provide convenience by offering hybrid beverages that are ready-to-drink and easily accessible to consumers in supermarkets, convenience stores, and online platforms. Effective branding, promotional activities, and point-of-sale marketing increase visibility and attract consumers to hybrid beverage products on retail shelves. Off-trade channels offer a wide selection of hybrid beverages, allowing consumers to choose from different flavors, formats, and sizes that suit their preferences and occasions.

Sales of hybrid beverages through on-trade is anticipated to grow at a significant CAGR from 2024 to 2030. The sale of hybrid beverages through on-trade distribution channels is driven by the appeal of unique and innovative drink options that enhance the drinking experience at bars, restaurants, and clubs. These beverages often combine different types of drinks, such as cocktails with infused flavors or specialty brews with added ingredients, attracting consumers looking for novel taste experiences. The trend towards premiumization is also significant, with consumers willing to pay for higher-quality and artisanal drinks that provide superior taste and craftsmanship. Health-conscious choices play a role as well, with the demand for hybrid beverages that incorporate natural ingredients, functional benefits, and lower sugar content appealing to patrons.

Regional Insights

The market in North America accounted for a share of 28.4% of the global revenue in 2023. The market's growth is largely propelled by a growing consumer focus on health, driving demand for beverages that offer enhanced health benefits beyond mere nutrition. Moreover, the increasing prevalence of fast-paced lifestyles has heightened the desire for convenient, ready-to-drink solutions that deliver efficient nutritional support. Additionally, the shift towards clean-label products, which prioritize natural ingredients and simplicity, significantly influences consumer choices in this market. For instance, beverages like cold-pressed juices with added vitamins and antioxidants or protein shakes made with natural ingredients align with these trends, appealing to health-conscious consumers seeking both convenience and nutritional value.

U.S. Hybrid Beverages Market Trends

The market in the U.S. is projected to grow at a CAGR of 8.4% from 2024 to 2030. Increasing consumer focus on health drives demand for beverages that offer functional benefits, natural ingredients, and specific health attributes.Consumers in the U.S. are attracted to unique and innovative flavor combinations that provide novel taste experiences. Sparkling waters infused with exotic fruit essences or herbal extracts, such as mint or lavender, offer refreshing alternatives to traditional sodas, appealing to those looking for flavorful and distinctive beverages.

Europe Hybrid Beverages Market Trends

Europe market is expected to grow at a CAGR of 5.8% from 2024 to 2030. There is a growing demand for premium and craft beverages that offer superior quality, authenticity, and artisanal craftsmanship. Similar to other regions, busy lifestyles prompt European consumers to seek convenient, ready-to-drink options that provide hydration and functional benefits.

Asia Pacific Hybrid Beverages Market Trends

Asia Pacific market is expected to grow at a CAGR of 6.8% from 2024 to 2030. Growing health awareness and a preference for functional beverages that offer nutritional benefits and natural ingredients.In Japan, there is a strong demand for beverages like matcha green tea with added antioxidants and health-boosting properties, appealing to health-conscious consumers. Rapid urbanization and busy lifestyles lead to increased demand for convenient, ready-to-drink options.

Key Hybrid Beverages Company Insights

The hybrid beverage industry is characterized by intense competition among key players who are continually innovating to meet evolving consumer preferences. This dynamic market is driven by health and wellness trends, flavor innovation, convenience, and sustainability.

Key Hybrid Beverages Companies:

The following are the leading companies in the hybrid beverages market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo Inc.

- The Coca-Cola Company

- Nestle SA

- Anheuser-Busch InBev

- Heineken

- ZICO Rising, Inc.

- Starbucks Corporation

- Molson Coors Beverage Company

- Diageo PLC

- Keurig Dr Pepper

Recent Developments

-

In January 2024, Aurora Cannabis Inc., a leading global medical cannabis company based in Canada, announced the launch of three new cannabis-infused beverages. Initially available exclusively to veteran patients, these beverages are designed to deliver exceptional taste, potency, and variety. This introduction responds to the needs of patients seeking alternative forms of cannabis to enhance their well-being.

Hybrid Beverages Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.75 billion

Revenue forecast in 2030

USD 12.54 billion

Growth Rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

PepsiCo Inc.; The Coca-Cola Company; Nestle SA; Anheuser-Busch InBev; Heineken; ZICO Rising, Inc.; Starbucks Corporation; Molson Coors Beverage Company; Diageo PLC; Keurig Dr Pepper

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hybrid Beverages Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hybrid beverages market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcoholic Beverages

-

Beers Blends

-

Wine Cocktails

-

Alcoholic Sodas

-

Others

-

-

Non-alcoholic Beverages

-

Coffee-tea Blends

-

Juice Infused Drinks

-

Functional Beverages

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-trade

-

Bars and Pubs

-

Hotels & Restaurants

-

Others

-

-

Off-trade

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hybrid beverages market size was estimated at USD 8.26 billion in 2023 and is expected to reach USD 8.75 billion in 2024.

b. The global hybrid beverages market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 12.54 billion by 2030.

b. Non-alcoholic hybrid beverages accounted for a market share of 64.3% of the global revenues in 2023. Health consciousness among consumers fuels demand for beverages with natural ingredients, vitamins, and antioxidants, promoting wellness.

b. Some key players operating in the hybrid beverages market include PepsiCo Inc., The Coca-Cola Company, Nestle SA, Anheuser-Busch InBev, Heineken, ZICO Rising, Inc., Starbucks Corporation, Molson Coors Beverage Company, Diageo PLC, Keurig Dr Pepper

b. Key factors that are driving the hybrid beverages market growth include Innovation in flavor combinations, such as Coca-Cola Plus Coffee and tea-infused cocktails, appeals to consumers seeking unique taste experiences. Health and wellness trends spur demand for functional beverages like kombucha that blend probiotics with tea or fruit juices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.