- Home

- »

- Distribution & Utilities

- »

-

HVDC Transmission Market Size And Share Report, 2033GVR Report cover

![HVDC Transmission Market Size, Share & Trends Report]()

HVDC Transmission Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Line Commutated Converter (LCC), Voltage Source Converter (VSC)), By Application (Overhead, Subsea), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-410-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

HVDC Transmission Market Summary

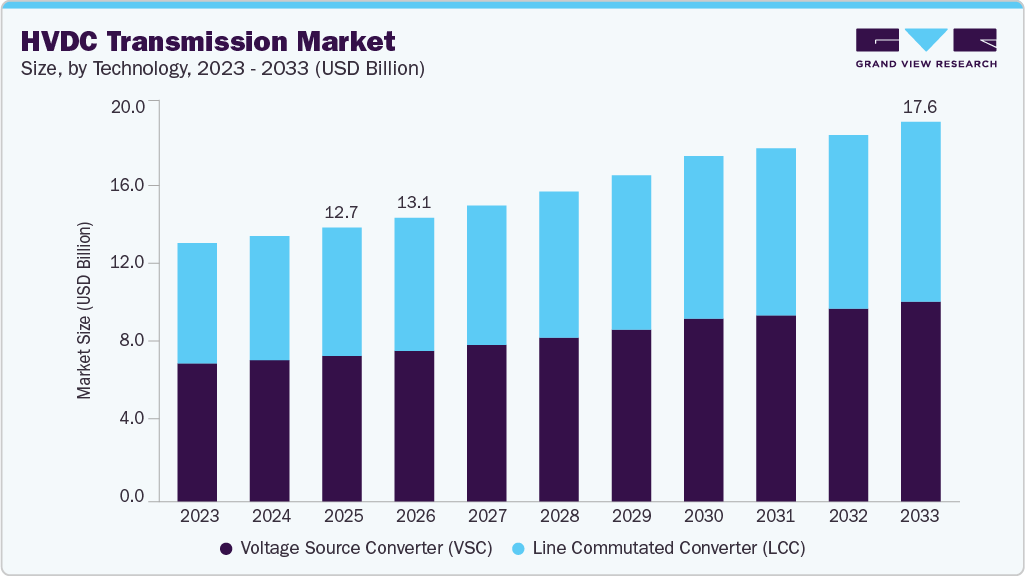

The global HVDC transmission market size was estimated at USD 12.69 billion in 2025 and is projected to reach USD 17.60 billion by 2033, growing at a CAGR of 4.2% from 2026 to 2033. An HVDC transmission system operates by converting alternating current to direct current for long-distance, high-capacity transfer, resulting in significantly lower electrical losses, enhanced controllability, and improved grid stability compared to conventional AC networks.

Key Market Trends & Insights

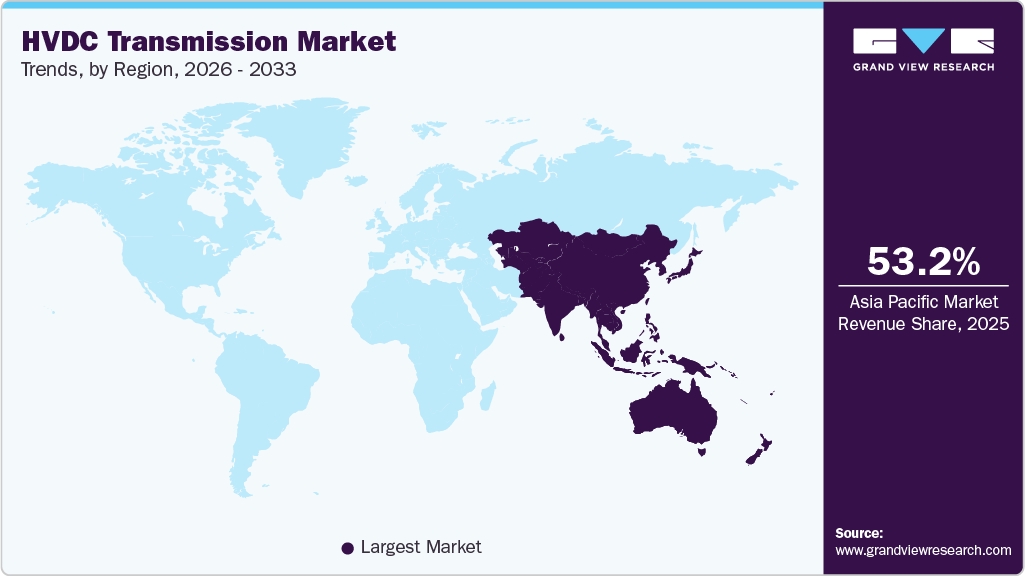

- The Asia Pacific HVDC transmission market held the largest global revenue share of 53.3% in 2025.

- The HVDC transmission industry in the U.S. is expected to grow significantly from 2026 to 2033.

- By technology, the voltage source converter (VSC) segment held the largest market share of 53.2% in 2025.

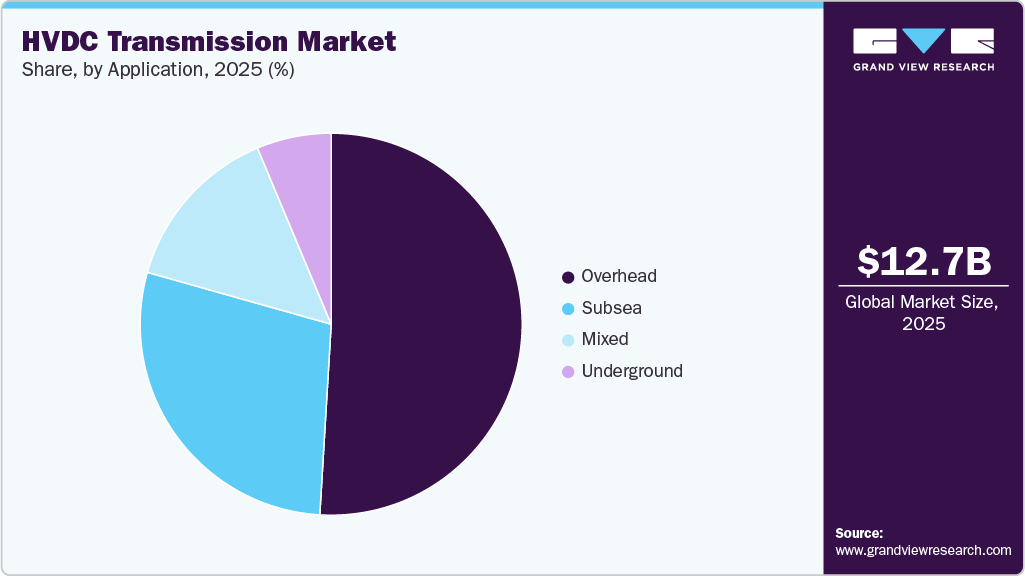

- By application, the overhead segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 12.69 Billion

- 2033 Projected Market Size: USD 17.60 Billion

- CAGR (2026-2033): 4.2%

- Asia Pacific: Largest Market in 2025

Continued technological progress in converter stations, cable systems, and power electronics, along with the growing adoption of long-distance renewable power transmission, are major factors driving the expansion of the HVDC transmission industry. Rising government support for grid modernization and cross-border interconnection projects aimed at integrating large-scale renewable energy is also strengthening demand across the global market.

The global HVDC transmission system market continues to advance on the back of rising demand for reliable, flexible, and low-loss long-distance power transfer solutions, particularly in regions transitioning away from coal-based power grids. Utilities and governments are increasingly investing in HVDC infrastructure to support decarbonization goals, integrate large-scale renewable energy, and enhance grid stability. The growing adoption of flexible HVDC transmission system market technologies, especially VSC-based solutions capable of supporting dynamic grid operations, plays a critical role in addressing the variability of wind and solar generation. Continuous advancements in converter designs, digital control systems, and multi-terminal configurations further strengthen market momentum globally.

Drivers, Opportunities & Restraints

The global market for HVDC transmission is advancing on the back of the rising demand for reliable, flexible, and low-loss long-distance power transfer solutions, particularly in regions transitioning from conventional coal-based grids to cleaner and more efficient energy networks. Utilities and governments are increasing their investments in HVDC infrastructure to support decarbonization efforts, enhance grid stability, and enable the integration of large-scale renewable energy sources, where variability in wind and solar output remains a challenge. The superior controllability, low transmission losses, and ability of HVDC systems to connect asynchronous grids make them essential for strengthening interregional power exchange and balancing fluctuations in renewable generation. Continuous improvements in converter technology, cable systems, and multi-terminal architectures are further accelerating adoption across both inland and offshore applications, including the rapidly evolving subsea HVDC transmission market.

Emerging opportunities arise from the development of offshore wind expansion corridors, cross-border interconnection projects, and the increasing deployment of Voltage Source Converter (VSC) systems, which are capable of supporting dynamic grid operations. Advancements in digital monitoring, predictive asset management, and high-performance power electronics are also reducing lifecycle costs and improving reliability. Growing electrification in developing economies and rising interest in long-distance renewable power corridors are further opening new avenues for deployment. However, the market continues to face constraints, including high upfront capital requirements, complex permitting for large-scale transmission projects, and regulatory uncertainties across multiple jurisdictions. Lengthy approval timelines, right-of-way challenges, and rising cybersecurity concerns in modern grid systems remain additional obstacles to widespread HVDC expansion.

Technology Insights

The Voltage Source Converter (VSC) segment remained the dominant technology category in the HVDC transmission industry, accounting for 53.2% of global revenue in 2025, and is expected to retain strong momentum throughout the forecast period. The VSC HVDC transmission market continues to expand due to its suitability for integrating offshore wind, facilitating asynchronous grid connections, and supporting urban grid reinforcement projects. Its independent control of active and reactive power, black-start capability, and superior performance in weak grid conditions reinforce its growing adoption. Ongoing improvements in semiconductor efficiency, modular multilevel converter topologies, and high-voltage cable compatibility further support the widespread deployment of VSC-based systems across global HVDC networks.

The Line Commutated Converter (LCC) segment is projected to register the fastest CAGR of 4.4% over the forecast period. Its proven ability to handle ultra-high-capacity, long-distance point-to-point transmission makes it especially suitable for large renewable energy corridors and bulk power transfer between geographically distant regions. LCC systems offer lower conduction losses and remain a preferred choice in countries with strong demand for multi-gigawatt transmission links, particularly across Asia Pacific and China’s expanding UHVDC network. The segment’s increasing deployment in interregional grid reinforcement and cross-border exchange projects is also accelerating demand for related components, such as high-power thyristors, converter transformers, and control systems, which support wider growth opportunities across the HVDC transmission value chain.

Application Insights

The overhead transmission segment accounted for approximately 50.9% of total revenue share in 2025, retaining its position as the dominant application category. Rising electricity demand resulting from global urbanization, population growth, and the transition to large-scale renewable energy generation continues to support the adoption of overhead HVDC lines for utility-scale power transfer. Governments and grid operators are increasingly prioritizing long-distance, low-loss transmission corridors to enhance system stability, a trend also reflected in the Asia Pacific and European HVDC transmission markets, where decarbonization targets and offshore wind integration remain key strategic priorities. Although long-term demand remains positive, some market participants remain cautious due to high capital requirements, permitting challenges, and uncertainties surrounding transmission route approvals in certain regions.

The subsea HVDC segment is projected to register the fastest CAGR of 4.7% over the forecast period. The expansion of activity in offshore wind development, cross-border interconnection projects, and island electrification continues to drive the need for dependable, long-distance submarine transmission solutions. Stricter environmental regulations and land-use constraints are also encouraging utilities to shift from overhead lines to subsea cable systems in sensitive ecological zones. Favorable policy incentives for offshore renewable integration and the enhanced controllability offered by VSC-based subsea links further strengthen adoption across a wide range of marine and intercontinental transmission environments.

Regional Insights

Asia Pacific held a 53.2% revenue share of the global HVDC transmission market in 2025, driven by the addition of large-scale transmission infrastructure and the increasing deployment of long-distance renewable energy corridors across major economies in the region. The APAC HVDC transmission systems market continues to benefit from strong policy support for grid modernization, offshore wind development, and cross-border interconnections. Rapid growth in nations such as India is further reshaping regional demand, with the India HVDC transmission systems market experiencing rising investment in long-distance transmission projects and advanced converter technologies. These factors collectively reinforce APAC’s position as the global hub for innovation and large-scale HVDC deployment.

North America HVDC Transmission Market Trends

Large-scale grid modernization initiatives and the growing emphasis on integrating renewable energy sources are major factors driving the market growth. Utilities are increasingly adopting HVDC systems to reduce transmission congestion, facilitate the movement of renewable power over long distances, and enhance overall grid stability. Supportive federal policies, improving regulatory coordination, and rising offshore wind development activity continue to strengthen the region’s investment outlook. Ongoing upgrades to transmission infrastructure and the need for controllable, resilient power transfer solutions remain central to the adoption of HVDC across North America.

U.S. HVDC Transmission Market Trends

The U.S. HVDC transmission industry is expanding due to the increasing need to connect geographically dispersed renewable resources, particularly large-scale wind and solar installations, to major demand centers. Growing investments in offshore wind projects, interregional transmission corridors, and long-distance grid reinforcement initiatives are supporting the deployment of HVDC across the country. Federal funding programs, clean energy mandates, and modernization of aging grid assets continue to reinforce the strategic importance of HVDC systems in improving reliability, reducing curtailment, and enhancing long-term power system flexibility.

Europe HVDC Transmission Market Trends

The growth of the Europe HVDC transmission industry is driven by the region’s ambitious decarbonization goals and the strategic need to integrate rapidly expanding offshore wind capacity. The European Union’s energy policies support the development of advanced HVDC links to enable cross-border electricity exchange, stabilize grids with high renewable penetration, and enhance energy security. Investments in subsea interconnectors, multi-terminal HVDC networks, and offshore wind hubs are accelerating market momentum. Europe’s strong R&D foundation and the presence of leading OEMs further position the region as a key contributor to the next generation of HVDC technologies.

Latin America HVDC Transmission Market Trends

Energy diversification goals and ongoing modernization of transmission networks are key growth drivers for the Latin America HVDC transmission industry. Countries across the region are increasingly adopting HVDC systems to move renewable energy from resource-rich zones to industrial and urban load centers over long distances. The growing reliance on wind, solar, and hydropower, combined with initiatives to improve grid stability and reduce losses, underscores the need for high-capacity transmission solutions. Supportive regulatory reforms and efforts to attract private investment in power infrastructure further contribute to market development.

Middle East & Africa HVDC Transmission Market Trends

The Middle East and Africa (MEA) HVDC transmission industry is expanding due to rising electricity demand, increasing renewable energy deployment, and initiatives aimed at diversifying national energy portfolios. HVDC systems are increasingly viewed as essential for connecting large solar installations, improving regional grid reliability, and facilitating future cross-border electricity trade. Government-led infrastructure development programs and long-term energy transition strategies are creating favorable conditions for HVDC investment. Strengthening interconnection networks and expanding transmission capacity remain central to the region’s power system planning.

Key HVDC Transmission Company Insights

Some of the key players operating in the global HVDC transmission market include Hitachi Energy, Siemens Energy AG, among others.

-

Hitachi Energy is the global leader in the HVDC transmission industry, recognized for pioneering both Line Commutated Converter (LCC) and Voltage Source Converter (VSC) technologies through its HVDC Classic and HVDC Light platforms. The company has delivered the largest number of operational HVDC projects worldwide, including ultra-high-voltage, long-distance, and offshore wind integration systems. Hitachi Energy’s technology strategy focuses on modular multilevel converter designs, digitalized control & protection systems (MACHTM), advanced cable integration, and enhanced grid-stabilization capabilities. The firm plays a critical role in enabling cross-border interconnections, renewable energy corridors, and multi-terminal HVDC networks.

-

Siemens Energy AG is a major global supplier in the HVDC transmission industry, known for its HVDC PLUS technology based on advanced Voltage Source Converter (VSC) systems. Its solutions are widely used for offshore wind connections, intercontinental subsea links, and urban grid reinforcement projects that require high controllability and a low environmental footprint. Siemens Energy’s technology portfolio emphasizes reliability, compact converter station design, reduced harmonic distortion, and efficient integration into hybrid AC/DC networks. The company is actively involved in European offshore wind expansion, North American grid modernization, and Asia Pacific interconnection projects. Strong R&D capabilities, strategic partnerships with utilities and cable manufacturers, and a global EPC service network enable Siemens Energy to deliver turnkey HVDC systems.

Key HVDC Transmission Companies:

The following are the leading companies in the HVDC transmission market. These companies collectively hold the largest Market share and dictate industry trends.

- American Superconductor Corporation (AMSC)

- General Electric Company (GE Grid Solutions)

- Hitachi Energy

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Nexans SA

- NR Electric Co., Ltd.

- Prysmian Group

- Siemens Energy AG

- Toshiba Corporation

Recent Developments

- In October 2025, Hitachi Energy and Grid United announced a key milestone in advancing the North Plains Connector HVDC project, a ±525 kV, 3-GW high-voltage direct current transmission line designed to link eastern and western U.S. grids and support large-scale renewable energy transfer. The collaboration marks the next phase of engineering and development aimed at strengthening interregional transmission capacity, bolstering grid resiliency, and facilitating the efficient movement of clean power across multiple states.

HVDC Transmission Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 13.15 billion

Revenue forecast in 2033

USD 17.60 billion

Growth rate

CAGR of 4.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Hitachi Energy; Siemens Energy AG; General Electric Company (GE Grid Solutions); Mitsubishi Electric Corporation; Toshiba Corporation; NR Electric Co., Ltd.; Nexans SA; Prysmian Group; LS Electric Co., Ltd.; American Superconductor Corporation (AMSC)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HVDC Transmission Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global HVDC Transmission market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Line Commutated Converter (LCC)

-

Voltage Source Converter (VSC)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Overhead

-

Subsea

-

Mixed

-

Underground

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global HVDC Transmission market size was estimated at USD 12.69 billion in 2025 and is expected to reach USD 13.15 billion in 2026.

b. The global HVDC Transmission market is expected to grow at a compound annual growth rate of 4.2% from 2026 to 2033 to reach USD 17.60 billion by 2033.

b. Based on the technology segment, voltage source converter (VSC) held the largest revenue share of more than 53% in 2025.

b. Some of the key vendors operating in the global HVDC transmission market include Hitachi Energy, Siemens Energy AG, General Electric (GE Grid Solutions), Mitsubishi Electric Corporation, Toshiba Corporation, NR Electric Co., Ltd., Nexans SA, Prysmian Group, LS Electric Co., Ltd., and American Superconductor Corporation (AMSC), among others

b. The key factors driving the HVDC transmission market include the rapid expansion of renewable energy sources such as solar and wind, which require long-distance, low-loss, and highly controllable transmission solutions to maintain grid stability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.