- Home

- »

- Distribution & Utilities

- »

-

HVDC Converter Station Market Size, Industry Report, 2030GVR Report cover

![HVDC Converter Station Market Size, Share & Trends Report]()

HVDC Converter Station Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Line Commutated Converter (LCC), Voltage Source Converter (VSC)), By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-373-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

HVDC Converter Station Market Summary

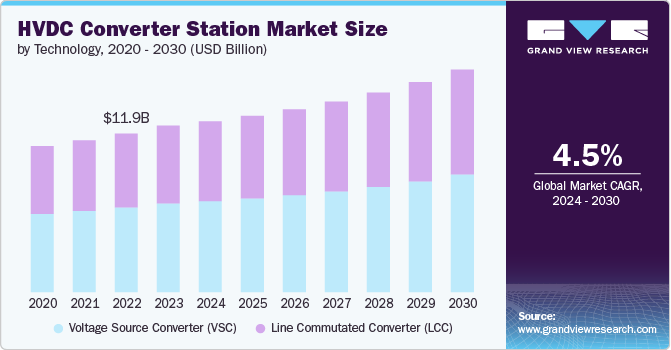

The global HVDC converter station market size was valued at USD 12.17 billion in 2024 and is projected to reach USD 15.84 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. An increasing demand for efficient long-distance power transmission is significantly driving the growth of the HVDC converter station industry.

Key Market Trends & Insights

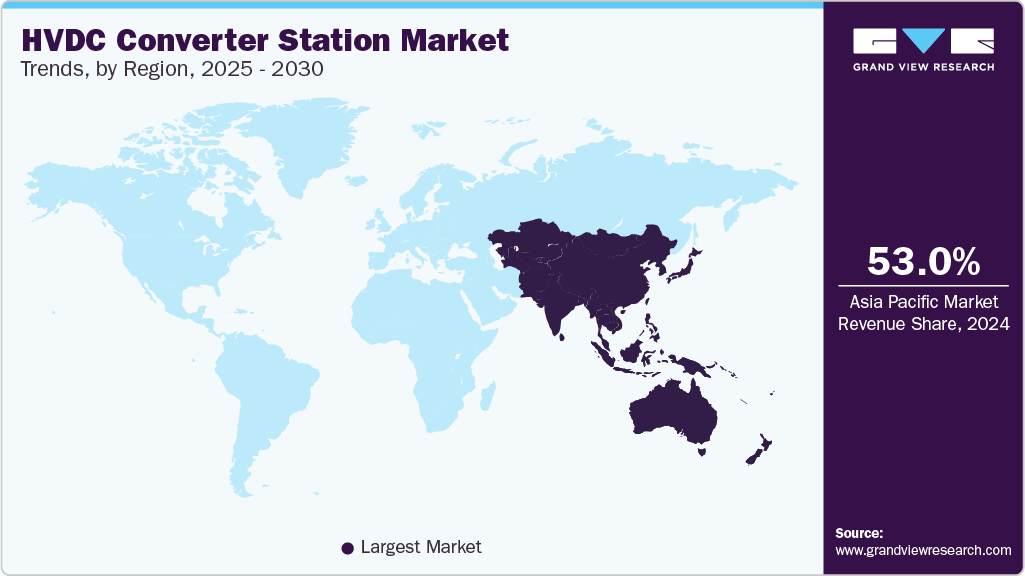

- Asia Pacific dominated the market and accounted for the largest revenue share of over 53.0% in 2024.

- China developed strong domestic capabilities in HVDC technology through a combination of technology transfers, research and development, and practical experience.

- Based on technology, the voltage source converter (VSC) technology segment registered the largest revenue market share of over 53.0% in 2024.

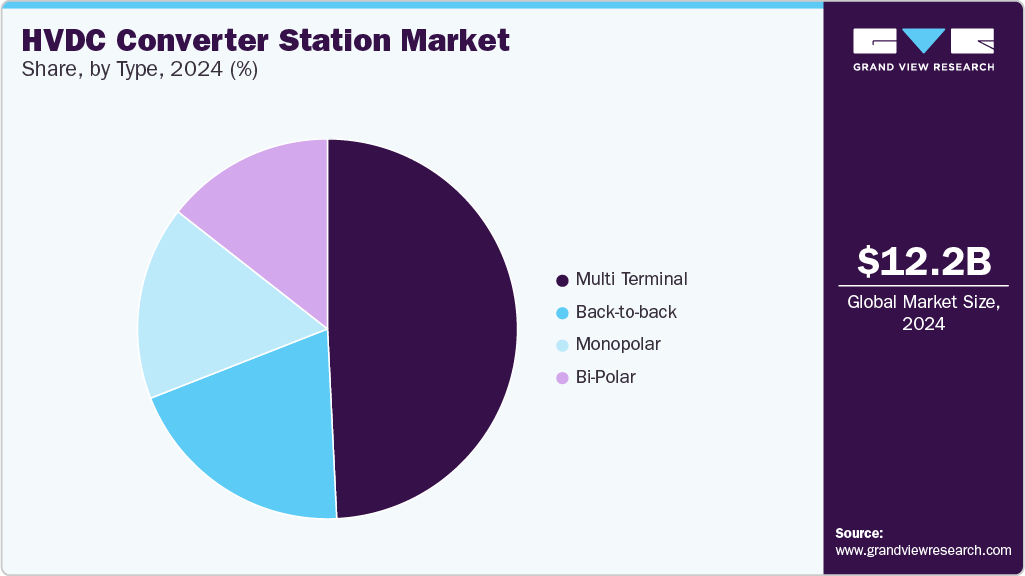

- Based on the type, the multi-terminal segment accounted for the highest revenue market share of over 49.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.17 Billion

- 2030 Projected Market Size: USD 15.84 Billion

- CAGR (2025-2030): 4.8%

- Asia Pacific: Largest market in 2024

HVDC technology offers lower power losses over long distances compared to traditional AC transmission, making it ideal for connecting remote renewable energy sources to population centers. For example, the Rio Madeira HVDC system in Brazil transmits hydroelectric power over 2,375 km, demonstrating the technology's capability in long-distance transmission.

Additionally, growing focus on renewable energy integration and grid interconnection is anticipated to positively influence the market over the forecast period. As countries aim to increase their renewable energy capacity, HVDC converter stations play a vital role in connecting offshore wind farms and solar parks to the main grid. For example, the DolWin alpha converter station in the North Sea connects multiple offshore wind farms to the German grid, showcasing how HVDC technology facilitates the integration of renewable sources.

Moreover, the need for grid stability and power flow control is also propelling the growth of the market. HVDC systems offer better control over power flow, which is especially important in interconnecting asynchronous grids or stabilizing weak AC systems. For example, the Pacific DC Intertie in the U.S., connecting the Pacific Northwest and Southern California, not only transmits power but also enhances grid stability during peak demand periods. Additionally, the increasing adoption of smart grid technologies and the modernization of aging power infrastructure in many countries are creating opportunities for HVDC converter station deployments.

Drivers, Opportunities, & Restraints

The global shift towards renewable energy has necessitated the development of transmission systems capable of efficiently transporting electricity from remote generation sites to consumption centers. HVDC converter stations are essential in this context, enabling the connection of offshore wind farms and solar plants to national grids with minimal losses. For instance, in 2023, approximately 60% of new HVDC projects were linked to offshore wind farms, highlighting their critical role in renewable energy integration.

Moreover, technological innovations, such as Voltage Source Converter (VSC) technology, have enhanced the efficiency, reliability, and grid compatibility of HVDC systems. These advancements have expanded the adoption of HVDC converter stations, facilitating their integration into existing power systems and supporting the development of multi-terminal HVDC networks.

Countries are increasingly collaborating to develop interconnected power grids that can support efficient electricity transfer across borders. HVDC technology is well-suited for such applications, enabling long-distance and high-capacity power transmission with minimal losses. The development of transnational power grids is expected to drive demand for HVDC converter stations.

Establishing HVDC converter stations requires significant capital investment, which can be a barrier to adoption, especially in developing regions. The high costs associated with equipment, installation, and maintenance can deter potential investors.

Technology Insights

Based on technology, the HVDC converter station industry is segmented into line commutated converter (LCC) and voltage source converter (VSC). The voltage source converter (VSC) technology segment registered the largest revenue market share of over 53.0% in 2024. VSC technology uses insulated-gate bipolar transistors (IGBTs) for power conversion, allowing for independent control of active and reactive power. VSC systems offer greater flexibility and faster response times, making them ideal for weak AC grids, offshore wind farm connections, and multi-terminal HVDC networks. Besides, VSC systems have a smaller footprint and can provide black start capability to AC grids.

On the other hand, LCC technology is the traditional and more established type of HVDC converter. LCC systems are capable of handling high power ratings, typically up to several gigawatts, making them suitable for long-distance bulk power transmission. They are known for their high efficiency and reliability, but require strong AC systems at both ends and have limited control capabilities compared to newer technologies.

Type Insights

Based on the type, the market is segmented into bi-polar, monopolar, back-to-back, and multi-terminal. The multi-terminal segment accounted for the highest revenue market share of over 49.0% in 2024. Multi-terminal HVDC converter stations involve three or more converter stations connected to a common DC grid. This configuration allows for power exchange between multiple points and is particularly useful for integrating offshore wind farms or creating interconnected regional grids. This system offers increased flexibility and efficiency in power distribution, but are more complex to control and protect.

Back-to-back HVDC converter stations are used to connect two asynchronous AC systems. These stations are typically located at the same site, with no DC transmission line between them. They allow for power exchange between grids with different frequencies or those that are not synchronized, providing grid stability and control.

Monopolar HVDC converter stations use a single high-voltage conductor for power transmission, with the return path typically being the ground or sea. This configuration is simpler and less expensive than bipolar systems but has lower transmission capacity and reliability. Monopolar systems are often used for submarine cable transmissions or as the first stage of a bipolar system.

Bi-polar HVDC converter stations use two conductors, one with positive polarity and the other with negative polarity. This configuration allows for higher power transmission capacity and improved reliability. In case of failure of one pole, the system can continue operating at reduced capacity using the remaining pole and ground return.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 53.0% in 2024. Rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations are driving massive demand for electricity transmission over long distances. HVDC technology is particularly well-suited for this, as it allows for efficient power transfer with lower losses compared to traditional AC systems. For example, China has been aggressively expanding its HVDC network, with projects such as the Changji-Guquan UHVDC link spanning over 3,000 km and capable of transmitting 12 GW of power.

China HVDC Converter Station Market Trends

China developed strong domestic capabilities in HVDC technology through a combination of technology transfers, research and development, and practical experience. Chinese companies such as State Grid Corporation of China (SGCC) and China Southern Power Grid have become global leaders in HVDC technology. They have not only implemented numerous projects within China but have also started exporting their expertise and equipment to other countries. For instance, SGCC was involved in Brazil's Belo Monte HVDC transmission project, demonstrating China's growing influence in the global HVDC market.

North America HVDC Converter Station Market Trends

The region has been experiencing a significant push towards renewable energy integration and grid modernization. Many North American countries, particularly the U.S. and Canada, invest heavily in developing offshore wind farms and large-scale solar projects. These renewable energy sources are often located far from population centers, necessitating efficient long-distance power transmission. HVDC technology excels in this area, offering lower losses over long distances than traditional AC transmission. For example, utilizing HVDC technology, the Atlantic Wind Connection project aims to create an offshore transmission backbone to support multiple offshore wind farms along the U.S. East Coast.

Europe HVDC Converter Station Market Trends

The European Union's efforts towards a more integrated energy market have driven the need for improved interconnections between national grids. Projects such as the North Sea Link between Norway and the UK, and the Viking Link connecting Denmark and the UK, are prime examples of HVDC converter stations being used to facilitate cross-border energy trading and enhance grid stability. These interconnectors allow for the efficient exchange of power between countries with different energy profiles, balancing supply and demand across the continent.

Latin America HVDC Converter Station Market Trends

The Latin America HVDC (High Voltage Direct Current) converter station market is poised for steady growth, driven by the region's increasing demand for efficient long-distance power transmission and integration of renewable energy sources. Brazil leads the region with significant HVDC projects like the Rio Madeira, Xingu-Rio, and Xingu-Estreito transmission lines, which connect remote hydroelectric power plants to major consumption centers, enhancing grid stability and reducing transmission losses. The adoption of Line Commutated Converter (LCC) technology remains dominant; however, there's a growing interest in Voltage Source Converter (VSC) systems due to their suitability for integrating renewable energy and urban grid applications. Despite challenges such as high initial investment costs and technical complexities, the market's outlook remains positive, supported by regional initiatives to modernize energy infrastructure and expand renewable energy capacity.

Middle East & Africa HVDC Converter Station Market Trends

The Middle East & Africa (MEA) HVDC converter station market is experiencing steady growth, driven by the region's increasing demand for efficient long-distance power transmission and integration of renewable energy sources. The adoption of Line Commutated Converter (LCC) technology remains dominant in the region, offering cost-effective solutions for large-scale power transmission. Notable projects, such as the 2,000 MW Ethiopia-Kenya HVDC interconnector completed in 2022, exemplify the region's commitment to enhancing cross-border electricity trade and grid stability. Additionally, countries like Saudi Arabia and Egypt are investing in HVDC infrastructure to support ambitious renewable energy targets and facilitate international energy exchanges. Despite challenges like high initial capital costs and technical complexities, the MEA region's strategic initiatives and growing energy needs position it as a promising market for HVDC converter station development.

Key HVDC Converter Station Company Insights

The HVDC converter station market is characterized by intense competition among multiple major global players and several regional manufacturers. Prominent players operating in the market are leveraging their technological expertise to strengthen their market positioning. Besides, companies are striving to differentiate themselves through advanced features such as improved control systems, higher power ratings, and reduced footprint designs. Moreover, the global push for clean energy has led companies to heavily invest in R&D to develop next-generation HVDC technologies, further fueling the competitive landscape.

-

In May 2024, Hitachi Energy Ltd was selected by Marinus Link Pty Ltd (MLPL) to develop and supply an HVDC project to enable a renewable energy power supply between Tasmania and the mainland Australian power grid. This project will allow the Tasmanian state to import a supply of wind and solar energy-generated power.

-

In March 2024, Bam-Hitachi Energy, a joint venture appointed by National Grid Energy Transmission (NGET) and SSEN Transmission to build the converter stations for the USD 2,700.0 million Eastern Green Link 2 (EGL2) offshore interconnector between Scotland and England. The 436 km long, 2GW high voltage direct current (HVDC) subsea cable project, which will be the longest HVDC cable in the UK, aims to connect Peterhead in Scotland with Drax in England by 2029 to support up to 50GW of offshore wind capacity as part of the UK's net-zero vision.

-

In January 2024, Alfanar Group entered into a strategic agreement with the Saudi Authority for Industrial Cities and Technology Zones (Modon) under which it will be developing an HVDC converter station for the Saudi Arabia government authority. This station will be developed to meetthe Tabuk Industrial City requirement.

Key HVDC Converter Station Companies:

The following are the leading companies in the HVDC converter station market. These companies collectively hold the largest market share and dictate industry trends.

- Bharat Heavy Electricals Limited

- GE Grid Solutions LLC

- Mitsubishi Electric Corporation

- Siemens Energy AG

- Hitachi Energy Ltd.

- LSIS

- Hyosung

- C-Epri Power Engineering Company

- Toshiba Corporation

- NR Electric Co. Ltd

- Crompton Greaves Ltd

- C-EPRI Electric Power Engineering Co., Ltd

- ABB

- XJ Electric

- Bhel

HVDC Converter Station Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.55 billion

Revenue forecast in 2030

USD 15.84 billion

Growth rate

CAGR of 4.8% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

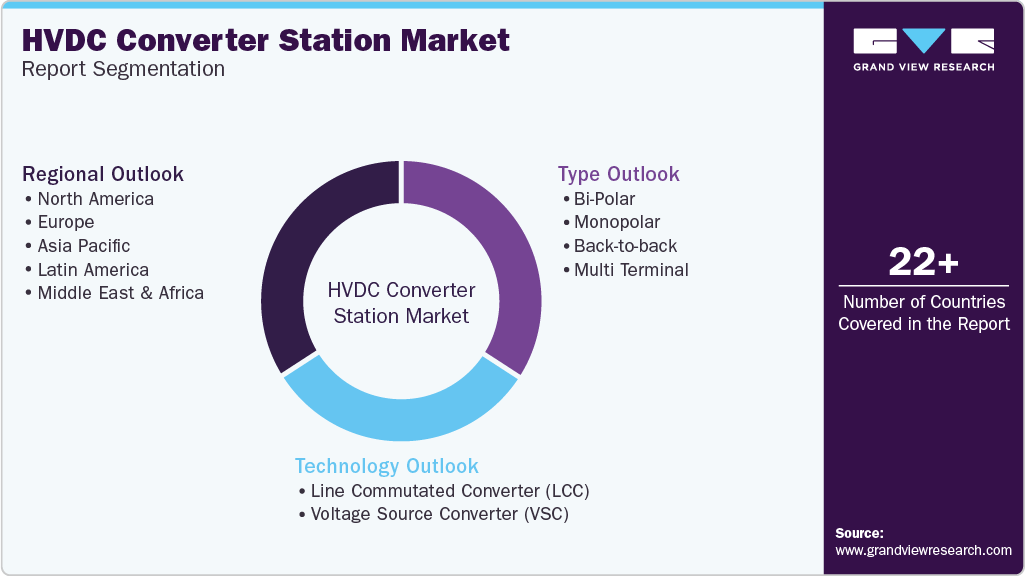

Segments covered

Technology, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; UAE

Key companies profiled

Bharat Heavy Electricals Limited; GE Grid Solutions LLC; Mitsubishi Electric Corporation; Siemens Energy AG; Hitachi Energy Ltd.; LSIS; Hyosung; C-Epri Power Engineering Company; Toshiba Corporation; NR Electric Co. Ltd; Crompton Greaves Ltd; C-EPRI Electric Power Engineering Co. Ltd; ABB; XJ Electric; Bhel

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HVDC Converter Station Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the HVDC converter station market report on the basis of technology, type, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Line Commutated Converter (LCC)

-

Voltage Source Converter (VSC)

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bi-Polar

-

Monopolar

-

Back-to-back

-

Multi Terminal

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global HVDC converter stations market was estimated at around USD 12.17 billion in 2024 and is expected to reach around USD 12.55 billion in 2025.

b. The global HVDC converter stations market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030, reaching around USD 15.84 billion by 2030.

b. The voltage source converter (VSC) technology segment registered the largest revenue market share. VSC technology uses insulated-gate bipolar transistors (IGBTs) for power conversion, allowing for independent control of active and reactive power. VSC systems offer greater flexibility and faster response times, making them ideal for weak AC grids, offshore wind farm connections, and multi-terminal HVDC networks.

b. Key players in the market include Bharat Heavy Electricals Limited; GE Grid Solutions LLC; Mitsubishi Electric Corporation; Siemens Energy AG; Hitachi Energy Ltd.; LSIS; Hyosung; C-Epri Power Engineering Company; Toshiba Corporation; NR Electric Co. Ltd; Crompton Greaves Ltd; C-EPRI Electric Power Engineering Co. Ltd; ABB; and XJ Electric.

b. The global HVDC converter station market is increasing, as demand for efficient long-distance power transmission is significantly driving its growth. HVDC technology offers lower power losses over long distances compared to traditional AC transmission, making it ideal for connecting remote renewable energy sources to population centers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.