HVAC Systems Market Size, Share & Trends Analysis Report Share & Trends Analysis Report By Equipment (Heat Pump, Air Conditioning, Air Purifier), By End-use (Residential, Commercial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-641-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

HVAC Systems Market Size & Trends

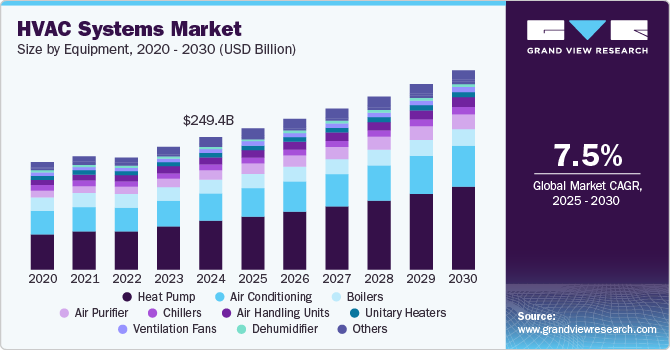

The global HVAC systems market size was estimated at USD 249.37 billion in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2030. The market is driven by the rising need for cost-effective and energy-efficient space cooling and heating applications in commercial and industrial sectors. Furthermore, rising demand for the high seasonal coefficient of performance (SCOP) heating equipment, which can be efficient in both winter and summer, is expected to fuel the product demand over the forecast period.

The growing global population is increasing the requirements for affordable housing units and enhanced commercial infrastructure. According to the United Nations, the global population is expected to reach 9.7 billion in 2050, exhibiting a growth of 2 billion in the next 30 years. This significant increase in the global population is facilitated by the improving standard of living of the masses, increasing lifespan, decreasing mortality rate, and ongoing advancements in medical technologies and medicines. As such, new housing projects are being launched worldwide. This is expected to positively impact the market growth over the forecast period.

Rapid urbanization coupled with increasing demand for energy-efficient products is expected to drive the demand for heat pumps in the residential sector. Favorable government initiatives and tax rebates offered on the energy-saving product's installation are also expected to propel the demand for heat pumps over the coming years. For instance, the U.S. federal government extended the federal tax credit of 26% for residential ground-source heat pump installations up to 31st December 2022. This tax credit was lowered to 22% for systems that were installed in 2023.

Moreover, governments have set standards for the manufacturing of energy-efficient equipment, reducing environmental hazards and carbon footprints. In addition to tax and rebate programs, several governments offer benefits for encouraging customers to use energy-efficient products with low power consumption or renewable energy products, subsequently attracting demand.

Moreover, the introduction of new HVAC regulations and standards or the updation of the existing ones in the U.S. is also expected to positively impact the growth of the market in the country. In January 2023, a new regulation related to energy efficiency SEER2 (Seasonal Energy Efficiency Ratio) was implemented in the U.S. The energy efficiency rating according to this regulation for heat pumps and air conditioners for northern states of the country has been changed to 14, while for southern states, it is 15. Further, the U.S. Environmental Protection Agency is expected to ban R-410 refrigerant in HVAC systems across the country by 2024 and promote the adoption of a new class of refrigerant, namely A2L, in these systems by 2025. Such changes in these systems are expected to surge the demand for replacing existing HVAC systems with new ones or updating them. This, in turn, is anticipated to lead to the growth of the market for HVAC systems in the U.S. over the forecast period.

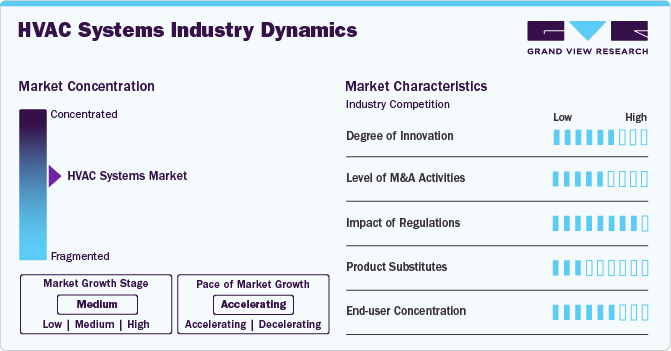

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The HVAC system industry is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers and acquisitions, and collaborations, to strengthen their position in the global industry.

Technological innovations are influencing HVAC systems to achieve better and optimum operations. The next-generation AI-based automated solutions for heating and cooling are likely to have a promising future. The industry is characterized by a race toward highly intelligent, fully automatic, and ecologically sound HVAC systems. Installing Internet of Things (IoT) sensors on HVAC systems offers capabilities of real-time data recording and efficient functioning of HVAC systems. Smart HVAC incorporates IoT technology, which significantly enhances the functioning and overall performance of HVAC (heating, ventilation, and air conditioning) systems.

The HVAC systems industry is also characterized by a high level of product launch activity by leading players. This is due to several factors, including increasing the reach of their products in the industry and enhancing the availability of their products and services in diverse geographical areas. Key industry players adopting this organic growth strategy include Carrier Corporation, Rheem Manufacturing Company, Hitachi Ltd., Daikin Industries, Ltd., and SAMSUNG.

Regulations play a pivotal role in shaping the HVAC systems industry, influencing both its dynamics and evolution. Moreover, environmental regulations and sustainability concerns are driving changes in the HVAC market. Governments worldwide are implementing stricter standards for energy efficiency and refrigerant usage. The transition to eco-friendly refrigerants, such as hydrofluoroolefins (HFOs), is an example of the industry's response to regulatory pressures.

There is an increased emphasis on improving indoor air quality, particularly in commercial and residential buildings. HVAC systems are incorporating advanced air filtration, UV-C sterilization, and ventilation solutions to address IAQ concerns. For instance, high-efficiency particulate air (HEPA) filters and UV-C light systems are being integrated into HVAC setups to eliminate airborne contaminants.

Furthermore, the increasing focus on sustainable construction practices has a direct impact on the HVAC market. Green building certifications, such as LEED (Leadership in Energy and Environmental Design), encourage the adoption of energy-efficient HVAC systems. Ground-source heat pumps, solar-powered HVAC solutions, and other sustainable technologies are gaining traction.

Drivers, Opportunities & Restraints

The HVAC systems industry is primarily driven by increasing demand for energy-efficient and environmentally friendly solutions. As global awareness of climate change grows, both residential and commercial sectors are looking for advanced HVAC systems that reduce energy consumption and minimize carbon footprints. In addition, rapid urbanization and the expansion of infrastructure projects worldwide are fueling the need for modern heating, ventilation, and air conditioning systems to ensure comfort and compliance with stringent regulations.

There are significant opportunities within the HVAC systems industry due to the rise of smart home technology and automation. The integration of the Internet of Things (IoT) allows for enhanced control and monitoring of HVAC systems, leading to improved energy efficiency and user convenience. Moreover, the growing trend of retrofitting existing buildings with modern HVAC systems presents a lucrative avenue for manufacturers and service providers. In addition, emerging markets, particularly in Asia-Pacific and Africa, offer vast potential for growth as these regions increasingly seek to improve indoor air quality and thermal comfort.

Despite the positive growth outlook, the market faces several constraints. High initial installation costs can deter consumers from upgrading to more efficient systems, especially in economically challenged regions. Furthermore, the complexity of system designs and the necessity for skilled labor in installation and maintenance can pose challenges for widespread adoption. In addition, fluctuations in raw material prices and regulatory changes related to refrigerants and energy efficiency standards can impact the market's stability and growth potential.

Equipment Insights

Based on equipment, the heat pump equipment segment led the market with the largest revenue share of 38.5% in 2024. The demand for heat pumps is experiencing a notable surge driven by a growing emphasis on energy efficiency, environmental sustainability, and a shift toward renewable heating solutions. Heat pumps, which can both heat and cool spaces by transferring heat between the indoors and outdoors, are gaining popularity in residential, commercial, and industrial applications. Moreover, the increasing focus on decarbonization and reducing greenhouse gas emissions is bolstering the demand for heat pumps as they offer a cleaner alternative to traditional heating methods such as fossil fuel-based systems.

The demand for air purifiers is witnessing a robust increase as concerns about indoor air quality and respiratory health grow worldwide. Driven by factors such as rising pollution levels, allergens, and the ongoing awareness of airborne viruses, consumers and businesses are increasingly investing in air purification technologies. Moreover, the COVID-19 pandemic has further accentuated the importance of clean indoor air, leading to a surge in demand for air purifiers in residential, commercial, and healthcare settings. As individuals prioritize well-being and cleaner living environments, the air purifier market continues to expand rapidly, with innovations in filtration technologies and smart features contributing to its growth.

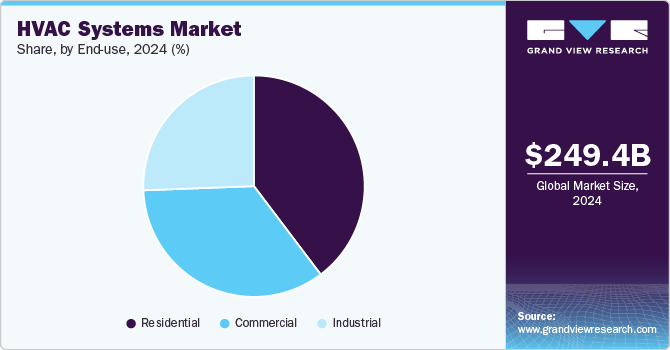

End-use Insights

Based on end-use, the residential segment led the market with the largest revenue share of 39.71% in 2024. Increasing multi-family and individual homeowners is creating avenues for the residential HVAC segment. Increasing urbanization, rising disposable incomes, and growing awareness of energy efficiency contribute to the heightened demand for comfortable living environments. These factors are anticipated to fuel the adoption of HVAC systems such as air-conditioning, air filtration, air purifiers, dehumidifiers, and others over the forecast period.

Commercial HVAC systems are bigger and more complex than residential HVAC units. These systems are used in large places such as shopping malls, airports, hotels, big restaurants, theaters, and other service sector companies. The growing number of commercial spaces such as shopping malls, offices, theatres, and hotels is anticipated to fuel the product demand in the commercial sector. Many factors are considered while choosing a commercial HVAC system, such as air quality, building design, and energy efficiency. The type of commercial HVAC system that is acceptable may also be determined by the local climate. The budget and the lifespan of the system are additional factors to consider.

Regional Insights

The North America HVAC systems market in, led by the U.S., Canada, and Mexico accounted for a significant share in terms of revenue in 2024. The market growthin this region can be attributed to the expansion of urban areas, the presence of industrially developed countries, and the stringent implementation of rules and regulations related to HVAC system installations in North America. Moreover, with the rapid growth of the real estate sector owing to the rise in requirements for residential and commercial buildings and the introduction of Green Building Certification in the U.S., the market of HVAC systems is expected to flourish over the forecast period in North America.

U.S. HVAC Systems Market Trends

The U.S. HVAC systems market is driven by the growing demand for energy-efficient, smart, and environmentally friendly solutions in both residential and commercial sectors. Factors such as rising construction activities, increasing consumer awareness about indoor air quality, and stringent government regulations on energy efficiency standards fuel market growth. Additionally, the adoption of advanced technologies like IoT-enabled smart HVAC systems, which offer improved control and automation, is becoming more prevalent.

The Canada HVAC systems market accounted for the largest revenue share of 11.9% in the North America in 2024. The growth of the construction industry in Canada can be attributed to the surged demand for residential, commercial, and industrial spaces in the country. The Government of Canada intends to spend USD 22.1 billion on social infrastructure development projects and residential building construction activities until 2027. These factors are anticipated to drive the demand for HVAC systems in Canada over the forecast period.

The HVAC systems market in Mexico accounted for the revenue share of 6.2% in North America in 2024. An increase in consumer awareness regarding the maintenance of indoor air quality, the prevalence of airborne diseases, and a surge in death rates due to respiratory diseases have led to the large-scale adoption of dehumidifiers in residential and commercial spaces in Mexico as the government of the country is promoting investments in technologies that lower pollution levels.

Asia Pacific HVAC Systems Market Trends

The Asia Pacific HVAC systems market accounted for the largest revenue share of 46.8% in 2024. Factors such as improving economic conditions, rapid industrialization, and commercialization are anticipated to positively impact the market growth. Asia Pacific is characterized by the availability of skilled labor at low cost. The shift in the production bases to emerging economies, India and China, is expected to positively influence the growth of the HVAC systems market over the forecast period.

The China HVAC systems market held the market share of 53.0% in the Asia Pacific in 2024. The China market has witnessed significant growth in recent years, driven by rapid urbanization, industrialization, and increasing demand for energy-efficient solutions. Government initiatives to enhance energy efficiency and reduce carbon emissions further propel market expansion. The rise in disposable income coupled with changes in consumer preferences towards comfort and air quality has spurred demand for advanced HVAC systems in residential, commercial, and industrial sectors.

The India HVAC systems market held 7.5% share in the Asia Pacific in 2024. The India market is growing rapidly, fueled by rising temperatures, increased commercial construction activities, and a burgeoning middle class that prioritizes comfort. The government's focus on sustainability and smart city initiatives has led to a greater emphasis on energy-efficient systems. The shift toward automation and IoT integration in HVAC solutions is also transforming the industry. As urbanization continues to rise, the demand for both residential and commercial HVAC installations is expected to increase, pushing manufacturers to innovate and cater to a more environmentally conscious consumer base.

Europe HVAC Systems Market Trends

The HVAC systems market in Europe has been increasingly emphasizing energy efficiency and sustainability in recent years. The demand for HVAC systems in the region is influenced by stringent regulations and initiatives aimed at reducing energy consumption and lowering greenhouse gas emissions. For instance, the European Union (EU) has implemented directives and standards to promote the use of energy-efficient HVAC systems, encouraging both residential and commercial sectors to adopt environmentally friendly solutions.

The Germany HVAC systems market held 15.4% share in the Europe in 2024. Germany has the largest construction market in Europe. This can be attributed to several variables: favorable government initiatives, incentives, economic confidence, resource efficiency, and a circular economy. In addition, demographic change, such as an aging population, is anticipated to accelerate the building of hospitals across the country, thereby driving the demand for HVAC systems in the coming years.

The HVAC systems market in France held a 17.0% share in the Europein 2024. One of the primary drivers in the French market is the increasing emphasis on energy efficiency. The government has implemented and continues reinforcing regulations to reduce energy consumption and promote sustainable building practices. These regulations influence the demand for HVAC systems that meet high energy efficiency standards.

Latin America HVAC Systems Market Trends

The HVAC systems market in Latin America is anticipated to grow at the fastest CAGR during the forecast period. According to the International Monetary Fund, in October 2023, the annual GDP of the Latin America region remained high. The World Bank in October 2023 estimated that the GDP is likely to grow by 3.4%, and its growth is likely to follow a similar trend in the coming years. Such promising economic growth in Central & South American countries, such as Brazil, Argentina, and Venezuela, is attracting huge investment in construction and the oil & gas industry, likely resulting in a high demand for HVAC systems.

The Brazil HVAC systems market held 36.1% share in the Latin America in 2024. According to a report published by International Trade Administration in December 2023, Brazil has one of the largest healthcare markets in Latin America, spending approximately 9.47% of its GDP toward the healthcare sector, which amounts to USD 161 billion. Simultaneously, the rising population in Brazil is expected to drive the demand for healthcare facilities such as hospitals. These aforementioned factors are anticipated to drive the market growth over the forecast period.

Middle East & Africa HVAC Systems Market Trends

The HVAC systems market in Middle East has been witnessing rising investment in residential, industrial, and commercial building construction. HVAC systems are used in these buildings to maintain ambient temperature, humidity, and ventilation. In November 2023, the U.A.E.’s largest real estate development company, Wasl, launched a premium hillside housing project. In addition, Saudi Arabia invested heavily in infrastructure projects like King Salman Energy Park, NEOM, and others. The NEOM project reached a total investment of USD 1.1 trillion.

The Saudi Arabia HVAC systems market held 32.9% share in the Middle East & Africa in 2024. The Saudi Arabia market is experiencing significant growth, driven by increasing industrialization, urbanization, and a rising population. With harsh climatic conditions characterized by high temperatures, there is a growing demand for efficient cooling and heating solutions across residential, commercial, and industrial sectors. Government initiatives aimed at boosting infrastructure development and diversifying the economy under Vision 2030 are further propelling this market.

Key HVAC Systems Company Insights

Some of the key players operating in the HVAC systems industry include Carrier, Daikin Industries, Ltd., Trane, LG Electronics, and SAMSUNG.

-

Carrier provides heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and foodservice sectors. It was acquired by United Technologies Corporation in 1979; however, it was separated into a separate business in April 2020.

-

Daikin Industries, Ltd. offers air-conditioning systems, room heating and heat pump hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings. It also provides low and medium air conditioning systems, water chillers, air purifiers, humidity-adjusting air processing units, marine-type container refrigeration systems, and air handling units. The company’s chemical products include fluoroplastics, fluorocarbons, fluorinated oils, mold release agents, water and oil-repellent products, dry air suppliers, and semiconductor etching products. Some of the emerging players operating in the HVAC systems industry is Fujitsu and Rheem Manufacturing Company.

Key HVAC Systems Companies:

The following are the leading companies in the HVAC systems market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier Corporation

- Daikin Industries, Ltd.

- Fujitsu

- Haier Group

- Havells India Ltd.

- Hitachi Ltd.

- Johnson Controls

- LG Electronics

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- SAMSUNG

- Trane

View a comprehensive list of companies in the HVAC Systems Market

Recent Developments

-

In January 2024, LG Electronics announced the opening of a new scroll compressor production line at its factory in Monterrey, Mexico. This new line will bolster LG’s scroll compressor manufacturing infrastructure, enabling the company to produce more of its acclaimed, eco-conscious solutions while creating a shorter supply chain for servicing customers across North America.

-

In February 2023, Lennox International launched packaged rooftop units with the introduction of Xion and Enlight product lines. These new products reduce environmental impact by offering exceptional efficiency, sustainable design, and efficient service.

HVAC Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 266.65 billion |

|

Revenue forecast in 2030 |

USD 382.66 billion |

|

Growth rate |

CAGR of 7.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Equipment, end-use, region |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Latvia; China; Japan; India; South Korea; Australia; Argentina; Brazil; Saudi Arabia; South Africa |

|

Key companies profiled |

Carrier Corporation; Daikin Industries, Ltd.; Emerson Electric Co.; Hitachi Ltd.; Johnson Controls International plc; Lennox International, Inc.; Trane Technologies |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global HVAC Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HVAC systems market report based on equipment, end-use, and region.

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heat Pump

-

Furnace

-

Unitary Heaters

-

Boilers

-

Air Purifier

-

Dehumidifier

-

Air Handling Units

-

Ventilation Fans

-

Air Conditioning

-

Chillers

-

Cooling Towers

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Latvia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global HVAC systems market size was estimated at USD 249.37 billion in 2024 and is expected to be USD 266.65 billion in 2025.

b. The global HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 382.66 billion by 2030.

b. The residential end-use segment dominated the market in 2024. Increasing multi-family and individual homeowners is creating avenues for the residential HVAC segment. Moreover, increasing urbanization, rising disposable incomes, and growing awareness of energy efficiency contribute to the heightened demand for comfortable living environments.

b. Asia Pacific led the market and accounted for 46.8% of the global revenue share in 2024. Factors such as improving economic conditions, rapid industrialization, and commercialization are anticipated to have a positive impact on the HVAC systems market growth.

b. The market is driven by the rising need for cost-effective and energy-efficient space cooling and heating applications in commercial and industrial sectors. Furthermore, rising demand for the high seasonal coefficient of performance (SCOP) heating equipment, which can be efficient in both winter and summer, is expected to fuel the product demand over the forecast period.

b. Some of the key players operating in the HVAC systems market include Carrier Corporation; Daikin Industries, Ltd.; Emerson Electric Co.; Hitachi Ltd.; Johnson Controls International plc; Lennox International, Inc.; Trane Technologies

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. HVAC Systems Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Concentration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Raw Material Outlook

3.3.2. Manufacturing Outlook

3.3.3. Distribution Outlook

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenge Analysis

3.5.4. Market Opportunity Analysis

3.6. Industry Analysis Tools

3.6.1. Porter’s Five Forces Analysis

3.6.2. Macro-environmental Analysis

3.7. Economic Mega Trend Analysis

3.7.1. COVID-19 Impact Analysis

3.7.2. Russia-Ukraine War

Chapter 4. HVAC Systems Market: Equipment Estimates & Trend Analysis

4.1. Equipment Movement Analysis & Market Share, 2024 & 2030

4.2. HVAC Systems Market Estimates & Forecast, By Equipment, 2018 to 2030 (USD Billion)

4.3. Heat Pump

4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.4. Furnace

4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.5. Unitary Heaters

4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.6. Boilers

4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.7. Air Purifier

4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.8. Dehumidifier

4.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.9. Air Handling Units

4.9.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.10. Ventilation Fans

4.10.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.11. Air Conditioning

4.11.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.12. Chillers

4.12.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.13. Cooling Towers

4.13.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.14. Others

4.14.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 5. HVAC Systems Market: End Use Estimates & Trend Analysis

5.1. End Use Movement Analysis & Market Share, 2024 & 2030

5.2. HVAC Systems Market Estimates & Forecast, By End Use, 2018 to 2030 (USD Billion)

5.3. Residential

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4. Commercial

5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.5. Industrial

5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 6. HVAC Systems Market: Regional Estimates & Trend Analysis

6.1. Regional Movement Analysis & Market Share, 2024 & 2030

6.2. North America

6.2.1. North America HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.2.2. North America HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.2.3. North America HVAC Systems Market Estimates & Forecast, By End Use, 2018 - 2030 (USD Billion)

6.2.4. U.S.

6.2.4.1. Key country dynamics

6.2.4.2. U.S. HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.2.4.3. U.S. HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.2.4.4. U.S. HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.2.5. Canada

6.2.5.1. Key country dynamics

6.2.5.2. Canada HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.2.5.3. Canada HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.2.5.4. Canada HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.2.6. Mexico

6.2.6.1. Key country dynamics

6.2.6.2. Mexico HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.2.6.3. Mexico HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.2.6.4. Mexico HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.3. Europe

6.3.1. Europe HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.3.2. Europe HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.3. Europe HVAC Systems Market Estimates & Forecast, By End Use, 2018 - 2030 (USD Billion)

6.3.4. UK

6.3.4.1. Key country dynamics

6.3.4.2. UK HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.4.3. UK HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.4.4. UK HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.3.5. Germany

6.3.5.1. Key country dynamics

6.3.5.2. Germany HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.5.3. Germany HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.5.4. Germany HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.3.6. France

6.3.6.1. Key country dynamics

6.3.6.2. France HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.6.3. France HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.6.4. France HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.3.7. Spain

6.3.7.1. Key country dynamics

6.3.7.2. Spain HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.7.3. Spain HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.7.4. Spain HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.3.8. Italy

6.3.8.1. Key country dynamics

6.3.8.2. Italy HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.8.3. Italy HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.8.4. Italy HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.3.9. Latvia

6.3.9.1. Key country dynamics

6.3.9.2. Latvia HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.9.3. Latvia HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.9.4. Latvia HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.4. Asia Pacific

6.4.1. Asia Pacific HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.4.2. Asia Pacific HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.3. Asia Pacific HVAC Systems Market Estimates & Forecast, By End Use, 2018 - 2030 (USD Billion)

6.4.4. China

6.4.4.1. Key country dynamics

6.4.4.2. China HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.4.3. China HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.4.4. China HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.4.5. India

6.4.5.1. Key country dynamics

6.4.5.2. India HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.5.3. India HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.5.4. India HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.4.6. Japan

6.4.6.1. Key country dynamics

6.4.6.2. Japan HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.6.3. Japan HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.6.4. Japan HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.4.7. South Korea

6.4.7.1. Key country dynamics

6.4.7.2. South Korea HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.7.3. South Korea HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.7.4. South Korea HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.4.8. Australia

6.4.8.1. Key country dynamics

6.4.8.2. Australia HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.8.3. Australia HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.8.4. Australia HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.5. Central & South America

6.5.1. Central & South America HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.5.2. Central & South America HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.5.3. Central & South America HVAC Systems Market Estimates & Forecast, By End Use, 2018 - 2030 (USD Billion)

6.5.4. Brazil

6.5.4.1. Key country dynamics

6.5.4.2. Brazil HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.5.4.3. Brazil HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.5.4.4. Brazil HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.5.5. Argentina

6.5.5.1. Key country dynamics

6.5.5.2. Argentina HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.5.5.3. Argentina HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.5.5.4. Argentina HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.5.6. Chile

6.5.6.1. Key country dynamics

6.5.6.2. Chile HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.5.6.3. Chile HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.5.6.4. Chile HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.6. Middle East & Africa

6.6.1. Middle East & Africa HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.6.2. Middle East & Africa HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.6.3. Middle East & Africa HVAC Systems Market Estimates & Forecast, By End Use, 2018 - 2030 (USD Billion)

6.6.4. Saudi Arabia

6.6.4.1. Key country dynamics

6.6.4.2. Saudi Arabia HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.6.4.3. Saudi Arabia HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.6.4.4. Saudi Arabia HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

6.6.5. South Africa

6.6.5.1. Key country dynamics

6.6.5.2. South Africa HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.6.5.3. South Africa HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.6.5.4. South Africa HVAC systems market estimates & forecast, By End Use, 2018 - 2030 (USD Billion)

Chapter 7. HVAC Systems Market - Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Share Analysis, 2024

7.4. Company Market Positioning

7.5. Competitive Dashboard Analysis

7.6. Company Heat Map Analysis, 2024

7.7. Strategy Mapping

7.7.1. Expansion

7.7.2. Mergers & Acquisition

7.7.3. Partnerships & Collaborations

7.7.4. New Product Launches

7.7.5. Research And Development

7.8. Company Profiles

7.8.1. Carrier Corporation

7.8.1.1. Participant’s overview

7.8.1.2. Financial performance

7.8.1.3. Product benchmarking

7.8.1.4. Recent developments

7.8.2. Daikin Industries, Ltd.

7.8.2.1. Participant’s overview

7.8.2.2. Financial performance

7.8.2.3. Product benchmarking

7.8.2.4. Recent developments

7.8.3. Fujitsu

7.8.3.1. Participant’s overview

7.8.3.2. Financial performance

7.8.3.3. Product benchmarking

7.8.3.4. Recent developments

7.8.4. Haier Group

7.8.4.1. Participant’s overview

7.8.4.2. Financial performance

7.8.4.3. Product benchmarking

7.8.4.4. Recent developments

7.8.5. Havells India Ltd.

7.8.5.1. Participant’s overview

7.8.5.2. Financial performance

7.8.5.3. Product benchmarking

7.8.5.4. Recent developments

7.8.6. Hitachi Ltd.

7.8.6.1. Participant’s overview

7.8.6.2. Financial performance

7.8.6.3. Product benchmarking

7.8.6.4. Recent developments

7.8.7. Johnson Controls

7.8.7.1. Participant’s overview

7.8.7.2. Financial performance

7.8.7.3. Product benchmarking

7.8.7.4. Recent developments

7.8.8. LG Electronics

7.8.8.1. Participant’s overview

7.8.8.2. Financial performance

7.8.8.3. Product benchmarking

7.8.8.4. Recent developments

7.8.9. Lennox International Inc.

7.8.9.1. Participant’s overview

7.8.9.2. Financial performance

7.8.9.3. Product benchmarking

7.8.9.4. Recent developments

7.8.10. Mitsubishi Electric Corporation

7.8.10.1. Participant’s overview

7.8.10.2. Financial performance

7.8.10.3. Product benchmarking

7.8.10.4. Recent developments

7.8.11. Rheem Manufacturing Company

7.8.11.1. Participant’s overview

7.8.11.2. Financial performance

7.8.11.3. Product benchmarking

7.8.11.4. Recent developments

7.8.12. SAMSUNG

7.8.12.1. Participant’s overview

7.8.12.2. Financial performance

7.8.12.3. Product benchmarking

7.8.12.4. Recent developments

7.8.13. Trane

7.8.13.1. Participant’s overview

7.8.13.2. Financial performance

7.8.13.3. Product benchmarking

7.8.13.4. Recent developments

7.8.14. Emerson Electric Co.

7.8.14.1. Participant’s overview

7.8.14.2. Financial performance

7.8.14.3. Product benchmarking

7.8.14.4. Recent developments

7.8.15. Nortek Air Managment

7.8.15.1. Participant’s overview

7.8.15.2. Financial performance

7.8.15.3. Product benchmarking

7.8.15.4. Recent developments

List of Tables

Table 1 Global HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 2 Global HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 3 Global HVAC systems market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 4 North America HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 5 North America HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 6 U.S Macroeconomic Outlay

Table 7 U.S HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 8 U.S HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 9 Canada Macroeconomic Outlay

Table 10 Canada HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 11 Canada HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 12 Mexico Macroeconomic Outlay

Table 13 Mexico HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 14 Mexico HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 15 Europe HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 16 Europe HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 17 UK Macroeconomic Outlay

Table 18 UK HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 19 UK HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 20 Germany Macroeconomic Outlay

Table 21 Germany HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 22 Germany HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 23 France Macroeconomic Outlay

Table 24 France HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 25 France HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 26 Spain Macroeconomic Outlay

Table 27 Spain HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 28 Spain HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 29 Italy Macroeconomic Outlay

Table 30 Italy HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 31 Italy HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 32 Latvia Macroeconomic Outlay

Table 33 Latvia HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 34 Latvia HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 35 Asia Pacific HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 36 Asia Pacific HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 37 China Macroeconomic Outlay

Table 38 China HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 39 China HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 40 India Macroeconomic Outlay

Table 41 India HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 42 India HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 43 Japan Macroeconomic Outlay

Table 44 Japan HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 45 Japan HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 46 South Korea Macroeconomic Outlay

Table 47 South Korea HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 48 South Korea HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 49 Australia Macroeconomic Outlay

Table 50 Australia HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 51 Australia HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 52 Central & South America HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 53 Central & South America HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 54 Brazil Macroeconomic Outlay

Table 55 Brazil HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 56 Brazil HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 57 Argentina Macroeconomic Outlay

Table 58 Argentina HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 59 Argentina HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 60 Middle East & Africa HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 61 Middle East & Africa HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 62 Saudi Arabia Macroeconomic Outlay

Table 63 Saudi Arabia HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 64 Saudi Arabia HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

Table 65 South Africa Macroeconomic Outlay

Table 66 South Africa HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 67 South Africa HVAC systems market estimates and forecasts by End Use, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 HVAC Systems Market Value, 2024 (USD Billion)

Fig. 10 Market Concentration & Growth Prospect Mapping

Fig. 11 Value Chain Analysis

Fig. 12 HVAC Systems: Market Dynamics

Fig. 13 HVAC Systems Market: PORTER’s Analysis

Fig. 14 HVAC Systems Market : PESTEL Analysis

Fig. 15 Impact Of COVID-19 On GDP, 2021 vs 2019

Fig. 16 Real GDP Compared To Pre-Pandemic Levels (%), 2019 - 2023

Fig. 17 Impact Of Russia-Ukraine War On Inflation (%), 2022 - 2023

Fig. 18 HVAC Systems Market, By Product: Key Takeaways

Fig. 19 HVAC Systems Market: Product Movement Analysis & Market Share, 2024 & 2030

Fig. 20 Heat Pump Protection Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 21 Furnace Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 22 Unitary Heaters Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 23 Boilers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 24 Air Purifier Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 25 Dehumidifier Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 26 Air Handling Units Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 27 Ventilation Fans Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 28 Air Conditioning Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 29 Chillers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 30 Cooling Towers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 31 Other Products Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 32 HVAC Systems Market, By End Use: Key Takeaways

Fig. 33 HVAC Systems Market: End Use Movement Analysis & Market Share, 2024 & 2030

Fig. 34 HVAC Systems Market Estimates And Forecasts, In Residential, 2018 - 2030 (USD Billion)

Fig. 35 Global Value Of Construction, 2020-2022, (USD Trillion)

Fig. 36 HVAC Systems Market Estimates And Forecasts, In Commercial, 2018 - 2030 (USD Billion)

Fig. 37 HVAC Systems Market Estimates And Forecasts, In Industrial, 2018 - 2030 (USD Billion)

Fig. 38 HVAC Systems Market Revenue, By Region, 2024 & 2030, (USD Billion)

Fig. 39 Region Marketplace: Key Takeaways

Fig. 40 Region Marketplace: Key Takeaways

Fig. 41 North America HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 42 North America HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 43 North America HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 44 US HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 US HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 46 US HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 47 Canada HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Canada HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 49 Canada HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 50 Mexico HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 51 Mexico HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 52 Mexico HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 53 Europe HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Europe HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 55 Europe HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 56 UK HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 UK HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 58 UK HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 59 Germany HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 Germany HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 61 Germany HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 62 France HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 France HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 64 France HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 65 Spain HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Spain HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 67 Spain HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 68 Italy HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 69 Italy HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 70 Italy HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 71 Latvia HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 72 Latvia HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 73 Latvia HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 74 Asia Pacific HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 75 Asia Pacific HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 76 Asia Pacific HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 77 China HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 78 China HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 79 China HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 80 India HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 81 India HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 82 India HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 83 Japan HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 84 Japan HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 85 Japan HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 86 South Korea HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 87 South Korea HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 88 South Korea HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 89 Australia HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 90 Australia HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 91 Australia HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 92 Central & South America HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 93 Central & South America HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 94 Central & South America HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 95 Brazil HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 96 Brazil HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 97 Brazil HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 98 Argentina HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 99 Argentina HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 100 Argentina HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 101 Middle East & Africa HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 102 Middle East & Africa HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 103 Middle East & Africa HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 104 Saudi Arabia HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 105 Saudi Arabia HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 106 Saudi Arabia HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 107 South Africa HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 108 South Africa HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 109 South Africa HVAC Systems Market Estimates & Forecasts, by End Use, 2018 - 2030 (USD Billion)

Fig. 110 Key Company/Competition Categorization

Fig. 111 Competitive Dashboard Analysis

Fig. 112 Company Market Positioning

Fig. 113 Company Market Share Analysis, 2024

Fig. 114 Strategic Framework

Market Segmentation

- HVAC Systems Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- HVAC Systems End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Residential

- Commercial

- Industrial

- HVAC Systems Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- North America HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- U.S.

- U.S. HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- U.S. HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- U.S. HVAC Systems Market, By Equipment

- Canada

- Canada HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Canada HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Canada HVAC Systems Market, By Equipment

- Mexico

- Mexico HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Mexico HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Mexico HVAC Systems Market, By Equipment

- North America HVAC Systems Market, By Equipment

- Europe

- Europe HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Europe HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- UK

- UK HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- UK HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- UK HVAC Systems Market, By Equipment

- Germany

- Germany HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Germany HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Germany HVAC Systems Market, By Equipment

- France

- France HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- France HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- France HVAC Systems Market, By Equipment

- Spain

- Spain HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Spain HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Spain HVAC Systems Market, By Equipment

- Italy

- Italy HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Italy HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Italy HVAC Systems Market, By Equipment

- Latvia

- Latvia HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Latvia HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Latvia HVAC Systems Market, By Equipment

- Europe HVAC Systems Market, By Equipment

- Asia Pacific

- Asia Pacific HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Asia Pacific HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- China

- China HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- China HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- China HVAC Systems Market, By Equipment

- India

- India HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- India HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- India HVAC Systems Market, By Equipment

- Japan

- Japan HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Japan HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Japan HVAC Systems Market, By Equipment

- South Korea

- South Korea HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- South Korea HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- South Korea HVAC Systems Market, By Equipment

- Australia

- Australia HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Australia HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Australia HVAC Systems Market, By Equipment

- Asia Pacific HVAC Systems Market, By Equipment

- Central & South America

- Central & South America HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Central & South America HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Brazil

- Brazil HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Brazil HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Brazil HVAC Systems Market, By Equipment

- Argentina

- Argentina HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Argentina HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Argentina HVAC Systems Market, By Equipment

- Central & South America HVAC Systems Market, By Equipment

- Middle East & Africa

- Middle East & Africa HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Middle East & Africa HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Saudi Arabia

- Saudi Arabia HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Saudi Arabia HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- Saudi Arabia HVAC Systems Market, By Equipment

- South Africa

- South Africa HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- South Africa HVAC Systems Market, By End Use

- Residential

- Commercial

- Industrial

- South Africa HVAC Systems Market, By Equipment

- Middle East & Africa HVAC Systems Market, By Equipment

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For comprehensive understanding of the market, it is essential to understand the complete value chain and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia and trade journals. Technical data is also gathered from intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development and pricing trends is fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, and industry experience and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of technology landscape, regulatory frameworks, economic outlook and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restrains, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation, but also provide critical insights into the market, current business scenario and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply side |

|

|

|

Demand side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."