HVAC Accessories Market Size, Share & Trends Analysis Report By Product (Thermostats, Sensors, Control Systems), By Application (Commercial, Residential, Industrial), By Distribution Channel, By End Users, By Deployment, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-524-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

HVAC Accessories Market Size & Trends

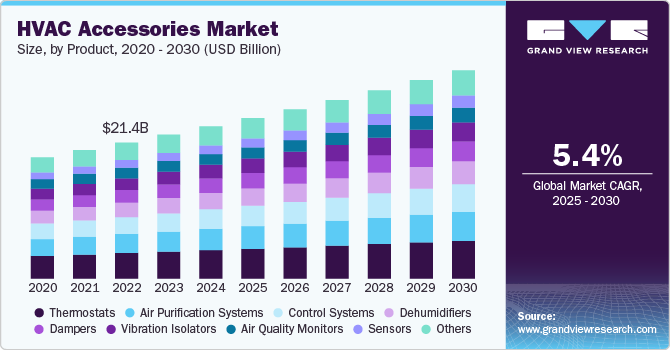

The global HVAC accessories market was valued at USD 23.97 billion in 2024 and is projected to grow at a CAGR of 5.4% over the forecast period from 2025 to 2030. The increasing demand for energy-efficient and environmentally friendly HVAC systems is a primary driver. As consumers and businesses seek to reduce energy consumption and minimize environmental impact, there is a growing need for accessories that enhance the efficiency and sustainability of HVAC systems.

Technological advancements in HVAC systems have also contributed to market growth. The integration of smart technologies, such as IoT-enabled devices, allows for improved control and automation of HVAC systems, leading to enhanced efficiency, comfort and convenience.

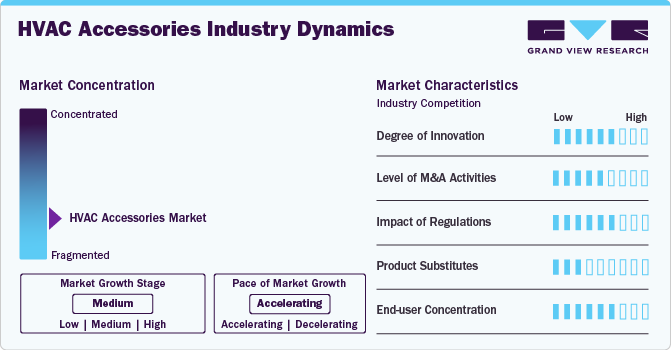

Market Concentration & Characteristics

The global HVAC accessories market is moderately fragmented, with a mix of large multinational companies and regional players competing for market share. Leading manufacturers focus on producing efficient HVAC accessories like thermostats, sensors, air filters, and ventilation systems, driven by growing demand for energy efficiency and smart technologies. Innovations aim to improve system performance, indoor air quality, and integration with smart home or commercial building systems. As energy efficiency and environmental concerns grow, these innovations are key to market expansion.

Regulations from bodies like the International Energy Agency (IEA) and national governments shape the market by enforcing standards related to energy efficiency, emissions reduction, and safety. Manufacturers are developing products that meet these stringent requirements, contributing to sustainability efforts.

Regulations from bodies like the International Energy Agency (IEA) and national governments shape the market by enforcing standards related to energy efficiency, emissions reduction, and safety. Manufacturers are developing products that meet these stringent requirements, contributing to sustainability efforts. This trend presents new opportunities, although competition from alternative energy-efficient solutions poses challenges. Manufacturers must continue to innovate and adapt to regulatory changes to remain competitive in a rapidly evolving market.

Drivers, Opportunities & Restraints

The rapid urbanization and industrialization in emerging economies have further fueled the demand for HVAC systems and their accessories. As infrastructure development accelerates in these regions, there is a heightened need for effective heating, ventilation, and air conditioning solutions, driving the market for related accessories.

Restraints of market growth include high initial installation costs, which can deter consumers from adopting advanced HVAC systems and their accessories. Additionally, the complexity of integrating new technologies into existing infrastructure can pose challenges.

Opportunities for growth lie in the development of smart HVAC accessories that offer enhanced control and energy efficiency, catering to the increasing consumer demand for intelligent home solutions. Moreover, expanding into emerging markets presents significant growth potential, as rising urbanization and industrialization in these regions drive the need for effective HVAC solutions.

Product Insights

The thermostats segment dominated the market in 2024 accounting for 18.6% of the market share. The strong share is attributed to increasing demand for smart homes and energy-efficient solutions. Consumers and businesses are seeking systems that can be controlled remotely to improve energy consumption and comfort. Additionally, with the growing awareness about indoor air quality and temperature regulation, the need for precise sensors that monitor and optimize HVAC performance has led to an uptick in their demand.

Sensors play a crucial role in enhancing the performance of HVAC systems, especially in energy-saving applications. The growing integration of Internet of Things (IoT) technology in HVAC systems is driving demand for advanced sensors that provide real-time data, helping to optimize HVAC operations. As energy efficiency becomes more important, sensors that monitor air quality, temperature, and humidity are in increasing demand, as they contribute to energy savings and system longevity.

Application Insights

The commercial segment led the market and accounted for 45.6% of the global revenue share in 2024. driven by the need for energy-efficient solutions in office buildings, shopping malls, and other large spaces. Commercial properties often have larger-scale HVAC systems, which require advanced accessories like air purifiers, thermostats, and sensors to ensure efficient operation and air quality. The push toward green building certifications and regulations also fuels the growth of energy-efficient HVAC solutions in commercial applications.

In the industrial sector, the demand for HVAC accessories is driven by the need for efficient and reliable systems that support large-scale operations. Industrial facilities require specialized HVAC solutions to maintain optimal working conditions, improve air quality, and ensure employee comfort. As industries strive for energy efficiency and compliance with environmental regulations, there is a growing focus on integrating advanced HVAC accessories like energy-efficient air purification systems, control systems, and temperature sensors.

Distribution Channel Insights

The retail stores segment dominated the market in 2024 accounting for the largest revenue share of 41.8% of the overall marketas they offer consumers easy access to a variety of HVAC products. The increasing trend of DIY home improvement and renovations, combined with the growing awareness of energy efficiency, has led to more consumers purchasing HVAC accessories through retail channels. Moreover, these stores often provide an opportunity for customers to see and test products, contributing to the rise in demand for HVAC-related accessories in the consumer space.

The online segment of the HVAC accessories market is driven by the increasing preference for convenience, competitive pricing, and the ability to compare products easily. Consumers and businesses are increasingly turning to online platforms for HVAC accessory purchases due to the wide selection of brands and products, ease of access, and the ability to deliver directly to job sites or homes. The growing trend of e-commerce, especially in the post-pandemic era, is further accelerated as both DIY consumers and professional contractors seek efficiency in their purchasing processes.

End User Insights

The HVAC contractors segment dominated the market in 2024 accounting for the largest revenue share of 41.6% driven by their central role in installing and maintaining HVAC systems. With increasing construction activity and demand for energy-efficient solutions, contractors require high-quality HVAC accessories such as thermostats, sensors, and air filtration devices to ensure optimal system performance. The growing trend of smart and connected HVAC systems has also spurred demand for advanced accessories among contractors.

HVAC distributors drive the market by facilitating the widespread availability of accessories through their established networks. They supply HVAC accessories to contractors, retailers, and other commercial buyers. With the rise of new technologies and energy-efficient products, distributors are increasingly focused on sourcing innovative HVAC accessories to meet growing consumer demand. Their role in delivering products in bulk also supports market expansion, particularly for large-scale commercial and residential projects.

Deployment Insights

The new installation segment dominated the market in 2024 accounting for 50.3% of the global marketdriven by the increasing number of residential and commercial construction projects is a key driver of the new installation segment. As the construction industry grows, there is a rising need for energy-efficient HVAC systems, which require advanced accessories for proper installation. With sustainability being a growing focus, new installations are often equipped with smart thermostats, air purifiers, and other energy-efficient components to reduce operating costs and improve system performance.

As older systems become inefficient or outdated, consumers and businesses are replacing components with newer, more efficient HVAC accessories. Additionally, the growing awareness of the importance of maintaining air quality and energy efficiency has led to higher demand for HVAC replacements, such as air filters, sensors, and thermostats, which help optimize system performance and reduce energy consumption.

Regional Insights

North America dominated the market in 2024 accounting for a global revenue share of 35.1%. driven by growing consumer demand for energy-efficient solutions, with an increasing preference for smart technologies. Both the residential and commercial sectors in the region are adopting more sustainable systems due to government incentives and stricter environmental regulations, particularly in the U.S. Additionally, extreme seasonal temperature variations further emphasize the need for advanced heating and cooling solutions across the region.

U.S. HVAC Accessories Market Trends

The market in the U.S. is projected to expand at a CAGR of 5.2% over the forecast period driven by the demand for energy-efficient systems and innovations like smart thermostats, air purifiers, and humidity control devices. With the diverse climate across the country, both heating and cooling solutions are essential year-round. Increasing consumer awareness of indoor air quality, especially post-COVID, is another key driver pushing demand for accessories that improve air filtration and comfort.

Europe HVAC Accessories Market Trends

Europe HVAC accessories market benefits from stringent environmental standards, pushing the adoption of energy-efficient and low-emission systems. The region’s focus on sustainability and reducing carbon footprints is a key driver, especially in countries like Germany and the UK. High energy costs and increasing awareness of indoor air quality among consumers also contribute to the growing demand for HVAC accessories that enhance system efficiency and air purification.

The market in Italy is projected to expand at a CAGR of 6.7% over the forecast period. Italy’s market for HVAC accessories is shaped by strict energy efficiency regulations and environmental targets. The country’s commitment to reducing carbon emissions pushes both residential and commercial sectors to adopt sustainable HVAC solutions. Government incentives for energy-efficient upgrades, coupled with Germany’s technological innovation in HVAC systems, create a significant demand for advanced accessories.

The market in Spain is projected to expand at a CAGR of 5.6% over the forecast period. The country is seeing a growing demand for energy-efficient HVAC systems due to high energy costs and an increasing focus on sustainability. Stringent building regulations and the government's pledge to achieve net-zero emissions by 2050 are driving the adoption of advanced HVAC systems. The trend toward smart homes and automation is also fueling the demand for HVAC accessories like smart thermostats and air quality monitors.

Asia Pacific HVAC Accessories Market Trends

Asia Pacific HVAC accessories market is rapidly expanding, driven by urbanization and the growing construction industry, particularly in countries like China and India. With rising temperatures and increased industrial activities, the demand for both residential and commercial HVAC solutions is surging. Additionally, the push for smarter, more energy-efficient systems and a growing middle class is accelerating market growth in this region.

The market in China is projected to expand at a CAGR of 6.6% over the forecast period due to rapid urbanization and industrialization. The increasing demand for air conditioning in both residential and commercial spaces, particularly in large cities, is a key driver. The country’s focus on energy efficiency and environmental regulations also supports the adoption of more sustainable HVAC solutions, creating demand for high-performance accessories that improve energy use and air quality.

The market in India is expected to grow at a CAGR of 6.0% over the forecast period. The rising middle class and rapid urbanization are major drivers of market growth in the country. As infrastructure development accelerates, especially in residential and commercial sectors, the need for efficient heating and cooling systems is growing. Additionally, concerns about air pollution and extreme heat are pushing demand for air purifiers and cooling accessories, as well as more energy-efficient HVAC systems.

Middle East & Africa HVAC Accessories Market Trends

In the Middle East and Africa, the HVAC accessories market is primarily driven by the extreme heat in the region, which increases the demand for cooling systems and related accessories. In the GCC (Gulf Cooperation Council) countries, high temperatures and a booming construction sector contribute significantly to market growth. Additionally, there is a growing interest in energy-efficient solutions that can reduce long-term operating costs, particularly in new developments and commercial buildings.

The market in Saudi Arabia is expected to grow at a CAGR of 4.4% over the forecast period. The country experiences extreme summer temperatures leading to a strong demand for cooling systems, which boosts the need for HVAC accessories. Moreover, the growing construction and real estate sectors are fueling demand for efficient HVAC solutions in both commercial and residential buildings.

Latin America HVAC Accessories Market Trends

In Latin America, the HVAC accessories market is being driven by a combination of expanding construction activities, rising disposable income, and urbanization. As the middle class grows, more consumers seek to improve living standards with advanced HVAC solutions that offer better comfort and energy efficiency. Countries like Brazil are seeing rising demand for cooling and air filtration systems, particularly in urban areas with hot climates.

The market in Brazil is projected to expand at a CAGR of 4.9% over the forecast period. Brazil's HVAC accessories market is benefiting from increasing construction activities, particularly in residential and commercial sectors, as urbanization accelerates. Rising disposable income and a growing middle class are prompting more consumers to invest in energy-efficient HVAC solutions. The demand for better indoor air quality and more sustainable cooling systems is driving the market for HVAC accessories in Brazil, especially in hotter regions.

Key HVAC Accessories Company Insights

Some of the key players operating in the market include Munters and Carrier among Dampers.

-

Munters provides energy-efficient air treatment and climate solutions. The company offers its Functions to create the ideal environment for consumers in a wide range of sectors. It operates through four business units, namely Air Treatment, Data Centers, AgHort, and Mist Elimination. The company provides HVAC systems and accessories through its air treatment business unit.

-

Carrier is a global provider of heating, ventilation, air conditioning, and refrigeration systems. The company offers a wide range of products and services, including commercial and residential HVAC systems, refrigeration equipment, building automation systems, and aftermarket parts and services. Carrier is known for its innovative products and solutions and has a long history of technological advancements in the HVAC industry.

Key HVAC Accessories Companies:

The following are the leading companies in the HVAC accessories market. These companies collectively hold the largest market share and dictate industry trends.

- DAIKIN INDUSTRIES, Ltd.

- SCOTTFRIO (ZHENXIE GROUP)

- Carrier

- Munters

- Condair Group

- Aeroqual

- Ocean Controls Limited

- Thermorex

- Lennox International Inc.

- Trane

Recent Developments

-

In January 2025, ecobee Ltd. introduced the Smart Thermostat Essential, a more affordable smart thermostat with a color touchscreen that offers significant energy savings (up to 23%) and convenience. It's easy to install and use, adapting to the household's routine to optimize energy use and maintain comfort.

-

In March 2024, Vaisala launched its latest air quality sensor, aiming to transform how cities pinpoint and manage their most pressing pollution problems. The sensor provides precise and dependable information and has been rated highly by the Norwegian Institute of Air Research.

HVAC Accessories Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 25,278.3 million |

|

Revenue forecast in 2030 |

USD 32,806.3 million |

|

Growth rate |

CAGR of 5.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, distribution channel, end users, deployment, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

DAIKIN INDUSTRIES, Ltd.; SCOTTFRIO (ZHENXIE GROUP); Carrier; Munters; Condair Group; Aeroqual; Ocean Controls Limited; Thermorex; Lennox International Inc.; Trane |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global HVAC Accessories Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HVAC Accessories Market on basis of product, application, distribution channel, end users, deployment, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Thermostats

-

Sensors

-

Control Systems

-

Vibration Isolators

-

Dampers

-

Air Quality Monitors

-

Dehumidifiers

-

Air Purification Systems

-

Dampers

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Dampers

-

-

End Users Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

HVAC Contractors

-

HVAC Distributors

-

OEM

-

-

Deployment Outlook (Revenue, USD Million; 2018 - 2030)

-

New Installation

-

Replacement

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global HVAC accessories market size was estimated at USD 23.97 billion in 2024 and is expected to reach USD 25,278.3 million in 2025.

b. The global HVAC Accessories Market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 32,806.3 million by 2030.

b. North America dominated the market in 2024 accounting for a global revenue share of 35.1%. The HVAC accessories market in North America is growing due to increasing demand for energy-efficient systems, driven by both regulatory pressures and consumer awareness of sustainability. The region's focus on smart home integration and climate control technologies further boosts market growth, with both residential and commercial sectors seeking advanced HVAC solutions.

b. Some of the key players operating in the HVAC Accessories Market are DAIKIN INDUSTRIES, Ltd., Kanomax USA, Inc., Carrier, Munters, Condair Group, Aeroqual, Ocean Controls Limited, Thermorex, Lennox International Inc.,ecobee Ltd, Awair Inc. and Trane.

b. The HVAC accessories market is driven by the growing demand for energy-efficient, smart technologies and increased awareness of indoor air quality.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."